Pine Cliff Energy Ltd. (“

Pine Cliff” or the

“

Company”) (

TSX: PNE) is pleased

to announce its year-end financial and operating results, the

filing of its 2018 disclosure documents and an operations update on

the oil well drilled in Q4 2018. Included in the filings were Pine

Cliff's annual information form (“

AIF”), which

includes disclosure and reports related to reserves data and other

oil and gas information pursuant to National Instrument 51‐101

Standards of Disclosure for Oil and Gas Activities and its

consolidated financial statements and related management's

discussion and analysis for the year ended December 31, 2018 (the

“

Annual Report”). Selected highlights are

shown below and should be read in conjunction with the Annual

Report and the AIF.

2018 Highlights

Pine Cliff’s natural gas market diversification

strategy was successful in generating positive adjusted funds flow

in 2018, despite enduring the lowest AECO gas prices in 19 years.

Pine Cliff was also able to use its extensive seismic

database to expand the Company’s prospect inventory by identifying

a number of operated, drilling locations on its existing land

base. And on the macro side, LNG Canada announced in the last

quarter of 2018 that it will be proceeding with a $40 billion LNG

project in Western Canada that will initially export two Bcf per

day of Western Canada gas. This project would be one of Canada’s

largest infrastructure projects ever undertaken and will play a

significant role in addressing the issue of getting Canadian

natural gas to the world. Other significant Pine Cliff highlights

from the fourth quarter and 2018 include:

- generated $4.4 million of adjusted

funds flow ($0.01 per basic share) for the three months ended

December 31, 2018;

- generated $10.5 million ($0.03 per

basic share) of adjusted funds flow during the year ended December

31, 2018;

- realized a $2.51 per Mcf gas price

for the three months ended December 31, 2018, 44% higher than the

AECO 5A benchmark of $1.74 per Mcf;

- realized a $2.07 per Mcf gas price

for the year ended December 31, 2018, 34% higher than the AECO 5A

benchmark of $1.54 per Mcf;

- achieved average production of

19,684 Boe/d (94% natural gas) in 2018, only 8% lower than the

21,408 Boe/d in 2017, despite incurring only $6.5 million of

drilling and recompletion capital spending in 2018, over half of

which was spent in the fourth quarter of 2018 with no corresponding

increase in production from that specific spend until 2019;

- completed a private placement of

$19 million of term debt to Alberta Investment Management

Corporation and extended $12 million of insider debt to 2020 to

eliminate $18 million in bank debt, ending 2018 with $3.6 million

in cash; and

- drilled and completed a 100%

working interest horizontal oil well that was successfully brought

on production in January, 2019.

Operations Update on Pekisko Oil Well

In 2018, Pine Cliff focused on identifying

growth opportunities within the Company’s Central Alberta land base

using the 420 square kilometers of 3D and 813 kilometers of 2D

seismic owned or licensed in the area. This work resulted in Pine

Cliff drilling its first horizontal oil well (100% working

interest) targeting the Pekisko formation which came on production

on January 14, 2019. Although the well was initially

restricted for the first 14 days, it flowed at an average rate of

410 Boe/d for the first 30 days of production, consisting of 238

Bbl/d of 30 degree API oil and 940 Mcf/d of raw natural gas.

Production for the first 57 days averaged 390 Boe/d (63% oil and

NGLs).

Pine Cliff currently estimates that there are

approximately 19 gross (15.8 net) Pekisko and Basal Quartz oil well

locations on the Company’s Central Alberta lands that would be

economic to drill at today’s commodity pricing, with 3 (2.5 net) of

these locations already booked in the Company’s Reserve Report

prepared by McDaniel & Associates Consultants Ltd. at December

31, 2018. Pine Cliff owns extensive infrastructure,

operations and seismic in Central Alberta and it will continue to

evaluate further development and acquisition potential in this

area.

Financial and Operating Results

| |

|

|

Three months ended December 31, |

Year ended December 31, |

| |

|

|

|

|

2018 |

2017 |

2018 |

2017 |

| ($000s, unless otherwise indicated) |

|

|

|

|

| Oil and gas

sales (before royalty expense) |

30,110 |

28,663 |

107,385 |

125,018 |

| Cash flow

from operating activities |

1,415 |

(4,350) |

8,616 |

25,009 |

| Adjusted

funds flow1 |

4,433 |

3,759 |

10,513 |

28,705 |

| Per share –

Basic and Diluted ($/share)1 |

0.01 |

0.01 |

0.03 |

0.09 |

| Loss |

(28,520) |

(32,996) |

(72,719) |

(67,864) |

| Per share –

Basic and Diluted ($/share) |

(0.09) |

(0.11) |

(0.24) |

(0.22) |

| Capital

expenditures |

4,302 |

3,091 |

10,665 |

13,477 |

| Net

Debt1 |

56,819 |

53,638 |

56,819 |

53,638 |

| Production

(Boe/d) |

19,576 |

21,489 |

19,684 |

21,408 |

|

Weighted-average common shares outstanding (000s) |

94% |

95% |

94% |

95% |

|

Basic and diluted |

307,076 |

307,076 |

307,076 |

307,076 |

| Combined

sales price ($/Boe) |

16.72 |

14.50 |

14.95 |

16.00 |

| Operating

netback ($/Boe)1 |

3.56 |

2.85 |

2.68 |

4.88 |

| Corporate

netback ($/Boe)1 |

2.46 |

1.90 |

1.47 |

3.68 |

| Operating

netback ($ per Mcfe)1 |

0.59 |

0.48 |

0.45 |

0.81 |

| Corporate netback ($ per Mcfe)1 |

0.41 |

0.32 |

0.25 |

0.61 |

1 This is a non-GAAP measure, see

“NON-GAAP Measures” for additional

information.

For further information, please contact:

Philip B. Hodge – President and CEOCheryne Lowe

–CFO and Corporate SecretaryTelephone: (403) 269-2289Fax: (403)

265-7488Email: info@pinecliffenergy.com

Cautionary Statements

Certain statements contained in this news

release include statements which contain words such as

“anticipate”, “could”, “should”, “expect”, “seek”, “may”, “intend”,

“likely”, “will”, “believe” and similar expressions, statements

relating to matters that are not historical facts, and such

statements of our beliefs, intentions and expectations about

developments, results and events which will or may occur in the

future, constitute “forward-looking information” within the meaning

of applicable Canadian securities legislation and are based on

certain assumptions and analysis made by us derived from our

experience and perceptions. Forward-looking information in

this news release includes, but is not limited to: future capital

expenditures, including the amount and nature thereof; future

acquisition opportunities including Pine Cliff’s ability to execute

on those opportunities; future drilling opportunities and Pine

Cliff’s ability to generate reserves and production from the

undrilled locations; oil and natural gas prices and demand;

expansion and other development trends of the oil and natural gas

industry; business strategy and guidance; expansion and growth of

our business and operations; maintenance of existing

customer, supplier and partner relationships; supply channels;

accounting policies; risks; Pine Cliff’s ability to generate cash

flow; and other such matters.

All such forward-looking information is based on

certain assumptions and analyses made by us in light of our

experience and perception of historical trends, current conditions

and expected future developments, as well as other factors we

believe are appropriate in the circumstances. The risks,

uncertainties and assumptions are difficult to predict and may

affect operations, and may include, without limitation: foreign

exchange fluctuations; equipment and labour shortages and

inflationary costs; general economic conditions; industry

conditions; changes in applicable environmental, taxation and other

laws and regulations as well as how such laws and regulations are

interpreted and enforced; the ability of oil and natural gas

companies to raise capital; the effect of weather conditions on

operations and facilities; the existence of operating risks;

volatility of oil and natural gas prices; oil and gas product

supply and demand; risks inherent in the ability to generate

sufficient cash flow from operations to meet current and future

obligations; increased competition; stock market volatility;

opportunities available to or pursued by us; and other factors,

many of which are beyond our control. The foregoing factors are not

exhaustive.

Actual results, performance or achievements

could differ materially from those expressed in, or implied by,

this forward-looking information and, accordingly, no assurance can

be given that any of the events anticipated by the forward-looking

information will transpire or occur, or if any of them do, what

benefits will be derived there from. Except as required by

law, Pine Cliff disclaims any intention or obligation to update or

revise any forward-looking information, whether as a result of new

information, future events or otherwise.

Natural gas liquids and oil volumes are recorded

in barrels of oil (“Bbl”) and are converted to a

thousand cubic feet equivalent (“Mcfe”) using a

ratio of one (1) Bbl to six (6) thousand cubic feet. Natural gas

volumes recorded in thousand cubic feet (“Mcf”)

are converted to barrels of oil equivalent (“Boe”)

using the ratio of six (6) thousand cubic feet to one (1) Bbl. This

conversion ratio is based on energy equivalence primarily at the

burner tip and does not represent a value equivalency at the

wellhead. The terms Boe or Mcfe may be misleading, particularly if

used in isolation.

Given that the value ratio based on the current

price of crude oil as compared to natural gas is significantly

different from the energy equivalency of oil, utilizing a

conversion on a 6:1 basis may be misleading as an indication of

value.

The forward-looking information contained in

this news release is expressly qualified by this cautionary

statement.

NON-GAAP Measures

This press release uses the terms “adjusted

funds flow”, “operating netbacks”, “corporate netbacks” and “net

debt” which are not recognized under International Financial

Reporting Standards (“IFRS”) and may not be

comparable to similar measures presented by other companies.

These measures should not be considered as an alternative to, or

more meaningful than, IFRS measures including net income (loss),

cash provided by operating activities, or total liabilities.

The Company uses these measures to evaluate its performance,

leverage and liquidity. Adjusted funds flow is a

non-Generally Accepted Accounting Principles

(“non-GAAP”) measure that represents the total of

funds provided by operating activities, before adjusting for

changes in non-cash working capital, and decommissioning

obligations settled. Net debt is a non-GAAP measure

calculated as the sum of bank debt, subordinated promissory notes

at the principal amount, amounts due to related party and trade and

other payables less trade and other receivables, cash, prepaid

expenses and deposits and investments. Operating netback is a

non-GAAP measure calculated as the Company’s total revenue, less

operating expenses, divided by the Boe production of the

Company. Corporate netback is a non-GAAP measure calculated

as the Company’s operating netback, less general and administrative

expenses, interest and bank charges plus finance and dividend

income, divided by the Boe production of the Company. Please

refer to the Annual Report for additional details regarding

non-GAAP measures and their calculation.

The TSX does not accept responsibility for the

accuracy of this release.

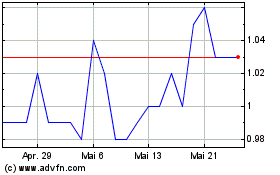

Pine Cliff Energy (TSX:PNE)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

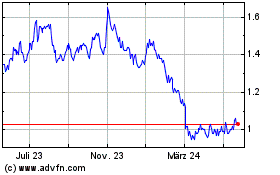

Pine Cliff Energy (TSX:PNE)

Historical Stock Chart

Von Nov 2023 bis Nov 2024