Henkel Cuts 2022 Margin Target Amid Ukraine War; 1Q Sales Rose

29 April 2022 - 9:28AM

Dow Jones News

By Joshua Kirby

Henkel AG & Co. KGaA said Friday that it expects a lower

earnings margin this year than previously targeted, as raw material

prices surge as a result of the war in Ukraine.

The German consumer-goods company now expects an adjusted

operating margin of 9%-11%, from 11.5%-13.5% previously. This

adjustment is due to rising raw-material prices and higher

logistics costs stemming from the Russia-Ukraine war, as well as

the effects of exiting operations in Russia and Belarus following

the invasion, Henkel said.

The company nevertheless said it expects higher sales growth for

the year than previously targeted, after first-quarter sales rose

on higher prices and with a slight decline in volumes, it said.

According to preliminary figures, the company's sales rose by 7.1%

to 5.3 billion euros ($5.56 billion) in the quarter.

As such, Henkel said it is now aiming for full-year organic

growth between 3.5% and 5.5% in fiscal 2022, compared with a

previous targeted range of 2% to 4%.

The company will set out full first-quarter results on May

5.

Write to Joshua Kirby at joshua.kirby@wsj.com;

@joshualeokirby

(END) Dow Jones Newswires

April 29, 2022 03:13 ET (07:13 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

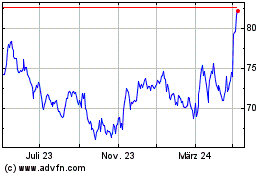

Henkel AG & Co KGAA (TG:HEN3)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

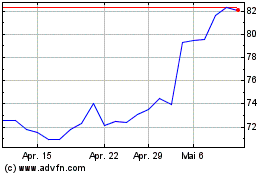

Henkel AG & Co KGAA (TG:HEN3)

Historical Stock Chart

Von Apr 2023 bis Apr 2024