Gross profit increased by 31% in Q4 2021 and by 20% in Fiscal

2021 driven by strong growth in Software & Cloud and

Services

Following record results in 2021, Softchoice updates 2022

outlook and announces 29% increase to dividend and new share

buyback program

Softchoice Corporation (“Softchoice” or the “Company”) (TSX:

SFTC) today announced its financial results for the quarter and

year ended December 31, 2021. The Company also updated its 2022

Outlook and announced a 29% increase to its quarterly dividend and

its intention to implement a normal course issuer bid (share

buyback). Softchoice’s management team will hold a conference

call/webcast to discuss its results today, March 4, 2022, at 8:30

a.m. ET, the details of which are further below. Unless otherwise

noted, all dollar ($) amounts are in U.S. dollars.

Commenting on Fiscal 2021 and the Company's 2022 outlook,

Vince De Palma, Softchoice’s President & Chief Executive

Officer, said:

“Our unique ability to unleash the potential of people and

technology drove exceptional results for Softchoice in Fiscal 2021,

including 20% growth in our top line gross profit while using our

free cash flow to aggressively reduce debt and initiate a quarterly

dividend. We achieved record salesforce productivity during the

year through our insight-driven approach with our customers and the

investments and initiatives we’ve made to support our strategic

focus on delivering advanced software- and cloud-focused IT

solutions. We continued to deepen our engagements with customers to

help them drive their digital transformation and succeed, resulting

in record Revenue Retention Rate of 113%. We are entering 2022 with

significant momentum and in a sound financial position. Given the

visibility in our business model and our continued strong

performance, we have increased our growth outlook for 2022.”

Commenting on Softchoice’s performance in the fourth quarter

of 2021 and capital allocation plans, Bryan Rocco, Softchoice’s

Chief Financial Officer, said:

“We were pleased to deliver very strong financial results this

past quarter including 31% gross profit growth over Q4 2020, driven

by significant growth in Software & Cloud and realizing gross

profit uplift from our business transformation initiative Project

Monarch. Adjusted EBITDA increased 2%, in line with our

expectations, as our gross profit growth both funded significant

investments in our technical resources, salesforce, and cloud

strategies, and offset a $10 million decline in CEWS funding. Our

Q4 2021 finish contributed to Softchoice achieving a record

Adjusted EBITDA in Fiscal 2021. Our strategic investments as well

as the benefits of Project Monarch, position Softchoice to drive

significant organic growth and Adjusted EBITDA margin expansion in

Fiscal 2022. In order to enhance shareholder returns while

maintaining balance sheet strength and flexibility, our Board has

also increased our quarterly dividend by 29% to 9-cents (Canadian)

per common share and we will commence a buy-back program for our

common shares.”

Financial Summary1

US$ M except per share amounts and

percentages

Q4 2021

Q4 2020

Growth %

Fiscal 2021

Fiscal 2020

Growth %

Gross Sales

634.3

526.7

20.4%

1,999.7

1,738.7

15.0%

Gross Sales by IT Solution Type*:

Software & Cloud

447.6

338.0

32.4%

1,360.9

1,099.9

23.7%

Services

26.8

22.1

21.4%

101.7

90.4

12.5%

Hardware

160.0

166.7

-4.0%

537.1

548.4

-2.1%

Net sales

258.2

231.4

11.6%

903.1

836.8

7.9%

Gross profit

85.8

65.4

31.1%

287.0

238.3

20.4%

Gross Profit by IT Solution Type*:

Software & Cloud

53.2

37.6

41.5%

176.4

143.0

23.3%

Services

7.3

4.3

70.2%

28.2

22.4

25.8%

Hardware

25.3

23.5

7.5%

82.5

72.9

13.2%

Adjusted EBITDA

26.5

26.0

1.8%

69.1

65.5

5.5%

Adjusted EBITDA as a % of Gross

Profit

30.8%

39.7%

24.1%

27.5%

Income (loss) from operations

10.7

14.5

(26.5%)

3.2

15.0

(78.3%)

Net income (loss)

7.4

19.3

(61.9%)

(10.0)

2.1

(575.9%)

Net income (loss) per Diluted Share

(attributable to the Owners of the Company)

$0.12

$0.21

(43.9%)

$(0.22)

$(0.01)

1947.2%

Adjusted Net Income

17.2

20.5

-16.4%

37.0

36.2

2.2%

Adjusted EPS (Diluted)

$0.27

$0.36

-25.5%

$0.65

$0.64

0.7%

* Amounts may not add to total due to

rounding

Selected Q4 2021 Highlights

- Gross Sales increased by 20.4% to $634.3 million from $526.7

million in Q4 2020, driven by a 32.4% increase in Software &

Cloud solutions.

- Net sales increased by 11.6% to $258.2 million from $231.4

million in Q4 2020, driven by double-digit growth in Software &

Cloud and Services solutions. Similar to previous quarters and

recent years, Gross Sales growth exceeded net sales growth due to

an increase in the mix of Software & Cloud solutions within

total Gross Sales, which is primarily recorded on a net basis for

accounting purposes.

- Gross profit increased by 31.1% to $85.8 million, from $65.4

million in Q4 2020, driven by growth in all IT solution types and

sales channels.

- Adjusted EBITDA increased by 1.8% to $26.5 million, from $26.0

million in Q4 2020, with the $20.4 million increase in gross profit

partially offset by a $19.8 million increase in Adjusted Cash

Operating Expenses, driven by the decrease in CEWS ($10.3 million

in Q4 2020 versus $nil in Q4 2021), growth investments made by the

Company in Q4 2021, and higher variable compensation tied to gross

profit performance.

Selected Fiscal 2021 Highlights

- Gross Sales increased by 15.0% to $2.0 billion from $1.7

billion in Fiscal 2020, driven by a 23.7% increase in Software

& Cloud solutions.

- Revenue Retention Rate increased to the highest level of 113%

in Fiscal 2021, compared to 94% in Fiscal 2020, illustrating strong

growth with existing Customers.

- Net sales increased by 7.9% to $903.1 million from $836.8

million in Fiscal 2020, driven by growth in all IT solution

types.

- Gross profit increased by 20.4% to $287.0 million, from $238.3

million in Fiscal 2020, driven by double-digit growth in all IT

solution types and sales channels.

- Adjusted EBITDA increased by 5.5% to $69.1 million, from $65.5

million in Fiscal 2020, with the $48.7 million increase in gross

profit partially offset by a $45.1 million increase in Adjusted

Cash Operating Expenses, driven primarily by the decrease in CEWS

($14.0 million in Fiscal 2020 versus $0.7 million in Fiscal 2021),

growth investments made by the Company in Fiscal 2021, and higher

variable compensation tied to gross profit performance.

Selected 2021 Business Highlights

- Made significant growth investments in our technical resources,

salesforce, and cloud strategies.

- Recipient of Microsoft Surface Velocity Partner of the Year,

which acknowledges the highest level of revenue growth in the

channel.

- Leveraged recognition as VMware’s Lifecycle Services Partner of

the Year to expand VMware Cloud market share, by accelerating the

migration of traditional on-premise environments into Amazon Web

Services (“AWS”), Microsoft Azure, and Google Cloud Platform

(“GCP”).

- Recipient of Red Hat Solution Provider Partner of the Year,

which represents the leadership we have demonstrated in using

software-defined tools to manage environments across private or

public cloud.

- Recipient of the U.S. Rising Star Partner of the Year by AWS

for strong pace of growth.

- Secured a multi-year partnership with AWS to strengthen cloud

migration and modernization service offerings which will enable

customers to transform and innovate in the cloud with agility.

- Honoured with the Social Impact Partner of the Year – Global

and Americas Security Partner of the Year at the Cisco Partner

Summit 2021, which recognizes the commitment of Softchoice to

create success for customers' organizations, their IT

professionals, and our communities.

- Subsequent to year-end, the Company achieved the elite Managed

Services Provider designation in the Google Cloud Advantage

Program, demonstrating the Company’s continued success in enabling

cloud transformation at scale with technical expertise in GCP.

Financial Position

The Company ended 2021 in strong financial condition, with

approximately $211 million in available funds from cash on hand and

through its $275 million revolving credit facility. Including

internally generated cash flows, the Company anticipates having

significant resources with which to pursue growth opportunities and

enhance shareholder returns.

The Company had approximately $66.8 million in loans and

borrowings outstanding as at year end. Net debt, equating to loans

and borrowings plus lease liabilities less cash-on-hand, was $85.9

million at December 31, 2021 compared to $190.6 million at December

31, 2020, with the decline driven by proceeds from the IPO as well

as net cash flows from operating activities in 2021. The ratio of

net debt to 2021 Adjusted EBITDA was 1.2x at December 31, 2021

compared to 2.9x at December 31, 2020.

Dividend

On March 3, 2022, the Company’s Board (the “Board”) of

Directors approved a 29% increase in quarterly cash dividends to

Cdn. $0.09 per common share (each, a “Common Share”), from Cdn.

$0.07 per Common Share. As such, the Company has declared a cash

dividend (the “Dividend”) in the amount of C$0.09 per Common Share

of the Company for the period from January 1, 2022 to March 31,

2022, payable as of April 14, 2022, to shareholders of record at

the close of business on March 31, 2022. The Dividend to which this

notice relates is an eligible dividend for tax purposes.

NCIB

On March 3, 2022, the Board approved the commencement of a

normal course issuer bid (“NCIB”) through the facilities of

the TSX and/or alternative Canadian trading systems to purchase and

cancel up to 3,018,528 of the Company’s Common Shares, representing

approximately 10% of the public float of 30,185,282, during the

twelve-month period commencing March 8, 2022 and ending March 7,

2023.

The Company intends to enter into an automatic purchase plan to

be effective on March 8, 2022 with a designated broker which will

allow for the purchase for cancellation of Common Shares, subject

to certain trading parameters, by its designated broker during

times when the Company would ordinarily not be active in the market

due to applicable regulatory restrictions or self-imposed blackout

periods. Outside of these periods, the Common Shares will be

repurchased by the Company at its discretion under the NCIB.

Our Outlook 1

Softchoice is revising its 2022 financial outlook that was

originally included in its Prospectus (as defined below) and

reiterated November 12, 2021. For full-year 2022, the Company is

now expecting:

Updated Fiscal 2022

Outlook

Gross Profit

>$320 million (>11.5%

growth over Fiscal 2021)

Adjusted EBITDA as a Percentage of

Gross Profit

~30% margin (Inclusive of ~$25

million of Project Monarch Uplift)

Adjusted Free Cash Flow

Conversion

Approximately 90%

Our outlook is based on certain assumptions and factors

(including those relating to our view of the drivers of, and

expectations related to, our anticipated growth), including the key

assumptions and factors set out in the Prospectus under ‘Our

Outlook’. Assumes an average U.S.$ / C$ exchange rate of 0.79 in

Fiscal 2022. For important information on risk factors, refer to

“Forward Looking Information Disclaimer” later in this news

release.

Quarterly Conference Call

Softchoice’s management team will hold a conference call to

discuss our fourth quarter and full year 2021 results today, March

4, 2022, at 8:30 a.m. ET.

DATE: Friday, March 4, 2022 TIME: 8:30 a.m.

Eastern Time DIAL-IN: 416-764-8659 or 1-888-664-6392,

Confirmation # 63207280 WEBCAST:

https://produceredition.webcasts.com/starthere.jsp?ei=1527612&tp_key=d22683293e

TAPED REPLAY: 416-764-8677 or 1-888-390-0541, Replay Code

207280 # (Available until Mar. 11, 2022)

A link to the webcast will also be available on the Events page

of the Investors section of Softchoice’s website at

http://investors.softchoice.com. Please connect at least 15 minutes

prior to the conference call to ensure adequate time for any

software download that may be required to join the webcast. An

archived replay of the webcast will be available for 90 days.

Capitalized Terms

Capitalized terms used in this release, including Project

Monarch, and terms we use to describe our IT solution types

including Software & Cloud, Services, and Hardware and sales

channels including SMB, Commercial, and Enterprise are described in

the Company’s Management’s Discussion and Analysis of Financial

Condition and Results of Operations for the three and twelve-months

ended December 31, 2021 (the “Q4 2021 MD&A”), and/or

defined in our Prospectus (as defined below) filed on SEDAR and

available on the Company’s investor relations website

http://investors.softchoice.com.

1 Non-IFRS Measures

This news release makes reference to certain non-IFRS measures

and other measures. These measures are not recognized measures

under International Financial Reporting Standards (“IFRS”) as

issued by the International Accounting Standards Board (“IASB”) and

do not have a standardized meaning prescribed by IFRS and are

therefore unlikely to be comparable to similar measures presented

by other companies. Rather, these measures are provided as

additional information to complement those IFRS measures by

providing further understanding of our results of operations from

management’s perspective. Accordingly, these measures should not be

considered in isolation nor as a substitute for analysis of our

financial information reported under IFRS. We use non-IFRS

measures, including “Adjusted EBITDA”, “Adjusted EBITDA as a

Percentage of Gross Profit”, “Adjusted Cash Operating Expenses”,

“Adjusted Net Income (Loss)”, “Adjusted EPS”, “Adjusted Free Cash

Flow Conversion”, and “Gross Sales”. These non-IFRS measures and

other measures are used to provide investors with supplemental

measures of our operating performance and thus highlight trends in

our core business that may not otherwise be apparent when relying

solely on IFRS measures. Our management uses these non-IFRS

measures and other measures in order to facilitate operating

performance comparisons from period to period, to prepare annual

operating budgets and forecasts and to determine components of

management compensation. We also believe that securities analysts,

investors and other interested parties frequently use certain of

these non-IFRS measures and other measures in the evaluation of

issuers. As required by Canadian securities laws, we reconcile the

non-IFRS measures to the most comparable IFRS measures. For more

information on non-IFRS measures and other measures, see the Q4

2021 MD&A filed on SEDAR and available on the Company’s

investor relations website http://investors.softchoice.com.

Reconciliations of Non-IFRS Financial Measures

(Information in thousands of U.S.

dollars, unless otherwise stated)

Three Months Ended December

31,

Fiscal Year Ended December

31,

Reconciliation of Net Sales to Gross

Sales

2021

2020

2021

2020

Net sales

258,175

231,391

903,066

836,751

Net adjustment for sales transacted as

agent

376,132

295,301

1,096,607

901,915

Gross Sales

634,307

526,692

1,999,673

1,738,666

Reconciliation of Operating Expenses to

Adjusted Cash Operating Expenses

Operating expenses

75,104

50,877

283,734

223,314

Depreciation and amortization

(5,027)

(5,938)

(21,167)

(23,141)

Equity-settled share-based compensation

and other costs (1)

(8,154)

(538)

(37,334)

(9,848)

Non-recurring compensation and other costs

(2)

(6)

(1,444)

(688)

(2,867)

Business transformation non-recurring

costs (3)

(499)

(3,516)

(1,573)

(14,630)

IPO related costs (4)

(79)

–

(3,071)

–

Follow-On Offering costs (5)

(287)

–

(287)

–

Non-recurring legal provision (6)

(1,714)

–

(1,714)

–

Adjusted Cash Operating

Expenses

59,338

39,441

217,900

172,828

Reconciliation of Income (loss) from

operations to Adjusted EBITDA

Income (loss) from operations

10,698

14,550

3,248

14,974

Depreciation and amortization

5,027

5,938

21,167

23,141

Equity-settled share-based compensation

and other costs (1)

8,154

538

37,334

9,848

Non-recurring compensation and other costs

(2)

6

1,444

688

2,867

Business transformation non-recurring

costs (3)

499

3,516

1,573

14,630

IPO related costs (4)

79

–

3,071

–

Follow-On Offering costs (5)

287

–

287

–

Non-recurring legal provision (6)

1,714

–

1,714

–

Adjusted EBITDA

26,464

25,986

69,082

65,460

Adjusted EBITDA as a Percentage of

Gross Profit (7)

30.8%

39.7%

24.1%

27.5%

Reconciliation of Net Income (Loss) to

Adjusted Net Income

Net income (loss)

7,358

19,302

(9,965)

2,094

Amortization of intangible assets

3,279

3,727

13,058

14,403

Equity-settled share-based compensation

and other costs (1)

8,154

538

37,334

9,848

Non-recurring compensation and other costs

(2)

6

1,444

688

2,867

Business transformation non-recurring

costs (3)

499

3,516

1,573

14,630

IPO related costs (4)

79

–

3,071

–

Follow-On Offering costs (5)

287

–

287

–

Non-recurring legal provision (6)

1,714

–

1,714

–

Related party debt interest (8)

–

1,006

1,736

3,891

Subordinated debt interest (8)

–

260

446

1,007

Interest expense (recovery) on accretion

of non-interest bearing notes (9)

–

(66)

120

96

Extinguishment of deferred financing fees

(10)

–

–

1,621

–

Unrecoverable withholding taxes (11)

(206)

–

829

–

Loss on lease modification (12)

–

–

1,184

–

Loss on disposal of property, plant and

equipment (13)

651

–

651

–

Foreign exchange gain (14)

(244)

(7,563)

(1,924)

(3,363)

Tax recovery on deferred tax liability

(15)

(2,612)

–

(5,475)

–

Related tax effects (16)

(1,810)

(1,635)

(9,994)

(9,306)

Adjusted Net Income

17,155

20,529

36,954

36,167

Weighted Average Number of Shares

(Basic)

59,457,156

45,162,331

53,406,543

45,135,727

Weighted Average Number of Shares

(Diluted)

63,227,619

56,402,447

57,177,006

56,375,843

Adjusted EPS (Basic) (17)

0.29

0.45

0.69

0.80

Adjusted EPS (Diluted) (17)

0.27

0.36

0.65

0.64

The following measures are reported on a trailing

twelve-month basis only:

Reconciliation of Net Cash (used in)

Provided by

Fiscal Year Ended December

31,

Operating Activities to Adjusted Free

Cash Flow

2021

2020

2019

Net cash provided by (used in)

operating activities

53,730

(10,548)

30,404

Adjusted for:

Share-based compensation and other costs

(18)

35,571

5,003

3,722

Non-recurring compensation and other costs

(2)

688

2,867

941

Business transformation non-recurring

costs (3)

1,573

14,630

12,334

IPO related costs (4)

3,071

–

–

Follow-On Offering costs (5)

287

–

–

Non-recurring legal provision (6)

1,714

–

–

Realized foreign exchange (gains)

losses

(7,515)

228

3,336

Finance and other expense (income)

(19)

846

(144)

(866)

Cash taxes paid

6,564

5,491

7,761

Cash interest paid

6,330

8,475

9,449

Change in non-cash operating working

capital

(33,777)

39,458

(4,623)

Adjusted EBITDA

69,082

65,460

62,458

Maintenance Capex

(1,796)

(1,132)

(2,830)

IFRS 16 lease payments (20)

(7,431)

(6,676)

(6,700)

Adjusted Free Cash Flow

59,855

57,652

52,928

Adjusted Free Cash Flow

Conversion

87%

88%

85%

Notes (Refer to the Q4 2021 MD&A for description of the

bolded items and sections with parentheses within these

Notes)

(1)

These expenses represent costs recognized

in connection with the Company’s legacy option plan and omnibus

long-term equity incentive plan, pursuant to which options granted

are fair valued at the time of grant using the Black-Scholes option

pricing model and adjusted for any plan modifications. Included in

Fiscal 2021, there was $16.9 million relating to certain payments

made in connection with extinguishment of certain equity-based

entitlements (the “Cash-Out Agreements”) in conjunction with

the IPO. In addition, $7.7 million relates to Cash-Out Agreements

in conjunction with the Follow-On offering. Other costs relate to

the employee investment plan and the long-term profit-sharing plan,

which were dissolved upon the completion of the IPO, and fair value

adjustments in relation to existing equity-based arrangements. As a

result of the IPO, a $6.1 million fair value adjustment was

triggered on an existing equity-based arrangement which was

dissolved thereafter. See “Share Information Prior to the

Completion of the Offering”.

(2)

These expenses include compensation costs

relating to severance and a one-time accrual recorded in Fiscal

2020 associated with the set-up of a new corporate vacation policy.

Other costs are comprised of professional, legal, consulting,

accounting and management fees that are non-recurring and are

sporadic in nature as they primarily relate to costs incurred in

connection with shareholder distributions.

(3)

These costs relate to the implementation

of Project Monarch which were largely comprised of one-time

third-party consulting expenses, personnel costs for dedicated

internal resources and software related costs. All costs relating

to Project Monarch were segregated for tracking purposes and are

monitored on a regular basis. As at December 31, 2021, $49.2

million has been invested in operating and capital expenditures for

Project Monarch. See “Summary of Factors Affecting Performance –

Business Transformation (Project Monarch)”.

(4)

In connection with the IPO, the Company

incurred expenses related to professional fees, legal, consulting,

accounting and compensation that would otherwise not have been

incurred and therefore are non-recurring. These costs have been

separately identified and adjusted for clarity. There were $253 of

IPO related costs which were incurred in three months ended March

31, 2021 that were previously classified under non-recurring

compensation and other costs; these costs have been reclassified

into IPO related costs in Fiscal 2021 year to date adjusted

amount.

(5)

In connection with the Follow-On Offering,

the Company incurred expenses related to professional fees, legal,

and accounting fees that would otherwise not have been incurred and

therefore are non-recurring. These costs have been separately

identified and adjusted above.

(6)

The Company has settled certain legal

claims, without admission of liability or wrongdoing, in respect of

U.S. wage and hour disputes and has provisioned $1.7 million for

such settlements, which are non-recurring in nature.

(7)

Adjusted EBITDA as a Percentage of Gross

Profit is calculated as Adjusted EBITDA divided by gross profit.

See “Non-IFRS Measures and Other Measures – Non-IFRS Measures –

Adjusted EBITDA and Adjusted EBITDA as a Percentage of Gross

Profit”.

(8)

Related party and subordinated debt

interest was settled at the time of Offering. For additional

details see “Related Party Transactions”, “Subordinated Debt

Information” and “Share Information Prior to the Completion of the

Offering”.

(9)

This represents the expense relating to

the accretion of the present value of the non-interest bearing

notes recognized over the term of the notes. These notes were

settled at the time of Offering. See also “Related Party

Transactions”, “Subordinated Debt Information” and “Share

Information Prior to the Completion of the Offering”.

(10)

As a result of the refinancing, the

unamortized balance of the deferred financing fees on the former

revolving credit facility and term credit facility of $1,621 were

extinguished in the June 2021.

(11)

Non-controlling interest portion of

unrecoverable withholding taxes on royalties. Non-controlling

interest was eliminated at the time of the IPO.

(12)

Loss on lease modification recognized in

three months ended September 30, 2021 (“Q3 2021”) as a

result the recognition of a sublease receivable for an office space

that has been subleased and the corresponding derecognition of a

right-of-use asset associated with this space.

(13)

Loss on disposal of property and equipment

recognized in Q4 2021 as a result of the disposal of assets related

to a subleased office space which is non-reoccurring in nature.

(14)

Foreign exchange gains (losses) includes

both realized and unrealized amounts.

(15)

Tax recovery on deferred tax liability as

a result of tax rate changes.

(16)

This relates to the tax effects of the

adjusting items, which was calculated by applying the statutory tax

rate of 26.5% and adjusting for any permanent differences and

capital losses.

(17)

Basic Adjusted EPS is calculated using the

weighted average number of shares outstanding during the period.

Diluted Adjusted EPS includes the dilutive impact of the stock

options in addition to the weighted average number of shares

outstanding during the period. See “Non-IFRS Measures and Other

Measures – Non-IFRS Measures – Adjusted Net Income (Loss) and

Adjusted EPS”.

(18)

Share-based compensation represents costs

recognized in connection with repurchases of stock options from

terminated employees. Included in the trialing twelve months ended

Q4 2021, there was $16.9 million relating to Cash-Out Agreements in

conjunction with the IPO and $7.7 million relating to Cash-Out

Agreements in conjunction with the Follow-On Offering. Other costs

are comprised of the employee investment plan and the long-term

profit-sharing plan, which were dissolved in connection with the

IPO; and fair value adjustments in relation to existing

equity-based arrangements. As a result of the IPO, a $6.1 million

fair value adjustment was triggered on an existing equity-based

arrangement which was dissolved thereafter. See “Share Information

Prior to the Completion of the Offering”.

(19)

Finance and other expense (income) refers

to interest income on cash, and payments received from employees

for parking, net of non-controlling interest portion of

unrecoverable withholding taxes on royalties.

(20)

Lease payments in Fiscal 2021 included a

one-time early lease termination payment of $0.5 million.

1 Forward-Looking Statements

This news release contains “forward-looking information” within

the meaning of applicable securities laws in Canada.

Forward-looking information may relate to our future business,

financial outlook and anticipated events or results and may include

information regarding our financial position, business strategy,

growth strategies, addressable markets, budgets, operations,

financial results, taxes, dividend policy, plans and objectives.

Particularly, information regarding our expectations of future

results, performance, achievements, prospects or opportunities or

the markets in which we operate is forward-looking information. In

some cases, forward-looking information can be identified by the

use of forward-looking terminology such as “plans”, “targets”,

“expects” or “does not expect”, “is expected”, “an opportunity

exists”, “budget”, “scheduled”, “estimates”, “outlook”, “financial

outlook”, “forecasts”, “projection”, “prospects”, “strategy”,

“intends”, “anticipates”, “does not anticipate”, “believes”, or

variations of such words and phrases or statements that certain

actions, events or results “may”, “could”, “would”, “might”,

“will”, “will be taken”, “occur” or “be achieved”. In addition, any

statements that refer to expectations, intentions, projections or

other characterizations of future events or circumstances contain

forward-looking information. Statements containing forward-looking

information are not historical facts but instead represent

management’s expectations, estimates and projections regarding

possible future events or circumstances.

Forward-looking information may include, among other things: (i)

the Company’s expectations regarding its financial performance and

outlook, including among others, net sales, gross profit, gross

profit growth rates, expenses, Adjusted EBITDA, Adjusted EBITDA to

Gross Profit margin, Adjusted Free Cash Flow Conversion,

operations, the number of account executives and employees, organic

growth and Adjusted EBITDA margin expansion; (ii) the Company’s

expectations regarding industry and market trends, growth rates and

growth strategies; (iii) the Company’s business plans and

strategies; (iv) the Company’s ability to retain customers and

increase margin per customer; (v) the Company’s relationship and

status with technology partners; (vi) the Company’s growth

strategies, future organic growth, and competitive position in the

IT industry; (vii) the Company’s dividend program and dividend

rates; (viii) the Company’s NCIB program and the purchase of Common

Shares in connection with such programs; and (ix) the long-term

impact of COVID-19 on our business, financial position, results of

operations and/or cash flows; (x) M&A opportunities; and (xi)

the materialization of the expected benefits of Project

Monarch.

Forward-looking information is necessarily based on a number of

opinions, estimates and assumptions that we considered appropriate

and reasonable as at the date such statements are made, and are

subject to known and unknown risks, uncertainties, assumptions and

other factors that may cause the actual results, level of activity,

performance or achievements to be materially different from those

expressed or implied by such forward-looking information, including

but not limited to the risk factors described in our Q4 2021

MD&A and under “Risk Factors” within the Company’s final

initial public offering prospectus dated May 26, 2021 (the

“Prospectus”). A copy of the Prospectus can be accessed under our

profile on the System for Electronic Document Analysis and

Retrieval (“SEDAR”) at www.sedar.com and on our website at

investors.softchoice.com. There can be no assurance that such

forward-looking information will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such information. Accordingly, readers should not

place undue reliance on forward-looking information, which speaks

only as at the date made.

In addition to the Forward-looking information cautions

described above, the outlook set forth herein includes Gross

Profit, Gross Profit growth, Adjusted EBITDA, Adjusted EBITDA to

Gross Profit margin and Adjusted Free Cash Flow Conversion, for

Fiscal 2022. Key underlying drivers for our forecast, particularly

related to Gross Profit and Gross Profit growth, include: (i) the

expected growth of our addressable market; (ii) the expected growth

of our salesforce and improvements of our salesforce productivity;

and (iii) the expected growth in our customer base and wallet share

amongst existing customers. A significant portion of the increase

in Gross Profit and Adjusted EBITDA for Fiscal 2022 is attributable

to the procurement savings, pricing margin improvements, and

business growth and reduced revenue leakage and expected net

workforce efficiencies anticipated to result from Project Monarch.

To the extent that these underlying drivers and benefits are not

realized as expected, our Gross Profit, Adjusted EBITDA, Adjusted

EBITDA to Gross Profit margin and, as a result, our Adjusted Free

Cash Flow Conversion, during the relevant period will be adversely

affected. The underlying assumptions relating to future results are

inherently uncertain and are subject to significant business,

economic, financial, regulatory, market and competitive risks,

including risks that our initiatives or projects (including Project

Monarch) do not result in the growth and increase in efficiencies

anticipated along with uncertainties that could cause actual

results to differ materially. If we do not achieve the anticipated

results, we may modify or discontinue certain of our other planned

business initiatives. In light of the foregoing, investors are

urged to put these statements in context and not to place undue

reliance on them.

About Softchoice

Softchoice (TSX: SFTC) is a software-focused IT solutions

provider that equips organizations to be agile and innovative, and

for their people to be engaged, connected and creative at work.

That means moving them to the cloud, helping them build the

workplace of tomorrow, and enabling them to make smarter decisions

about their technology portfolio. For more information, please

visit www.softchoice.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220304005088/en/

Investor Relations Tim Foran (416) 986-8515

investors@softchoice.com

Press Justin Hane (647) 917-1761

justin.hane@softchoice.com

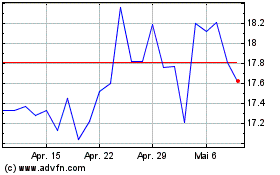

Softchoice (TSX:SFTC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Softchoice (TSX:SFTC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024