TSX, NYSE:STN Stantec, a global leader in

sustainable design and engineering, today reported its results for

the fourth quarter and year ended December 31, 2021, and

provided its 2022 outlook. Unless otherwise indicated, financial

figures are expressed in Canadian dollars, and comparisons are to

the prior periods ended December 31, 2020.

Momentum from acquisitions, strong performance in the Global

region and Canada, improving market conditions in the US, and

shifts in project mix drove net revenue and project margin

(previously referred to as “gross margin”) growth in the fourth

quarter. Further progress was also made on the 2023 Real Estate

Strategy, which remains on track to achieve a 30% reduction in

Stantec's real estate footprint relative to 2019. For the fourth

quarter, Stantec delivered earnings per share ("EPS") of $0.15 and

adjusted diluted EPS of $0.57. For the full year, earnings achieved

new records of $1.80 per share and adjusted diluted EPS of

$2.42.

Stantec's outlook for 2022 reflects growing strength in the

macroeconomic environment, record backlog, and infrastructure

stimulus spending across various jurisdictions. These factors are

expected to drive net revenue growth of 18% to 22% in 2022, with

organic net revenue growth in the mid to high single digits, and an

adjusted net income margin at or above 7.5% of net revenue. As a

result, adjusted diluted EPS in 2022 is expected grow by 22% to

26%.

“In addition to achieving record earnings this year, several

important strategic milestones attained in 2021 position us for

accelerated value creation in 2022 and beyond,” said Gord Johnston,

President and CEO. “The acquisition of Cardno, along with the five

other acquisitions we made in 2021, expand our presence in key

business lines such as environmental services and the energy

transition, and key geographies like the United States and

Australia that are poised for strong growth. Looking forward, we

see a strong multi-year cycle ahead for the industry which will

support expansion of our record 2021 Adjusted EBITDA margin and

earnings.”

Full-Year 2021 Financial Highlights

- Full-year net

revenue was $3.6 billion, a 2.6% increase on a constant

currency basis compared with the prior year, driven by acquisition

growth of 3.9%, partly offset by a slight organic retraction.

Excluding the impact of the descoped Trans Mountain Expansion

Project ("TMEP"), organic growth was 0.3% driven by strong

performances in Canada and Global and offset by a slower US

recovery. Fluctuations in foreign currencies resulted in negative

foreign exchange impacts of 3.9%.

- The Canadian dollar

strengthened considerably relative to the US dollar during the

year, with the average exchange rate shifting to $1.25 in 2021 from

$1.34 in 2020. This reduced 2021 net revenues by $130.7 million.

Stantec further estimates that the impact to adjusted EBITDA,

adjusted net income, and adjusted diluted EPS was approximately

$16.6 million, $6.5 million, and $0.06 per share,

respectively.

- Project margin

increased $32.8 million or 1.7% to $2.0 billion, and

increased as a percentage of net revenue from 52.4% to 54.0%, as a

result of strong project execution in all geographies and

businesses and shifts in project mix.

- Adjusted EBITDA from

continuing operations was $573.8 million, approximating

amounts generated in 2020 and increasing as a percentage of net

revenue by 10 basis points to a record 15.8% from 15.7%. The

increase in project margin was partly offset by higher

administrative and marketing expenses, most notably a $30.3 million

increase in share-based compensation expense (83 basis points as a

percentage of net revenue) reflecting the revaluation of incentive

plans due to an increase in Stantec's share price.

- The 2023 Real Estate

Strategy contributed more than $0.18 per share in cost savings to

net income ($0.15 per share savings to adjusted net income). On a

pre-IFRS 16 basis, the cumulative impact from this initiative is

estimated to have increased 2021 adjusted EBITDA margin by more

than 100 basis points. As further progress was made on the Real

Estate Strategy in 2021, additional leased spaces were identified

to vacate and sub-let, and expectations for sub-let opportunities

were adjusted to reflect current market conditions and outlook.

This led to a $24.8 million non-cash net impairment of lease

assets and related property and equipment and $12.5 million in

onerous contract costs being recorded. Stantec is on track to

achieve a 30% reduction in its real estate footprint relative to

its 2019 baseline and expects to deliver a further $0.20 to $0.25

contribution to earnings per share by the end of 2023.

- Net income from

continuing operations increased 26.1%, or $41.6 million, to

$200.7 million; net income margin from continuing operations

increased 1.2% from 4.3% to 5.5%, and diluted EPS increased 26.8%,

or $0.38, to $1.80. Factors contributing to higher net income

include project margin growth, lower interest and depreciation,

unrealized fair value gains from equity investments, the combined

effects of the 2023 Real Estate Strategy, and a lower effective tax

rate partially offset by increased acquisition and integration

costs.

- Adjusted net income

from continuing operations increased 8.4%, or $21.0 million,

to $269.9 million, representing 7.4% of net revenue, an

improvement of 60 basis points, and adjusted diluted EPS increased

9.0%, or $0.20, to $2.42.

- Contract backlog

stands at a record $5.1 billion—a 17.3% increase from

December 31, 2020—representing approximately 13 months of work

(11 months of work in 2020). Year over year, backlog grew 11.9%

through acquisitions and 6.7% organically, with organic growth in

all geographies. Of particular note, US backlog achieved 10.2%

organic growth, with US Environmental Services recording over 50%

organic growth. Further, Environmental Services backlog across all

Stantec stands at over $1 billion, a new high-water mark for this

business operating unit.

- Net debt to adjusted

EBITDA was 1.8x at December 31, 2021 —within the guideline

range of 1.0x to 2.0x. The ratio increased as a result of additions

to net debt from acquisitions made in the fourth quarter.

- Operating cash flows

from continuing operations decreased 34.1% from $602.6 million to

$397.0 million; this was mainly due to decreased cash receipts from

clients, negative foreign exchange impacts, and increased payments

paid to suppliers.

- Days sales

outstanding ("DSO") was 75 days at December 31, 2021 and 2020,

well below the expectation of 80 days.

- In 2021, 939,482

common shares were repurchased for an aggregated price of

$50.7 million under the normal course issuer bid which was

renewed on November 9, 2021, to allow for the repurchase of up to

an additional 5,559,312 common shares.

- On February 23,

2022, Stantec's Board of Directors declared a dividend of $0.18 per

share, payable on April 18, 2022, to shareholders of record on

March 31, 2022, representing an 9.1% increase on an annual

basis.

2022 Outlook

Targets for 2022 are based on the assumption of a continued

gradual global recovery but may not be valid should any of our key

geographies experience a severe worsening of the pandemic.

|

|

2022 Annual Range |

|

Targets |

|

| Net revenue growth |

18% to 22% |

| Adjusted EBITDA as % of net

revenue (note) |

15.3% to 16.3% |

| Adjusted net income as % of

net revenue (note) |

At or above 7.5% |

|

Adjusted ROIC (note) |

Above 10.5% |

|

Other expectations |

|

| Growth in adjusted diluted EPS

(note) |

22% to 26% |

| Net debt to adjusted EBITDA

(note) |

1.0x to 2.0x |

| Effective tax rate (without

discrete transactions) |

23.2% to 24.2% |

| Earnings

pattern |

40% in Q1 and Q4 |

|

60% in Q2 and Q3 |

| Days

sales outstanding (note) |

Under 80 |

In setting these targets and guidance, an average value for the

US dollar of $1.25 and for the GBP $1.73 was assumed (see

Assumptions in Stantec's 2021 Annual Report for more

information).

note: Adjusted EBITDA, adjusted net income, adjusted diluted

EPS, adjusted ROIC, and net debt to adjusted EBITDA are non-IFRS

measures and DSO is a metric discussed in the Definitions section

of Stantec's 2021 Annual Report.

Net revenue is expected to increase 18% to 22% in 2022, and

organic net revenue growth is expected to be in the mid to high

single digits, weighted to the second half of the year. Organic

growth in the US is expected to be in the high single digits,

driven by growing momentum as evidenced by Stantec's record-high US

backlog and project opportunities arising from the $1.2 trillion

infrastructure stimulus bill. After a year of robust organic growth

in Canada in 2021, high levels of activity are expected to be

maintained, driving 2022 organic growth in the low single digits.

Organic growth in Global is expected to achieve high single to low

double-digit growth propelled by strong economic growth, continued

demand, and stimulus in infrastructure sectors.

Project margin as a percent of net revenues is expected to be

relatively consistent in 2022 compared to 2021. Adjusted EBITDA

margin is anticipated to be in the range of 15.3% to 16.3%,

reflecting investments in internal resources to support growth and

the commercialization of new innovations and technologies, and

increased discretionary spending (albeit not to pre-pandemic

levels). Adjusted EBITDA margin in Q1 2022 will likely be at or

below the low end of this range because of the additional effects

of regular seasonal factors in the northern hemisphere and the

protracted ramp-up of US activities and major projects awarded in

Q4 2021. The higher end of the range is expected to be reached by

the second half of 2022 driven by high organic net revenue growth

and increased utilization in the US operations.

Adjusted net income is expected to continue to benefit from the

2023 Real Estate Strategy, which remains on track to achieve a 30%

reduction in real-estate footprint compared with a 2019 baseline

and a cumulative $0.35 to $0.40 per share by the end of 2023. With

$0.15 recognized in 2021, the remaining $0.20 to $0.25 per share is

expected to be generated approximately evenly between 2022 and

2023. For 2022, this, in conjunction with continued benefits from

tax planning strategies, is expected to drive an adjusted net

income margin of 7.5% or greater as a percent of net revenue. As a

result, adjusted diluted EPS is expected to grow 22% to 26% in

comparison to 2021.

The above targets do not include any assumptions for additional

acquisitions given the unpredictable nature of the size and timing

of such acquisitions, or the unpredictable impact from share price

movements subsequent to December 31, 2021, and the relative total

shareholder return components on Stantec's share-based compensation

programs.

Fourth Quarter 2021 Financial Highlights

- Net revenue, on a

constant currency basis, increased 8.7% or $75.0 million, driven by

acquisition growth of 6.7% and organic growth of 2.0%; including

the effects of foreign exchange, net revenue increased

$54.5 million. Without the impact of TMEP, organic growth

would have been 4.2%, reflecting strong growth achieved in Canada

and Global, and organic growth across most business lines with the

exception of Infrastructure which stayed consistent with the prior

period.

- Project margin

increased 11.3%, or $51.6 million, and increased as a

percentage of net revenue from 52.8% to 55.3%, primarily from

higher net revenue, a shift in project mix, and strong project

execution.

- Adjusted EBITDA from

continuing operations increased 2.6% or $3.6 million to

$142.1 million, representing 15.5% of net revenue compared

with $138.5 million or 16.1% of net revenue in the prior

period. The increase in project margin was partly offset by higher

administrative and marketing expenses, most notably a $13.4 million

increase in share-based compensation expense (146 basis points as a

percentage of net revenue) reflecting the revaluation of incentive

plans due to an increase in Stantec's share price. As well, 2020

included the recovery of certain claim costs.

- Net income from

continuing operations increased 11.4%, or $1.7 million, to

$16.6 million, net income from continuing operations as a

percentage of net revenue increased from 1.7% to 1.8%, and diluted

EPS increased by 15.4%, or $0.02, to $0.15. Strong project margin,

lower non-cash net lease asset and related property and equipment

impairments and adjustments for onerous contract costs from the

continued execution of the 2023 Real Estate Strategy, and non-cash

fair value gains on equity investments contributed to a higher net

income, partly offset by lower utilization in the US and higher

amortization of intangible assets and acquisition and integration

costs related to recent acquisitions.

- Adjusted net income

decreased 4.8%, or $3.2 million, to $63.8 million,

representing 7.0% of net revenue, and adjusted diluted EPS

decreased 5.0%, or $0.03, to $0.57. Q4 2020 adjusted net income

benefited from the favorable recovery of claim costs and resolution

of certain tax matters.

Q4 and Full-year 2021 Financial Summary

| |

Quarter Ended Dec 31, |

Year Ended Dec 31, |

| |

2021 |

2020 |

2021 |

2020 |

| (In

millions of Canadian dollars, except per share amounts and

percentages) |

$ |

% of NetRevenue |

$ |

% of NetRevenue |

$ |

% of NetRevenue |

$ |

% of NetRevenue |

|

Gross revenue |

1,185.3 |

|

129.4 |

% |

1,126.1 |

|

130.7 |

% |

4,576.8 |

|

125.9 |

% |

4,730.1 |

128.4 |

% |

| Net

revenue |

916.2 |

|

100.0 |

% |

861.7 |

|

100.0 |

% |

3,636.1 |

|

100.0 |

% |

3,684.5 |

100.0 |

% |

| Direct

payroll costs |

409.6 |

|

44.7 |

% |

406.7 |

|

47.2 |

% |

1,672.8 |

|

46.0 |

% |

1,754.0 |

47.6 |

% |

|

Project margin (note) |

506.6 |

|

55.3 |

% |

455.0 |

|

52.8 |

% |

1,963.3 |

|

54.0 |

% |

1,930.5 |

52.4 |

% |

|

Administrative and marketing expenses |

387.6 |

|

42.3 |

% |

317.5 |

|

36.8 |

% |

1,423.6 |

|

39.2 |

% |

1,352.9 |

36.7 |

% |

| Depreciation of property and

equipment |

13.5 |

|

1.5 |

% |

14.2 |

|

1.6 |

% |

53.9 |

|

1.5 |

% |

57.9 |

1.6 |

% |

| Depreciation of lease

assets |

28.3 |

|

3.1 |

% |

27.9 |

|

3.3 |

% |

107.9 |

|

3.0 |

% |

117.7 |

3.2 |

% |

| Net impairment of lease assets

and property and equipment |

29.1 |

|

3.2 |

% |

66.7 |

|

7.7 |

% |

24.8 |

|

0.7 |

% |

78.6 |

2.1 |

% |

| Amortization of intangible

assets |

18.0 |

|

2.0 |

% |

11.8 |

|

1.4 |

% |

60.0 |

|

1.7 |

% |

53.2 |

1.4 |

% |

| Net interest expense |

8.4 |

|

0.9 |

% |

10.2 |

|

1.2 |

% |

37.9 |

|

1.0 |

% |

49.2 |

1.4 |

% |

| Other |

(2.2 |

) |

(0.3 |

%) |

(3.8 |

) |

(0.4 |

%) |

(7.8 |

) |

(0.3 |

%) |

4.3 |

0.1 |

% |

| Income

taxes |

7.3 |

|

0.8 |

% |

(4.4 |

) |

(0.5 |

%) |

62.3 |

|

1.7 |

% |

57.6 |

1.6 |

% |

|

Net income from continuing operations |

16.6 |

|

1.8 |

% |

14.9 |

|

1.7 |

% |

200.7 |

|

5.5 |

% |

159.1 |

4.3 |

% |

|

Net income from discontinued operations (note) |

— |

|

0.0 |

% |

1.8 |

|

0.2 |

% |

— |

|

— |

% |

12.0 |

0.3 |

% |

|

Net income |

16.6 |

|

1.8 |

% |

16.7 |

|

1.9 |

% |

200.7 |

|

5.5 |

% |

171.1 |

4.6 |

% |

|

Basic earnings per share (EPS) from continuing operations |

0.15 |

|

n/m |

|

0.13 |

|

n/m |

|

1.80 |

|

n/m |

|

1.43 |

n/m |

|

| Diluted

EPS from continuing operations |

0.15 |

|

n/m |

|

0.13 |

|

n/m |

|

1.80 |

|

n/m |

|

1.42 |

n/m |

|

|

Adjusted EBITDA from continuing operations (note) |

142.1 |

|

15.5 |

% |

138.5 |

|

16.1 |

% |

573.8 |

|

15.8 |

% |

578.9 |

15.7 |

% |

| Adjusted net income from

continuing operations (note) |

63.8 |

|

7.0 |

% |

67.0 |

|

7.8 |

% |

269.9 |

|

7.4 |

% |

248.9 |

6.8 |

% |

|

Adjusted diluted EPS from continuing operations (note) |

0.57 |

|

n/m |

|

0.60 |

|

n/m |

|

2.42 |

|

n/m |

|

2.22 |

n/m |

|

|

Dividends declared per common share |

0.165 |

|

n/m |

|

0.16 |

|

n/m |

|

0.66 |

|

n/m |

|

0.62 |

n/m |

|

|

Total assets |

|

|

|

|

5,226.4 |

|

|

4,388.9 |

|

| Total

long-term debt |

|

|

|

|

1,245.1 |

|

|

680.8 |

|

note: Project margin was previously labeled as gross margin. The

composition of project margin remains unchanged from our approach

previously applied to gross margin. Construction Services

operations are presented as discontinued operations. Adjusted

EBITDA, adjusted net income, adjusted basic and diluted EPS

are non-IFRS measures (discussed in the Definitions of

Non-IFRS and Other Financial Measures section of the 2021 Annual

Report).

n/m = not meaningful

Net Revenue by Reportable Segment

Full-Year 2021

|

(In millions of Canadian dollars, except percentages) |

2021 |

2020 |

Total Change |

|

Change Due to Acquisitions |

|

Change Due to Foreign Exchange |

|

Change Due to Organic Growth (Retraction) |

|

% of Organic Growth (Retraction) |

|

|

Canada |

1,068.5 |

1,073.7 |

(5.2 |

) |

3.8 |

|

n/a |

|

(9.0 |

) |

(0.8 |

)% |

| United States |

1,799.5 |

1,959.8 |

(160.3 |

) |

69.0 |

|

(130.7 |

) |

(98.6 |

) |

(5.0 |

)% |

|

Global |

768.1 |

651.0 |

117.1 |

|

69.1 |

|

(10.2 |

) |

58.2 |

|

8.9 |

% |

|

Total |

3,636.1 |

3,684.5 |

(48.4 |

) |

141.9 |

|

(140.9 |

) |

(49.4 |

) |

|

|

Percentage Growth (Retraction) |

|

|

(1.3 |

)% |

3.9 |

% |

(3.9 |

)% |

(1.3 |

)% |

|

Fourth Quarter 2021

| (In

millions of Canadian dollars, except percentages) |

Q4 2021 |

Q4 2020 |

Total Change |

Change Due to Acquisitions |

Change Due to Foreign Exchange |

Change Due to Organic Growth (Retraction) |

% of Organic Growth (Retraction) |

|

Canada |

260.0 |

266.6 |

(6.6 |

) |

— |

|

n/a |

|

(6.6 |

) |

(2.5 |

)% |

| United States |

440.2 |

439.5 |

0.7 |

|

28.9 |

|

(14.8 |

) |

(13.4 |

) |

(3.0 |

)% |

|

Global |

216.0 |

155.6 |

60.4 |

|

29.1 |

|

(5.7 |

) |

37.0 |

|

23.8 |

% |

|

Total |

916.2 |

861.7 |

54.5 |

|

58.0 |

|

(20.5 |

) |

17.0 |

|

|

|

Percentage Growth (Retraction) |

|

|

6.3 |

% |

6.7 |

% |

(2.4 |

)% |

2.0 |

% |

|

Backlog

| (In

millions of Canadian dollars, except percentages) |

Dec 31, 2021 |

Dec 31, 2020 |

Total Change |

Change Due to Acquisitions |

Change Due to Foreign Exchange |

Change Due to Organic Growth |

% of Organic Growth |

|

Canada |

1,169.1 |

1,134.3 |

34.8 |

— |

|

n/a |

|

34.8 |

|

3.1 |

% |

| United States |

3,016.9 |

2,449.2 |

567.7 |

336.5 |

|

(17.9 |

) |

249.1 |

|

10.2 |

% |

|

Global |

948.3 |

793.6 |

154.7 |

183.0 |

|

(39.4 |

) |

11.1 |

|

1.4 |

% |

|

Total |

5,134.3 |

4,377.1 |

757.2 |

519.5 |

|

(57.3 |

) |

295.0 |

|

|

|

Percentage Growth (Retraction) |

|

|

|

11.9 |

% |

(1.3 |

)% |

6.7 |

% |

|

Tomorrow’s Conference Call

On Thursday, February 24, 2022, at 7:00 AM Mountain Time

(9:00 AM Eastern Time), Gord Johnston, President and Chief

Executive Officer, and Theresa Jang, Executive Vice President and

Chief Financial Officer, will hold a conference call to discuss the

Company’s fourth quarter performance.

The webcast and slide presentation can be accessed at the

following link:https://edge.media-server.com/mmc/p/ss8xmh3q

The conference call and slideshow presentation will be broadcast

live and archived in their entirety in the Investors section of

stantec.com. Participants wishing to listen to the call via

telephone may dial in toll-free at 1-888-394-8218 (Canada and

United States) or +1-647-484-0475 (international). Please provide

confirmation code 6376520 when prompted.

About Stantec

Communities are fundamental. Whether around the corner or across

the globe, they provide a foundation, a sense of place and of

belonging. That's why at Stantec, we always design with

community in mind. We care about the communities we

serve—because they're our communities too. This allows us to assess

what's needed and connect our expertise, to appreciate nuances and

envision what's never been considered, to bring together diverse

perspectives so we can collaborate toward a shared success.

We're designers, engineers, scientists, and project managers,

innovating together at the intersection of community, creativity,

and client relationships. Balancing these priorities results in

projects that advance the quality of life in communities across the

globe.

Stantec trades on the TSX and the NYSE under the symbol STN.

Visit us at stantec.com or find us on social media.

Cautionary Statements

Non-IFRS and Other Financial Measures

Stantec reports its financial results in accordance with IFRS.

However, in this press release, the following non-IFRS and other

financial measures are used by the Company: adjusted EBITDA,

adjusted net income, adjusted earnings per share (EPS), adjusted

return on invested capital (ROIC), net debt to adjusted EBITDA,

days sales outstanding (DSO), margin (percentage of net revenue),

organic growth (retraction), acquisition growth, and measures

described as on a constant currency basis and the impact of foreign

exchange or currency fluctuations, as well as measures and ratios

calculated using these non-IFRS or other financial measures.

Additional disclosure for these non-IFRS and other financial

measures, incorporated by reference, is included in the Definitions

of Non-IFRS and Other Financial Measures section of the 2021 Annual

Report, available on SEDAR at SEDAR.com, EDGAR at sec.gov, and the

company's website at stantec.com and the reconciliation of Non-IFRS

Financial Measures appended hereto.

These non-IFRS and other financial measures do not have a

standardized meaning under IFRS and, therefore, may not be

comparable similar measures presented by other issuers. Management

believes that, in addition to conventional measures prepared in

accordance with IFRS, these non-IFRS and other financial measures

provide useful information to investors to assist them in

understanding components of our financial results. These measures

should not be considered in isolation or viewed as a substitute for

the related financial information prepared in accordance with

IFRS.

Forward Looking Statements

Certain statements contained in this news release constitute

forward-looking statements. Forward-looking statements in this news

release include, but are not limited to, Stantec's Outlook and

Annual Targets for 2022 in their entirety, the timing and ability

to achieve the 2023 targets initially laid out in the strategic

plan Stantec launched in December 2019, its position to withstand

the challenges caused by the pandemic, any projections related to

revenue, project margin, utilization and days sales outstanding.

Any such statements represent the views of management only as of

the date hereof and are presented for the purpose of assisting the

Company’s shareholders in understanding Stantec’s operations,

objectives, priorities, and anticipated financial performance as at

and for the periods ended on the dates presented and may not be

appropriate for other purposes. By their nature, forward-looking

statements require management to make assumptions and are subject

to inherent risks and uncertainties. Stantec's assumptions relating

to Stantec's Annual Targets for 2022 and Stantec's 2022 Outlook are

provided in the Company’s 2021 annual report.

Readers of this news release are cautioned not to place undue

reliance on forward-looking statements since a number of factors

could cause actual future results to differ materially from the

expectations expressed in these forward-looking statements. These

factors include, but are not limited to, the risk of economic

downturn, project cancellations and a slowdown in new opportunities

related to COVID-19, decreased infrastructure spending levels, the

failure of US infrastructure stimulus spending to materialize,

changing market conditions for Stantec’s services, and the risk

that Stantec fails to capitalize on its strategic initiatives.

Investors and the public should carefully consider these factors,

other uncertainties, and potential events, as well as the inherent

uncertainty of forward-looking statements, when relying on these

statements to make decisions with respect to the Company.

For more information about how other material risk factors could

affect Stantec’s results, refer to the Risk Factors section and

Cautionary Note Regarding Forward-Looking Statements section in the

Company’s 2021 annual report. This report is accessible online by

visiting EDGAR on the SEC website at sec.gov or by visiting the CSA

website at sedar.com or Stantec’s website, stantec.com. You may

obtain a hard copy of the 2021 annual report free of charge from

the investor contact noted below.

|

Investor Contact |

Media Contact |

| Tom McMillan |

Stephanie Smith |

| Stantec Investor Relations |

Stantec Media Relations |

| Ph: 780-917-8159 |

Ph: 780-917-7230 |

| tom.mcmillan@stantec.com |

stephanie.smith2@stantec.com |

To subscribe to Stantec’s email news alerts, please fill out the

subscription form, which is available on the Contact Information

page of the Investors section at Stantec.com.

Design with community in mind

Attached to this news release are Stantec’s

consolidated statements of financial position, consolidated

statements of income and reconciliation of

non-IFRS measures.

Reconciliation of Non-IFRS Financial

Measures

| |

Quarter Ended Dec 31, |

Year Ended Dec 31, |

|

(In millions of Canadian dollars, except per share amounts) |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

|

Net income from continuing operations |

16.6 |

|

14.9 |

|

200.7 |

|

159.1 |

|

| Add back (deduct): |

|

|

|

|

|

Income taxes |

7.3 |

|

(4.4 |

) |

62.3 |

|

57.6 |

|

|

Net interest expense |

8.4 |

|

10.2 |

|

37.9 |

|

49.2 |

|

|

Impairment of lease assets and property and equipment (note 1) |

41.6 |

|

66.7 |

|

37.3 |

|

78.6 |

|

|

Depreciation and amortization |

59.8 |

|

53.9 |

|

221.8 |

|

228.8 |

|

|

Unrealized gain on investments held on equity securities |

(4.8 |

) |

(5.2 |

) |

(13.9 |

) |

(0.7 |

) |

|

COVID-related expenses (note 4) |

— |

|

1.1 |

|

— |

|

5.0 |

|

|

Acquisition, integration, and restructuring costs (note 5) |

13.2 |

|

1.3 |

|

27.7 |

|

1.3 |

|

|

Adjusted EBITDA from continuing operations |

142.1 |

|

138.5 |

|

573.8 |

|

578.9 |

|

| |

Quarter Ended Dec 31, |

Year Ended Dec 31, |

|

(In millions of Canadian dollars, except per share amounts) |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

|

Net income from continuing operations |

16.6 |

|

14.9 |

|

200.7 |

|

159.1 |

|

| Add back (deduct) after

tax: |

|

|

|

|

|

Impairment of lease assets and property and equipment (note 1) |

31.8 |

|

48.1 |

|

28.5 |

|

56.6 |

|

|

Amortization of intangible assets related to acquisitions (note

2) |

9.1 |

|

5.8 |

|

30.2 |

|

26.4 |

|

|

Unrealized gain on investments held on equity securities (note

3) |

(3.6 |

) |

(3.7 |

) |

(10.6 |

) |

(0.5 |

) |

|

COVID-related expenses (note 4) |

— |

|

0.8 |

|

— |

|

3.6 |

|

|

Acquisition, integration, and restructuring costs (note 5) |

9.9 |

|

1.1 |

|

21.1 |

|

3.7 |

|

|

Adjusted net income from continuing operations |

63.8 |

|

67.0 |

|

269.9 |

|

248.9 |

|

|

Weighted average number of shares outstanding - basic |

111,223,711 |

|

111,597,381 |

|

111,242,658 |

|

111,553,711 |

|

| Weighted average number of

shares outstanding - diluted |

111,669,548 |

|

111,987,362 |

|

111,616,665 |

|

111,949,305 |

|

|

Adjusted earnings per share from continuing operations |

|

|

|

|

| Adjusted earnings per share -

basic (note 6) |

0.57 |

|

0.60 |

|

2.43 |

|

2.23 |

|

|

Adjusted earnings per share - diluted (note 6) |

0.57 |

|

0.60 |

|

2.42 |

|

2.22 |

|

See the Definitions section of the 2021 annual report for the

discussion of non-IFRS and other financial measures used

and additional reconciliations of non-IFRS financial measures. This

table includes only continuing operations results.

note 1: The add back of net impairment of lease assets and

property and equipment for the quarter and year ended

December 31, 2021 includes onerous contracts associated with

impairment of $12.5 (2020 - nil). For the year ended

December 31, 2021, this amount is net of tax of $8.8 (2020 -

$22.0). For the quarter ended December 31, 2021, this amount

is net of tax of $9.8 (2020 - $18.6).

note 2: The add back of intangible amortization relates only to

the amortization from intangible assets acquired through

acquisitions and excludes the amortization of software purchased by

Stantec. For the year ended December 31, 2021, this amount is

net of tax of $9.4 (2020 - $10.3). For the quarter ended

December 31, 2021, this amount is net of tax of $3.1 (2020 -

$2.0).

note 3: For the year ended December 31, 2021, this amount

is net of tax of ($3.3) (2020 - ($0.2)). For the quarter ended

December 31, 2021, this amount is net of tax of ($1.2) (2020 -

$(1.5)).

note 4: The add back of COVID-related expenses primarily relates

to severance. For the year ended December 31, 2021, this

amount is net of tax of nil (2020 - $1.4). For the quarter ended

December 31, 2021, this amount is net of tax of nil (2020 -

$0.3).

note 5: The add back of other costs primarily relates to

integration expenses associated with acquisitions, past service

costs for pensions, financing costs associated with internal debt

restructuring, reorganization and transitional tax expenses, and

severance related to organizational reshaping. For the year ended

December 31, 2021, this amount is net of tax of $6.6 (2020 -

$0.4, 2020 also included reorganization tax expense of $2.8). For

the quarter ended December 31, 2021, this amount is net of tax

of $3.3 (2020 - $0.4, 2020 also included reorganization tax expense

of $0.2).

note 6: Earnings per share calculated in accordance with IFRS

disclosed in the 2021 annual report.

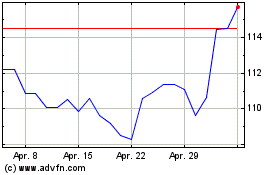

Stantec (TSX:STN)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Stantec (TSX:STN)

Historical Stock Chart

Von Apr 2023 bis Apr 2024