Tilray, Inc. (“Tilray” or the “Company”) (Nasdaq: TLRY; TSX:

TLRY), a leading global cannabis-lifestyle and consumer packaged

goods company inspiring and empowering the worldwide community to

live their very best life, today reported financial results for the

second fiscal quarter ended November 30, 2021. All financial

information in this press release is reported in U.S. dollars,

unless otherwise indicated.

The Company also announced a new parent name,

Tilray Brands, Inc., reflecting the Company’s

evolution from a Canadian LP to a global consumer packaged goods

company powerhouse with a market leading portfolio of cannabis and

lifestyle CPG brands.

Irwin D. Simon, Tilray’s Chairman and Chief

Executive Officer, stated, “Our second quarter performance reflects

notable success building high-quality and highly sought-after

cannabis and lifestyle CPG brands which, coupled with our scale,

operational excellence and broad global distribution, enabled us to

increase sales and maintain profitability despite sector-specific

and macro-economic headwinds.”

Mr. Simon continued, “Looking at performance

highlights across key markets, we maintained our #1 cannabis market

share position in Canada – despite market saturation and related

competitive challenges -- on the strength of our brands and adept

pricing and marketing adjustments. Importantly, we believe these

adjustments will enable us to aggressively recapture share when the

market right-sizes. In Germany – Europe’s largest and most

profitable medical cannabis market – our nearly 20% share leads the

market. We believe this, coupled with our infrastructure, will also

allow us to capture the adult-use market as legalization

accelerates under the new coalition government. Turning to the

U.S., SweetWater Brewing and Manitoba Harvest continued to invest

in product innovation and acquisitions to enhance awareness and

distribution. These profitable businesses further provide an

opportunity to launch THC-based products upon federal legalization

in the U.S. Subsequent to the end of the fiscal quarter, we also

expanded our spirits portfolio through the acquisition of

Breckenridge Distillery, deepening our presence in the fast-growing

spirits sector while also providing an immediate contribution to

earnings.”

Mr. Simon concluded, “The totality of our

performance, our prospects and our global platform make Tilray

Brands' opportunity as compelling as ever, driven by our success as

a cannabis and lifestyle CPG powerhouse and our relentless focus on

delivering shareholder value.”

Financial Highlights – Second Quarter

Fiscal 2022

- Net income increased to $6 million

from a net loss of $89 million in the previous year quarter.

- Net revenue increased ~20% to $155

million during the second quarter from $129 million in the prior

year quarter. The increase was driven by 7% growth in cannabis

revenue to $58.8 million, net beverage alcohol revenue of $13.7

million from SweetWater, and wellness segment revenue of $13.8

million from Manitoba Harvest.

- Adjusted EBITDA of $13.8 million in

the second quarter 2022, 8% growth compared to the preceding prior

quarter, and the eleventh consecutive quarter of positive Adjusted

EBITDA

- Gross profit of $32.8 million, a 7%

decrease from $35.3 million in the prior year quarter.

- Adjusted gross margin in the

cannabis segment remained strong at 43%.

- Maintained #1 cannabis market share

in Canada1 with leading portfolio of comprehensive medical cannabis

and adult-use brands, including top position in cannabis flower and

pre-rolls.

- International medical cannabis

market leader and #1 in Germany2 with ~20% market share.

- Cost synergies from Aphria-Tilray

combination of $70 million achieved on a run-rate basis to date,

with actual cash-savings close to $36 million to date. Expect to

reach $80 million synergy target, ahead of schedule, by May 31,

2022 and to generate an additional $20 million in synergies in

fiscal 2023.

Strategic Growth Actions

- On December 21, 2021 – SweetWater

acquired award-winning craft-beer brands, Alpine Beer and Green

Flash Brewing.

- On December 8, 2021, Tilray

acquired Breckenridge Distillery, strengthening its strategic

position in the U.S.

- On November 4, 2021, SweetWater

entered the Spirits category with new ready-to-drink cocktail and

cross-brand collaboration with Canadian cannabis brand, RIFF.

- On October 26, 2021, Tilray

announced European expansion with medical cannabis agreement in

Luxembourg.

- On October 20, 2021, Tilray

announced an expanded distribution agreement with Great North

Distributors for adult-use cannabis sales across Canada.

Growth and High Potential Across Key

Markets

- #1 Market Leading Position

in Germany and Poised to Benefit from Recreational

Legalization –Tilray is also the only company currently

supplying the German government with medical cannabis grown

in-country. The Company’s state-of-the-art EU GMP

certified cultivation facility in Germany has additional capacity

to immediately support entry into the recreational market upon

legalization, which the new German coalition government is

accelerating.

- Ongoing Progress Across the

EU - Tilray’s success across the EU, a powerful growth

market worth potentially $1 billion for the Company, is backed by

its two state-of-the-art cultivation facilities in Portugal and

Germany that provide EU GMP certified pharmaceutical-grade medical

cannabis across the region. Tilray is also the only Company with

two EU GMP certified cannabis facilities in Europe. This

unparalleled production capability coupled with Tilray’s sales

arrangements through major distribution channels in Germany, the

UK, and other key markets, and strong relationships with local

governments and the trust of patients give Tilray the ability to

drive accelerated growth.

- #1 Leading Cannabis Market

Share in Canada – Amid an intensely competitive and

over-saturated market, Tilray remains the market leader in the

CAD$4.26 billion Canadian cannabis market, driven by a portfolio of

carefully curated brands across all consumer segments; medical,

wellness, innovative cannabis 2.0 products across concentrates,

edibles, and drinks; processing capacity; and distribution. In

order to address the saturated marketplace, Tilray has implemented

strategic price adjustments, expanded distribution through its

coast-to-coast agreement with Rose Life Sciences and Great North

Distributors, and doubled-down on and accelerated product

innovation.

- A Leading U.S. CPG Platform

that Generates Considerable Cash Flow Now and Will Be Immediately

Leveraged for Cannabis Products Upon Federal Legalization

- In the U.S., Tilray’s operating businesses include SweetWater,

the 11th largest craft brewer in the nation3 and leading lifestyle

brand, and Manitoba Harvest, a pioneer in hemp, CBD and wellness

products. Together, they generate approximately $100 million in

revenue and are EBITDA and cash flow positive and will expand in

the near term into CBD adjacencies and THC-based products upon

legalization. Further, the Company continues to build its U.S.

platform, including through its prior acquisition of a majority of

the outstanding senior secured convertible notes of MedMen

Enterprises Inc. (CSE: MMEN) (OTCQX: MMNFF) – which marked a

critical step towards delivering on its objective of leading the

U.S. cannabis market upon federal legalization.

Conference CallTilray

executives will host a conference call and live audio webcast to

discuss these results at 8:30 am Eastern Time, details of which are

provided below.

Call-in Number: (877) 407-0792

from Canada and the U.S. or (201) 689-8263 from international

locations. Please dial in at least 10 minutes prior to the start

time.

A telephone replay will be available

approximately two hours after the call concludes through January

26, 2022. To access the recording dial (844)-512-2921 and use the

passcode 13725661.

There will be a simultaneous, live webcast

available on the Investors section of Tilray’s website at

www.tilray.com. The webcast will also be archived.

ICR Conference Participation

Today

Tilray executives will also host a virtual

fireside chat at the ICR Conference at 1:30 pm Eastern Time today.

There will be a simultaneous, live webcast available on the

Investors section of Tilray’s website at www.tilray.com. The

webcast will also be archived.

About Tilray

Tilray, Inc. (Nasdaq: TLRY; TSX: TLRY), is a

leading global cannabis-lifestyle and consumer packaged goods

company with operations in Canada, the United States, Europe,

Australia, and Latin America that is changing people's lives for

the better – one person at a time – by inspiring and empowering the

worldwide community to live their very best life by providing them

with products that meet the needs of their mind, body, and soul and

invoke a sense of wellbeing. Tilray’s mission is to be the trusted

partner for its patients and consumers by providing them with a

cultivated experience and health and wellbeing through

high-quality, differentiated brands and innovative products. A

pioneer in cannabis research, cultivation, and distribution,

Tilray’s unprecedented production platform supports over 20 brands

in over 20 countries, including comprehensive cannabis offerings,

hemp-based foods, and alcoholic beverages.

For more information on how we open a world of

wellbeing, visit www.Tilray.com.

Forward-Looking Statements

Certain statements in this communication that

are not historical facts constitute forward-looking information or

forward-looking statements (together, “forward-looking statements”)

under Canadian securities laws and within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended, that are intended

to be subject to the “safe harbor” created by those sections and

other applicable laws. Forward-looking statements can be identified

by words such as “forecast,” “future,” “should,” “could,” “enable,”

“potential,” “contemplate,” “believe,” “anticipate,” “estimate,”

“plan,” “expect,” “intend,” “may,” “project,” “will,” “would” and

the negative of these terms or similar expressions, although not

all forward-looking statements contain these identifying words.

Certain material factors, estimates, goals, projections or

assumptions were used in drawing the conclusions contained in the

forward-looking statements throughout this communication.

Forward-looking statements include statements regarding our

intentions, beliefs, projections, outlook, analyses or current

expectations concerning, among other things: the Company’s ability

to become the world's leading cannabis-focused consumer branded

company; expectations regarding profitable revenue growth and

expected cost savings; and the Company’s ability to commercialize

new and innovative beverage products. Many factors could cause

actual results, performance or achievement to be materially

different from any forward-looking statements, and other risks and

uncertainties not presently known to the Company or that the

Company deems immaterial could also cause actual results or events

to differ materially from those expressed in the forward-looking

statements contained herein. For a more detailed discussion of

these risks and other factors, see the most recently filed annual

information form of Tilray and the Annual Report on Form 10-K (and

other periodic reports filed with the SEC)

of Tilray made with the SEC and available on EDGAR. The

forward-looking statements included in this communication are made

as of the date of this communication and the Company does not

undertake any obligation to publicly update such forward-looking

statements to reflect new information, subsequent events or

otherwise unless required by applicable securities laws.

Use of Non-U.S. GAAP Financial

Measures

This press release and the accompanying tables

include non-GAAP financial measures, including adjusted gross

margin, Adjusted EBITDA and adjusted free cash flow. Management

believes that the non-GAAP financial measures presented provide

useful additional information to investors about current trends in

the Company's operations and are useful for period-over-period

comparisons of operations. These non-GAAP financial measures should

not be considered in isolation or as a substitute for the

comparable GAAP measures. In addition, these non-GAAP measures may

not be the same as similar measures provided by other companies due

to potential differences in methods of calculation and items being

excluded. They should be read only in connection with the Company's

Consolidated Statements of Operations and Cash Flows presented in

accordance with GAAP.

Adjusted EBITDA is calculated as net income

(loss) before finance expense, net; non-operating expense (income),

net; amortization; stock-based compensation; facility start-up and

closure costs; inventory valuation adjustment; lease expense; and

transaction costs. A reconciliation of Adjusted EBITDA to net loss,

the most directly comparable GAAP measure, has been provided in the

financial statement tables included below in this press release.

Gross margin, excluding inventory valuation adjustments, is

calculated as revenue less cost of sales adjusted to add back

inventory valuation adjustments and amortization of inventory

step-up, divided by revenue. A reconciliation of Gross margin,

excluding inventory valuation adjustments, to gross margin, the

most directly comparable GAAP measure, has been provided in the

financial statement tables included below in this press release.

Free cash flow is comprised of two GAAP measures deducted from each

other which are net cash flow provided by (used in) operating

activities less investments in capital and intangible assets.

Adjusted free cash flow removes the cash impact of acquisitions

from free cash flow. A reconciliation of net cash flow provided by

(used in) operating activities to free cash flow and to adjusted

cash flows, the most directly comparable GAAP measure, has been

provided in the financial statement tables included below in this

press release.

For further information:

Media: Berrin Noorata, news@tilray.com Investors: Raphael Gross,

+1-203-682-8253, Raphael.Gross@icrinc.com

1 Based on Hifyre retail data.2 Insight Health NPI: Panel data

of 5,500 pharmacies (29% coverage)3 The Brewers Association Top 50

Brewing Companies by Sales Volume Report for 2020.

Consolidated Statements of Financial

Position

| (In thousands of

United States dollars) |

|

November 30,2021 |

|

|

May 31,2021 |

|

|

Assets |

|

|

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

331,783 |

|

|

$ |

488,466 |

|

|

Accounts receivable, net |

|

|

84,575 |

|

|

|

87,309 |

|

|

Inventory |

|

|

233,020 |

|

|

|

256,429 |

|

|

Prepaids and other current assets |

|

|

57,340 |

|

|

|

48,920 |

|

|

Convertible notes receivable |

|

|

1,560 |

|

|

|

2,485 |

|

| Total current

assets |

|

|

708,278 |

|

|

|

883,609 |

|

|

Capital assets |

|

|

604,249 |

|

|

|

650,698 |

|

|

Right-of-use assets |

|

|

13,933 |

|

|

|

18,267 |

|

|

Intangible assets |

|

|

1,450,015 |

|

|

|

1,605,918 |

|

|

Goodwill |

|

|

2,814,163 |

|

|

|

2,832,794 |

|

|

Interest in equity investees |

|

|

4,440 |

|

|

|

8,106 |

|

|

Long-term investments |

|

|

168,244 |

|

|

|

17,685 |

|

|

Other assets |

|

|

164 |

|

|

|

8,285 |

|

| Total

assets |

|

$ |

5,763,486 |

|

|

$ |

6,025,362 |

|

| Liabilities |

|

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

|

|

Bank indebtedness |

|

$ |

8,736 |

|

|

$ |

8,717 |

|

|

Accounts payable and accrued liabilities |

|

|

168,300 |

|

|

|

212,813 |

|

|

Contingent consideration |

|

|

62,339 |

|

|

|

60,657 |

|

|

Warrant liability |

|

|

40,455 |

|

|

|

78,168 |

|

|

Current portion of lease liabilities |

|

|

3,588 |

|

|

|

4,264 |

|

|

Current portion of long-term debt |

|

|

31,510 |

|

|

|

36,622 |

|

| Total current

liabilities |

|

|

314,928 |

|

|

|

401,241 |

|

| Long - term

liabilities |

|

|

|

|

|

|

|

|

|

Lease liabilities |

|

|

49,265 |

|

|

|

53,946 |

|

|

Long-term debt |

|

|

151,819 |

|

|

|

167,486 |

|

|

Convertible debentures |

|

|

554,854 |

|

|

|

667,624 |

|

|

Deferred tax liability |

|

|

219,311 |

|

|

|

265,845 |

|

|

Other liabilities |

|

|

320 |

|

|

|

3,907 |

|

|

Total liabilities |

|

|

1,290,497 |

|

|

|

1,560,049 |

|

| Shareholders'

equity |

|

|

|

|

|

|

|

|

|

Common stock ($0.0001 par value; 990,000,000 shares authorized;

463,802,393 and 265,423,304 shares issued and outstanding,

respectively) |

|

|

46 |

|

|

|

46 |

|

|

Additional paid-in capital |

|

|

4,954,547 |

|

|

|

4,792,406 |

|

|

Accumulated other comprehensive income |

|

|

9,595 |

|

|

|

152,668 |

|

|

Accumulated Deficit |

|

|

(527,900 |

) |

|

|

(486,050 |

) |

| Total Tilray

shareholders' equity |

|

|

4,436,288 |

|

|

|

4,459,070 |

|

|

Non-controlling interests |

|

|

36,701 |

|

|

|

6,243 |

|

| Total shareholders'

equity |

|

|

4,472,989 |

|

|

|

4,465,313 |

|

| Total liabilities and

shareholders' equity |

|

$ |

5,763,486 |

|

|

$ |

6,025,362 |

|

Condensed Consolidated Statements of Net Income (Loss)

and Comprehensive (Loss)

|

|

|

Three months ended November 30, |

|

|

Six months endedNovember 30, |

|

|

Three months ended November 30, |

|

|

Six months ended November 30, |

|

| (In thousands of

United States dollars) |

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

|

Change |

|

|

%Change |

|

|

Change |

|

|

%Change |

|

|

Net revenue |

|

$ |

155,153 |

|

|

$ |

129,459 |

|

|

$ |

323,176 |

|

|

$ |

246,949 |

|

|

$ |

25,694 |

|

|

20 |

% |

|

|

$ |

76,227 |

|

|

31 |

% |

|

| Cost of goods sold |

|

|

122,387 |

|

|

|

94,176 |

|

|

|

239,455 |

|

|

|

176,721 |

|

|

|

28,211 |

|

|

30 |

% |

|

|

|

62,734 |

|

|

35 |

% |

|

| Gross profit |

|

|

32,766 |

|

|

|

35,283 |

|

|

|

83,721 |

|

|

|

70,228 |

|

|

|

(2,517 |

) |

|

(7 |

%) |

|

|

|

13,493 |

|

|

19 |

% |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

0 |

|

|

|

|

|

| General and administrative |

|

|

33,469 |

|

|

|

28,273 |

|

|

|

82,956 |

|

|

|

54,245 |

|

|

|

5,196 |

|

|

18 |

% |

|

|

|

28,711 |

|

|

53 |

% |

|

| Selling |

|

|

9,210 |

|

|

|

6,079 |

|

|

|

16,642 |

|

|

|

11,896 |

|

|

|

3,131 |

|

|

52 |

% |

|

|

|

4,746 |

|

|

40 |

% |

|

| Amortization |

|

|

29,016 |

|

|

|

4,208 |

|

|

|

59,755 |

|

|

|

8,335 |

|

|

|

24,808 |

|

|

590 |

% |

|

|

|

51,420 |

|

|

617 |

% |

|

| Marketing and promotion |

|

|

7,120 |

|

|

|

4,252 |

|

|

|

12,585 |

|

|

|

9,177 |

|

|

|

2,868 |

|

|

67 |

% |

|

|

|

3,408 |

|

|

37 |

% |

|

| Research and development |

|

|

515 |

|

|

|

225 |

|

|

|

1,300 |

|

|

|

345 |

|

|

|

290 |

|

|

129 |

% |

|

|

|

955 |

|

|

277 |

% |

|

| Transaction costs |

|

|

8,120 |

|

|

|

18,206 |

|

|

|

33,699 |

|

|

|

20,664 |

|

|

|

(10,086 |

) |

|

(55 |

%) |

|

|

|

13,035 |

|

|

100 |

% |

|

| Total operating expenses |

|

|

87,450 |

|

|

|

61,243 |

|

|

|

206,937 |

|

|

|

104,662 |

|

|

|

26,207 |

|

|

43 |

% |

|

|

|

102,275 |

|

|

98 |

% |

|

| Operating loss |

|

|

(54,684 |

) |

|

|

(25,960 |

) |

|

|

(123,216 |

) |

|

|

(34,434 |

) |

|

|

(28,724 |

) |

|

111 |

% |

|

|

|

(88,782 |

) |

|

258 |

% |

|

| Interest expense, net |

|

|

(9,940 |

) |

|

|

(4,832 |

) |

|

|

(20,110 |

) |

|

|

(10,568 |

) |

|

|

(5,108 |

) |

|

106 |

% |

|

|

|

(9,542 |

) |

|

90 |

% |

|

| Non-operating income (expense),

net |

|

|

64,750 |

|

|

|

(72,649 |

) |

|

|

113,610 |

|

|

|

(86,008 |

) |

|

|

137,399 |

|

|

(189 |

%) |

|

|

|

199,618 |

|

|

(232 |

%) |

|

| Income (loss) before income

taxes |

|

|

126 |

|

|

|

(103,441 |

) |

|

|

(29,716 |

) |

|

|

(131,010 |

) |

|

|

103,567 |

|

|

(100 |

%) |

|

|

|

101,294 |

|

|

(77 |

%) |

|

| Income taxes (recovery) |

|

|

(5,671 |

) |

|

|

(14,192 |

) |

|

|

(909 |

) |

|

|

(20,017 |

) |

|

|

8,521 |

|

|

(60 |

%) |

|

|

|

19,108 |

|

|

(95 |

%) |

|

| Net income (loss) |

|

$ |

5,797 |

|

|

$ |

(89,249 |

) |

|

$ |

(28,807 |

) |

|

$ |

(110,993 |

) |

|

$ |

95,046 |

|

|

(106 |

%) |

|

|

$ |

82,186 |

|

|

(74 |

%) |

|

| Total net income (loss)

attributable to Shareholders of Tilray Inc. |

|

$ |

(201 |

) |

|

$ |

(99,900 |

) |

|

$ |

(41,850 |

) |

|

$ |

(134,243 |

) |

|

$ |

99,699 |

|

|

(100 |

%) |

|

|

$ |

92,393 |

|

|

(69 |

%) |

|

| Weighted average number of common

shares - basic |

|

|

460,254,275 |

|

|

|

243,477,655 |

|

|

|

454,797,598 |

|

|

|

242,207,388 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of common

shares - diluted |

|

|

460,254,275 |

|

|

|

243,477,655 |

|

|

|

454,797,598 |

|

|

|

242,207,388 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per share -

basic |

|

$ |

(0.00 |

) |

|

$ |

(0.41 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.55 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per share -

diluted |

|

$ |

(0.00 |

) |

|

$ |

(0.41 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.55 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Revenue by Operating Segment

| (In thousands of

United States dollars) |

|

Three monthsendedNovember

30,2021 |

|

|

%

ofTotalrevenue |

|

|

Three monthsendedNovember

30,2020 |

|

|

%

ofTotalrevenue |

|

|

Six monthsendedNovember

30,2021 |

|

|

%

ofTotalrevenue |

|

|

Six monthsendedNovember

30,2020 |

|

|

%

ofTotalrevenue |

|

|

Cannabis revenue |

|

$ |

58,775 |

|

|

38 |

% |

|

|

$ |

54,766 |

|

|

42 |

% |

|

|

$ |

129,224 |

|

|

40 |

% |

|

|

$ |

105,968 |

|

|

43 |

% |

|

|

Distribution revenue |

|

|

68,869 |

|

|

44 |

% |

|

|

|

73,983 |

|

|

57 |

% |

|

|

|

136,055 |

|

|

42 |

% |

|

|

|

140,271 |

|

|

57 |

% |

|

|

Beverage alcohol revenue |

|

|

13,707 |

|

|

9 |

% |

|

|

|

710 |

|

|

1 |

% |

|

|

|

29,168 |

|

|

9 |

% |

|

|

|

710 |

|

|

0 |

% |

|

|

Wellness revenue |

|

|

13,802 |

|

|

9 |

% |

|

|

|

— |

|

|

0 |

% |

|

|

|

28,729 |

|

|

9 |

% |

|

|

|

— |

|

|

0 |

% |

|

| Net revenue |

|

$ |

155,153 |

|

|

100 |

% |

|

|

$ |

129,459 |

|

|

100 |

% |

|

|

$ |

323,176 |

|

|

100 |

% |

|

|

$ |

246,949 |

|

|

100 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Cannabis Revenue by Market Channel

| |

|

Three months ended November 30, |

|

|

Six months ended November 30, |

|

| (In thousands of

United States dollars) |

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

Revenue from Canadian medical cannabis products |

|

$ |

7,929 |

|

|

11 |

% |

|

|

$ |

6,260 |

|

|

9 |

% |

|

|

$ |

16,303 |

|

|

10 |

% |

|

|

$ |

12,640 |

|

|

9 |

% |

|

| Revenue from Canadian

adult-use cannabis products |

|

|

49,535 |

|

|

67 |

% |

|

|

|

58,175 |

|

|

83 |

% |

|

|

|

119,128 |

|

|

73 |

% |

|

|

|

115,123 |

|

|

84 |

% |

|

| Revenue from wholesale

cannabis products |

|

|

2,259 |

|

|

3 |

% |

|

|

|

1,440 |

|

|

2 |

% |

|

|

|

3,959 |

|

|

2 |

% |

|

|

|

5,232 |

|

|

4 |

% |

|

| Revenue from international

cannabis products |

|

|

13,706 |

|

|

19 |

% |

|

|

|

4,280 |

|

|

6 |

% |

|

|

|

23,972 |

|

|

15 |

% |

|

|

|

4,280 |

|

|

3 |

% |

|

| Total cannabis revenue |

|

|

73,429 |

|

|

|

|

|

|

|

70,155 |

|

|

|

|

|

|

|

163,362 |

|

|

|

|

|

|

|

137,275 |

|

|

|

|

|

| Excise taxes |

|

|

(14,654 |

) |

|

(20 |

%) |

|

|

|

(15,389 |

) |

|

(22 |

%) |

|

|

|

(34,138 |

) |

|

(21 |

%) |

|

|

|

(31,307 |

) |

|

(23 |

%) |

|

| Total cannabis net

revenue |

|

$ |

58,775 |

|

|

|

|

|

|

$ |

54,766 |

|

|

|

|

|

|

$ |

129,224 |

|

|

|

|

|

|

$ |

105,968 |

|

|

|

|

|

Other Financial Information: Gross Margin and Adjusted

Gross Margin

| (In thousands of

United States dollars) |

|

Three months ended November 30, 2021 |

|

| |

|

Cannabis |

|

|

Beverage |

|

|

Distribution |

|

|

Wellness |

|

|

Total |

|

|

Gross revenue |

|

$ |

73,429 |

|

|

$ |

14,544 |

|

|

$ |

68,869 |

|

|

$ |

13,802 |

|

|

$ |

170,644 |

|

| Excise taxes |

|

|

(14,654 |

) |

|

|

(837 |

) |

|

|

— |

|

|

|

— |

|

|

|

(15,491 |

) |

| Net revenue |

|

|

58,775 |

|

|

|

13,707 |

|

|

|

68,869 |

|

|

|

13,802 |

|

|

|

155,153 |

|

| Cost of goods sold |

|

|

45,259 |

|

|

|

5,921 |

|

|

|

61,237 |

|

|

|

9,970 |

|

|

|

122,387 |

|

| Gross profit |

|

$ |

13,516 |

|

|

$ |

7,786 |

|

|

$ |

7,632 |

|

|

$ |

3,832 |

|

|

$ |

32,766 |

|

| Gross margin |

|

|

23 |

% |

|

|

57 |

% |

|

|

11 |

% |

|

|

28 |

% |

|

|

21 |

% |

| Adjusted gross profit |

|

$ |

25,516 |

|

|

$ |

7,786 |

|

|

$ |

7,632 |

|

|

$ |

3,832 |

|

|

$ |

44,766 |

|

| Adjusted gross margin |

|

|

43 |

% |

|

|

57 |

% |

|

|

11 |

% |

|

|

28 |

% |

|

|

29 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended November 30, 2020 |

|

| |

|

Cannabis |

|

|

Beverage |

|

|

Distribution |

|

|

Wellness |

|

|

Total |

|

| Gross revenue |

|

$ |

70,155 |

|

|

$ |

754 |

|

|

$ |

73,983 |

|

|

$ |

— |

|

|

$ |

144,892 |

|

| Excise taxes |

|

|

(15,389 |

) |

|

|

(44 |

) |

|

|

— |

|

|

|

— |

|

|

|

(15,433 |

) |

| Net revenue |

|

|

54,766 |

|

|

|

710 |

|

|

|

73,983 |

|

|

|

— |

|

|

|

129,459 |

|

| Cost of goods sold |

|

|

29,632 |

|

|

|

281 |

|

|

|

64,263 |

|

|

|

— |

|

|

|

94,176 |

|

| Gross profit |

|

$ |

25,134 |

|

|

$ |

429 |

|

|

$ |

9,720 |

|

|

$ |

— |

|

|

$ |

35,283 |

|

| Gross margin |

|

|

46 |

% |

|

|

60 |

% |

|

|

13 |

% |

|

|

|

|

|

|

27 |

% |

| Adjusted gross profit |

|

$ |

25,134 |

|

|

$ |

429 |

|

|

$ |

9,720 |

|

|

$ |

— |

|

|

$ |

35,283 |

|

| Adjusted gross margin |

|

|

46 |

% |

|

|

60 |

% |

|

|

13 |

% |

|

|

|

|

|

|

27 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Six months ended November 30, 2021 |

|

| |

|

Cannabis |

|

|

Beverage |

|

|

Distribution |

|

|

Wellness |

|

|

Total |

|

| Gross revenue |

|

$ |

163,362 |

|

|

$ |

31,027 |

|

|

$ |

136,055 |

|

|

$ |

28,729 |

|

|

$ |

359,173 |

|

| Excise taxes |

|

|

(34,138 |

) |

|

|

(1,859 |

) |

|

|

— |

|

|

|

— |

|

|

|

(35,997 |

) |

| Net revenue |

|

|

129,224 |

|

|

|

29,168 |

|

|

|

136,055 |

|

|

|

28,729 |

|

|

|

323,176 |

|

| Cost of goods sold |

|

|

85,450 |

|

|

|

12,583 |

|

|

|

120,527 |

|

|

|

20,895 |

|

|

|

239,455 |

|

| Gross profit |

|

$ |

43,774 |

|

|

$ |

16,585 |

|

|

$ |

15,528 |

|

|

$ |

7,834 |

|

|

$ |

83,721 |

|

| Gross margin |

|

|

34 |

% |

|

|

57 |

% |

|

|

11 |

% |

|

|

27 |

% |

|

|

26 |

% |

| Adjusted gross profit |

|

$ |

55,774 |

|

|

$ |

16,585 |

|

|

$ |

15,528 |

|

|

$ |

7,834 |

|

|

$ |

95,721 |

|

| Adjusted gross margin |

|

|

43 |

% |

|

|

57 |

% |

|

|

11 |

% |

|

|

27 |

% |

|

|

30 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Six months ended November 30, 2020 |

|

| |

|

Cannabis |

|

|

Beverage |

|

|

Distribution |

|

|

Wellness |

|

|

Total |

|

| Gross revenue |

|

$ |

137,275 |

|

|

$ |

754 |

|

|

$ |

140,271 |

|

|

$ |

— |

|

|

$ |

278,300 |

|

| Excise taxes |

|

|

(31,307 |

) |

|

|

(44 |

) |

|

|

— |

|

|

|

— |

|

|

|

(31,351 |

) |

| Net revenue |

|

|

105,968 |

|

|

|

710 |

|

|

|

140,271 |

|

|

|

— |

|

|

|

246,949 |

|

| Cost of goods sold |

|

|

55,407 |

|

|

|

281 |

|

|

|

121,033 |

|

|

|

— |

|

|

|

176,721 |

|

| Gross profit |

|

$ |

50,561 |

|

|

$ |

429 |

|

|

$ |

19,238 |

|

|

$ |

— |

|

|

$ |

70,228 |

|

| Gross margin |

|

|

48 |

% |

|

|

60 |

% |

|

|

14 |

% |

|

|

|

|

|

|

28 |

% |

| Adjusted gross profit |

|

$ |

50,561 |

|

|

$ |

429 |

|

|

$ |

19,238 |

|

|

$ |

— |

|

|

$ |

70,228 |

|

| Adjusted gross margin |

|

|

48 |

% |

|

|

60 |

% |

|

|

14 |

% |

|

|

|

|

|

|

28 |

% |

Other Financial Information: Adjusted Earnings before

Interest, Taxes, and Amortization

| (In thousands of

United States dollars) |

|

For the three months endedNovember

30, |

|

|

For the six months endedNovember

30, |

|

| Adjusted EBITDA

reconciliation: |

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

|

Net income (loss) |

|

|

5,797 |

|

|

|

(89,249 |

) |

|

|

(28,807 |

) |

|

|

(110,993 |

) |

| Income taxes |

|

|

(5,671 |

) |

|

|

(14,192 |

) |

|

|

(909 |

) |

|

|

(20,017 |

) |

| Interest expense, net |

|

|

9,940 |

|

|

|

4,832 |

|

|

|

20,110 |

|

|

|

10,568 |

|

| Non-operating expense (income),

net |

|

|

(64,750 |

) |

|

|

72,649 |

|

|

|

(113,610 |

) |

|

|

86,008 |

|

| Amortization |

|

|

37,471 |

|

|

|

12,031 |

|

|

|

76,804 |

|

|

|

23,010 |

|

| Stock-based compensation |

|

|

8,253 |

|

|

|

5,489 |

|

|

|

17,670 |

|

|

|

8,339 |

|

| Facility start-up and closure

costs |

|

|

1,700 |

|

|

|

— |

|

|

|

7,900 |

|

|

|

— |

|

| Lease expense |

|

|

900 |

|

|

|

373 |

|

|

|

1,600 |

|

|

|

630 |

|

| Inventory write down |

|

|

12,000 |

|

|

|

— |

|

|

|

12,000 |

|

|

|

— |

|

| Transaction costs |

|

|

8,120 |

|

|

|

18,206 |

|

|

|

33,699 |

|

|

|

20,664 |

|

| Adjusted EBITDA |

|

$ |

13,760 |

|

|

$ |

10,139 |

|

|

$ |

26,457 |

|

|

$ |

18,209 |

|

Other Financial Information: Free Cash Flow and Adjusted

Free Cash Flow

| |

|

Three months endedNovember

30, |

|

|

Six months endedNovember 30, |

|

| (In thousands of

United States dollars) |

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

|

Net cash provided by (used in) operating activities |

|

$ |

(17,121 |

) |

|

$ |

2,438 |

|

|

$ |

(110,348 |

) |

|

$ |

(53,662 |

) |

| Less: investments in capital

and intangible assets, net |

|

|

(6,972 |

) |

|

|

(9,301 |

) |

|

|

(15,592 |

) |

|

|

(23,256 |

) |

| Free cash flow |

|

$ |

(24,093 |

) |

|

$ |

(6,863 |

) |

|

$ |

(125,940 |

) |

|

$ |

(76,918 |

) |

| Cash expended related to

acquisitions |

|

|

8,120 |

|

|

|

18,206 |

|

|

|

56,510 |

|

|

|

20,664 |

|

| Adjusted free cash flow |

|

$ |

(15,973 |

) |

|

$ |

11,343 |

|

|

$ |

(69,430 |

) |

|

$ |

(56,254 |

) |

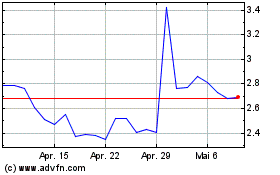

Tilray Brands (TSX:TLRY)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Tilray Brands (TSX:TLRY)

Historical Stock Chart

Von Apr 2023 bis Apr 2024