STEP Energy Services Ltd. (the “Company” or “STEP”) is pleased to

announce its financial and operating results for the three months

ended March 31, 2022. The following press release should be read in

conjunction with the management’s discussion and analysis

(“MD&A”) and unaudited condensed consolidated interim financial

statements and notes thereto as at and for the three months ended

March 31, 2022 (the “Financial Statements”). Readers should also

refer to the “Forward-looking information & statements” legal

advisory and the section regarding “Non-IFRS Measures and Ratios”

at the end of this press release. All financial amounts and

measures are expressed in Canadian dollars unless otherwise

indicated. Additional information about STEP is available on the

SEDAR website at www.sedar.com, including the Company’s Annual

Information Form for the year ended December 31, 2021 dated March

16, 2022 (the “AIF”).

CONSOLIDATED HIGHLIGHTS

FINANCIAL

REVIEW

|

($000s except percentages, per share amounts, days, proppant

pumped, horsepower, and units) |

|

Three months ended |

|

|

|

March 31, |

|

|

March 31, |

|

|

December 31, |

|

|

|

2022 |

|

|

2021 |

|

|

2021 |

|

|

Consolidated revenue |

$ |

219,539 |

|

$ |

136,812 |

|

$ |

158,716 |

|

| Net income (loss) |

$ |

9,173 |

|

$ |

(7,944 |

) |

$ |

(6,212 |

) |

|

Per share-basic |

$ |

0.135 |

|

$ |

(0.117 |

) |

$ |

(0.091 |

) |

|

Per share-diluted |

$ |

0.132 |

|

$ |

(0.117 |

) |

$ |

(0.091 |

) |

|

Weighted average shares – basic |

|

68,189,275 |

|

|

67,720,318 |

|

|

68,141,058 |

|

|

Weighted average shares – diluted |

|

69,737,461 |

|

|

67,720,318 |

|

|

68,141,058 |

|

| Adjusted EBITDA (1) |

$ |

36,990 |

|

$ |

15,960 |

|

$ |

17,340 |

|

|

Adjusted EBITDA % (1) |

|

17 |

% |

|

12 |

% |

|

11 |

% |

|

Fracturing services |

|

|

|

|

|

|

|

Fracturing operating days (2) |

|

615 |

|

|

414 |

|

|

508 |

|

|

Proppant pumped (tonnes) |

|

601,000 |

|

|

516,000 |

|

|

495,000 |

|

|

Active horsepower (“HP”), ending (3) |

|

380,000 |

|

|

310,000 |

|

|

365,000 |

|

|

Total HP, ending |

|

490,000 |

|

|

490,000 |

|

|

490,000 |

|

| Coiled tubing services |

|

|

|

|

|

|

|

Coiled tubing operating days (2) |

|

1,075 |

|

|

776 |

|

|

955 |

|

|

Active coiled tubing units, ending |

|

16 |

|

|

14 |

|

|

15 |

|

|

Total coiled tubing units, ending |

|

29 |

|

|

29 |

|

|

29 |

|

(1) Adjusted EBITDA is a non-IFRS financial

measure and Adjusted EBITDA % is a non-IFRS financial ratio. These

metrics are not defined and have no standardized meaning under

IFRS. See Non-IFRS Measures and Ratios.(2) An operating day is

defined as any coiled tubing or fracturing work that is performed

in a 24-hour period, exclusive of support equipment.(3) Active

horsepower denotes units active on client work sites. An additional

15-20% of this amount is required to accommodate equipment

maintenance cycles.

|

($000s except shares) |

|

March 31, |

December 31, |

|

|

|

|

|

2022 |

|

2021 |

|

Cash and cash equivalents |

$ |

6,637 |

$ |

3,698 |

|

Working capital (including cash and cash equivalents) (1) |

$ |

52,800 |

$ |

3,912 |

|

Total assets |

$ |

546,651 |

$ |

483,848 |

|

Total long-term financial liabilities (1) |

$ |

211,928 |

$ |

175,689 |

|

Net debt (1) |

$ |

214,278 |

$ |

186,885 |

|

Shares outstanding |

68,204,590 |

|

68,156,981 |

(1) Working capital, Total long-term financial

liabilities and Net debt are non-IFRS financial measures. They are

not defined and have no standardized meaning under IFRS. See

Non-IFRS Measures and Ratios.

|

|

Three months ended |

|

|

March 31, |

December 31, |

September 30, |

June 30, |

March 31, |

|

|

|

2022 |

|

2021 |

|

2021 |

|

2021 |

|

2021 |

|

AECO-C Spot Average Price (CAD/MMBtu) |

$ |

4.78 |

$ |

4.75 |

$ |

3.57 |

$ |

3.10 |

$ |

3.10 |

|

WTI – Average Price (USD/bbl) |

$ |

94.77 |

$ |

77.31 |

$ |

70.61 |

$ |

66.19 |

$ |

58.04 |

|

WCS – Average Price (USD/bbl) |

$ |

81.80 |

$ |

60.84 |

$ |

57.64 |

$ |

53.29 |

$ |

46.21 |

|

Condensate – Average Price (USD/bbl) |

$ |

97.19 |

$ |

79.53 |

$ |

70.85 |

$ |

64.87 |

$ |

59.16 |

|

Average Exchange Rate (USD/CAD) |

$ |

0.79 |

$ |

0.79 |

$ |

0.79 |

$ |

0.81 |

$ |

0.79 |

|

Canadian Average Drilling Rig Count (4) |

|

193 |

|

159 |

|

150 |

|

71 |

|

144 |

|

U.S. Average Drilling Rig Count (4) |

|

636 |

|

545 |

|

484 |

|

437 |

|

378 |

Source: Baker Hughes, Bloomberg (4) Only

includes land-based rigs.

FINANCIAL HIGHLIGHTS

- Revenue of $219.5 million in the

first quarter of 2022 was the strongest first quarter in company

history and was significantly better than the $136.8 million

generated in Q1 2021 and $158.7 million generated in Q4 2021.

- Q1 2022 adjusted EBITDA of $37.0

million, was an increase of 131% over the $16.0 million generated

in Q1 2021 and a sequential increase of 114% over the $17.3 million

generated in Q4 2021. Q1 2021 benefited from $3.6 million of

Canadian Emergency Wage Subsidy (“CEWS”) (Q4 2021 - $nil, Q1 2022 -

$nil).

- Q1 2022 generated net income of

$9.2 million, the first quarter since Q3 2018 that STEP generated

net income. STEP had a net loss of $7.9 million in Q1 2021 and a

net loss of $6.2 million in Q4 2021.

- STEP’s operations in Canada and the

U.S. continued to benefit from improving market conditions, with

net pricing and utilization improvements driving stronger financial

results in Q1 2022 relative to Q4 2021.

- As a result of the significant

increase in operating activity in Q1 2022, Working capital

increased to $52.8 million at the end of Q1 from $3.9 million in Q4

2021 and Net debt increased to $214.3 million from $186.9 million

in Q4 2021.

- Subsequent to March 31, 2022, STEP

delivered notice to its syndicate of lenders of early termination

of the covenant relief, reflecting the Company’s return to

conventional credit metrics and lowering the Company’s borrowing

costs by 200 basis points for the remainder of the second

quarter.

FIRST QUARTER 2022 OVERVIEW The

first quarter of 2022 delivered the confident start to the year

that the Company had signalled in its Q4 2021 release. Industry

activity levels, as represented by rig counts, increased markedly

on a sequential and year over year basis. According to the Baker

Hughes rig count, the Canadian land rig count averaged 193 in Q1

2022, up 21% sequentially and 35% on a year over year basis. The

U.S. land rig count averaged 636 in Q1 2022, up 17% sequentially

and 68% on a year over year basis.

STEP’s fracturing and coiled tubing crews

experienced high utilization across both countries, despite the

typical cold weather impacts early in Q1 2022 and the Omicron COVID

19 variant that caused significant operational disruption. The

health and safety of our professionals is our utmost priority, and

Management is extremely proud of the resilience shown by our

operational teams as they managed crews in the field that were

impacted by quarantine requirements while still delivering the

Exceptional Client Experience that STEP prides itself in.

Management estimates that COVID 19 had an impact of $0.4-0.5

million in the quarter through reduced operating days and higher

costs. The Company pumped 601 thousand tonnes of sand,

across 395 operating days in Canada and 220 operating days in the

US. Following a January that was characterized by smaller single

well jobs in both countries, the Company moved on to larger

multi-well pad work through most of February and March, driving

strong efficiencies and delivering sequentially improved returns.

The coiled tubing division had similarly strong utilization, with

561 operating days in Canada and 514 operating days in the U.S. The

coiled tubing service line was more severely impacted by COVID 19

compared to the fracturing service line, as coiled tubing’s smaller

crew sizes cannot absorb an absence of professionals in the same

way that a fracturing crew can.

Rising industry activity supported our continued

drive for higher pricing, as exploration and production (“E&P”)

companies faced inflationary pressure from service providers across

their value chain. STEP faced similar inflationary pressure from

its supply chain but has been successful in passing on these costs

to our clients and through strategic buying has been able to secure

supply and cost certainty. Our U.S. region had sand contracts in

place for the quarter, which was a key factor in maintaining steady

utilization through a quarter where sand supply disrupted

fracturing operations in the Permian basin.

STEP generated $219.5 million of revenue in the

quarter, the strongest first quarter in company history, with

$146.8 million coming from Canada and $72.7 million coming from the

U.S. This was a significant increase from $158.7 million in the

prior quarter and $136.8 million in the same period last year. U.S.

revenue benefitted from STEP supplied sand in Q1 2022, supplying

38% of sand pumped in the quarter, up from 36% in the prior quarter

and up from 16% in the same period of the prior year. Canadian

operations saw improved utilization and pricing resulting in 61%

revenue increase over the prior quarter and 34% increase over the

same period in the prior year.

STEP earned $37.0 million in Adjusted EBITDA for

the quarter and $9.2 million in net income. Both metrics are a

meaningful improvement over the prior quarter and same period in

the prior year and are the best first quarter results since Q1

2018. STEP generated net income for the first time since Q3 2018,

producing basic and diluted net income per share of $0.135 and

$0.132, respectively. This is a significant improvement compared to

a net loss per share, basic and diluted, of $0.091 and $0.117 in

the prior quarter and same period of the prior year, respectively.

The improvement in Adjusted EBITDA outpaced the improvement in net

income as there was a 74% increase in the Company’s share price

through the quarter, which led to a $5.2 million expense for cash

settled share-based compensation. STEP has added back equity and

cash settled share-based compensation to its Adjusted EBITDA

calculation since becoming a public company in 2017 as Management

believes this is a better representation of the operational

performance of the Company.

The sharp ramp up in activity and increased STEP

supplied sand in the U.S. resulted in an increased draw on our

credit facilities and higher Working capital. Net Debt at quarter

end was $214.3 million, higher than the $186.9 million at December

31, 2021 while Working capital increased to $52.8 million at March

31, 2022, up from $3.9 million at December 31, 2021. Liquidity was

$77.5 million at March 31, 2022, an increase of $20.0 million from

$57.5 million at December 31, 2021. The Company made a $7 million

payment on its term loan facility during the first quarter and

remained in compliance with all financial and nonfinancial

covenants at March 31, 2022. Subsequent to the quarter end, the

Company provided notice of early termination of the covenant relief

provisions that were granted in Q3 2021. The termination will

reduce the Company’s borrowing costs by approximately 200 basis

points for the balance of Q2 2022.

OUTLOOKSTEP anticipates that

the current strength in oil and gas prices will continue through

the balance of the year, supporting higher demand for oilfield

services. Global inventories of oil and gas were already at the low

end of their five-year ranges, and there are indications that the

fallout from Russia’s unprovoked invasion of Ukraine is leading to

a rebalancing of global oil and gas flows and a call for higher

North American energy exports. STEP is aligned with the broader

commentary expressed by our peers and clients that the North

American oil and gas industry is positioned well to respond to this

increased demand, and STEP will participate in this growth with its

operations in the major basins.

The Company has a constructive view on the

second quarter, which could show stronger results than the second

quarter of 2021, itself the strongest on record for the Company.

Fracturing capacity in the U.S. is largely committed through the

second quarter, carrying forward the steady utilization experienced

in the first quarter. Coiled tubing in the U.S. and Canada are both

expected to see steady utilization, with some impact from spring

break up conditions and heavy snowstorms already experienced in

Canada and in northern U.S. operating regions. Fracturing activity

in Canada has similarly had some impact from spring break up from

mid April to mid May, providing an opportunity to complete needed

maintenance and give our professionals some time off. The balance

of the quarter is anticipated to see robust utilization, with

virtually no pricing discounts given relative to the first quarter,

unlike the typical pattern in Canada where spring break up work is

priced at a discount. Inclement weather conditions and their impact

on activity are always a concern in the second quarter in Canada,

but we anticipate that any missed work will push into the third and

fourth quarter.

Visibility into the second half of the year is

improving, with much of the third quarter fracturing schedule

already filled. Consistent with the commentary coming from the

publicly traded drilling companies, our clients are indicating that

rig count will build and that the Q4 rig count will be higher than

Q1, which will be supportive of a highly utilized fourth

quarter.

Inflationary pressures are expected to continue

building. Costs of proppant, chemicals, equipment parts,

electronics, major components are all increasing, with availability

becoming more of a concern than it has been in the past. Labour

costs are expected to continue escalating, adding costs through

direct compensation expense and through higher third party service

costs. STEP will be resolute in passing these costs through to our

clients.

The limited availability of qualified labour and

field ready equipment will constrain the ability of the oilfield

service sector to add capacity, creating a market that has

tightened considerably since the fourth quarter of 2021. These

restraints are fortifying the oilfield service narrative around the

need for increased pricing not just to cover the cost of inflation

but also the need for return to shareholders. STEP will continue to

move prices higher, targeting top of cycle returns, and anticipates

sequential margin growth in the coming quarters as the market

shifts from oversupplied in 2021 to an undersupplied position in

2022.

STEP is also pleased to announce the inaugural

publication of its Environment, Social and Governance Report (“ESG

Report”) which highlights the Company’s historic and current drive

to incorporate sustainable practices and strategies throughout its

operations, and to communicate its progress and commitment to

continual improvement with key stakeholders. The ESG Report covers

the period between January 1 and December 31, 2021 and is informed

by sustainability practices and the reporting framework as per

Sustainability Accounting Standards Board (SASB). The ESG Report is

available on STEP’s website at www.stepenergyservices.com.

CAPITAL EXPENDITURESIn response

to the higher activity expectations, STEP’s Board of Directors has

approved an increase of $8.3 million to the 2022 capital program,

increasing it to $56.0 million. The additional capital will fund

further investment into low emissions focused equipment upgrades

that support the Company’s Environmental, Social and Governance

objectives as well as additional maintenance capital to support

operations.

The Company will continue to evaluate and manage

its manned equipment fleet and capital program based on market

demand for STEP’s services. CANADIAN FINANCIAL AND

OPERATIONS REVIEW

STEP has a fleet of 16 coiled tubing units in

the WCSB. The Company’s coiled tubing units are designed to service

the deepest wells in the WCSB. STEP’s fracturing business primarily

focuses on the deeper, more technically challenging plays in

Alberta and northeast British Columbia. STEP has 282,500 fracturing

HP of which approximately 132,500 HP has dual-fuel capability. The

Company deploys or idles coiled tubing units or fracturing

horsepower as dictated by the market’s ability to support targeted

utilization and economic returns.

|

($000’s except per day, days, units, proppant pumped and HP) |

Three months ended |

| |

March 31, |

|

March 31, |

|

December 31, |

|

|

|

|

2022 |

|

|

2021 |

|

|

2021 |

|

|

Revenue: |

|

|

|

|

|

|

|

Fracturing |

$ |

119,014 |

|

$ |

87,829 |

|

$ |

68,590 |

|

|

Coiled tubing |

|

27,798 |

|

|

21,533 |

|

|

22,868 |

|

|

|

|

146,812 |

|

|

109,362 |

|

|

91,458 |

|

| Expenses: |

|

|

|

|

|

|

|

Operating expenses |

|

121,365 |

|

|

96,126 |

|

|

85,391 |

|

|

Selling, general and administrative |

|

3,324 |

|

|

1,764 |

|

|

1,820 |

|

|

Results from operating activities |

$ |

22,123 |

|

$ |

11,472 |

|

$ |

4,247 |

|

| Add non-cash items: |

|

|

|

|

|

|

|

Depreciation |

|

9,126 |

|

|

9,239 |

|

|

9,294 |

|

|

Share-based compensation – Cash settled |

|

544 |

|

|

361 |

|

|

72 |

|

|

Share-based compensation – Equity settled |

|

75 |

|

|

459 |

|

|

(22 |

) |

|

Adjusted EBITDA (1) |

$ |

31,867 |

|

$ |

21,531 |

|

$ |

13,591 |

|

|

Adjusted EBITDA % (1) |

|

22 |

% |

|

20 |

% |

|

15 |

% |

|

Sales mix (% of segment revenue) |

|

|

|

|

|

|

|

Fracturing |

|

81 |

% |

|

80 |

% |

|

75 |

% |

|

Coiled tubing |

|

19 |

% |

|

20 |

% |

|

25 |

% |

|

Fracturing services |

|

|

|

|

|

|

|

Fracturing revenue per operating day (1) |

$ |

301,301 |

|

$ |

313,675 |

|

$ |

245,842 |

|

|

Number of fracturing operating days (2) |

|

395 |

|

|

280 |

|

|

279 |

|

|

Proppant pumped (tonnes) |

|

323,000 |

|

|

327,000 |

|

|

193,000 |

|

|

Stages completed |

|

4,761 |

|

|

3,213 |

|

|

3,593 |

|

|

Proppant pumped per stage |

|

68 |

|

|

102 |

|

|

54 |

|

|

Horsepower (“HP”) |

|

|

|

|

|

|

|

Active pumping HP, end of period (3) |

|

215,000 |

|

|

200,000 |

|

|

200,000 |

|

|

Total pumping HP, end of period |

|

282,500 |

|

|

282,500 |

|

|

282,500 |

|

| Coiled tubing services |

|

|

|

|

|

|

|

Coiled tubing revenue per operating day (1) |

$ |

49,551 |

|

$ |

46,709 |

|

$ |

51,045 |

|

|

Number of coiled tubing operating days (2) |

|

561 |

|

|

461 |

|

|

448 |

|

|

Active coiled tubing units, end of period |

|

8 |

|

|

7 |

|

|

7 |

|

|

Total coiled tubing units, end of period |

|

16 |

|

|

16 |

|

|

16 |

|

(1) Adjusted EBITDA is a non-IFRS financial

measure and Adjusted EBITDA % and Revenue per operating day are

non-IFRS financial ratios. They are not defined and have no

standardized meaning under IFRS. See Non-IFRS Measures and

Ratios.(2) An operating day is defined as any coiled tubing or

fracturing work that is performed in a 24-hour period, exclusive of

support equipment. (3) Active horsepower denotes units active on

client work sites. An additional 15-20% of this amount is required

to accommodate equipment maintenance cycles.

FIRST QUARTER 2022 COMPARED TO FIRST

QUARTER 2021Revenue for the three months ended March 31,

2022 was $146.8 million compared to $109.4 million for the first

quarter of 2021. Revenue improved due to a substantial rise in

utilization for both service lines as a result of an industry wide

increase in activity. Fracturing operating days increased to 395 in

first quarter of 2022 from 280 during first quarter of 2021

allowing us to add a small low pressure spread in the oil focused

Viking and Cardium areas, bringing the Canadian fracturing spread

count to five. The oil focused work is typically characterized by

higher stages and lower proppant per stage, which resulted in a

lower revenue per day and proppant per stage relative to Q1 2021,

which was more focused on the natural gas plays in the Montney and

Duvernay areas. The low-pressure crew typically fractures through

coiled tubing, leading to additional coiled tubing operating days,

albeit at lower revenue per day. Coiled tubing operating days

increased to 561 in first quarter of 2022 from 461 during first

quarter of 2021, while revenue per day had a slight increase of

6%.

Operating expenses scaled upwards with increased

activity levels. Personnel related costs increased following

adjustments to base and incentive pay to remain competitive in the

current market and the reinstatement of various benefits and

allowances that were eliminated during the Pandemic to reduce

costs. Inflationary pressures continued to be a factor in the

current quarter with supply chain disruptions, commodity price

appreciation, and increased industry activity resulting in costs

escalating across all expense categories. The overhead and SG&A

structure has been scaled up to support increased field operations

compared to the first quarter of 2021, however, the Company will

continue to maintain a lean cost structure while adequately

supporting the growth of the business.

Adjusted EBITDA for the first quarter of 2022

was $31.9 million (22% of revenue) versus $21.5 million (20% of

revenue) in the first quarter of 2021. Adjusted EBITDA increased as

a result of the improved operating environment enabling higher

pricing and utilization partially offset by rising costs due to

continued inflationary pressure. Q1 2021 benefited from $3.6

million received from the CEWS program.

FracturingCanadian fracturing

revenue of $119.0 million for the three months ended March 31, 2022

increased by 36% from $87.8 million for the three months ended

March 31, 2021. STEP operated five fracturing spreads with 215,000

HP during the first quarter of 2022, compared to four spreads and

200,000 HP operated during the first quarter of 2021. Fracturing

operating days increased to 395 in first quarter of 2022 from 280

during first quarter of 2021, as strong demand in the Viking and

Cardium areas allowed STEP to add a small low pressure spread to

these oil focused areas.

The oil focused work is typically characterized

by higher stages and lower proppant per stage, which resulted in a

lower revenue per day and proppant per stage relative to Q1 2021,

which was more focused on the natural gas plays in the Montney and

Duvernay areas. The shift in job mix resulting from the additional

low-pressure crew resulted in a lower revenue per day, offsetting

the increase in pricing realized from Q1 2021 to Q1 2022.

Coiled TubingCanadian coiled

tubing revenue of $27.8 million for the three months ended March

31, 2022 increased 29% from $21.5 million for the three months

ended March 31, 2021. The service line operated eight units for 561

operating days during the first quarter of 2022 compared to seven

units and 461 operating days in the comparable period of 2021. The

increase in utilization followed improvement in drilling and

completions activity while pricing gains have been slower to

materialize.

FIRST QUARTER 2022 COMPARED TO FOURTH

QUARTER 2021Revenue for the three months ended March 31,

2022 of $146.8 million increased 60% from $91.5 million from the

quarter ended December 31, 2021 due to an overall increase in

utilization coupled with some pricing improvement. Strong commodity

price fundamentals drove our operations to a quick start, despite

the cold weather and Omicron COVID-19 challenges experienced at the

start of the quarter.

Canadian operations had Adjusted EBITDA of $31.9

million (22% of revenue) in the first quarter of 2022 compared to

$13.6 million (15% of revenue) in the fourth quarter of 2021.

Inflationary pressures hit the industry hard in Q1 2022, with high

commodity prices, supply chain interruptions and tight labour

conditions combining to increase costs. STEP monitors inflation

closely to ensure that bids and pricing reflect these cost

increases and was able to work with clients to increase pricing to

avoid margin erosion.

FracturingSTEP operated five

fracturing spreads with 215,000 HP during the first quarter of

2022, compared to four spreads and 200,000 HP operated during the

fourth quarter of 2021. The growing demand from oil focused E&P

clients enabled STEP to add a small low pressure fracturing spread

in Q1 2022, while continuing to enjoy strong utilization on the

larger crews that work in the gas focused areas of the basin. Total

operating days surged 42% on a quarter over quarter basis and

revenue increased to $119.0 million, up 61% sequentially. STEP

pumped 323 thousand tonnes of proppant in Q1 2022, up from 193

thousand tonnes in Q4 2021.

The high level of activity throughout the basin

created a more constructive pricing environment, allowing for

recovery of costs as well as modest margin expansion. Pricing in Q1

2022 increased in response to inflation by approximately 10-15%

from Q4 2021 although timing of the increase limited the immediate

quarterly benefit to less than 5%. The full benefit of the pricing

increase is expected to be realized in the coming quarters.

Coiled TubingCoiled tubing

operations operated eight coiled tubing units, with 561 operating

days, generating $27.8 million in revenue in the first quarter of

2022, compared to $22.9 million over 448 operating days in the

fourth quarter of 2021. Pricing improved sequentially from Q4 2021,

but revenue per day was marginally lower on a sequential basis due

to a change in job mix.

UNITED STATES FINANCIAL AND OPERATIONS

REVIEW

STEP’s U.S. business commenced operations in

2015 with coiled tubing services. STEP has a fleet of 13 coiled

tubing units in the Permian and Eagle Ford basins in Texas, the

Bakken shale in North Dakota, and the Uinta-Piceance and

Niobrara-DJ basins in Colorado. STEP entered the U.S. fracturing

business in April 2018. The U.S. fracturing business has 207,500

fracturing HP, of which 80,000 HP is Tier 4 diesel and 50,250 HP

has dual-fuel capabilities. Fracturing primarily operates in the

Permian and Eagle Ford basins in Texas. The Company deploys or

idles coiled tubing units or fracturing horsepower as dictated by

the market’s ability to support targeted utilization and economic

returns.

|

($000’s except per day, days, units, proppant pumped and HP) |

Three months ended |

| |

|

March 31, |

|

|

March 31, |

|

|

December 31, |

|

|

|

|

2022 |

|

|

2021 |

|

|

2021 |

|

|

Revenue: |

|

|

|

|

|

|

|

Fracturing |

$ |

49,667 |

|

$ |

16,425 |

|

$ |

44,773 |

|

|

Coiled tubing |

|

23,060 |

|

|

11,025 |

|

|

22,485 |

|

|

|

|

72,727 |

|

|

27,450 |

|

|

67,258 |

|

| Expenses: |

|

|

|

|

|

|

|

Operating expenses |

|

68,127 |

|

|

38,029 |

|

|

66,520 |

|

|

Selling, general and administrative |

|

2,904 |

|

|

1,406 |

|

|

2,496 |

|

|

Results from operating activities |

$ |

1,696 |

|

$ |

(11,985 |

) |

$ |

(1,758 |

) |

| Add non-cash items: |

|

|

|

|

|

|

|

Depreciation |

|

7,694 |

|

|

8,691 |

|

|

9,829 |

|

|

Share-based compensation – Cash settled |

|

430 |

|

|

277 |

|

|

(59 |

) |

|

Share-based compensation – Equity settled |

|

- |

|

|

- |

|

|

- |

|

|

Adjusted EBITDA (1) |

$ |

9,822 |

|

$ |

(3,017 |

) |

$ |

8,012 |

|

|

Adjusted EBITDA % (1) |

|

14 |

% |

|

(11 |

%) |

|

12 |

% |

|

Sales mix (% of segment revenue) |

|

|

|

|

|

|

|

Fracturing |

|

68 |

% |

|

60 |

% |

|

67 |

% |

|

Coiled tubing |

|

32 |

% |

|

40 |

% |

|

33 |

% |

|

Fracturing services |

|

|

|

|

|

|

|

Fracturing revenue per operating day (1) |

$ |

225,759 |

|

$ |

122,575 |

|

$ |

195,515 |

|

|

Number of fracturing operating days (2) |

|

220 |

|

|

134 |

|

|

229 |

|

|

Proppant pumped (tonnes) |

|

278,000 |

|

|

189,000 |

|

|

302,000 |

|

|

Stages completed |

|

1,122 |

|

|

909 |

|

|

1,515 |

|

|

Proppant pumped per stage |

|

248 |

|

|

208 |

|

|

199 |

|

|

Horsepower (“HP”) |

|

|

|

|

|

|

|

Active pumping HP, end of period (3) |

|

165,000 |

|

|

110,000 |

|

|

165,000 |

|

|

Total pumping HP, end of period |

|

207,500 |

|

|

207,500 |

|

|

207,500 |

|

| Coiled tubing services |

|

|

|

|

|

|

|

Coiled tubing revenue per operating day (1) |

$ |

44,864 |

|

$ |

35,000 |

|

$ |

44,349 |

|

|

Number of coiled tubing operating days (2) |

|

514 |

|

|

315 |

|

|

507 |

|

|

Active coiled tubing units, end of period |

|

8 |

|

|

7 |

|

|

8 |

|

|

Total coiled tubing units, end of period |

|

13 |

|

|

13 |

|

|

13 |

|

(1) Adjusted EBITDA is a non-IFRS financial

measure and Adjusted EBITDA % and Revenue per operating day are

non-IFRS financial ratios. They are not defined and have no

standardized meaning under IFRS. See Non-IFRS Measures and

Ratios.(2) An operating day is defined as any coiled tubing or

fracturing work that is performed in a 24-hour period, exclusive of

support equipment. (3) Active horsepower denotes units active on

client work sites. An additional 15-20% of this amount is required

to accommodate equipment maintenance cycles.

FIRST QUARTER 2022 COMPARED TO FIRST

QUARTER 2021 Revenue for the three months ended March 31,

2022 was $72.7 million compared to $27.5 million for the first

quarter of 2021. U.S. operations realized a substantial increase in

utilization for both service lines as a result of the industry wide

increase in activity and improved pricing due to the strong

industry fundamentals. Operating days across the fracturing

operations increased to 220 in the first quarter of 2022 from 134

days during the first quarter of 2021 due to the improved macro

environment and as result of operating an additional fracturing

spread in the current period. Revenue per day increased by 84%

primarily due to increased proppant supplied by STEP combined with

improved pricing. Coiled tubing operating days increased to 514 in

first quarter of 2022 from 315 during first quarter of 2021 while

revenue per day increased by 28%.

U.S. operations continued the trend of improved

performance and Adjusted EBITDA. Adjusted EBITDA was $9.8 million

for the three months ended March 31, 2022, compared to an Adjusted

EBITDA loss of $3.0 million for the three months ended March 31,

2021. The 14% Adjusted EBITDA margin is inline with STEP’s larger

U.S. based competitors, who also publicly raised concern over the

rising inflation which is leading to higher costs across all

expense categories.

FracturingSTEP operated three

fracturing spreads with 165,000 HP during the first quarter of

2022, compared to two spreads and 110,000 HP operated during the

first quarter of 2021. Operating days across the fracturing

operations increased to 220 in the first quarter of 2022 from 134

days during the first quarter of 2021 due to an improved operating

environment and from operating an additional fracturing spread in

the current period.

Revenue per day for the first quarter of 2022

increased by 84% primarily due to increased proppant supplied by

STEP combined with improved pricing. U.S. fracturing revenue of

$49.7 million increased 203% from the same period in 2021. A shift

in client mix resulting in increased proppant revenue was a

significant factor in the higher revenue per day in the first

quarter of 2022 compared to the first quarter of 2021, however, the

U.S. fracturing operations was also able to realize a significant

increase in base operating rate over this same period.

Coiled TubingU.S. coiled tubing

continued to build momentum during the first quarter of 2022 with

revenue of $23.0 million, increasing from $11.0 million in the

first quarter of 2021. STEP staffed eight coiled tubing units,

which operated 514 days during the first quarter of 2022 compared

to seven units and 315 days in the first quarter of 2021. The

increased utilization was combined with increased revenue per day

of $45 thousand, compared to $35 thousand in the same period last

year; improved rates and stronger activity is materializing in all

operating regions. STEP’s strategic market presence and reputation

for execution continues to help secure utilization and drive higher

pricing in all regions.

FIRST QUARTER 2022 COMPARED TO FOURTH

QUARTER 2021Revenue for the first quarter of 2022

increased $5.4 million to $72.7 million from $67.3 million in the

fourth quarter of 2021 driven primarily from additional proppant

revenue and price increases in fracturing operations. The U.S.

market tightened considerably from Q4 2021 to Q1 2022, leading to

stronger pricing and a shift in the supply narrative between

service providers and E&P companies.

Adjusted EBITDA of $9.8 million (14% of revenue)

for the first quarter of 2022 compared to $8.0 million (12% of

revenue) for the fourth quarter of 2021 continues the positive

trend in the U.S. business. Utilization remains strong across both

business lines and steady price increases have allowed for the

continuous improvement of Adjusted EBITDA on a sequential basis

despite ongoing inflationary pressures.

FracturingChanging client mix,

improved demand and higher rates resulted in revenue of $49.7

million for U.S. fracturing services in Q1 2022 compared to $44.8

million in Q4 2021. While activity remained relatively flat at 220

operating days in the first quarter of 2022 compared to 229 in the

fourth quarter of 2021, revenue per day increased to $266 thousand

from $196 thousand due to an increase in proppant and chemicals

supplied by STEP along with pricing improvements. Pricing in Q1

2022 increased in response to inflation by approximately 20-25%

from Q4 2021 although timing of the increase limited the immediate

quarterly benefit to less than 5%. The full benefit of the pricing

increase is expected to be realized in the coming quarters.

Coiled TubingCoiled tubing

operations continued to operate eight coiled tubing units, with 514

operating days, generating $23.0 million in revenue in the first

quarter of 2022 compared to $22.5 million over 507 operating days

in the fourth quarter of 2021; sequentially flat in both

utilization and pricing. While there were modest increases in both

rates and operating days, weather delays during the quarter and

continued pressure from low-cost providers limited STEP’s ability

to further increase revenue in these operations.

CORPORATE FINANCIAL REVIEW

The Company’s corporate activities are separated

from Canadian and U.S. operations. Corporate operating expenses

include expenses related to asset reliability and optimization

teams, as well as general and administrative costs which include

costs associated with the executive team, the Board of Directors,

public company costs, and other activities that benefit Canadian

and U.S. operating segments collectively.

|

($000’s) |

Three months ended |

| |

March 31, |

|

March 31, |

|

December 31, |

|

|

|

|

2022 |

|

|

2021 |

|

|

2021 |

|

|

Expenses: |

|

|

|

|

|

|

|

Operating expenses |

$ |

571 |

|

$ |

214 |

|

$ |

360 |

|

|

General and administrative |

|

8,722 |

|

|

5,205 |

|

|

4,108 |

|

|

Results from operating activities |

$ |

(9,293 |

) |

$ |

(5,419 |

) |

$ |

(4,468 |

) |

| Add items: |

|

|

|

|

|

|

|

Depreciation |

|

138 |

|

|

173 |

|

|

137 |

|

|

Share-based compensation – Cash settled |

|

4,192 |

|

|

1,564 |

|

|

7 |

|

|

Share-based compensation – Equity settled |

|

265 |

|

|

1,128 |

|

|

61 |

|

|

Adjusted EBITDA (1) |

$ |

(4,699 |

) |

$ |

(2,554 |

) |

$ |

(4,263 |

) |

|

Adjusted EBITDA % (1) |

|

(2 |

%) |

|

(2 |

%) |

|

(3 |

%) |

(1) Adjusted EBITDA is a non-IFRS financial

measure and Adjusted EBITDA % is a non-IFRS financial ratio. They

are not defined and have no standardized meaning under IFRS. See

Non-IFRS Measures and Ratios.

FIRST QUARTER 2022 COMPARED TO FIRST

QUARTER 2021For the three months ended March 31, 2022

expenses from corporate activities were $9.3 million compared to

$5.4 million for the same period in 2021. Share based compensation

was significantly higher in the first quarter of 2022 as the share

price increased $1.19 (74%) from December 31, 2021 to March 31,

2022 compared to an increased share price of only $0.54 (73%)

during the same period of the prior year resulting in higher

expenses as a result the mark to market adjustment in the current

period on cash settled share-based compensation. Additionally,

payroll costs rose as the Company increased total rewards to retain

and attract talented professionals in an increasingly competitive

labour market while Q1 2021 recognized $0.2 million in CEWS

benefits, which reduced total expenses.

FIRST QUARTER 2022 COMPARED TO FOURTH

QUARTER 2021Expenses from corporate activities were $9.3

million for the first quarter of 2022 compared to $4.5 million for

the fourth quarter of 2021, an increase of $4.8 million. The mark

to market adjustments on cash settled share-based compensation were

a significant factor in the first quarter of 2022, unlike the

fourth quarter of 2021 which saw minimal mark to market adjustments

due to limited share price appreciation. The Company accrued an

additional performance bonus for our professionals in Q1 2022 in

recognition of the strong year to date performance. This bonus was

paid in Q2 2022, at the same time as the 2021 performance bonus,

which was accrued through the prior year. STEP is committed to

increasing the total reward package for its professionals to

recognize the contribution that they have made to the improving

results.

NON-IFRS MEASURES AND

RATIOS

This Press Release includes terms and

performance measures commonly used in the oilfield services

industry that are not defined under IFRS. The terms presented are

intended to provide additional information and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS. These non-IFRS

measures have no standardized meaning under IFRS and therefore may

not be comparable to similar measures presented by other issuers.

The non-IFRS measures should be read in conjunction with the

Company’s Quarterly Financial Statements and Annual Financial

Statements and the accompanying notes thereto.

“Adjusted EBITDA” is a financial measure not

presented in accordance with IFRS and is equal to net (loss) income

before finance costs, depreciation and amortization, (gain) loss on

disposal of property and equipment, current and deferred income tax

provisions and recoveries, equity and cash settled share-based

compensation, transaction costs, foreign exchange forward contract

(gain) loss, foreign exchange (gain) loss, and impairment losses.

“Adjusted EBITDA %” is a non-IFRS ratio and is calculated as

Adjusted EBITDA divided by revenue. Adjusted EBITDA and Adjusted

EBITDA % are presented because they are widely used by the

investment community as they provide an indication of the results

generated by the Company’s normal course business activities prior

to considering how the activities are financed and the results are

taxed. The Company uses Adjusted EBITDA and Adjusted EBITDA %

internally to evaluate operating and segment performance, because

management believes they provide better comparability between

periods. The following table presents a reconciliation of the

non-IFRS financial measure of Adjusted EBITDA to the IFRS financial

measure of net income (loss).

|

($000s except percentages) |

Three months ended |

| |

March 31, |

|

March 31, |

|

December 31, |

|

|

|

|

2022 |

|

|

2021 |

|

|

2021 |

|

|

Net income (loss) |

$ |

9,173 |

|

$ |

(7,944 |

) |

$ |

(6,212 |

) |

|

Add (deduct): |

|

|

|

|

|

|

|

Depreciation and amortization |

|

17,072 |

|

|

18,217 |

|

|

19,376 |

|

|

(Gain) loss on disposal of equipment |

|

(818 |

) |

|

369 |

|

|

(638 |

) |

|

Finance costs |

|

3,317 |

|

|

3,087 |

|

|

4,196 |

|

|

Income tax expense (recovery) |

|

2,560 |

|

|

(1,549 |

) |

|

314 |

|

|

Share-based compensation – Cash settled |

|

5,166 |

|

|

2,202 |

|

|

21 |

|

|

Share-based compensation – Equity settled |

|

340 |

|

|

1,587 |

|

|

38 |

|

|

Foreign exchange loss (gain) |

|

180 |

|

|

(9 |

) |

|

245 |

|

|

Adjusted EBITDA |

$ |

36,990 |

|

$ |

15,960 |

|

$ |

17,340 |

|

|

Adjusted EBITDA % |

|

17 |

% |

|

12 |

% |

|

11 |

% |

“Revenue per operating day” is a financial ratio

not presented in accordance with IFRS and is used as a reference to

represent market pricing for our services. It is calculated based

on total revenue divided by total operating days. An operating day

is defined as any coiled tubing and fracturing work that is

performed in a 24-hour period, exclusive of support equipment. This

calculation may fluctuate based on both pricing and sales mix. See

the tables under “Canadian Operations Review” and “United States

Operations Review” for the inputs used to calculate STEP’s revenue

per operating day metrics.

“Working capital”, “Total long-term financial

liabilities” and “Net debt” are financial measures not presented in

accordance with IFRS. “Working capital” is equal to total current

assets less total current liabilities. “Total long-term financial

liabilities” is comprised of loans and borrowings, long-term lease

obligations and other liabilities. “Net debt” is equal to loans and

borrowings before deferred financing charges less cash and cash

equivalents. The data presented is intended to provide additional

information about items on the statement of financial position and

should not be considered in isolation or as a substitute for

measures prepared in accordance with IFRS.

The following table represents the composition

of the non-IFRS financial measure of Working capital (including

cash and cash equivalents).

|

($000s) |

|

March 31, |

|

December 31, |

|

|

|

|

|

|

2022 |

|

|

2021 |

|

|

Current assets |

$ |

198,478 |

|

$ |

133,255 |

|

|

Current liabilities |

|

(145,678 |

) |

|

(129,343 |

) |

|

Working capital (including cash and cash equivalents) |

$ |

52,800 |

|

$ |

3,912 |

|

The following table presents the composition of

the non-IFRS financial measure of Total long-term financial

liabilities.

|

($000s) |

|

|

March 31, |

December 31, |

|

|

|

|

|

|

|

2022 |

|

2021 |

|

Long-term loans |

|

|

|

|

$ |

192,442 |

|

162,007 |

|

Long-term leases |

|

|

|

11,324 |

|

9,163 |

|

Other long-term liabilities |

|

|

|

|

|

8,162 |

|

4,519 |

|

Total long-term financial liabilities |

|

|

|

|

$ |

211,928 |

|

175,689 |

The following table presents the composition of

the non-IFRS financial measure of Net debt.

|

($000s) |

|

|

March 31, |

|

December 31, |

|

|

|

|

|

|

|

|

2022 |

|

|

2021 |

|

|

Loans and borrowings |

|

|

|

|

$ |

220,392 |

|

|

189,957 |

|

|

Add back: Deferred financing costs |

|

|

|

523 |

|

|

626 |

|

|

Less: Cash and cash equivalents |

|

|

|

|

|

(6,637 |

) |

|

(3,698 |

) |

|

Net debt |

|

|

|

|

$ |

214,278 |

|

|

186,885 |

|

RISK FACTORS AND RISK

MANAGEMENT

The oilfield services industry involves many

risks, which may influence the ultimate success of the Company. The

risks and uncertainties set out in the AIF and Annual MD&A are

not the only ones the Company is facing. There are additional risks

and uncertainties that the Company does not currently know about or

that the Company currently considers immaterial which may also

impair the Company’s business operations and can cause the price of

the Common Shares to decline. Readers should review and carefully

consider the disclosure provided under the heading “Risk Factors”

in the AIF and “Risk Factors and Risk Management” in the Annual

MD&A, both of which are available on www.sedar.com, and the

disclosure provided in this Press Release under the headings

“Industry Conditions & Outlook”. In addition, global and

national risks associated with inflation or economic contraction

may adversely affect the Company by, among other things, reducing

economic activity resulting in lower demand, and pricing, for crude

oil and natural gas products, and thereby the demand and pricing

for the Company’s services. Other than as supplemented in this

Press Release, the Company’s risk factors, and management thereof

has not changed substantially from those disclosed in the AIF and

Annual MD&A.

FORWARD-LOOKING INFORMATION &

STATEMENTS Certain statements contained in this Press

Release constitute “forward-looking statements” or “forward-looking

information” within the meaning of applicable securities laws

(collectively, “forward-looking statements”). These statements

relate to the expectations of management about future events,

results of operations and the Company’s future performance (both

operational and financial) and business prospects. All statements

other than statements of historical fact are forward-looking

statements. The use of any of the words “anticipate”, “plan”,

“contemplate”, “continue”, “estimate”, “expect”, “intend”,

“propose”, “might”, “may”, “will”, “shall”, “project”, “should”,

“could”, “would”, “believe”, “predict”, “forecast”, “pursue”,

“potential”, “objective” and “capable” and similar expressions are

intended to identify forward-looking statements. These statements

involve known and unknown risks, uncertainties and other factors

that may cause actual results or events to differ materially from

those anticipated in such forward-looking statements. While the

Company believes the expectations reflected in the forward-looking

statements included in this Press Release are reasonable, such

statements are not guarantees of future performance or outcomes and

may prove to be incorrect and should not be unduly relied upon.

In particular, but without limitation, this

Press Release contains forward-looking statements pertaining to:

2022 industry conditions and outlook, including the continuation of

string oil and gas prices in 2022, and its effects on drilling

activity levels and activity levels; anticipated Q2 2022 results;

the potential for higher North American energy exports; supply and

demand for the Company’s and its competitors’ services, including

the ability for the industry to respond to demand increases and the

Company’s capacity commitments; expected price improvements for the

Company’s services; the impact of weather on the Company’s

operations; staffing challenges and labour shortages, and its

effect on activity and equipment levels and service sector supply;

the potential for an undersupplied market in 2022; the Company’s

ability to realize the benefits of pricing increases in subsequent

quarters; the Company’s ability to meet all financial commitments

including interest payments over the next twelve months; the

Company’s anticipated business strategies and expected success,

including the level of operating capacity in Canada and U.S.; the

Company’s ability to manage its capital structure; pricing received

for the Company’s services, including the Company’s ability to

increase pricing; the Company’s capital program in 2022 and

management’s continued evaluation thereof; expected profitability;

expected income tax liabilities; adequacy of resources to funds

operations, financial obligations and planned capital expenditures

in 2022; the Company’s ability to retain its existing clients; the

monitoring of industry demand, client capital budgets and market

conditions; client credit risk, including the Company’s ability to

set credit limits, monitor client payment patterns, and to apply

liens; and the Company’s expected compliance with covenants under

its Credit Facilities and its ability to satisfy its financial

commitments under its Credit Facilities.

The forward-looking information and statements

contained in this Press Release reflect several material factors

and expectations and assumptions of the Company including, without

limitation: the effect of military conflict in the Ukraine and

related Canadian, U.S. and international sanctions involving Russia

on the market for the Company’s services; OPEC or OPEC+ related

market uncertainty on the market for the Company’s services; that

the Company will continue to conduct its operations in a manner

consistent with past operations; the Company will continue as a

going concern; the general continuance of current or, where

applicable, assumed industry conditions; pricing of the Company’s

services; the Company’s ability to market successfully to current

and new clients; predictable effect of seasonal weather on the

Company’s operations; the Company’s ability to utilize its

equipment; the Company’s ability to collect on trade and other

receivables; the Company’s ability to obtain and retain qualified

staff and equipment in a timely and cost effective manner; levels

of deployable equipment; future capital expenditures to be made by

the Company; future funding sources for the Company’s capital

program; the Company’s future debt levels; the availability of

unused credit capacity on the Company’s credit lines; the impact of

competition on the Company; the Company’s ability to obtain

financing on acceptable terms; the Company’s continued compliance

with financial covenants; the amount of available equipment in the

marketplace; and client activity levels and spending. The Company

believes the material factors, expectations and assumptions

reflected in the forward-looking information and statements are

reasonable but no assurance can be given that these factors,

expectations and assumptions will prove correct.

Actual results could differ materially from

those anticipated in these forward‐looking statements due to the

risk factors set forth under the heading “Risk Factors” in the AIF

and under the heading “Risk Factors and Risk Management” in this

Press Release and the Annual MD&A.

Any financial outlook or future orientated

financial information contained in this Press Release regarding

prospective financial performance, financial position or cash flows

is based on the assumptions about future events, including economic

conditions and proposed courses of action based on management’s

assessment of the relevant information that is currently available.

Projected operational information, including the Company’s capital

program, contains forward looking information and is based on a

number of material assumptions and factors, as are set out above.

These projections may also be considered to contain future oriented

financial information or a financial outlook. The actual results of

the Company’s operations will likely vary from the amounts set

forth in these projections and such variations may be material.

Readers are cautioned that any such financial outlook and future

oriented financial information contains herein should not be used

for purposes other than those for which it is disclosed herein.

The forward-looking information and statements

contained in this Press Release speak only as of the date of the

document, and none of the Company or its subsidiaries assumes any

obligation to publicly update or revise them to reflect new events

or circumstances, except as may be required pursuant to applicable

laws. The reader is cautioned not to place undue reliance on

forward-looking information.

ABOUT STEPSTEP is an oilfield

service company that provides stand-alone and fully integrated

fracturing, fluid and nitrogen pumping, and coiled tubing

solutions. Our combination of modern equipment along with our

commitment to safety and quality execution has differentiated STEP

in plays where wells are deeper, have longer laterals and higher

pressures. STEP has a high-performance, safety-focused culture and

its experienced technical office and field professionals are

committed to providing innovative, reliable and cost-effective

solutions to its E&P clients.

Founded in 2011 as a specialized deep capacity

coiled tubing company, STEP has grown into a North American service

provider delivering completion and stimulation services to

exploration and production companies in Canada and the U.S. Our

Canadian services are focused in the Western Canadian Sedimentary

Basin, while in the U.S., our fracturing and coiled tubing services

are focused in the Permian and Eagle Ford basins in Texas, the

Uinta-Piceance and Niobrara-DJ basins in Colorado and the Bakken

basin in North Dakota.

Our four core values; Safety,

Trust, Execution and

Possibilities inspire our team of professionals to

provide differentiated levels of service, with a goal of flawless

execution and an unwavering focus on safety.

For more information please contact:

| Regan DavisChief Executive

Officer |

|

Klaas DeemterChief Financial

Officer |

|

|

| Telephone: 403-457-1772 |

|

Telephone: 403-457-1772 |

|

|

Email: investor_relations@step-es.com Web:

www.stepenergyservices.com

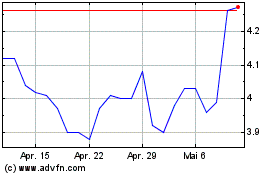

STEP Energy Services (TSX:STEP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

STEP Energy Services (TSX:STEP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024