TWC Enterprises Limited (TSX: TWC) -

Consolidated Financial Highlights

(unaudited)

|

(in thousands of dollars except per share

amounts) |

Three months ended |

Nine months ended |

|

September 30, 2021 |

September 30, 2020 |

September 30, 2021 |

September 30, 2020 |

|

Net earnings (loss) |

22,757 |

22,427 |

27,684 |

(7,388 |

) |

|

Basic and diluted earnings (loss) per share |

0.93 |

0.87 |

1.12 |

(0.28 |

) |

|

|

|

|

|

|

|

Operating Data

|

|

Three months ended |

Nine months ended |

|

|

September 30, 2021 |

September 30, 2020 |

September 30, 2021 |

September 30, 2020 |

|

Canadian Full Privilege Golf Members |

|

|

15,714 |

14,671 |

|

Championship rounds – Canada |

631,000 |

689,000 |

993,000 |

991,000 |

|

18-hole equivalent championship golf courses – Canada |

|

|

39.5 |

39.5 |

|

18-hole equivalent managed championship golf courses – Canada |

|

|

2.0 |

1.0 |

|

Championship rounds – U.S. |

37,000 |

43,000 |

193,000 |

191,000 |

|

18-hole equivalent championship golf courses – U.S. |

|

|

8.0 |

8.0 |

|

|

|

|

|

|

The following is a breakdown of net operating income (loss) by

segment:

| |

For the three months ended |

| (thousands of Canadian

dollars) |

September 30, 2021 |

|

September 30, 2020 |

|

|

|

|

|

|

Net operating income (loss) by segment |

|

|

|

|

|

|

|

Canadian golf club operations |

$ |

28,016 |

|

$ |

32,193 |

|

|

US golf club operations (2021 - US loss $294,000; 2020 - US

loss $336,000) |

|

(370 |

) |

|

(445 |

) |

|

Corporate operations |

|

(693 |

) |

|

(758 |

) |

| |

|

|

| Net

operating income (1) |

$ |

26,953 |

|

$ |

30,990 |

|

| |

|

|

| |

For the nine months ended |

| (thousands of Canadian

dollars) |

September 30, 2021 |

|

September 30, 2020 |

|

|

|

|

|

| Net operating

income (loss) by segment |

|

Canadian golf club operations |

$ |

34,194 |

|

$ |

35,140 |

|

|

US golf club operations (2021 - US $1,422,000; 2020 - US

$207,000) |

|

1,786 |

|

|

263 |

|

|

Corporate operations |

|

(2,248 |

) |

|

(2,260 |

) |

| |

|

|

| Net

operating income (1) |

$ |

33,732 |

|

$ |

33,143 |

|

| |

|

|

The following is an analysis of net earnings (loss):

| |

For the three months ended |

|

(thousands of Canadian dollars) |

September 30, 2021 |

|

September 30, 2020 |

|

|

|

|

|

|

Operating revenue |

$ |

63,245 |

|

$ |

55,293 |

|

| Direct operating expenses

(1) |

|

36,292 |

|

|

24,303 |

|

|

|

|

|

| Net operating income (1) |

|

26,953 |

|

|

30,990 |

|

| |

|

|

| Amortization of membership

fees |

|

1,324 |

|

|

1,307 |

|

| Depreciation and

amortization |

|

(4,712 |

) |

|

(4,718 |

) |

| Interest, net and investment

income |

|

(263 |

) |

|

(1,046 |

) |

| Other items |

|

5,109 |

|

|

3,119 |

|

| Income

taxes |

|

(5,654 |

) |

|

(7,225 |

) |

| Net

earnings |

$ |

22,757 |

|

$ |

22,427 |

|

| |

|

|

| |

For the nine months ended |

| (thousands of Canadian

dollars) |

September 30, 2021 |

|

September 30, 2020 |

|

|

|

|

|

|

Operating revenue |

$ |

111,413 |

|

$ |

97,059 |

|

| Direct operating expenses

(1) |

|

77,681 |

|

|

63,916 |

|

|

|

|

|

| Net operating income (1) |

|

33,732 |

|

|

33,143 |

|

| |

|

|

| Amortization of membership

fees |

|

3,319 |

|

|

3,552 |

|

| Depreciation and

amortization |

|

(14,255 |

) |

|

(14,561 |

) |

| Interest, net and investment

income |

|

(1,083 |

) |

|

(2,848 |

) |

| Other items |

|

10,446 |

|

|

(24,744 |

) |

| Income

taxes |

|

(4,475 |

) |

|

(1,930 |

) |

| Net

earnings (loss) |

$ |

27,684 |

|

$ |

(7,388 |

) |

| |

|

|

|

|

|

|

(1) Please see Non-IFRS Measures

Third Quarter 2021 Consolidated Operating

Highlights

Revenue consists of the following:

| |

For the three months ended |

|

(thousands of Canadian dollars) |

September 30, 2021 |

September 30, 2020 |

|

Annual dues |

$ |

19,598 |

$ |

15,821 |

| Golf |

|

21,161 |

|

20,874 |

| Corporate events |

|

2,347 |

|

1,689 |

| Food and beverage |

|

12,134 |

|

10,089 |

| Merchandise |

|

4,799 |

|

4,194 |

| Rooms

and other |

|

3,206 |

|

2,626 |

|

|

$ |

63,245 |

$ |

55,293 |

| |

|

|

|

|

As required by IFRS, ClubLink recognizes its

annual dues revenue on a straight-line basis throughout the year

based on when its properties are allowed to open and services are

provided. As a result of COVID-19 lockdowns in both 2020 and 2021,

annual dues revenue was not recognized during certain periods early

in both years. Canadian annual dues revenue increased 27.2% to

$18,133,000 for the three month period ended September 30, 2021

from $14,254,000 in 2020 due to this policy and an increase in

members. Any displaced revenue from the closure period will be

recognized into revenue throughout the remainder of the year on a

straight-line basis.

Operating revenue increased 14.4% for the three

month period ended September 30, 2021 due to higher annual dues

revenue along with the ability to operate in 2021 with less

restrictions as compared to 2020.

Direct operating expenses increased 49.3% to

$36,292,000 for the three month period ended September 30, 2021

from $24,303,000 in 2020 due to higher revenue levels in 2021 in

addition to lower Canada Emergency Wage Subsidy amounts received in

2021.

Net operating income for the Canadian golf club

operations segment decreased to $28,016,000 for the three month

period ended September 30, 2021 from income of $32,193,000 in

2020.

Interest, net and investment income decreased

74.9% to an expense of $263,000 for the three month period ended

September 30, 2021 from $1,046,000 in 2020 due to a decrease in

operational borrowings and an increase in investment income from

the Company’s investment in Automotive Properties REIT.

Other items consist of the following income

(loss) items:

| |

For the three months ended |

| (thousands of Canadian

dollars) |

September 30, 2021 |

September 30, 2020 |

|

|

|

|

|

Impairment reversal (Heron Bay) |

$ |

2,628 |

|

$ |

- |

|

| Foreign exchange gain

(loss) |

|

708 |

|

|

(1,556 |

) |

| Gain on property, plant and

equipment |

|

238 |

|

|

891 |

|

| Unrealized gain on investment

in marketable securities |

|

2,067 |

|

|

3,909 |

|

| Equity income (loss) from

investments in joint ventures |

|

(340 |

) |

|

43 |

|

| Glen Abbey development

charge |

|

(189 |

) |

|

- |

|

|

Other |

|

(3 |

) |

|

(168 |

) |

|

|

|

|

|

|

|

|

| Other

items |

$ |

5,109 |

|

$ |

3,119 |

|

| |

|

|

|

|

|

|

On October 8, 2021, the Company sold Heron Bay Golf Club for

proceeds of US$32,000,000. At September 30, 2021, Heron Bay Golf

Club has been classified as held for sale. Immediately prior to the

classification of asset held for sale, the carrying amount of Heron

Bay was re-measured to its recoverable amount. As a result, the

Company recorded an impairment reversal pertaining to the 2018

impairment charge of US$2,510,000. As of September 30, 2021, the

impairment reversal was recorded at a value of $2,628,000

(US$2,074,000) representing the impairment reversal net of what

would have otherwise subsequently been depreciated from January 1,

2019 to September 30, 2021.

The exchange rate used for translating US

denominated assets has changed from 1.2394 at June 30, 2021 to

1.2741 at September 30, 2021. This has resulted in a foreign

exchange gain of $708,000 for the three-month period ended

September 30, 2021 on the translation of the Company’s US

denominated financial instruments.

Net earnings remained relatively flat at

$22,757,000 for the three month period ended September 30, 2021 as

compared to $22,427,000 in 2020. Basic and diluted earnings per

share increased to 93 cents per share in 2021, compared to 87 cents

in 2020 due to the decline in weighted average shares outstanding

in 2021.

Non-IFRS Measures

TWC uses non-IFRS measures as a benchmark

measurement of our own operating results and as a benchmark

relative to our competitors. We consider these non-IFRS measures to

be a meaningful supplement to net earnings. We also believe these

non-IFRS measures are commonly used by securities analysts,

investors, and other interested parties to evaluate our financial

performance. These measures, which included direct operating

expenses and net operating income do not have standardized meaning

under IFRS. While these non-IFRS measures have been disclosed

herein to permit a more complete comparative analysis of the

Company’s operating performance and debt servicing ability relative

to other companies, readers are cautioned that these non-IFRS

measures as reported by TWC may not be comparable in all instances

to non-IFRS measures as reported by other companies.

The glossary of financial terms is as follows:

Direct operating expenses =

expenses that are directly attributable to company’s business units

and are used by management in the assessment of their performance.

These exclude expenses which are attributable to major corporate

decisions such as impairment.

Net operating income =

operating revenue – direct operating expenses

Net operating income is an important metric used

by management in evaluating the Company’s operating performance as

it represents the revenue and expense items that can be directly

attributable to the specific business unit’s ongoing operations. It

is not a measure of financial performance under IFRS and should not

be considered as an alternative to measures of performance under

IFRS. The most directly comparable measure specified under IFRS is

net earnings.

Eligible Dividend

Today, TWC Enterprises Limited announced an

eligible cash dividend of 2 cents per common share to be paid on

December 15, 2021 to shareholders of record as at November 30,

2021.

Corporate Profile

TWC is engaged in golf club operations under the

trademark, “ClubLink One Membership More Golf.” TWC is Canada’s

largest owner, operator, and manager of golf clubs with 49.5

18-hole equivalent championship and 3.5 18-hole equivalent academy

courses (including two managed properties) at 37 locations in

Ontario, Quebec and Florida.

For further information please contact:

Andrew Tamlin Chief Financial Officer 15675

Dufferin Street King City, Ontario L7B 1K5 Tel: 905-841-5372 Fax:

905-841-8488 atamlin@clublink.ca

Management’s discussion and analysis, financial

statements and other disclosure information relating to the Company

is available through SEDAR and at www.sedar.com and on the Company

website at www.twcenterprises.ca

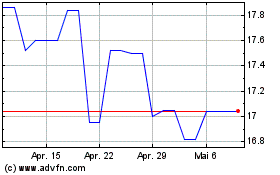

TWC Enterprises (TSX:TWC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

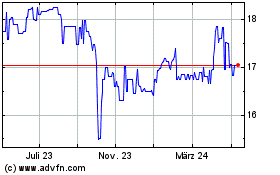

TWC Enterprises (TSX:TWC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024