Total Energy Services Inc. (“Total Energy” or the “Company”)

(TSX:TOT) announces its consolidated financial results for the

three and nine months ended September 30, 2021.

Financial Highlights ($000’s

except per share data)

|

|

Three months ended September 30 |

|

Nine months ended September 30 |

|

|

2021 |

2020 |

Change |

|

2021 |

2020 |

Change |

|

Revenue |

$ |

118,881 |

|

$ |

77,240 |

|

54 |

% |

|

$ |

296,947 |

|

$ |

282,278 |

|

5 |

% |

| Operating income (loss) |

|

6,415 |

|

|

(5,894 |

) |

nm |

|

|

|

(3,093 |

) |

|

(32,526 |

) |

(90 |

%) |

| EBITDA (1) |

|

27,015 |

|

|

17,869 |

|

51 |

% |

|

|

63,448 |

|

|

61,658 |

|

3 |

% |

| Cashflow |

|

26,253 |

|

|

19,810 |

|

33 |

% |

|

|

58,047 |

|

|

55,514 |

|

5 |

% |

| Net income (loss) |

|

4,279 |

|

|

(4,602 |

) |

nm |

|

|

|

(1,464 |

) |

|

(28,723 |

) |

(95 |

%) |

|

Attributable to shareholders |

|

4,278 |

|

|

(4,618 |

) |

nm |

|

|

|

(1,409 |

) |

|

(28,711 |

) |

(95 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Per Share Data (Diluted) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA (1) |

$ |

0.60 |

|

$ |

0.40 |

|

50 |

% |

|

$ |

1.41 |

|

$ |

1.37 |

|

3 |

% |

| Cashflow |

$ |

0.58 |

|

$ |

0.44 |

|

32 |

% |

|

$ |

1.29 |

|

$ |

1.23 |

|

5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Attributable to

shareholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

$ |

0.09 |

|

$ |

(0.10 |

) |

nm |

|

|

$ |

(0.03 |

) |

$ |

(0.64 |

) |

(95 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common shares

(000’s)(4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

44,921 |

|

|

45,081 |

|

0 |

% |

|

|

44,737 |

|

|

45,083 |

|

(1 |

%) |

|

Diluted |

|

45,164 |

|

|

45,081 |

|

0 |

% |

|

|

44,965 |

|

|

45,083 |

|

0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

September 30 |

December 31 |

|

|

Financial Position at |

|

|

|

|

|

|

|

|

2021 |

2020 |

Change |

|

Total Assets |

|

|

|

|

|

|

|

|

$ |

822,898 |

|

$ |

849,579 |

|

(3 |

%) |

| Long-Term Debt

and Lease Liabilities (excluding current portion) |

201,967 |

|

|

238,937 |

|

(15 |

%) |

| Working Capital (2) |

|

|

|

|

|

|

|

|

|

138,383 |

|

|

138,940 |

|

0 |

% |

| Net Debt (3) |

|

|

|

|

|

|

|

|

|

63,584 |

|

|

99,997 |

|

(36 |

%) |

| Shareholders’ Equity |

|

|

|

|

|

|

|

|

|

497,356 |

|

|

510,987 |

|

(3 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes 1 through 4 please refer to the Notes to

the Financial Highlights set forth at the end of this release.

“nm” – calculation not meaningful

Total Energy’s results for the three months

ended September 30, 2021 reflect improving industry conditions in

North America and lower Australian activity levels as compared to

the third quarter of 2020. $4.5 million was recorded during the

third quarter of 2021 under various COVID-19 relief programs

compared to $7.4 million of COVID-19 relief received in the third

quarter of 2020.

Contract Drilling Services

(“CDS”)

|

|

Three months ended September 30 |

|

Nine months ended September 30 |

|

|

2021 |

2020 |

Change |

|

2021 |

2020 |

Change |

|

Revenue |

$ |

43,334 |

|

$ |

16,178 |

|

168 |

% |

|

$ |

97,645 |

|

$ |

73,373 |

|

33 |

% |

| EBITDA (1) |

$ |

11,392 |

|

$ |

3,142 |

|

263 |

% |

|

$ |

22,368 |

|

$ |

13,224 |

|

69 |

% |

| EBITDA (1) as a % of

revenue |

|

26 |

% |

|

19 |

% |

37 |

% |

|

|

23 |

% |

|

18 |

% |

28 |

% |

| Operating days(2) |

|

2,221 |

|

|

717 |

|

210 |

% |

|

|

4,994 |

|

|

3,323 |

|

50 |

% |

|

Canada |

|

1,318 |

|

|

372 |

|

254 |

% |

|

|

2,965 |

|

|

1,901 |

|

56 |

% |

|

United States |

|

610 |

|

|

127 |

|

380 |

% |

|

|

1,378 |

|

|

495 |

|

178 |

% |

|

Australia |

|

293 |

|

|

218 |

|

34 |

% |

|

|

651 |

|

|

927 |

|

(30 |

%) |

| Revenue per operating day(2),

dollars |

$ |

19,511 |

|

$ |

22,563 |

|

(14 |

%) |

|

$ |

19,552 |

|

$ |

22,080 |

|

(11 |

%) |

|

Canada |

|

16,187 |

|

|

14,231 |

|

14 |

% |

|

|

16,180 |

|

|

16,324 |

|

(1 |

%) |

|

United States |

|

19,269 |

|

|

18,307 |

|

5 |

% |

|

|

19,144 |

|

|

20,487 |

|

(7 |

%) |

|

Australia |

|

34,969 |

|

|

39,261 |

|

(11 |

%) |

|

|

35,774 |

|

|

34,737 |

|

3 |

% |

| Utilization |

|

25 |

% |

|

8 |

% |

213 |

% |

|

|

19 |

% |

|

12 |

% |

58 |

% |

|

Canada |

|

19 |

% |

|

5 |

% |

280 |

% |

|

|

14 |

% |

|

9 |

% |

56 |

% |

|

United States |

|

51 |

% |

|

11 |

% |

364 |

% |

|

|

39 |

% |

|

11 |

% |

255 |

% |

|

Australia |

|

64 |

% |

|

47 |

% |

36 |

% |

|

|

48 |

% |

|

68 |

% |

(29 |

%) |

| Rigs, average for period |

|

95 |

|

|

98 |

|

(3 |

%) |

|

|

97 |

|

|

103 |

|

(6 |

%) |

|

Canada |

|

77 |

|

|

80 |

|

(4 |

%) |

|

|

79 |

|

|

81 |

|

(2 |

%) |

|

United States |

|

13 |

|

|

13 |

|

- |

|

|

|

13 |

|

|

17 |

|

(24 |

%) |

|

Australia |

|

5 |

|

|

5 |

|

- |

|

|

|

5 |

|

|

5 |

|

- |

|

(1) See Note 1 of the Notes to the

Financial Highlights set forth at the end of this

release.(2) Operating days includes drilling and paid

stand-by days.

Third quarter drilling activity in North America

was higher in 2021 compared to the prior year. Canadian industry

activity levels continued to recover from the historic lows of 2020

and market share gains in the United States drove a significant

year over year increase in operating days despite a more muted

recovery in United States drilling activity relative to

Canada. In Australia, third quarter operating days increased

in 2021 compared to 2020 as two drilling rigs returned to service

following the completion of recertifications and upgrades. One

drilling rig was removed from service in Australia during the third

quarter of 2021 to complete necessary recertifications and upgrades

and is expected to return to service in the first quarter of 2022.

Despite a decrease in revenue per operating day arising from year

over year changes in the geographic revenue mix and mix of

equipment operating, third quarter CDS segment revenue increased by

168% in 2021 compared to 2020. Negatively impacting third quarter

2021 CDS segment results was $0.5 million of non-recurring

equipment reactivation costs as several idle drilling rigs were put

back into service.

Rentals and Transportation Services

(“RTS”)

|

|

Three months ended September 30 |

|

Nine months ended September 30 |

|

|

2021 |

2020 |

Change |

|

2021 |

2020 |

Change |

|

Revenue |

$ |

12,313 |

|

$ |

5,939 |

|

107 |

% |

|

$ |

26,101 |

|

$ |

27,554 |

|

(5 |

%) |

| EBITDA (1) |

$ |

4,638 |

|

$ |

2,544 |

|

82 |

% |

|

$ |

9,928 |

|

$ |

7,275 |

|

36 |

% |

| EBITDA (1) as a % of

revenue |

|

38 |

% |

|

43 |

% |

(12 |

%) |

|

|

38 |

% |

|

26 |

% |

46 |

% |

| Revenue per utilized piece of

equipment, dollars |

$ |

9,452 |

|

$ |

7,463 |

|

19 |

% |

|

$ |

26,023 |

|

$ |

28,842 |

|

(10 |

%) |

| Pieces of rental

equipment |

|

9,410 |

|

|

10,640 |

|

(12 |

%) |

|

|

9,410 |

|

|

10,640 |

|

(12 |

%) |

|

Canada |

|

8,567 |

|

|

9,710 |

|

(12 |

%) |

|

|

8,567 |

|

|

9,710 |

|

(12 |

%) |

|

United States |

|

843 |

|

|

930 |

|

(9 |

%) |

|

|

843 |

|

|

930 |

|

(9 |

%) |

| Rental equipment

utilization |

|

13 |

% |

|

7 |

% |

86 |

% |

|

|

10 |

% |

|

9 |

% |

11 |

% |

|

Canada |

|

13 |

% |

|

7 |

% |

86 |

% |

|

|

9 |

% |

|

7 |

% |

29 |

% |

|

United States |

|

19 |

% |

|

6 |

% |

217 |

% |

|

|

14 |

% |

|

21 |

% |

(33 |

%) |

| Heavy trucks |

|

80 |

|

|

87 |

|

(8 |

%) |

|

|

80 |

|

|

87 |

|

(8 |

%) |

|

Canada |

|

56 |

|

|

62 |

|

(10 |

%) |

|

|

56 |

|

|

62 |

|

(10 |

%) |

|

United States |

|

24 |

|

|

25 |

|

(4 |

%) |

|

|

24 |

|

|

25 |

|

(4 |

%) |

(1) See Note 1 of the Notes to the

Financial Highlights set forth at the end of this release.

Third quarter revenue in the RTS segment

increased as compared to the same period in 2020 due to higher

equipment utilization in Canada and the United States. Canadian

activity was bolstered by the commencement of several projects that

were delayed during the first half of 2021 due to COVID-19

restrictions unrelated to the Company’s operations or personnel.

The decrease in the third quarter EBITDA margin percentage as

compared to prior year same quarter was due primarily to the mix of

equipment operating, equipment reactivation expenses and the

receipt of less COVID-19 relief funds.

Compression and Process Services

(“CPS”)

| |

Three months ended September 30 |

|

Nine months ended September 30 |

|

|

2021 |

2020 |

Change |

|

2021 |

2020 |

Change |

|

Revenue |

$ |

38,188 |

|

$ |

32,282 |

|

18 |

% |

|

$ |

106,001 |

|

$ |

103,238 |

|

3 |

% |

| EBITDA (1) |

$ |

5,843 |

|

$ |

5,722 |

|

2 |

% |

|

$ |

17,100 |

|

$ |

16,838 |

|

2 |

% |

| EBITDA (1) as a % of

revenue |

|

15 |

% |

|

18 |

% |

(17 |

%) |

|

|

16 |

% |

|

16 |

% |

- |

|

| Horsepower of equipment on

rent at period end |

|

28,605 |

|

|

35,400 |

|

(19 |

%) |

|

|

28,605 |

|

|

35,400 |

|

(19 |

%) |

|

Canada |

|

12,080 |

|

|

17,300 |

|

(30 |

%) |

|

|

12,080 |

|

|

17,300 |

|

(30 |

%) |

|

United States |

|

16,525 |

|

|

18,150 |

|

(9 |

%) |

|

|

16,525 |

|

|

18,150 |

|

(9 |

%) |

| Rental equipment utilization

during the period (HP)(2) |

|

53 |

% |

|

66 |

% |

(20 |

%) |

|

|

47 |

% |

|

67 |

% |

(30 |

%) |

|

Canada |

|

37 |

% |

|

52 |

% |

(29 |

%) |

|

|

33 |

% |

|

53 |

% |

(38 |

%) |

|

United States |

|

78 |

% |

|

94 |

% |

(17 |

%) |

|

|

71 |

% |

|

97 |

% |

(27 |

%) |

| Sales

backlog at period end, $ million |

$ |

95.5 |

|

$ |

37.0 |

|

158 |

% |

|

$ |

95.5 |

|

$ |

37.0 |

|

158 |

% |

(1) See Note 1 of the Notes to the

Financial Highlights set forth at the end of this release.(2)

Rental equipment utilization is measured on a horsepower basis.

The year over year increase in the CPS segment’s

third quarter revenue was due primarily to higher fabrication sales

and increased equipment overhaul activity. Compression rental fleet

utilization continued to recover during the third quarter of 2021

but remained below prior year levels. Ongoing cost management

and increased overhead absorption from higher fabrication activity

contributed to a year over year increase in third quarter

EBITDA. Third quarter EBITDA margin was lower on a year over

year basis due to a $0.8 million provision for bad debt and an

increased relative contribution of lower margin fabrication revenue

to CPS segment revenue. The fabrication sales backlog continued to

strengthen during the third quarter of 2021, increasing by another

$38.0 million, or 66%, compared to the $57.5 million backlog at

June 30, 2021.

Well Servicing (“WS”)

| |

Three months ended September 30 |

|

Nine months ended September 30 |

|

|

2021 |

2020 |

Change |

|

2021 |

2020 |

Change |

|

Revenue |

$ |

25,046 |

|

$ |

22,841 |

|

10 |

% |

|

$ |

67,200 |

|

$ |

78,113 |

|

(14 |

%) |

| EBITDA (1) |

$ |

6,494 |

|

$ |

7,581 |

|

(14 |

%) |

|

$ |

16,313 |

|

$ |

21,071 |

|

(23 |

%) |

| EBITDA (1) as a % of

revenue |

|

26 |

% |

|

33 |

% |

(21 |

%) |

|

|

24 |

% |

|

27 |

% |

(11 |

%) |

| Service hours(2) |

|

29,927 |

|

|

26,069 |

|

15 |

% |

|

|

81,060 |

|

|

89,096 |

|

(9 |

%) |

|

Canada |

|

15,076 |

|

|

9,226 |

|

63 |

% |

|

|

40,501 |

|

|

28,969 |

|

40 |

% |

|

United States |

|

4,147 |

|

|

1,896 |

|

119 |

% |

|

|

10,206 |

|

|

8,897 |

|

15 |

% |

|

Australia |

|

10,704 |

|

|

14,947 |

|

(28 |

%) |

|

|

30,353 |

|

|

51,230 |

|

(41 |

%) |

| Revenue per service hour(2),

dollars |

$ |

837 |

|

$ |

876 |

|

(4 |

%) |

|

$ |

829 |

|

$ |

877 |

|

(5 |

%) |

|

Canada |

|

719 |

|

|

615 |

|

17 |

% |

|

|

682 |

|

|

643 |

|

6 |

% |

|

United States |

|

716 |

|

|

687 |

|

4 |

% |

|

|

691 |

|

|

733 |

|

(6 |

%) |

|

Australia |

|

1,050 |

|

|

1,061 |

|

(1 |

%) |

|

|

1,072 |

|

|

1,034 |

|

4 |

% |

| Utilization(3) |

|

31 |

% |

|

23 |

% |

35 |

% |

|

|

28 |

% |

|

26 |

% |

8 |

% |

|

Canada |

|

29 |

% |

|

18 |

% |

61 |

% |

|

|

26 |

% |

|

19 |

% |

37 |

% |

|

United States |

|

32 |

% |

|

15 |

% |

113 |

% |

|

|

27 |

% |

|

23 |

% |

17 |

% |

|

Australia |

|

40 |

% |

|

56 |

% |

(29 |

%) |

|

|

39 |

% |

|

65 |

% |

(40 |

%) |

| Rigs, average for period |

|

83 |

|

|

83 |

|

- |

|

|

|

83 |

|

|

83 |

|

- |

|

|

Canada |

|

57 |

|

|

57 |

|

- |

|

|

|

57 |

|

|

57 |

|

- |

|

|

United States |

|

14 |

|

|

14 |

|

- |

|

|

|

14 |

|

|

14 |

|

- |

|

|

Australia |

|

12 |

|

|

12 |

|

- |

|

|

|

12 |

|

|

12 |

|

- |

|

(1) See Note 1 of the Notes to the

Financial Highlights set forth at the end of this

release.(2) Service hours is defined as well servicing

hours of service provided to customers and includes paid rig move

and standby.(3) The Company reports its service rig

utilization for its operational service rigs in North America based

on service hours of 3,650 per rig per year to reflect standard 10

hour operations per day. Utilization for the Company’s service rigs

in Australia is calculated based on service hours of 8,760 per rig

per year to reflect standard 24 hour operations.

WS segment revenue increased in the third

quarter of 2021 as compared to 2020 due to higher production

activity levels in North America and increased well abandonment

activity in Canada. The year over year decrease in EBITDA and

EBITDA margin for the three and nine months ended September 30,

2021 was primarily due to decreased activity in Australia and

increased North American operating costs that were not fully offset

by price increases.

Corporate

Total Energy continued to focus on the safe and

efficient operation of its business and the preservation of its

balance sheet strength and financial liquidity during the third

quarter of 2021. Bank debt was reduced by $7.6 million, or 4%,

during the quarter. The Company also purchased 582,900 common

shares during the quarter under its normal course issuer bid at an

average price of $4.27 (including commissions). There were

44,000,000 common shares outstanding at September 30, 2021.

The Company exited the third quarter of 2021

with $138.4 million of positive working capital (including $25.6

million of cash) and $120 million of available credit under its

$255 million of revolving bank credit facilities. The

weighted average interest rate on the Company’s outstanding debt at

September 30, 2021 was 2.80%.

Outlook

Total Energy’s diversified geographic and

business exposure provided a measure of stability following the

outbreak of the COVID-19 pandemic in March of 2020 and contributed

to the generation of significant free cash flow during very

difficult industry conditions. A substantial portion of the

Company’s free cash flow generated since the 2020 collapse in oil

prices has been directed towards debt repayment, with bank debt

(net of cash) being reduced from January 1, 2020 to September 30,

2021 by $87.4 million, or 34%. Such diversity also provides Total

Energy with significant leverage to recovering conventional energy

industry activity levels, including increased oilfield abandonment

and reclamation activity, as evidenced by the Company’s return to

profitability in the third quarter of 2021.

In response to increasing demand for drilling

rigs and compression rental equipment, Total Energy has increased

its 2021 capital expenditure budget by $6.5 million to $33.2

million. Included in the 2021 capital budget is $6.2 million of

light duty vehicle capital leases. Excluding capital leases, $17.2

million of capital expenditures have been made to September 30,

2021 and the Company intends to fund the remaining $9.8 million of

budgeted 2021 capital expenditures with cash on hand.

While oil and natural gas prices remain elevated

and activity levels continue to modestly improve from the historic

lows of 2020, activity levels remain subdued relative to prior

periods of similarly high oil and natural gas prices. At

current commodity prices, Total Energy expects that industry

activity levels in all geographies will continue to increase albeit

at a measured pace, due in part to the pressure on many oil and

natural gas producers to curtail reinvestment. A reduction in

energy service industry capacity will serve to offset muted capital

expenditure programs as personnel and equipment shortages begin to

materialize, particularly in Canada where industry conditions have

been challenging for several years.

Given the unique and uncertain environment

currently faced by the energy industry, Total Energy remains

focused on the safe and efficient operation of its business, debt

repayment, disciplined capital deployment and enhancing shareholder

returns, including through share repurchases under its recently

renewed normal course issuer bid. Total Energy also continues to

pursue opportunities to leverage its technologies, expertise and

equipment to pursue new business opportunities, including in the

areas of alternative resource extraction and emissions reduction

and sequestration.

Conference Call

At 9:00 a.m. (Mountain Time) on November 9, 2021

Total Energy will conduct a conference call and webcast to discuss

its third quarter financial results. Daniel Halyk, President &

Chief Executive Officer, will host the conference call. A live

webcast of the conference call will be accessible on Total Energy’s

website at www.totalenergy.ca by selecting “Webcasts”. Persons

wishing to participate in the conference call may do so by calling

(800) 319-4610 or (416) 915-3239. Those who are unable to listen to

the call live may listen to a recording of it on Total Energy’s

website. A recording of the conference call will also be available

until December 9, 2021 by dialing (855) 669-9658 (passcode

7881).

Selected Financial

Information

Selected financial information relating to the

three and nine months ended September 30, 2021 and 2020 is included

in this news release. This information should be read in

conjunction with the condensed interim consolidated financial

statements of Total Energy and the notes thereto as well as

management’s discussion and analysis to be issued in due course and

the Company’s 2020 Annual report.

Consolidated Statements of Financial Position(in thousands of

Canadian dollars)

|

|

September 30 |

|

December 31 |

|

|

2021 |

|

2020 |

|

|

(unaudited) |

|

(audited) |

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

25,569 |

|

|

$ |

22,996 |

|

|

Accounts receivable |

|

90,240 |

|

|

|

73,373 |

|

|

Inventory |

|

99,225 |

|

|

|

95,586 |

|

|

Prepaid expenses and deposits |

|

8,746 |

|

|

|

6,876 |

|

|

Income taxes receivable |

|

1,467 |

|

|

|

1,287 |

|

|

Current portion of lease asset |

|

473 |

|

|

|

566 |

|

|

|

|

225,720 |

|

|

|

200,684 |

|

| |

|

|

|

| Property, plant and

equipment |

|

584,589 |

|

|

|

636,996 |

|

| Income taxes receivable |

|

7,070 |

|

|

|

7,070 |

|

| Deferred income tax asset |

|

970 |

|

|

|

57 |

|

| Lease asset |

|

496 |

|

|

|

719 |

|

|

Goodwill |

|

4,053 |

|

|

|

4,053 |

|

|

|

$ |

822,898 |

|

|

$ |

849,579 |

|

|

|

|

|

|

| Liabilities &

Shareholders' Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable and accrued liabilities |

$ |

63,208 |

|

|

$ |

46,410 |

|

|

Deferred revenue |

|

17,588 |

|

|

|

6,365 |

|

|

Current portion of lease liabilities |

|

3,945 |

|

|

|

6,417 |

|

|

Current portion of long-term debt |

|

2,596 |

|

|

|

2,552 |

|

|

|

|

87,337 |

|

|

|

61,744 |

|

| |

|

|

|

| Long-term debt |

|

193,562 |

|

|

|

230,517 |

|

| |

|

|

|

| Lease liabilities |

|

8,405 |

|

|

|

8,420 |

|

| |

|

|

|

| Deferred tax liability |

|

36,238 |

|

|

|

37,911 |

|

| |

|

|

|

| Shareholders' equity: |

|

|

|

|

Share capital |

|

277,121 |

|

|

|

284,077 |

|

|

Contributed surplus |

|

5,542 |

|

|

|

4,966 |

|

|

Accumulated other comprehensive loss |

|

(26,737 |

) |

|

|

(18,736 |

) |

|

Non-controlling interest |

|

574 |

|

|

|

629 |

|

|

Retained earnings |

|

240,856 |

|

|

|

240,051 |

|

|

|

|

497,356 |

|

|

|

510,987 |

|

|

|

|

|

|

|

|

$ |

822,898 |

|

|

$ |

849,579 |

|

|

|

Consolidated Statements of Comprehensive Income (Loss)(in

thousands of Canadian dollars except per share

amounts)(unaudited)

|

|

Three months ended |

Nine months ended |

| |

September 30 |

September 30 |

|

|

2021 |

2020 |

2021 |

2020 |

|

|

|

|

|

|

| |

|

|

|

|

|

Revenue |

$ |

118,881 |

|

$ |

77,240 |

|

$ |

296,947 |

|

$ |

282,278 |

|

| |

|

|

|

|

| Cost of services |

|

85,255 |

|

|

54,447 |

|

|

219,435 |

|

|

207,613 |

|

| Selling, general and

administration |

|

7,254 |

|

|

5,691 |

|

|

19,862 |

|

|

22,032 |

|

| Other (income) expense |

|

(474 |

) |

|

579 |

|

|

(2,654 |

) |

|

(6,813 |

) |

| Share-based compensation |

|

186 |

|

|

21 |

|

|

576 |

|

|

690 |

|

| Depreciation |

|

20,245 |

|

|

22,396 |

|

|

62,821 |

|

|

91,282 |

|

|

Operating income (loss) |

|

6,415 |

|

|

(5,894 |

) |

|

(3,093 |

) |

|

(32,526 |

) |

| |

|

|

|

|

| Gain on sale of property,

plant and equipment |

|

355 |

|

|

1,367 |

|

|

3,720 |

|

|

2,902 |

|

| Finance

costs, net |

|

(1,675 |

) |

|

(2,106 |

) |

|

(5,254 |

) |

|

(8,063 |

) |

| Net income (loss) before

income taxes |

|

5,095 |

|

|

(6,633 |

) |

|

(4,627 |

) |

|

(37,687 |

) |

| |

|

|

|

|

| Current income tax expense

(recovery) |

|

(122 |

) |

|

14 |

|

|

(577 |

) |

|

2,307 |

|

|

Deferred income tax expense (recovery) |

|

938 |

|

|

(2,045 |

) |

|

(2,586 |

) |

|

(11,271 |

) |

|

Total income tax expense (recovery) |

|

816 |

|

|

(2,031 |

) |

|

(3,163 |

) |

|

(8,964 |

) |

| |

|

|

|

|

|

Net income (loss) |

$ |

4,279 |

|

$ |

(4,602 |

) |

$ |

(1,464 |

) |

$ |

(28,723 |

) |

|

|

|

|

|

|

| Net income (loss)

attributable to: |

|

|

|

|

|

Shareholders of the Company |

$ |

4,278 |

|

$ |

(4,618 |

) |

$ |

(1,409 |

) |

$ |

(28,711 |

) |

|

Non-controlling interest |

|

1 |

|

|

16 |

|

|

(55 |

) |

|

(12 |

) |

|

|

|

|

|

|

| Income (loss) per

share |

|

|

|

|

|

Basic |

$ |

0.10 |

|

$ |

(0.10 |

) |

$ |

(0.03 |

) |

$ |

(0.64 |

) |

|

Diluted |

|

0.09 |

|

|

(0.10 |

) |

|

(0.03 |

) |

|

(0.64 |

) |

|

|

|

|

|

|

Condensed Interim Consolidated Statements of

Comprehensive Income (Loss)(unaudited)

|

|

Three months ended |

Nine months ended |

| |

September 30 |

September 30 |

|

|

2021 |

2020 |

2021 |

2020 |

|

|

|

|

|

|

|

Net income (loss) for the period |

$ |

4,279 |

|

$ |

(4,602 |

) |

$ |

(1,464 |

) |

$ |

(28,723 |

) |

| |

|

|

|

|

| Foreign currency

translation |

|

3,121 |

|

|

(2,206 |

) |

|

(8,001 |

) |

|

2,636 |

|

| Deferred tax effect |

|

- |

|

|

(125 |

) |

|

- |

|

|

(126 |

) |

|

|

|

|

|

|

|

Total other comprehensive income (loss) for the period |

|

3,121 |

|

|

(2,331 |

) |

|

(8,001 |

) |

|

2,510 |

|

|

|

|

|

|

|

|

Total comprehensive income (loss) |

$ |

7,400 |

|

$ |

(6,933 |

) |

$ |

(9,465 |

) |

$ |

(26,213 |

) |

|

|

|

|

|

|

| Total comprehensive

income (loss) attributable to: |

|

|

|

|

| |

|

|

|

|

|

Shareholders of the Company |

$ |

7,399 |

|

$ |

(6,949 |

) |

$ |

(9,410 |

) |

$ |

(26,201 |

) |

|

Non-controlling interest |

|

1 |

|

|

16 |

|

|

(55 |

) |

|

(12 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statements of Cash Flows(in thousands of Canadian

dollars)(unaudited)

|

|

Three months ended |

Nine months ended |

|

|

September 30 |

September 30 |

|

|

2021 |

2020 |

2021 |

2020 |

|

|

|

|

|

|

| Cash provided by (used

in): |

|

|

|

|

| |

|

|

|

|

| Operations: |

|

|

|

|

|

Net income (loss) for the period |

$ |

4,279 |

|

$ |

(4,602 |

) |

$ |

(1,464 |

) |

$ |

(28,723 |

) |

|

Add (deduct) items not affecting cash: |

|

|

|

|

|

Depreciation |

|

20,245 |

|

|

22,396 |

|

|

62,821 |

|

|

91,282 |

|

|

Share-based compensation |

|

186 |

|

|

21 |

|

|

576 |

|

|

690 |

|

|

Gain on sale of property, plant and equipment |

|

(355 |

) |

|

(1,367 |

) |

|

(3,720 |

) |

|

(2,902 |

) |

|

Finance costs |

|

1,675 |

|

|

2,106 |

|

|

5,254 |

|

|

8,063 |

|

|

Unrealized (gain) loss on foreign currencies translation |

|

(474 |

) |

|

1,015 |

|

|

(2,654 |

) |

|

(6,813 |

) |

|

Current income tax expense (recovery) |

|

(122 |

) |

|

14 |

|

|

(577 |

) |

|

2,307 |

|

|

Deferred income tax expense (recovery) |

|

938 |

|

|

(2,045 |

) |

|

(2,586 |

) |

|

(11,271 |

) |

|

Income taxes (paid) recovered |

|

(119 |

) |

|

2,272 |

|

|

397 |

|

|

2,881 |

|

|

Cashflow |

|

26,253 |

|

|

19,810 |

|

|

58,047 |

|

|

55,514 |

|

|

Changes in non-cash working capital items: |

|

|

|

|

|

Accounts receivable |

|

(17,132 |

) |

|

1,599 |

|

|

(17,291 |

) |

|

44,698 |

|

|

Inventory |

|

(6,431 |

) |

|

4,236 |

|

|

(4,302 |

) |

|

3,564 |

|

|

Prepaid expenses and deposits |

|

(3,911 |

) |

|

(943 |

) |

|

(1,870 |

) |

|

5,384 |

|

|

Accounts payable and accrued liabilities |

|

7,984 |

|

|

(8,398 |

) |

|

15,975 |

|

|

(46,590 |

) |

|

Deferred revenue |

|

6,531 |

|

|

(1,913 |

) |

|

11,223 |

|

|

4,326 |

|

|

Cash provided by operating activities |

|

13,294 |

|

|

14,391 |

|

|

61,782 |

|

|

66,896 |

|

| Investing: |

|

|

|

|

|

Purchase of property, plant and equipment |

|

(4,077 |

) |

|

(2,108 |

) |

|

(17,230 |

) |

|

(12,298 |

) |

|

Proceeds on disposal of property, plant and equipment |

|

711 |

|

|

2,125 |

|

|

9,156 |

|

|

5,468 |

|

|

Changes in non-cash working capital items |

|

(709 |

) |

|

(810 |

) |

|

342 |

|

|

(2,808 |

) |

|

Cash used in investing activities |

|

(4,075 |

) |

|

(793 |

) |

|

(7,732 |

) |

|

(9,638 |

) |

| Financing: |

|

|

|

|

|

Advances on long-term debt |

|

- |

|

|

- |

|

|

- |

|

|

29,796 |

|

|

Repayment of long-term debt |

|

(7,636 |

) |

|

(5,622 |

) |

|

(36,911 |

) |

|

(63,964 |

) |

|

Repayment of lease liabilities |

|

(1,088 |

) |

|

(2,090 |

) |

|

(4,710 |

) |

|

(6,354 |

) |

|

Dividends to shareholders |

|

- |

|

|

- |

|

|

- |

|

|

(2,710 |

) |

|

Repurchase of common shares |

|

(2,489 |

) |

|

- |

|

|

(4,742 |

) |

|

(427 |

) |

|

Partnership distributions |

|

- |

|

|

- |

|

|

- |

|

|

(125 |

) |

|

Interest paid |

|

(1,668 |

) |

|

(2,130 |

) |

|

(5,114 |

) |

|

(8,494 |

) |

|

|

|

|

|

|

|

Cash used in financing activities |

|

(12,881 |

) |

|

(9,842 |

) |

|

(51,477 |

) |

|

(52,278 |

) |

|

|

|

|

|

|

|

Change in cash and cash equivalents |

|

(3,662 |

) |

|

3,756 |

|

|

2,573 |

|

|

4,980 |

|

| |

|

|

|

|

| Cash

and cash equivalents, beginning of period |

|

29,231 |

|

|

21,097 |

|

|

22,996 |

|

|

19,873 |

|

|

|

|

|

|

|

| Cash

and cash equivalents, end of period |

$ |

25,569 |

|

$ |

24,853 |

|

$ |

25,569 |

|

$ |

24,853 |

|

|

|

|

|

|

|

Segmented Information

The Company provides a variety of products and

services to the energy and other resource industries through five

reporting segments, which operate substantially in three geographic

regions. These reporting segments are Contract Drilling Services,

which includes the contracting of drilling equipment and the

provision of labour required to operate the equipment, Rentals and

Transportation Services, which includes the rental and

transportation of equipment used in energy and other industrial

operations, Compression and Process Services, which includes the

fabrication, sale, rental and servicing of gas compression and

process equipment and Well Servicing, which includes the

contracting of service rigs and the provision of labour required to

operate the equipment. Corporate includes activities related to the

Company’s corporate and public issuer affairs.

As at and for the three months ended September 30,

2021 (unaudited, in thousands of Canadian dollars)

| |

Contract |

Rentals and |

Compression |

Well |

Corporate (1) |

Total |

| |

Drilling |

Transportation |

and Process |

Servicing |

|

|

|

|

Services |

Services |

Services |

|

|

|

| |

|

|

|

|

|

|

|

Revenue |

$ |

43,334 |

|

$ |

12,313 |

|

$ |

38,188 |

|

$ |

25,046 |

|

$ |

- |

|

$ |

118,881 |

|

| |

|

|

|

|

|

|

| Cost of

services |

|

31,089 |

|

|

6,288 |

|

|

30,475 |

|

|

17,403 |

|

|

- |

|

|

85,255 |

|

| Selling, general and

administration |

|

856 |

|

|

1,487 |

|

|

2,129 |

|

|

1,141 |

|

|

1,641 |

|

|

7,254 |

|

| Other

income |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(474 |

) |

|

(474 |

) |

| Share-based

compensation |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

186 |

|

|

186 |

|

|

Depreciation (2) |

|

9,038 |

|

|

4,917 |

|

|

2,353 |

|

|

3,658 |

|

|

279 |

|

|

20,245 |

|

|

Operating income (loss) |

|

2,351 |

|

|

(379 |

) |

|

3,231 |

|

|

2,844 |

|

|

(1,632 |

) |

|

6,415 |

|

| |

|

|

|

|

|

|

| Gain (loss) on sale of

property, plant and equipment |

|

3 |

|

|

100 |

|

|

259 |

|

|

(8 |

) |

|

1 |

|

|

355 |

|

|

Finance costs |

|

(1 |

) |

|

(13 |

) |

|

(69 |

) |

|

(5 |

) |

|

(1,587 |

) |

|

(1,675 |

) |

|

|

|

|

|

|

|

|

|

Net income (loss) before income taxes |

|

2,353 |

|

|

(292 |

) |

|

3,421 |

|

|

2,831 |

|

|

(3,218 |

) |

|

5,095 |

|

|

|

|

|

|

|

|

|

| Goodwill |

|

- |

|

|

2,514 |

|

|

1,539 |

|

|

- |

|

|

- |

|

|

4,053 |

|

| Total

assets |

|

322,629 |

|

|

186,198 |

|

|

214,807 |

|

|

95,598 |

|

|

3,666 |

|

|

822,898 |

|

| Total

liabilities |

|

57,587 |

|

|

9,908 |

|

|

43,168 |

|

|

5,244 |

|

|

209,635 |

|

|

325,542 |

|

|

Capital expenditures |

|

2,818 |

|

|

61 |

|

|

910 |

|

|

288 |

|

|

- |

|

|

4,077 |

|

|

|

Canada |

United States |

Australia |

Other |

Total |

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

70,832 |

|

$ |

26,492 |

|

$ |

21,557 |

|

$ |

- |

|

$ |

118,881 |

|

|

Non-current assets (3) |

|

386,720 |

|

|

141,153 |

|

|

61,265 |

|

|

- |

|

|

589,138 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As at and for the three months ended September 30,

2020 (unaudited, in thousands of Canadian dollars)

| |

Contract |

Rentals and |

Compression |

Well |

Corporate (1) |

Total |

| |

Drilling |

Transportation |

and Process |

Servicing |

|

|

|

|

Services |

Services |

Services |

|

|

|

| |

|

|

|

|

|

|

|

Revenue |

$ |

16,178 |

|

$ |

5,939 |

|

$ |

32,282 |

|

$ |

22,841 |

|

$ |

- |

|

$ |

77,240 |

|

| |

|

|

|

|

|

|

| Cost of services |

|

12,251 |

|

|

2,591 |

|

|

25,360 |

|

|

14,245 |

|

|

- |

|

|

54,447 |

|

| Selling, general and

administration |

|

1,094 |

|

|

1,180 |

|

|

1,582 |

|

|

1,027 |

|

|

808 |

|

|

5,691 |

|

| Other expense |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

579 |

|

|

579 |

|

| Share-based compensation |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

21 |

|

|

21 |

|

|

Depreciation (2) |

|

9,950 |

|

|

5,809 |

|

|

2,451 |

|

|

3,994 |

|

|

192 |

|

|

22,396 |

|

|

Operating income (loss) |

|

(7,117 |

) |

|

(3,641 |

) |

|

2,889 |

|

|

3,575 |

|

|

(1,600 |

) |

|

(5,894 |

) |

| |

|

|

|

|

|

|

| Gain on sale of property,

plant and equipment |

|

309 |

|

|

376 |

|

|

382 |

|

|

12 |

|

|

288 |

|

|

1,367 |

|

| Finance

costs |

|

(51 |

) |

|

(15 |

) |

|

(92 |

) |

|

(7 |

) |

|

(1,941 |

) |

|

(2,106 |

) |

|

|

|

|

|

|

|

|

| Net

income (loss) before income taxes |

|

(6,859 |

) |

|

(3,280 |

) |

|

3,179 |

|

|

3,580 |

|

|

(3,253 |

) |

|

(6,633 |

) |

|

|

|

|

|

|

|

|

| Goodwill |

|

- |

|

|

2,514 |

|

|

1,539 |

|

|

- |

|

|

- |

|

|

4,053 |

|

| Total assets |

|

322,464 |

|

|

204,812 |

|

|

221,112 |

|

|

102,297 |

|

|

23,206 |

|

|

873,891 |

|

| Total liabilities |

|

54,146 |

|

|

11,182 |

|

|

30,165 |

|

|

5,428 |

|

|

255,903 |

|

|

356,824 |

|

| Capital

expenditures |

|

521 |

|

|

15 |

|

|

855 |

|

|

717 |

|

|

- |

|

|

2,108 |

|

|

|

Canada |

United States |

Australia |

Other |

Total |

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

34,493 |

|

$ |

18,237 |

|

$ |

24,510 |

|

$ |

- |

|

$ |

77,240 |

|

|

Non-current assets (3) |

|

432,917 |

|

|

163,896 |

|

|

67,090 |

|

|

- |

|

|

663,903 |

|

(1) Corporate includes the Company’s corporate activities

and obligations pursuant to long-term credit facilities. (2)

Effective April 1, 2020 the Company changed certain estimates

relating to the useful life and residual value of equipment in the

Contract Drilling Services segment. See note 10 to the 2020

Financial Statements for further details.(3) Includes

property, plant and equipment, lease asset (excluding current

portion) and goodwill.

As at and for the nine months ended September 30,

2021 (unaudited, in thousands of Canadian dollars)

| |

Contract |

Rentals and |

Compression |

Well |

Corporate (1) |

Total |

| |

Drilling |

Transportation |

and Process |

Servicing |

|

|

|

|

Services |

Services |

Services |

|

|

|

| |

|

|

|

|

|

|

|

Revenue |

$ |

97,645 |

|

$ |

26,101 |

|

$ |

106,001 |

|

$ |

67,200 |

|

$ |

- |

|

$ |

296,947 |

|

| |

|

|

|

|

|

|

| Cost of

services |

|

72,359 |

|

|

13,989 |

|

|

85,631 |

|

|

47,456 |

|

|

- |

|

|

219,435 |

|

| Selling, general and

administration |

|

3,201 |

|

|

4,015 |

|

|

4,753 |

|

|

3,470 |

|

|

4,423 |

|

|

19,862 |

|

| Other

income |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(2,654 |

) |

|

(2,654 |

) |

| Share-based

compensation |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

576 |

|

|

576 |

|

|

Depreciation (2) |

|

28,364 |

|

|

15,477 |

|

|

7,025 |

|

|

11,259 |

|

|

696 |

|

|

62,821 |

|

|

Operating income (loss) |

|

(6,279 |

) |

|

(7,380 |

) |

|

8,592 |

|

|

5,015 |

|

|

(3,041 |

) |

|

(3,093 |

) |

| |

|

|

|

|

|

|

| Gain on sale of

property, plant and equipment |

|

283 |

|

|

1,831 |

|

|

1,483 |

|

|

39 |

|

|

84 |

|

|

3,720 |

|

|

Finance costs |

|

(10 |

) |

|

(59 |

) |

|

(221 |

) |

|

(16 |

) |

|

(4,948 |

) |

|

(5,254 |

) |

|

|

|

|

|

|

|

|

|

Net income (loss) before income taxes |

|

(6,006 |

) |

|

(5,608 |

) |

|

9,854 |

|

|

5,038 |

|

|

(7,905 |

) |

|

(4,627 |

) |

|

|

|

|

|

|

|

|

| Goodwill |

|

- |

|

|

2,514 |

|

|

1,539 |

|

|

- |

|

|

- |

|

|

4,053 |

|

| Total

assets |

|

322,629 |

|

|

186,198 |

|

|

214,807 |

|

|

95,598 |

|

|

3,666 |

|

|

822,898 |

|

| Total

liabilities |

|

57,587 |

|

|

9,908 |

|

|

43,168 |

|

|

5,244 |

|

|

209,635 |

|

|

325,542 |

|

|

Capital expenditures |

|

12,557 |

|

|

341 |

|

|

3,491 |

|

|

841 |

|

|

- |

|

|

17,230 |

|

|

|

Canada |

United States |

Australia |

Other |

Total |

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

173,125 |

|

$ |

67,695 |

|

$ |

56,125 |

|

$ |

2 |

|

$ |

296,947 |

|

|

Non-current assets (3) |

|

386,720 |

|

|

141,153 |

|

|

61,265 |

|

|

- |

|

|

589,138 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As at and for the nine months ended September 30,

2020 (unaudited, in thousands of Canadian dollars)

| |

Contract |

Rentals and |

Compression |

Well |

Corporate (1) |

Total |

| |

Drilling |

Transportation |

and Process |

Servicing |

|

|

|

|

Services |

Services |

Services |

|

|

|

| |

|

|

|

|

|

|

|

Revenue |

$ |

73,373 |

|

$ |

27,554 |

|

$ |

103,238 |

|

$ |

78,113 |

|

$ |

- |

|

$ |

282,278 |

|

| |

|

|

|

|

|

|

| Cost of services |

|

56,382 |

|

|

16,367 |

|

|

81,681 |

|

|

53,183 |

|

|

- |

|

|

207,613 |

|

| Selling, general and

administration |

|

4,832 |

|

|

4,824 |

|

|

5,211 |

|

|

3,875 |

|

|

3,290 |

|

|

22,032 |

|

| Other income |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(6,813 |

) |

|

(6,813 |

) |

| Share-based compensation |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

690 |

|

|

690 |

|

|

Depreciation(2) |

|

54,475 |

|

|

17,842 |

|

|

7,122 |

|

|

11,284 |

|

|

559 |

|

|

91,282 |

|

|

Operating income (loss) |

|

(42,316 |

) |

|

(11,479 |

) |

|

9,224 |

|

|

9,771 |

|

|

2,274 |

|

|

(32,526 |

) |

| |

|

|

|

|

|

|

| Gain on sale of property,

plant and equipment |

|

1,065 |

|

|

912 |

|

|

492 |

|

|

16 |

|

|

417 |

|

|

2,902 |

|

| Finance

costs |

|

(129 |

) |

|

(57 |

) |

|

(289 |

) |

|

(25 |

) |

|

(7,563 |

) |

|

(8,063 |

) |

|

|

|

|

|

|

|

|

| Net

income (loss) before income taxes |

|

(41,380 |

) |

|

(10,624 |

) |

|

9,427 |

|

|

9,762 |

|

|

(4,872 |

) |

|

(37,687 |

) |

|

|

|

|

|

|

|

|

| Goodwill |

|

- |

|

|

2,514 |

|

|

1,539 |

|

|

- |

|

|

- |

|

|

4,053 |

|

| Total assets |

|

322,464 |

|

|

204,812 |

|

|

221,112 |

|

|

102,297 |

|

|

23,206 |

|

|

873,891 |

|

| Total liabilities |

|

54,146 |

|

|

11,182 |

|

|

30,165 |

|

|

5,428 |

|

|

255,903 |

|

|

356,824 |

|

| Capital

expenditures |

|

2,540 |

|

|

857 |

|

|

6,934 |

|

|

1,955 |

|

|

12 |

|

|

12,298 |

|

|

|

Canada |

United States |

Australia |

Other |

Total |

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

130,698 |

|

$ |

65,398 |

|

$ |

86,129 |

|

$ |

53 |

|

|

282,278 |

|

|

Non-current assets (3) |

|

432,917 |

|

|

163,896 |

|

|

67,090 |

|

|

- |

|

|

663,903 |

|

(1) Corporate includes the Company’s corporate activities

and obligations pursuant to long-term credit facilities. (2)

Effective April 1, 2020 the Company changed certain estimates

relating to the useful life and residual value of equipment in the

Contract Drilling Services segment. See note 10 to the 2020

Financial Statements for further details.(3) Includes

property, plant and equipment, lease asset (excluding current

portion) and goodwill.

Total Energy provides contract drilling

services, equipment rentals and transportation services, well

servicing and compression and process equipment and service to the

energy and other resource industries from operation centers in

North America and Australia. The common shares of Total Energy are

listed and trade on the TSX under the symbol TOT.

For further information, please contact Daniel

Halyk, President & Chief Executive Officer at (403) 216-3921 or

Yuliya Gorbach, Vice-President Finance and Chief Financial Officer

at (403) 216-3920 or by e-mail at: investorrelations@totalenergy.ca

or visit our website at www.totalenergy.ca

Notes to the Financial

Highlights

|

|

(1) |

EBITDA means earnings before interest, taxes, depreciation and

amortization and is equal to net income before income taxes plus

finance costs plus depreciation. EBITDA is not a recognized measure

under IFRS. Management believes that in addition to net income,

EBITDA is a useful supplemental measure as it provides an

indication of the results generated by the Company’s primary

business activities prior to consideration of how those activities

are financed, amortized or how the results are taxed in various

jurisdictions as well as the cash generated by the Company’s

primary business activities without consideration of the timing of

the monetization of non-cash working capital items. Readers should

be cautioned, however, that EBITDA should not be construed as an

alternative to net income determined in accordance with IFRS as an

indicator of Total Energy’s performance. Total Energy’s method of

calculating EBITDA may differ from other organizations and,

accordingly, EBITDA may not be comparable to measures used by other

organizations. |

|

|

|

|

|

|

(2) |

Working capital equals current assets minus current

liabilities. |

|

|

|

|

|

|

(3) |

Net Debt equals long-term debt plus lease liabilities plus current

liabilities minus current assets. |

|

|

|

|

|

|

(4) |

Basic and diluted shares outstanding reflect the weighted average

number of common shares outstanding for the periods. See note 5 to

the Company’s condensed interim consolidated financial

statements. |

Certain statements contained in this press

release, including statements which may contain words such as

"could", "should", "expect", "believe", "will" and similar

expressions and statements relating to matters that are not

historical facts are forward-looking statements. Forward-looking

statements are based upon the opinions and expectations of

management of Total Energy as at the effective date of such

statements and, in some cases, information supplied by third

parties. Although Total Energy believes the expectations reflected

in such forward-looking statements are based upon reasonable

assumptions and that information received from third parties is

reliable, it can give no assurance that those expectations will

prove to have been correct.

In particular, this press release contains

forward-looking statements concerning industry activity levels,

including expectations regarding Total Energy’s future activity

levels, market share and compression and process production

activity. Such forward-looking statements are based on a number of

assumptions and factors including fluctuations in the market for

oil and natural gas and related products and services, political

and economic conditions, central bank interest rate policy, the

demand for products and services provided by Total Energy, Total

Energy’s ability to attract and retain key personnel and other

factors. Such forward-looking statements involve known and

unknown risks and uncertainties which may cause the actual results,

performance or achievements of Total Energy to be materially

different from any future results, performances or achievements

expressed or implied by such forward-looking statements.

Reference should be made to Total Energy’s most recently filed

Annual Information Form and other public disclosures (available at

www.sedar.com) for a discussion of such risks and

uncertainties.

The TSX has neither approved nor disapproved of

the information contained herein.

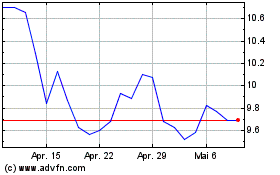

Total Energy Services (TSX:TOT)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Total Energy Services (TSX:TOT)

Historical Stock Chart

Von Apr 2023 bis Apr 2024