Unisync Reports 20% Revenue Increase in Q3 2021

16 August 2021 - 2:30PM

Unisync Corp. (“Unisync" or the “Company”)

(TSX:"UNI") (OTCQX: “USYNF”) reports consolidated revenue for the

three months ended June 30, 2021, of $20.7 million up 20% over the

same quarter in 2020. This result was well below what could be

expected with our key customers at full staffing levels but

compares positively to revenues of $17.2 million in the same

quarter last year when the Company realized the full impact of

shutdowns on its customers need for employee operational clothing

and accessories.

Adjusted EBITDA (comprehensive income before

interest expense, income taxes, depreciation and amortization,

share-based payment, and acquisition related costs) was $0.3

million for Q3 2021, after nominal support of $0.3 million from the

Canada Emergency Wage Subsidy program (“CEWS”). This compares to a

loss of $0.4 million for the same quarter in fiscal 2020 during

which $0.9 million was received from CEWS. The benefit derived from

the Q3 2021 subsidy was offset by one-time termination costs

associated with rationalization of the Company’s senior management

structure. With a $5.1 million or 7% decrease in revenue for the 9

months ended June 30, 2021, associated EBITDA was $3.5 million

versus $3.7 million for the same period in fiscal 2020. EBITDA does

not have a standardized meaning prescribed by IFRS and is therefore

unlikely to be comparable to similar measures presented by other

issuers and should not be considered in isolation nor as a

substitute for financial information reported under IFRS.

Consolidated after tax net income attributable

to Unisync shareholders for the quarter was a loss of $1.0 million

($0.06/share), compared to a loss of $1.1 million ($0.06/share) in

the same quarter last year. For the nine months ended June 30,

2021, the net loss was $1.3 million ($0.07/share) compared to a

loss of $0.8 million ($0.04/share) for the same period in fiscal

2020.

Business Outlook

The revenue increase in the current quarter was

due to improving business conditions for existing accounts that

were severely impacted by COVID-19 pandemic restrictions in the

same quarter last year and the addition of new managed services

accounts. With Canadian vaccination levels providing renewed

confidence, the Company is now seeing our major transportation and

hospitality accounts planning for the return of their staffing

levels to pre-pandemic levels – some immediately and others on a

more gradual basis. Plans for new uniform designs that were put on

hold by some of the Company’s larger clients are now back on track,

which should result in a build up in deferred revenue by the end of

this fiscal year and bode well for increased revenues and a return

to profitability in fiscal 2022. The Company also expects to

continue to take advantage of opportunities in the PPE space as

COVID-19 moves through the fourth wave amid expectations that PPE

will still be required well into fiscal 2022. The buildup in

business opportunities and the recent addition of new accounts such

as BC Ferries, Canadian Coast Guard and LCBO as well as sales from

the new Tactical Gear Experts B2C eCommerce platform, should also

add to a continued improvement to earnings in fiscal 2022 and

beyond.

About UnisyncUnisync is a

broad-based vertically integrated North American enterprise with

exceptional capabilities in garment design, domestic manufacturing,

and off-shore outsourcing, including state-of-the-art web based B2B

ordering, distribution, and program management systems. Unisync

operates through two business units: Unisync Group Limited (“UGL”)

and 90% owned Peerless Garments LP which has been producing

operational uniforms and accessories to Canada’s Armed Forces and

others for over 50 years.

UGL is a leading provider of full-service,

managed apparel programs for major corporations and government

entities with a broad-based geographical footprint across Canada.

In early 2019 Unisync expanded this footprint into the US

marketplace through the establishment of a distribution and service

facility in Henderson, Nevada, and a sales and service facility in

Farmingdale, New Jersey. Our core business is comprised of

state-of-the-art eCommerce based B2B/C custom online ordering and

program management systems for our long-term contracted tactical

and imagewear clients and their employees. In addition, we recently

launched Tactical Gear Experts, a B2C eCommerce portal which can be

accessed at https://tacticalgearexperts.com/.

On Behalf of the Board of Directors

Matthew GrahamCEO

Investor relations contact: 778-370-1725 or Email

investorrelations@unisyncgroup.com

Forward Looking StatementsThis

news release may contain forward-looking statements that involve

known and unknown risk and uncertainties that may cause the

Company’s actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied in these forward-looking

statements. Any forward-looking statements contained herein are

made as of the date of this news release and are expressly

qualified in their entirety by this cautionary statement. Except as

required by law, the Company undertakes no obligation to publicly

update or revise any such forward-looking statements to reflect any

change in its expectations or in events, conditions or

circumstances on which any such forward-looking statements may be

based, or that may affect the likelihood that actual results will

differ from those set forth in the forward-looking statements.

Neither the TSX nor its Regulation Services Provider (as that term

is defined in the policies of the TSX) accepts responsibility for

the adequacy or accuracy of this release.

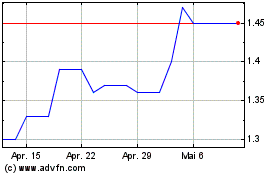

Unisync (TSX:UNI)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Unisync (TSX:UNI)

Historical Stock Chart

Von Apr 2023 bis Apr 2024