Sustainable Power & Infrastructure Split Corp. Increases Class A Share Distribution

24 Oktober 2024 - 11:15PM

Sustainable Power & Infrastructure Split Corp. class A shares

(the “Class A Shares”) have delivered a 66.6% year-to-date return

and a 13.5% per annum return since inception in May 2021(1). As a

result of this strong performance, a positive outlook for the

sectors Sustainable Power & Infrastructure Split Corp. (the

“Fund”) invests in and dividend growth from the Fund’s portfolio

holdings, Brompton Funds is pleased to announce an increase to the

monthly distribution rate from $0.06667 to $0.085 per Class A

Share. The new distribution rate for the Class A Shares of $1.02

per annum, or 10.5%(2) based on the TSX closing price of $9.70 on

October 23, 2024, represents a 27.5% increase from the previous

level of $0.80 per annum.

Brompton Funds announces a distribution payable

November 14, 2024 to the Fund’s Class A shareholders of record at

the close of business on October 31, 2024:

|

|

Ticker |

Amount per Share |

|

Sustainable Power & Infrastructure Split Corp. |

PWI |

$0.085 |

The Fund invests in a globally diversified and

actively managed portfolio (the “Portfolio”) consisting primarily

of dividend-paying securities of power and infrastructure companies

whose assets, products and services Brompton Funds Limited, the

manager, believes are facilitating the multi-decade transition

toward decarbonization and environmental sustainability. The

Portfolio may include investments in companies operating in the

areas of renewable power (wind, solar, hydroelectric), green

transportation (electric vehicles, energy transportation and

storage, railroads, carbon capture), energy efficiency (smart

grids, smart meters, building efficiency), and communications

(communication networks, 5G wireless technology), among others.

The Fund’s Class A Shares have significantly

outperformed the S&P Global Infrastructure Total Return Index

and the MSCI World Total Return Index year-to-date, over 1-year,

3-years, and since inception(1).

|

Annual Compound

Returns(1) |

YTD |

1-Year |

3-Year |

Inception |

|

|

Sustainable Power & Infrastructure Split Corp. (TSX:

PWI) |

66.6 |

% |

101.5 |

% |

16.1 |

% |

13.5 |

% |

|

|

S&P Global Infrastructure Total Return Index |

18.0 |

% |

30.8 |

% |

9.6 |

% |

8.2 |

% |

|

|

MSCI World Total Return Index |

19.3 |

% |

32.9 |

% |

9.6 |

% |

9.4 |

% |

|

About Brompton Funds

Founded in 2000, Brompton is an experienced

investment fund manager with income and growth focused investment

solutions including exchange-traded funds (ETFs) and other Toronto

Stock Exchange (“TSX”) traded investment funds. For further

information, please contact your investment advisor, call

Brompton’s investor relations line at 416-642-6000 (toll-free at

1-866-642-6001), email info@bromptongroup.com or visit our website

at www.bromptongroup.com.

(1)Returns are for the periods ended September

30, 2024 and are unaudited. Inception date May 21, 2021. The table

shows the Fund’s compound returns on a Class A Share for each

period indicated, compared with the S&P Global Infrastructure

Total Return Index ("Infrastructure Index"), and the MSCI World

Index (“MSCI Index”) (together the “Indices”). The Infrastructure

Index tracks 75 companies from around the world, chosen to

represent the listed infrastructure industry and related

operations. The index includes three distinct infrastructure

clusters: energy, transportation, and utilities. The MSCI Index

captures large‑ and mid‑cap representation across 23 developed

markets countries and covers approximately 85% of the free

float‑adjusted market capitalization in each country. The Fund is

actively managed; therefore, its performance is not expected to

mirror that of the Indices, which have more diversified portfolios

and include a substantially larger number of companies.

Furthermore, the Indices performance is calculated without the

deduction of management fees, fund expenses and trading commissions

whereas the performance of the Class A Shares is calculated after

deducting such fees and expenses. Additionally, the performance of

the Class A Shares is impacted by the leverage provided by the

Fund’s preferred shares. The performance information shown is

based on the net asset value per Class A Share and assumes that

cash distributions made by the Fund during the periods shown were

reinvested at net asset value per Class A Share in additional Class

A Shares of the Fund. Past performance does not necessarily

indicate how the Fund will perform in the future.

(2)No distributions will be paid on the Class A

Shares if (i) the distributions payable on the Preferred Shares are

in arrears, or (ii) in respect of a cash distribution, after the

payment of a cash distribution by the Fund the NAV per unit would

be less than $15.00.

You will usually pay brokerage fees to your

dealer if you purchase or sell shares of the investment funds on

the TSX or other alternative Canadian trading system (an

“exchange”). If the shares are purchased or sold on an exchange,

investors may pay more than the current net asset value when buying

shares of the investment fund and may receive less than the current

net asset value when selling them.

There are ongoing fees and expenses associated

with owning shares of an investment fund. An investment fund must

prepare disclosure documents that contain key information about the

fund. You can find more detailed information about the Fund in the

public filings available at www.sedarplus.ca. The indicated rates

of return are the historical annual compounded total returns

including changes in share value and reinvestment of all

distributions and do not take into account certain fees such as

redemption costs or income taxes payable by any securityholder that

would have reduced returns. Investment funds are not guaranteed,

their values change frequently, and past performance may not be

repeated.

Certain statements contained in this document

constitute forward-looking information within the meaning of

Canadian securities laws. Forward-looking information may relate to

matters disclosed in this document and to other matters identified

in public filings relating to the Fund, to the future outlook of

the Fund and anticipated events or results and may include

statements regarding the future financial performance of the Fund.

In some cases, forward-looking information can be identified by

terms such as “may”, “will”, “should”, “expect”, “plan”,

“anticipate”, “believe”, “intend”, “estimate”, “predict”,

“potential”, “continue” or other similar expressions concerning

matters that are not historical facts. Actual results may vary from

such forward-looking information. Investors should not place undue

reliance on forward-looking statements. These forward-looking

statements are made as of the date hereof and we assume no

obligation to update or revise them to reflect new events or

circumstances.

Certain information contained herein (the

“Information”) is sourced from/copyright of MSCI Inc., MSCI ESG

Research LLC, or their affiliates (“MSCI”), or information

providers (together the “MSCI Parties”) and may have been used to

calculate scores, signals, or other indicators. The Information is

for internal use only and may not be reproduced or disseminated in

whole or part without prior written permission. The Information may

not be used for, nor does it constitute, an offer to buy or sell,

or a promotion or recommendation of, any security, financial

instrument or product, trading strategy, or index, nor should it be

taken as an indication or guarantee of any future performance. Some

funds may be based on or linked to MSCI indexes, and MSCI may be

compensated based on the fund’s assets under management or other

measures. MSCI has established an information barrier between index

research and certain Information. None of the Information in and of

itself can be used to determine which securities to buy or sell or

when to buy or sell them. The Information is provided “as is” and

the user assumes the entire risk of any use it may make or permit

to be made of the Information. No MSCI Party warrants or guarantees

the originality, accuracy and/or completeness of the Information

and each expressly disclaims all express or implied warranties. No

MSCI Party shall have any liability for any errors or omissions in

connection with any Information herein, or any liability for any

direct, indirect, special, punitive, consequential or any other

damages (including lost profits) even if notified of the

possibility of such damages.

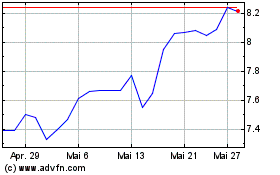

Sustainable Power & Infr... (TSX:PWI)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Sustainable Power & Infr... (TSX:PWI)

Historical Stock Chart

Von Nov 2023 bis Nov 2024