TIDMFTK

flatexDEGIRO AG

26 April 2022

flatexDEGIRO with strongest quarter in the company's history

after 'meme stock mania' in Q1 2021

DGAP-News: flatexDEGIRO AG / Key word(s): Quarterly / Interim Statement

flatexDEGIRO with strongest quarter in the company's history after 'meme stock mania' in

Q1 2021

26.04.2022 / 17:45 CET

The issuer is solely responsible for the content of this announcement.

Group Interim Management Statement, January - March 2022

Frankfurt/ Main, 26 April 2022

flatexDEGIRO with strongest quarter in the company's history after "meme stock mania" in Q1

2021

- Over 185,000 new customers acquired in the first quarter (+31% compared to the customer

growth in Q4/2021), customer retention rate of 99.5%

- Number of transactions increased by 11% to 21.9 m (Q4 2021: 19.8 m),

despite subdued trading activity by retail investors due to fears of interest rate hikes,

rising inflation and war

- Revenues of EUR 118.1 m (+14% vs. Q4 2021), almost completely free of

reimbursements from trading venues (so-called "payment for order flow", PFOF), which only

account for 0.7%

- Increase in revenue per transaction to EUR 5.39, the highest level since the acquisition

of DEGIRO, confirms the value enhancement potential of the product and pricing measures introduced

in 2021

- Adj. EBITDA of EUR 54.5 m represents a 76% increase in operating profitability vs. Q4 2021,

despite higher marketing spent to raise brand awareness

Frank Niehage, CEO of flatexDEGIRO AG: "Leaving aside the first quarter of 2021, which was

incomparable in all aspects, we have just delivered the best quarter in our company's history:

In no other quarter have we won more new customer accounts (approx. +185,000), settled more

transactions (almost 22 million) or generated higher revenues (over EUR 118 million). We achieved

this in an environment in which peers are reporting significant declines in customer growth

and where the trading activity of retail investors remains at a comparatively low level due

to fears of interest rate hikes, rising inflation and war. With an Adj. EBITDA of well over

EUR 54 million, which corresponds to a margin of 46 percent, we also reported by far the highest

profitability since the acquisition of DEGIRO, and this despite increased marketing investments

in future growth. These figures confirm the success of our strategy to combine industry-leading

growth with high profitability."

Major Events

- Documentary "True Stories of Investing" successfully broadcasted

With "True Stories of Investing", flatexDEGIRO launched a documentary together with Discovery

at the end of January 2022 to demystify investing and to convey important basics that every

retail investor needs to know.

The documentary explains the difference between active and passive investing, how to diversify

risk across sectors, regions and time, and how investing can actually contribute to a better

world. Behavioural scientists and pioneers such as Hersh Shefrin (professor at Santa Clara

University and best-selling author of Beyond Greed and Fear) and Wendy De La Rosa (TED speaker

and PhD student at Stanford University) explain how investing requires mental discipline to

avoid being tricked by one's own psychology and succumbing to phenomena such as FOMO (Fear

Of Missing Out), cognitive biases, as well as tendencies towards self-affirmation and the

perpetuation of historical values.

Well over 1.2 million viewers in all major European countries had watched the documentary

by the end of the first quarter of 2022, which was subsequently added to the Discovery+ media

library.

All episodes of the documentary can be found on the websites of our brands DEGIRO and flatex,

for example at DEGIRO.co.uk > Knowledge > Documentary ( link ).

- Robo-Advisory in partnership with Whitebox

At the end of March 2022, flatexDEGIRO signed a Memorandum of Understanding (MoU) with its

long-standing B2B partner and digital asset manager Whitebox, one of the leading independent

robo-advisors for retail investors. Together, flatexDEGIRO and Whitebox will offer flatexDEGIRO

customers a fully digital investment solution. The aim is to roll out the new product first

at flatex Germany in summer 2022.

The partnership enables flatexDEGIRO to offer its customers access to an additional, very

attractive and convenient form of investment. Customers who were previously less active in

trading will benefit from this in particular. In addition, new customer groups can be addressed

who are generally looking for support with sustainable and long-term investments in the capital

market. Offering digital asset management in the form of robo-advisory is the next, logical

step in the verticalisation of flatexDEGIRO's European brokerage platform.

- flatexDEGIRO with double triple in customer awards

DEGIRO was once again named "Best Stockbroker 2021" in Spain, Portugal and Italy by Rankia,

one of the world's leading financial communities with more than 600,000 registered users.

In Spain, the top position was achieved for the sixth time in a row, in Portugal for the third

time in a row. In Italy, the awards were presented for the first time.

In April 2022, flatex took three first places in its German home market in the highly regarded

customer vote of "Brokerwahl". flatex achieved the top ranking as "Best Online Broker", best

"ETF & Funds Broker" as well as best "Daytrade Broker", with votes of almost 81,000 traders,

savers and investors. As the only provider, flatex thus covers the entire range of online

brokerage in outstanding form. DEGIRO was also able to convince in the survey and secured

a third place in Germany (Futures Broker) as well as three further top 10 rankings (Online

Broker, ETF & Funds Broker and Daytrade Broker). ViTrade, the high-performance platform for

professional brokerage within the flatexDEGIRO Group, came in an excellent fifth place among

particularly trading-active customers (Daytrade Broker), despite its strongly focused customer

base.

Upcoming Growth Initiatives

- Direct trading of cryptocurrencies in preparation

flatexDEGIRO is working towards enabling its customers to trade cryptocurrencies directly

in the near future. This will be realised together with a renowned partner. The Management

Board is confident that it will be able to communicate further details in the course of the

second quarter 2022.

Financial Position and Results of Operations

Muhamad Chahrour, CFO of flatexDEGIRO AG and CEO of DEGIRO: "The strong figures for the first

quarter reflect the steady improvements in our customer offering and the successful implementation

of key value drivers. Eearly and late trading via Tradegate, which has been available since

August 2021, has been very well received by DEGIRO customers. The same applies to the ETP

offering of our European partners BNP Paribas and Société Générale, which

is available in several DEGIRO-markets since December. The change in DEGIRO's pricing structure

has the expected effect. Compared to the average of the last three quarters, we were thus

able to increase revenue per transaction by almost EUR 0.50 to EUR 5.39, despite subdued trading

activity, especially in the US market. Annualised average revenue per user (ARPU) stood at

EUR 221 in the first quarter of 2022, a peak compared to previous quarters and a confirmation

of the continued high quality of our customer base."

Key Figures Q1 2022 Q4 2021 Change in %

KPIs

Customer accounts at the end of the

period m 2.21 2.06 +7.0

New customer additions (gross) k 185 141 +31.0

Transactions settled m 21.9 19.8 +10.6

Financials

Revenues EUR m 118.1 103.4 +14.2

Average revenue per customer (ARPU),

annualised EUR 221 207 +6.8

EBITDA EUR m 51.7 28.8 +79.5

EBITDA margin % 43.8 27.9 +57.0

Adj. EBITDA EUR m 54.5 31.0 +75.8

Adj. EBITDA margin % 46.1 30.0 +53.9

Adj. EBITDA before marketing

expenses EUR m 72.9 48.4 +50.6

Adj. EBITDA margin before marketing

expenses % 61.7 46.8 +31.9

Strongest customer growth in the industry

By the end of March 2022, the number of flatexDEGIRO customer accounts had risen to 2.21 million,

an increase of 7.0 percent compared to the 2.06 million customer accounts on 31 December 2021.

In total, flatexDEGIRO added around 185,000 new customer accounts in the first quarter of

2022, approximately 44,000 or 31.0 percent more than in the fourth quarter of 2021. flatexDEGIRO

has thus left its most important peers far behind in the past three months and has further

consolidated its position as the fastest-growing pan-European online broker.

In continuation of its strategy to focus exclusively on the online brokerage business, flatexDEGIRO

terminated with around 20,000 non-brokerage customers in the course of the first quarter of

2022, as already announced in the Trading Update at the beginning of January 2022. Furthermore,

around 8,000 customer accounts were closed by flatexDEGIRO in the course of the customer migration

in Austria from DEGIRO to flatex.

The customer retention rate was around 99.5 percent at the end of the first quarter.

Subdued trading activity is clearly overcompensated by customer growth

The number of transactions settled via flatexDEGIRO's platforms increased by 10.6 percent

to 21.9 million in the first quarter of 2022 (Q4 2021: 19.8 million). The increase is primarily

due to strong customer growth. It overcompensated the subdued trading activity of retail investors

in the first quarter of 2022, which remained at the level of the previous quarter due to fears

of interest rate hikes, rising inflation and war.

Growth Markets with strongest customer growth, Core Markets with significantly more transactions

With a presence in 18 European countries, flatexDEGIRO structures its market presence according

to the size and growth dynamics of its customer base. The Core Markets with the largest customer

base include Germany, the Netherlands and Austria. The strongest growth opportunities are

seen in France, Spain, Portugal, Italy, Switzerland, Ireland and the United Kingdom ( Growth

Markets ). The remaining markets (Denmark, Norway, Sweden, Finland, Poland, Hungary, the Czech

Republic and Greece) are described as Research Markets.

In the first quarter of 2022, the most significant gains in customers were achieved in the

Growth Markets, both in absolute figures (approx. +86,000) and in relative terms (+13 percent).

The large customer base in the Core Markets also recorded further growth (+4 percent or approx.+46,000),

but particularly impressived with a significant increase in transactions compared to the fourth

quarter (+2.2 million or +17 percent). Q1 2022 Q4 2021 Growth absolute Growth in %

Customer accounts (in

millions)

flatexDEGIRO 2.21 2.06 +0.15 +7.0

Core Markets 1.35 1.30 +0.05 +3.7

Growth Markets 0.75 0.67 +0.09 +12.9

Research Markets 0.11 0.10 +0.01 +11.9

Transactions (in millions)

flatexDEGIRO 21.9 19.8 +2.1 +10.6

Core Markets 15.1 12.9 +2.2 +16.8

Growth Markets 6.1 6.2 -0.1 -0.9

Research Markets 0.8 0.7 +0.0 +2.3

ARPU further improved

Revenues increased by EUR 14.7 million or 14.2 percent to EUR 118.1 million in Q1 2022 (Q4

2021: EUR 103.4 million). The increase is due to the increased number of transactions as well

as higher average revenues per transaction. This was mainly due to the increasing use of early

and late trading in the international markets, the successful launch of the derivatives partnerships

at DEGIRO with Société Générale and BNP Paribas in December 2021 and the

optimised pricing structure at DEGIRO since the end of December 2021.

In relation to customer assets under custody of over EUR 43.1 billion (full year 2021: EUR

43.9 billion), flatexDEGIRO achieved an annualised revenue margin of 117 basis points in the

first quarter of 2022 (full year 2021: 110 basis points).

The average revenue per transaction already rose continuously in 2021 and was increased again

in the first quarter of 2022 due to the product and pricing measures described above. At EUR

5.39, it reached the highest level since the acquisition of DEGIRO. Based on the last twelve

months (LTM), average revenue per transaction stood at EUR 5.05 and thus EUR 0.46 above the

annual average in 2021 (EUR 4.59). Annualised revenue per customer account (ARPU) amounted

to EUR 221 in the first quarter of 2022, an increase of 7 percent compared to the previous

quarter (EUR 207).

The share of revenues resulting from reimbursements from trading venues (so-called "payment

for order flow", PFOF) amounted to only 0.7 percent in the first quarter of 2022 and was thus

almost completely eliminated.

Profitable growth leads to growing profitability

Due to the high scalability of the business model, the strong operating leverage and the improved

monetisation resulting from the successful product and pricing measures at the end of 2021,

Adjusted EBITDA increased disproportionately and reached EUR 54.5 million in the reporting

period. This corresponds to an increase of 75.8 percent compared to the previous quarter (Q4

2021: EUR 31.0 million). The Adjusted EBITDA margin in the first quarter of 2022 amounted

to 46.1 percent (Q4 2021: 30.0 percent).

In the past reporting period, flatexDEGIRO continued to strengthen brand awareness, particularly

in the Growth Markets, in order to enable long-term growth with high-quality customers. Marketing

expenses in the first quarter of 2022 amounted to EUR 18.4 million and were thus another 5.8

percent higher than in the previous quarter (EUR 17.4 million). The pure operating profitability

before these future-oriented expenses (Adj. EBITDA margin before marketing expenses) reached

61.7 percent in the first quarter of 2022 and was thus almost 15 percentage points above the

comparable number of the fourth quarter 2021 (46.8 percent).

Outlook

The management confirms its forecast of being able to acquire between 640,000 and 840,000

new customer accounts in the full year 2022 and to settle a total of 95 to 115 million transactions.

Basis of the Presentation

All information and figures contained in the Group Interim Management Statement of flatexDEGIRO

AG (herein either "flatexDEGIRO", "Company" or "Group") relate to the reporting date 31 March

2022 or the three-month period from 1 January 2022 to 31 March 2022. The personal pronouns

"we", "us" or "our" used in this Group Interim Management Statement refer to flatexDEGIRO

with its subsidiaries.

Forward-looking Statements

This Group Interim Management Statement may contain forward-looking statements, which may

be identified by formulations such as "expect", "want", "anticipate", "intend", "plan", "believe",

"aim", "estimate", "will" or similar expressions. Such forward-looking statements are based

on current expectations and certain assumptions that may be subject to a number of risks and

uncertainties. The results actually achieved by flatexDEGIRO may differ materially from these

forward-looking statements. flatexDEGIRO assumes no obligation to update these forward-looking

statements after publication or to correct them in the event of developments that differ from

those anticipated.

Contact

Achim Schreck

Head of Investor Relations & Corporate Communications

Tel.. +49 (0) 69 450001 0

achim.schreck@flatexdegiro.com

About flatexDEGIRO AG

flatexDEGIRO AG (WKN: FTG111, ISIN: DE000FTG1111, Ticker: FTK.GR) operates the leading and

fastest growing online brokerage platform in Europe. Based on modern, in-house state-of-the-art

technology, customers of the flatex and DEGIRO brands are offered a wide range of independent

products with execution on top TIER 1 exchanges. The technological edge as well as the high

efficiency and strong economies of scale enable flatexDEGIRO to continuously improve its service

offering to customers.

With more than 2 million customer accounts and more than 91 million securities transactions

settled in 2021, flatexDEGIRO is the largest retail online broker in Europe. In times of bank

consolidation, low interest rates and digitalisation, flatexDEGIRO is ideally positioned for

further growth. Within the next five years, flatexDEGIRO aims to expand its customer base

to 7 to 8 million customer accounts and settle 250 to 350 million transactions per year -

even in years of low volatility.

Further information at https://www.flatexdegiro.com/en

26.04.2022 Dissemination of a Corporate News, transmitted by DGAP - a service of EQS Group

AG.

The issuer is solely responsible for the content of this announcement.

The DGAP Distribution Services include Regulatory Announcements, Financial/Corporate News

and Press Releases.

Archive at www.dgap.de

Language: English

Company: flatexDEGIRO AG

Rotfeder-Ring 7

60327 Frankfurt / Main

Germany

Phone: +49 (0) 69 450001 0

E-mail: ir@flatexdegiro.com

Internet: www.flatexdegiro.com

ISIN: DE000FTG1111

WKN: FTG111

Indices: SDAX

Listed: Regulated Market in Berlin, Dusseldorf, Frankfurt (Prime Standard), Hamburg, Munich, Stuttgart,

Tradegate Exchange

EQS News ID: 1335901

End of News DGAP News Service

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

Reach is a non-regulatory news service. By using this service an

issuer is confirming that the information contained within this

announcement is of a non-regulatory nature. Reach announcements are

identified with an orange label and the word "Reach" in the source

column of the News Explorer pages of London Stock Exchange's

website so that they are distinguished from the RNS UK regulatory

service. Other vendors subscribing for Reach press releases may use

a different method to distinguish Reach announcements from UK

regulatory news.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRAPPUBUCUPPGMQ

(END) Dow Jones Newswires

April 26, 2022 13:36 ET (17:36 GMT)

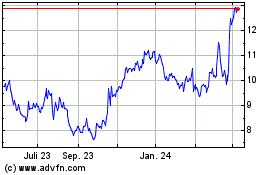

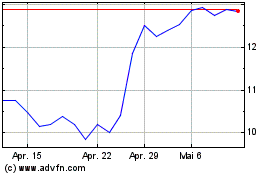

Flatex (TG:FTK)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Flatex (TG:FTK)

Historical Stock Chart

Von Apr 2023 bis Apr 2024