Petrus Resources Ltd. ("

Petrus" or the

"

Company") (TSX: PRQ) is pleased to announce that

it has entered into agreements with new lenders to the Company

which provide two new credit facilities (the “

New Credit

Facilities”) totaling $55 million. The New Credit

Facilities, together with the net proceeds of the Company's

recently closed $20 million rights offering (the "

Rights

Offering" and together with the New Credit Facilities, the

“

Transactions”), will be used to repay in full all

amounts owing under the Company's existing secured revolving credit

facility (the "

Existing RCF"), which will be

approximately $27 million at the end of May.

The refinancing completes the Company’s debt

restructuring. Replacing the Existing RCF with the New Credit

Facilities is an opportunity for Petrus to move forward with

supportive lenders and benefit from a debt structure with greater

liquidity and stability. The refinancing is the product of

strategic efforts made by management, the Board and major

shareholders over the past year to strengthen the Company’s balance

sheet. As a result, Petrus is well positioned to capitalize on its

financial flexibility, invest in the continued development of the

Company’s high quality assets and create meaningful value through

strategic growth.

ATB Facility

Petrus has entered into a commitment letter with

ATB Financial ("ATB") providing for a $30 million

reserve-based, secured operating revolving loan facility (the

"ATB Facility") that is repayable in full on

demand. Upon closing of the Transactions, up to $15 million will be

drawn on the ATB Facility and used to repay a portion of the

amounts owing under the Existing RCF and the balance of which will

be used for general corporate purposes. The interest rate on this

facility is the Canadian Prime Rate plus 2.5%, which currently

totals 5.7% per annum.

The availability of the ATB Facility is subject

to the satisfaction of certain conditions precedent, including the

execution of outstanding definitive documentation in respect of the

ATB Facility; the execution of definitive documentation and a

subordination and postponement agreement in respect of the Second

Lien Facility (as defined below); receipt of the proceeds from the

Second Lien Facility; and the concurrent repayment in full and

termination of the Existing RCF. Petrus anticipates satisfying all

conditions precedent in May 2022.

Second Lien Facility

In addition to the ATB Facility, Petrus has also

entered into a term sheet with Stuart Gray (the

"Lender"), a principal shareholder of the Company,

providing for a second lien secured term facility in the amount of

$25 million (the "Second Lien Facility"). On

closing of the Transactions, approximately $12 million of the

Second Lien Facility will be used to repay amounts owing under the

Existing RCF and the balance will be used for selected development

activities and general corporate purposes.

Principal amounts due under the Second Lien

Facility, together with accrued and unpaid interest thereon, will

be due and payable in full on the last day of the month that is 36

months following the month in which the closing of the Transactions

occurs. Amounts outstanding under the Second Lien Facility will

bear interest at a fixed rate of 11% per annum for the duration of

the loan. The repayment terms of the Second Lien Facility are

flexible with no additional fees, making it attractive compared to

alternative borrowing opportunities available to the Company.

The availability of the Second Lien Facility is

subject to the satisfaction of certain conditions precedent,

including: the execution of definitive documentation; the closing

of the Rights Offering; the satisfaction of the conditions

precedent to the ATB Facility; the concurrent repayment in full and

termination of the Existing RCF; and the approval of the Toronto

Stock Exchange ("TSX"). Petrus anticipates

satisfying all conditions precedent in May 2022.

Related Party Matters

The Second Lien Facility is a related party

transaction under applicable securities legislation as the Lender

is a controlling shareholder of Petrus who currently owns or

exercises control or direction over (directly or indirectly)

22,575,750 common shares of Petrus ( representing approximately

21.2% of the outstanding common shares on a non-diluted basis). The

board of directors of Petrus (the "Board")

established a committee of independent and disinterested directors

of Petrus (the "Independent Committee"), comprised

of Don Cormack, Patrick Arnell and Peter Verburg, to review and

recommend approval of the Second Lien Facility to the Board. The

Board (with Ken Gray and Don Gray abstaining), based on, among

other things, the recommendation of the Independent Committee and

the advice received from ATB Capital Markets Inc., the Company's

financial advisor for the Second Lien Facility, approved the Second

Lien Facility after determining that it is on reasonable commercial

terms that are not less advantageous to Petrus than if the Second

Lien Facility were obtained from a person dealing at arm's length

with Petrus.

The formal valuation requirements of applicable

securities legislation are not applicable to the Second Lien

Facility. The Second Lien Facility is exempt from the minority

shareholder approval requirements of applicable securities

legislation because (i) the Board has determined that the Second

Lien Facility is on reasonable commercial terms that are not less

advantageous to Petrus than if the Second Lien Facility were

obtained from a person dealing at arm’s length with Petrus, and

(ii) advances under the Second Lien Facility are not (A)

convertible, directly or indirectly, into equity or voting

securities of Petrus or a subsidiary thereof, or otherwise

participating in nature, or (B) repayable as to principal or

interest, directly or indirectly, in equity or voting securities of

Petrus or a subsidiary thereof.

Advisors

ATB Capital Markets Inc. acted as a financial

debt advisor and Burnett, Duckworth & Palmer LLP is acting as

legal advisor to the Company with respect to the New Credit

Facilities.

ABOUT PETRUS

Petrus is a public Canadian oil and gas company

focused on property exploitation, strategic acquisitions and

risk-managed exploration in Alberta.

FOR FURTHER INFORMATION PLEASE

CONTACT:

Ken Gray President and Chief Executive Officer

T: 403-930-0889 E: kgray@petrusresources.com

FORWARD-LOOKING STATEMENTS:

This news release contains forward‐looking

statements regarding: the Company's ability to obtain the ATB

Facility and the Second Lien Facility; the use of proceeds of the

Transactions; the amounts that will be drawn on the New Credit

Facilities in order to repay all amounts owing under the Existing

RCF; our forecast for the amounts owing under the Existing RCF in

May 2022; the expected material terms of each facility; the timing

of obtaining the facilities; the Company's ability to satisfy the

conditions precedent to obtaining each facility; the Company's

forecast for the amounts that will be drawn on the New Credit

Facilities following the closing of the Transactions; Petrus'

belief that the Transactions will provide it with a debt structure

with greater liquidity and stability; Petrus' belief that it is

well positioned to capitalize on its financial flexibility, invest

in the continued development of its high quality assets and create

meaningful value through strategic growth. These forward‐looking

statements are provided as of the date of this news release, or the

effective date of the documents referred to in this news release,

as applicable, and reflect predictions, expectations or beliefs

regarding future events based on the Company's beliefs at the time

the statements were made, as well as various assumptions made by

and information currently available to it. In making the

forward-looking statements included in this news release, the

Company has applied several material assumptions, including, but

not limited to, the assumption that: TSX approval of the Second

Lien Facility will be obtained in a timely manner; all conditions

precedent to obtaining each credit facility will be satisfied in a

timely manner; that the Rights Offering closes on the terms and on

the timetable anticipated; that the material terms of each credit

facility do not change prior to closing; that the credit facilities

are obtained on the timetable anticipated; Petrus' debt levels in

May 2022 will be as forecast. Although management considers these

assumptions to be reasonable based on information available to it,

they may prove to be incorrect. By their very nature,

forward‐looking statements involve inherent risks and

uncertainties, both general and specific, and risks exist that

estimates, forecasts, projections and other forward‐looking

statements will not be achieved or that assumptions on which they

are based do not reflect future experience. We caution readers not

to place undue reliance on these forward‐looking statements as a

number of important factors could cause the actual outcomes to

differ materially from the expectations expressed in them. These

risk factors may be generally stated as the risk that the

assumptions expressed above do not occur, but specifically include,

without limitation, risks relating to: the failure to receive TSX

approval of the Second Lien Facility; the failure to satisfy all

conditions precedent to obtaining each credit facility; a delay in

obtaining (or failure to obtain) one or both credit facilities; a

material change in the terms of one or both credit facilities; debt

levels exceeding those currently forecast due to changes in

production levels, commodity prices or other factors; the

possibility that the Company continues to experience liquidity

challenges, whether due to changes in credit availability under the

New Credit Facilities, changes in production levels or commodity

prices, or other factors; the risk that Petrus fails to capitalize

on its financial flexibility, develop its assets and/or create

meaningful value through strategic growth; and the additional risks

described in the Company's latest Annual Information Form, and

other disclosure documents filed by the Company on SEDAR. This

press release contains future-oriented financial information and

financial outlook information (collectively, "FOFI") about Petrus'

indebtedness under the Existing RCF in May 2022 before completing

the Transactions and Petrus' indebtedness under the New Credit

Facilities in May 2022 after completing the Transactions, which are

subject to the same assumptions, risk factors, limitations, and

qualifications as set forth above. Readers are cautioned that the

assumptions used in the preparation of such information, although

considered reasonable at the time of preparation, may prove to be

imprecise and, as such, undue reliance should not be placed on

FOFI. Petrus' actual results, performance or achievement could

differ materially from those expressed in, or implied by, these

FOFI, or if any of them do so, what benefits Petrus will derive

therefrom. Petrus has included the FOFI in order to provide readers

with a more complete perspective on Petrus' future operations and

such information may not be appropriate for other purposes. The

foregoing list of factors that may affect future results is not

exhaustive. When relying on Petrus' forward‐looking statements and

FOFI, investors and others should carefully consider the foregoing

factors and other uncertainties and potential events. The Company

does not undertake to update any forward‐looking statement or FOFI,

whether written or oral, that may be made from time to time by the

Company or on behalf of the Company, except as required by law.

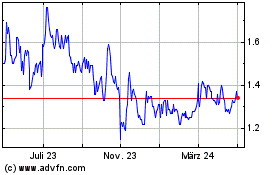

Petrus Resources (TSX:PRQ)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

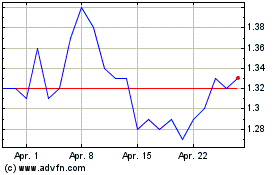

Petrus Resources (TSX:PRQ)

Historical Stock Chart

Von Apr 2023 bis Apr 2024