Petrus Resources Announces Fully Backstopped Rights Offering

24 März 2022 - 10:30PM

Petrus Resources Ltd. (TSX:PRQ) ("

Petrus" or the

"

Corporation") is pleased to announce that it has

filed today a rights offering circular (the "

Rights

Offering Circular") and related notice of rights offering

(the "

Notice of Rights Offering") with the

securities regulatory authorities in each of the provinces and

territories of Canada in connection with an offering (the

"

Rights Offering") of rights

("

Rights") to acquire common shares of Petrus

("

Common Shares") for gross

proceeds of approximately $20 million.

Pursuant to the Rights Offering, each eligible

registered holder of Common Shares as at the close of business

on March 31, 2022 (the "Record Date") will receive

one (1) Right for each Common Share held. 7.214653 Rights plus the

sum of $1.35 will entitle the holder to subscribe for one (1)

Common Share. The Rights issued under the Rights Offering will be

evidenced by direct registration system advices (each, a

"Rights DRS"), and will expire at 5:00 p.m.

(Toronto time) on April 26, 2022 (the "Expiry

Date"), after which time unexercised Rights will be void

and of no value. The Rights Offering includes an additional

subscription privilege under which eligible holders of Rights who

fully exercise their Rights will be entitled to subscribe for

additional available Common Shares.

The Common Shares will trade on the Toronto

Stock Exchange ("TSX") on an "ex-rights" basis.

The Rights will be listed for trading on the TSX under the symbol

"PRQ.RT" commencing on March 30, 2022 and will be de-listed from

the TSX at 12:00 p.m. (Toronto time) on the Expiry Date.

In connection with the Rights Offering, the

Corporation has entered into a standby purchase agreement (the

"Standby Purchase Agreements") with each of its

major shareholders, being Don Gray, Stuart Gray and Glen Gray

(collectively, the "Stand-By Guarantors"). Each of

the Standby-by Guarantors has agreed, subject to the satisfaction

of certain conditions, to fully exercise his basic subscription

privilege to purchase his pro rata share of the Common Shares

offered pursuant to the Rights Offering and to acquire his pro rata

share of all other Common Shares offered pursuant to the Rights

Offering that are not acquired on the exercise of Rights held by

shareholders other than the Stand-By Guarantors. As a result, the

Rights Offering will be fully backstopped by the Stand-By

Guarantors. As of the date hereof, the Stand-By Guarantors

collectively own approximately 70.8% of the Corporation's issued

and outstanding Common Shares. If the standby commitment is

utilized in full because no other shareholders exercise Rights, the

Stand-By Guarantors will collectively own approximately 74.4% of

the issued and outstanding Common Shares on completion of the

Rights Offering.

The Notice of Rights Offering and related Rights

DRS will be mailed to all eligible registered shareholders as of

the close of business on the Record Date. Eligible registered

shareholders wishing to exercise their Rights must forward a

completed Rights DRS, together with the applicable funds, to

Odyssey Trust Company, the rights agent of the Corporation, on or

before the Expiry Date. Shareholders who own their Common Shares

through an intermediary, such as a bank, trust company, securities

dealer or broker, will receive materials and instructions from

their intermediary.

Closing of the Rights Offering is expected to

occur on or about April 29, 2022. The net proceeds of the

Rights Offering will be used to repay amounts drawn under the

Corporation's senior secured credit facility as further detailed in

the Rights Offering Circular.

The Rights Offering is part of a larger strategy

continuing the restructuring of the Corporation's debt to provide

more long-term stability. Despite having other viable financing

alternatives available, the Corporation moved forward with the

Rights Offering because Petrus continues to enjoy strong support

from existing shareholders who see significant value in the

Corporation and recognize the important contributions Alberta's

energy sector makes to the overall quality of life in North

America. Through the Rights Offering, Petrus is providing its

shareholders an additional opportunity to participate in the

Corporation's potential upside.

Further details concerning the Rights Offering,

including the details of the Standby Purchase Agreements, are

contained in the Notice of Rights Offering and Rights Offering

Circular available on the Corporation's SEDAR profile

at www.sedar.com.

This press release is not an offer of securities

of the Corporation for sale in the United States. The Rights and

Common Shares issuable on exercise of the Rights have not been and

will not be registered under the U.S. Securities Act of 1933, as

amended, and the Rights and Common Shares may not be offered or

sold in the United States except pursuant to an applicable

exemption from such registration. No public offering of securities

is being made in the United States.

For inquiries please contact:

Ken GrayPresident and Chief Executive OfficerT: 403-930-0889E:

kgray@petrusresources.com

Website: www.petrusresources.com

About Petrus

Petrus is a public Canadian oil and gas company

focused on property exploitation, strategic acquisitions and

risk-managed exploration in Alberta.

Reader Advisories

Forward looking information: Certain information

set forth in this news release, including: matters relating to the

timing and completion of the Rights Offering, the proceeds to be

raised pursuant to the Rights Offering, the use of proceeds from

the Rights Offering, our strategy to restructure our debt to

provide long-term stability, the availability of alternative

financing alternatives, and the Corporation's potential upside, is

considered forward-looking information, and necessarily involve

risks and uncertainties, certain of which are beyond Petrus'

control. Such risks include but are not limited to: the receipt of

all necessary regulatory and third party approvals; the risk that

the Rights Offering is not completed in the manner and timeframes

contemplated herein (or at all) due to the termination of the

Standby Purchase Agreements or otherwise; the risk that the

Corporation may reallocate the net proceeds from the Rights

Offering; the risk that we are not able to restructure all of our

debt before it matures and/or that other financing alternatives are

not available on acceptable terms or at all; and the risk that the

Corporation's potential upside does not materialize. Actual

results, performance or achievements could differ materially from

those expressed in, or implied by, the forward-looking information

and, accordingly, no assurance can be given that any events

anticipated by the forward-looking information will transpire or

occur, or if any of them do so, what benefits that Petrus will

derive therefrom. With respect to forward-looking information

contained herein, the Corporation has made certain assumptions,

including that: the Standby Purchase Agreements will not be

terminated and that the Stand-By Guarantors will comply with their

obligations thereunder; the timely receipt of any required

regulatory approvals; that the Corporation will be able to deploy

the net proceeds from the Rights Offering as anticipated; and that

the Corporation will be able to refinance its credit facility

before it matures with the proceeds of the Rights Offering and

alternative financing sources. Additional information on these and

other factors that could affect Petrus are included in reports on

file with Canadian securities regulatory authorities, including

under the heading "Risk Factors" in the Rights Offering Circular

and in the Corporation's most recent annual information form, and

may be accessed through the SEDAR website (www.sedar.com).

Furthermore, the forward-looking information contained in this news

release are made as of the date of this document, and Petrus does

not undertake any obligation to update publicly or to revise any of

the included forward looking information, whether as a result of

new information, future events or otherwise, except as may be

expressly required by applicable securities law.

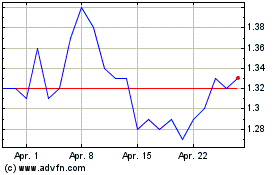

Petrus Resources (TSX:PRQ)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

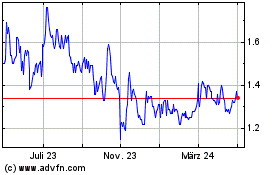

Petrus Resources (TSX:PRQ)

Historical Stock Chart

Von Apr 2023 bis Apr 2024