Fortum Gets EUR2.35 Billion Bridge Financing From Finland

06 September 2022 - 10:09AM

Dow Jones News

By Dominic Chopping

Finnish energy group Fortum Oyj said Tuesday it has secured a

2.35 billion euro ($2.33 billion) bridge financing facility from

the Finnish state to ensure access to liquidity amid soaring

collateral requirements.

Fortum said it currently has sufficient liquid funds to meet

collateral needs and utilisation of the bridge financing will be a

last resort.

The Finnish state, Fortum's majority owner, is providing the

liquidity facility through state-owned holding company Solidium.

The first tranche of at least EUR350 million must be drawn by 30

September, 2022, in order for the arrangement to remain effective

thereafter, and the last required tranche might be drawn by 31

March, 2023.

The financing can't be used to cover collateral needs of

Fortum's subsidiary Uniper, it said.

If Fortum draws on the facility, it will be required to issue up

to 8.97 million new shares to Solidium, increasing the Finnish

state's ownership to 51.26% from 50.76%.

"Regulatory changes are urgently needed to curb the unreasonably

high margining and collateral requirements," Chief Executive Markus

Rauramo said.

At market close yesterday, Fortum's standalone collaterals tied

up on Nasdaq amounted to around EUR3.5 billion. At their highest,

the collateral requirements amounted to approximately EUR5

billion.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

September 06, 2022 03:54 ET (07:54 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

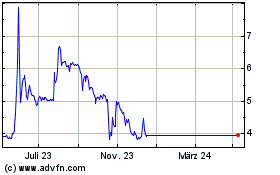

Uniper (TG:UN01)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Uniper (TG:UN01)

Historical Stock Chart

Von Apr 2023 bis Apr 2024