Fresenius SE 2Q Profit Fell as Medical Care Subsidiary Suffers

02 August 2022 - 7:59AM

Dow Jones News

By Ed Frankl

Fresenius SE said Tuesday that second-quarter profits fell,

buffeted by "significantly worsening" business at its subsidiary

Fresenius Medical Care AG and a challenging macroeconomic

situation.

Last week, the German healthcare company cut its guidance for

the year after its 32%-owned subsidiary FMC said it would lower its

outlook due to U.S. labor shortages and a worsening economic

environment.

Fresenius's net income in the three months to the end of June

fell 5% to 450 million euros ($461.8 million), though its sales

climbed 8% to EUR10.02 billion.

Dialysis-care company FMC said its net income fell almost 40% to

EUR147 million, while revenue rose 10% to EUR4.76 billion.

Fresenius Kabi, a drug-making subsidiary, had solid organic

sales growth, while its Helios private-hospital operator continued

good admissions growth at its German and Spanish markets, Fresenius

said.

The Bad Homburg-based company confirmed its lowered guidance

issued on July 27 of sales growth in a low-to-mid single-digit

percentage range at constant currency, anticipating more pronounced

headwinds in 2022 from supply-chain disruptions and cost inflation,

including energy prices.

Write to Ed Frankl at edward.frankl@dowjones.com

(END) Dow Jones Newswires

August 02, 2022 01:44 ET (05:44 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

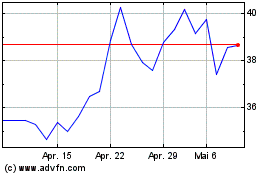

Fresenius Medical Care (TG:FME)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

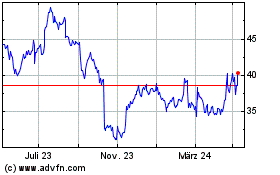

Fresenius Medical Care (TG:FME)

Historical Stock Chart

Von Apr 2023 bis Apr 2024