Volkswagen Plans $192 Billion Investment Focusing on EVs, New Tech -- Commodities Roundup

14 März 2023 - 12:33PM

Dow Jones News

MARKET MOVEMENTS:

-- Brent crude oil is down 2.2% at $78.96 a barrel

-- European benchmark gas is down 4.6% at EUR 47.30 a megawatt

hour

-- Gold futures are down 0.5% at $1,906.30 a troy ounce

-- LME three-month copper futures are 0.9% lower at $8,851 a

metric ton

-- Wheat futures are 0.9% lower at $6.79 a bushel

TOP STORY:

Volkswagen Plans $192 Billion Investment Focusing on EVs, New

Tech

Volkswagen AG is planning a $192 billion spending spree over the

next five years to fix its struggling business in China and try to

hoist the German car maker out of its niche as an also-ran in the

U.S., the company said Tuesday.

VW said it would target two-thirds of that investment, or about

$127 billion, on the development of electric vehicles and new

technology, with a particular focus on the expansion of its

business in China and the U.S.

The move is the first major strategy announcement by Chief

Executive Oliver Blume since he took the reins at VW in September

after the board ousted his predecessor, Herbert Diess. With the

company's new five-year investment plan, Mr. Blume is now starting

a spending war with rival auto makers as he tries to claw back

market share in China and make the company's U.S. business relevant

after decades of failed attempts to build significant market

share.

OTHER STORIES:

Sustainable Aviation Fuel No Quick Fix to Greening Air

Travel

United Airlines Holdings Inc. has turned to an apt pitchman for

a new advertising campaign touting the environmental benefits of

jet fuel made from waste: Oscar the Grouch.

But the "Sesame Street" character's cynical worldview may be

ideally suited to the airline's campaign for another reason. The

reality is that flying planes on sustainable aviation fuel--known

as SAF--faces big hurdles, and the airline acknowledged in the ad

that it currently uses less than 0.1% of SAF for its fuel

needs.

Aviation produces more than 2% of global energy-related

carbon-dioxide emissions, according to the International Energy

Agency, and that is on track to rise as more of the world's

population takes to the skies. It is one of the hardest industries

to decarbonize because it requires very energy-dense fuels to

travel long distances.

MARKET TALKS:

Steel Price Rally Expected to Lead to Margin Recovery

1012 GMT - Steel prices are recovering on both sides of the

Atlantic with the U.S. market in particular accelerating in recent

weeks on the back of brighter market sentiment in Asia, Deutsche

Bank analyst Bastian Synagowitz says in a research note. Prices are

expected to keep recovering in the near term despite the fragility

of the current environment, he says. "Hence, we expect margins to

recover into 2023, and we believe steel stocks are still

attractive, based on valuation and underlying cash generation,"

Synagowitz says. Deutsche Bank's top picks are ArcelorMittal and

Voestalpine in carbon steel and Aperam and Outokumpu in stainless

steel. (pierre.bertrand@wsj.com)

--

Palm Oil Prices Fall Amid Oversupply of Vegetable Oils

1005 GMT - Crude palm oil prices declined in late trading amid

an oversupply of vegetable oils, Affin Hwang analyst Nadia Aquidah

says in a note. The prospect of a global recession could also curb

palm oil consumption in many markets and pressure prices, she says.

The Bursa Malaysia Derivatives contract for May delivery closed

MYR61 lower at MYR3,982 a metric ton. (yiwei.wong@wsj.com)

--

Metals Slip Ahead of U.S. CPI Print

0835 GMT - Metals prices are moving lower, with traders looking

to today's consumer price inflation print in the U.S. Three-month

copper is down 1% to $8,839 a metric ton while aluminum is 0.6%

lower at $2,306 a ton. Gold meanwhile is flat at $1,916.80 a troy

ounce. Peak Trading Research says that interest-rate expectations

changed dramatically during the past 24 hours due to the fallout

from the regional banking collapse, noting that "last week the

market was pricing four rate hikes by September--today [it is]

zero." Peak in a note says, "the big drop in rate expectations

yesterday levered the U.S. dollar lower, which helped limit the

macro damage to our commodity markets," adding that "now it is all

eyes on today's CPI inflation print." (yusuf.khan@wsj.com)

--

Oil Slips Ahead of US Inflation Data

0813 GMT - Oil prices weaken further as concerns over the

fallout from Silicon Valley Bank's collapse reverberate through

commodity markets and investors await crucial inflation data. Brent

crude, the international oil benchmark, declines 1.1% to $79.85 a

barrel. Prices slumped as low as $78.37 on Monday, before paring

losses to close down 2.4%. "The oil market was unable to escape the

broader risk-off move as markets grappled with the spillover from

the SVB collapse," ING says in a note. SVB's end has prompted

worries about the impact of interest rate rises on banks and driven

some investors to anticipate the Fed will ease off on its interest

rate rising. U.S. CPI data due later Tuesday would be key for

gauging the Fed's plans. (william.horner@wsj.com)

--

Indonesia's Nickel Miners Seen Raising Significant Capital for

Expansion

0534 GMT - Nickel miners and processors in Indonesia are

expected to raise "significant" capital over the next two to three

years, as they expand operations amid climbing demand for battery

materials, S&P Global Ratings says in a report. Roughly $30

billion in announced investments in Indonesia's capital-intensive

nickel industry "will prompt external financings, including

dollar-bond issuance," the report says. Indonesian miners have

typically been well funded by domestic banks and the domestic bond

market, it notes. (rhiannon.hoyle@wsj.com; @RhiannonHoyle)

Write to Yusuf Khan at yusuf.khan@wsj.com

(END) Dow Jones Newswires

March 14, 2023 07:18 ET (11:18 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

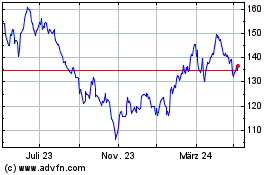

Volkswagen (TG:VOW)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

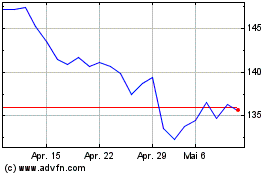

Volkswagen (TG:VOW)

Historical Stock Chart

Von Apr 2023 bis Apr 2024