Over the Counter Profit Potential

is Huge

May 30, 2019 -- InvestorsHub NewsWire -- via microcapspeculators.com --

According to the National Marketing Institute’s website, nearly 50%

of Americans rely on supplements in their daily lives. There

are more than 80 therapeutic categories of OTC drugs, ranging from

acne drug products to weight control drug products. OTC

medicines and supplements are an accepted and often first-line

therapy and are recommended for many of the most common conditions

and ailments affecting the U.S. population.

One OTC company selling OTC products you should start

researching right away is Innovus Pharmaceuticals,

Inc. (USOTC:

INNV).

INNV markets over 35 products in the United States and in a

range of countries around the world. Its marketed products

include FlutiCare® (the main competitor of Flonase on Amazon),

GlucoGorx®, Zestra®, EjectDelay®,

Sensum+®, Zestra Glide®, Vesele®,

PeVarx®, Diabasens and Androferti®.

Innovus Pharma also offers Beyond

Human® testosterone booster, ketones, krill oil,

omega 3 fish oil, Vision Formula™, blood sugar, colon cleanse,

green coffee extract, and growth agent;

RecalMax® and RecalMax® nitric

oxide strips for brain health; UriVarx®, a supplement

for overall bladder health and ProstaGorx®, a supplement

for prostate support

The company’s strength is its sales platform. For example,

their first product called Vesele had sales of 200 units a

year when they acquired it. INNV was able to increase sales

to close to $3.5M in one year. INNV’s sales and marketing

platform called Beyond Human targeting between 20-30 million

consumers on a monthly basis. With over 35 commercial

products in multiple countries and a unique direct to consumer

sales and marketing platform, the company has been doubling its

revenue for the past three years.

The company just took on Regoxidine™, a topical foam containing

5% minoxidil that is approved by the FDA as a hair regrowth

treatment and is used to grow hair on the top of the scalp.

The active ingredient is 5% minoxidil and is comparable to the

Rogaine line. Using their sales platform, this could be a big

winner.

The companies we’re highlighting today include:

Innovus Pharmaceuticals, Inc. (USOTC:

INNV), OrganiGram Holdings (TSXV:

OGI), Aphria (NYSE:

APHA), The Green Organic Dutchman (TGODF), and Canopy Growth

Corporation (NYSE:

CGC).

Innovus Pharmaceuticals, Inc. (USOTC:

INNV)

(Market Cap:

$5.601M;

Share Price: $2.17), an emerging

commercial-stage pharmaceutical company that delivers safe,

innovative and effective over-the-counter medicine and consumer

care products to improve men’s and women's health and respiratory

diseases, has had quite the start to the year: revenues of

approximately $5.4 million, an increase of $0.8 million

or 18.0% compared to prior year and $0.6 million or 12.8% compared

to the prior quarter. With annual 2019 net revenue projected

to achieve record levels of $26-28 million, INNV is in a good

position.

“We are encouraged by our start to the 2019 year with

revenues increasing 18% and 12.8% in the comparable quarter in

the prior year and the previous quarter, respectively. The Company

has been able to strategically diversify its revenue channels

during the quarter without significant disruption to overall

revenue and achieving revenues from e-commerce platforms by

approximately 30%. Additionally, with twelve products now approved

by Health Canada, we are poised to focus more marketing efforts in

Canada where we have historically experienced superior returns

which we believe will help us achieve our goal of profitability,”

stated Bassam Damaj, President and Chief Executive Officer of

Innovus Pharma.

What investors may be most excited about however, is new CBD

treatment. The company launched

first hemp-derived Cannabidiol product with MZS Sleeping

Aid™. Retailers like Walmart, Target, and Walgreens

are getting in line to sell CBD products. With hemp being

legal through the new Farm Bill, this makes companies like INNV

even more enticing. Start your research today.

________

OrganiGram Holdings (TSXV:

OGI) (Market Cap: $1.192B; Share Price:

$7.69), a leading licensed producer of cannabis,

announced that its common shares will commence trading on the

Nasdaq Global Select Market under the symbol "OGI" on Tuesday May

21, 2019. Organigram's common shares will continue to be

listed and trade on the Toronto Venture Exchange (TSXV), also

under the symbol "OGI".

________

Aphria Inc. (NYSE:

APHA) (Market Cap: $1.764B; Share Price:

$7.00) shares fell after the Canadian cannabis

company reported fiscal third-quarter results. It posted

a C$108.2 million ($81.1 million) loss for its fiscal third

quarter, or 43 cents a share, after a profit of C$12.9

million, or 8 cents a share, in the same period a year ago.

Revenue climbed to C$73.6 million from C$10.3 million in the first

full quarter of Canadian legal cannabis. But the company sold

less cannabis than a year ago—kilograms sold fell to 2,636.5 from

3,408.9, while the average retail selling price for medical

cannabis increased to C$8.03 per gram from C$7.51, primarily

because of higher oil sales.

In April, it announced that the previously announced take-over

bid (the "Offer") by Green Growth Brands Inc. ("GGB") has failed to

meet the statutory minimum tender condition and has now expired and

is terminated. As previously announced on April 15,

2019, the company entered into a definitive agreement with GGB to

accelerate the expiry date of the Offer to April 25, 2019, as well

as to terminate certain arrangements with GA Opportunities Corp.

("GAOC") for consideration of $89.0 million payable on future dates

as set out in the April 15th press release. The Offer is now

expired and terminated and no longer open to any Aphria shareholder

to tender their shares. Accordingly, GGB will not be taking

up any securities that may have been tendered to the Offer.

GGB will promptly return to the securityholder any Aphria shares

tendered and not withdrawn during the period from the commencement

of the Offer up to the expiry time of the Offer.

________

The Green Organic Dutchman (TGODF) (Market Cap:

$782.932M; Share Price: $2.90) recently participated

in Virtual Investor Conferences.

The Green Organic Dutchman is an Ontario, Canada, based marijuana

company that was IPO’d in spring 2018 and is currently valued at

$957 million.

The Green Organic Dutchman expects that its production capacity

will be 170,000 kg marijuana a year, based on several deals that

have expanded the company’s asset base during 2018.

This includes the June 2018 acquisition of a facility

(approximately 280,000 square foot) that The Green Organic Dutchman

plans to use for producing marijuana-containing edible products and

marijuana-infused beverages. It recently announced that

effective March 25th, 2019 sales of certified-organic cannabis have

started with national distribution to medical patients. The

Growers' Circle is a select group of patients across Canada now

receiving TGOD's first certified-organic flower.

________

Canopy Growth Corporation (NYSE:

CGC) (Market Cap: $14.727B; Share Price:

$42.48) signed an offtake agreement with

PharmHouse Inc., a 49 per cent-owned joint venture of Canopy Rivers

Inc. (CNOPOF). Under the terms of the agreement, PharmHouse

has agreed to allocate high quality cannabis flower from an

additional 20 per cent of the flowering space available at

its Leamington greenhouse facility over the next three

years.

Legal Disclaimer:

This article was written by Regal Consulting, LLC (“Regal

Consulting”). Regal Consulting

has agreed to a three-month term consulting agreement with

Innovus Pharmaceuticals, Inc. (INNV) signed 05/20/2019. The

agreement calls for $20,000 in cash and 10,000 restricted 144

shares per month. All payments were made directly by Innovus

Pharmaceuticals, Inc. to Regal Consulting, LLC to provide investor

relations services, of which this article is a part of. Regal

Consulting also paid one thousand dollars cash to

microcapspeculators.com to distribute this article. Regal

Consulting may have a position in the securities mentioned in this

article at the time of publication, and may increase or decrease

its position without notice. This article is based on public

information and the opinions of Regal Consulting. INNV was

given an opportunity to edit this article. This article contains

forward-looking statements that are subject to certain risks and

uncertainties that could cause actual results to differ materially

from any results predicted herein. Regal Consulting is not

registered with any financial or securities regulatory authority,

and does not provide or claim to provide investment advice.

http://www.regalconsultingllc.com/full

legal disclaimer/

Full Legal Disclaimer Click Here.

Contact Information:

Company Name: ACR Communication LLC.

Contact Person: Media Manager

Email: info@microcapspeculators.com

Phone: 1-702-720-6310

Country: United States

SOURCE: microcapspeculators.com

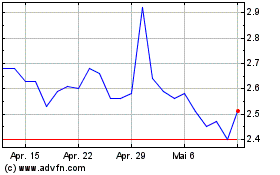

OrganiGram (TSX:OGI)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

OrganiGram (TSX:OGI)

Historical Stock Chart

Von Nov 2023 bis Nov 2024