Onex Files Normal Course Issuer Bid

13 April 2022 - 2:00PM

Onex Corporation (“Onex”) (TSX: ONEX) announced today it has filed

with the Toronto Stock Exchange, and the Exchange has accepted, a

Notice of Intention to make a Normal Course Issuer Bid permitting

Onex to purchase for cancellation up to 10% of the public float in

its Subordinate Voting Shares, or 7,167,381 shares. There are

86,060,456 Subordinate Voting Shares issued and outstanding and the

public float as at April 8, 2022 was 71,673,811 shares.

Onex may buy back shares from time to time

during the next twelve months. Any purchases made under the Normal

Course Issuer Bid will be effected through the facilities of TSX or

alternative Canadian trading systems. The number of shares Onex is

permitted to purchase under the bid may be reduced by private

acquisitions pursuant to issuer bid exemption orders issued by a

securities regulatory authority or otherwise exempt from the issuer

bid requirements of applicable law and/or by purchases of shares by

certain Onex executives or employees under purchase programs

administered by Onex. Any purchases made by way of private

agreements under an issuer bid exemption order issued by a

securities regulatory authority will be at a discount to the

prevailing market price as provided in the exemption order. Subject

to any discretionary relief provided by the TSX, Onex may purchase

up to 35,172 Subordinate Voting Shares during any trading day,

being 25% of its average daily trading volume of 140,690

Subordinate Voting Shares for the most recently completed six

calendar months. Onex may also purchase Subordinate Voting Shares

from time to time under the Exchange's block purchase exemption, if

available.

Onex commenced a similar Normal Course Issuer

Bid on April 18, 2021 (the “2021 Bid”). The 2021 Bid, which

permitted the purchase of up to 7,398,197 Subordinate Voting

Shares, expires on April 17, 2022. A total of 3,682,783

shares were purchased under the 2021 Bid as at March 31, 2022 at an

average purchase price of C$89.77 per share. Onex may also purchase

Subordinate Voting Shares from time to time under the Exchange's

block purchase exemption, if available. All such purchases under

the 2021 Bid occurred through the facilities of the TSX or the

block purchase exemption in a private transaction pursuant to an

issuer bid exemption order issued by a securities regulatory

authority.

The Normal Course Issuer Bid is being renewed as

it is Onex’ view it is advantageous to the company and its

shareholders to continue to repurchase Subordinate Voting Shares,

from time to time, when they are trading at prices that result in

an attractive risk-adjusted return for the continuing

shareholders.

The Normal Course Issuer Bid will commence on

April 18, 2022 and will conclude on the earlier of the date on

which purchases under the bid have been completed and

April 17, 2023.

About Onex Founded in 1984, Onex

manages and invests capital on behalf of its shareholders,

institutional investors and high net worth clients from around the

world. Onex’ platforms include: Onex Partners, private equity funds

focused on mid- to large-cap opportunities in North America and

Western Europe; ONCAP, private equity funds focused on middle

market and smaller opportunities in North America; Onex Credit,

which manages primarily non-investment grade debt through

tradeable, private and opportunistic credit strategies as well as

actively managed public equity and public credit funds; and Gluskin

Sheff’s wealth management services. In total, as of December 31,

2021, Onex has approximately $49 billion of assets under

management, of which approximately $8.2 billion is its own

investing capital. With offices in Toronto, New York, New Jersey,

Boston and London, Onex and its experienced management teams are

collectively the largest investors across Onex’ platforms.

Onex shares trade on the Toronto Stock Exchange

under the stock symbol ONEX. For more information on Onex, visit

its website at www.onex.com. Onex’ security filings can also be

accessed at www.sedar.com.

Forward-Looking Statements This

press release may contain, without limitation, statements

concerning possible or assumed future operations, performance or

results preceded by, followed by or that include words such as

“believes”, “expects”, “potential”, “anticipates”, “estimates”,

“intends”, “plans” and words of similar connotation, which would

constitute forward-looking statements. Forward-looking statements

are not guarantees. The reader should not place undue reliance on

forward-looking statements and information because they involve

significant and diverse risks and uncertainties that may cause

actual operations, performance or results to be materially

different from those indicated in these forward-looking statements.

Except as may be required by Canadian securities law, Onex is under

no obligation to update any forward-looking statements contained

herein should material facts change due to new information, future

events or other factors. These cautionary statements expressly

qualify all forward-looking statements in this press release.

For further information:

|

Jill Homenuk

Managing Director – Shareholder Relations and Communications +1

416.362.7711 |

Emilie Blouin Director, Shareholder Relations and Communications +1

416.362.7711 |

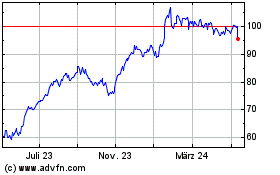

Onex (TSX:ONEX)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

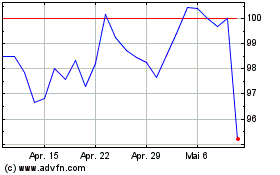

Onex (TSX:ONEX)

Historical Stock Chart

Von Apr 2023 bis Apr 2024