Fortis Inc. ("Fortis" or the "Corporation") (TSX/NYSE: FTS), a

well-diversified leader in the North American regulated electric

and gas utility industry, released its first quarter results1 and

announced a 2050 net-zero target.

Highlights

- First quarter net earnings of

$350 million, or $0.74 per common share

- Adjusted net earnings2 of $0.78 per

common share, up from $0.77 in the first quarter of 2021

- Capital expenditures2 of $1.0

billion in the first quarter; $4.0 billion annual capital plan on

track

- 2050 net-zero direct GHG emissions

target announced, building on Fortis' commitment to a clean energy

future

- First TCFD and Climate Assessment

Report issued during the quarter

- Notice of intent submitted with

respect to Tucson Electric Power's next general rate application to

be filed in June 2022

"Our first quarter results reflect the stability

of our transmission and distribution business," said David

Hutchens, President and Chief Executive Officer, Fortis. "With

capital investments on track for 2022 and recent progress made on

incremental growth opportunities at ITC, we remain confident in our

growth outlook."

"We are pleased to take the next step on our ESG

journey by committing to a 2050 net-zero direct GHG emissions

target, which builds on our mid-term target to reduce GHG emissions

75% by 2035," said Mr. Hutchens. "The net-zero target and TCFD and

climate assessment report issued in March align with our focus on

operational excellence, sustainable growth and a clean energy

future."

Net EarningsThe Corporation

reported net earnings attributable to common equity shareholders

("Net Earnings") of $350 million for the first quarter, or

$0.74 per common share, compared to $355 million, or $0.76 per

common share in the first quarter of 2021. Results for the quarter

reflected higher unrealized losses of $14 million on the

mark-to-market accounting of natural gas derivatives at Aitken

Creek. Excluding this impact, the Corporation delivered earnings

growth driven by rate base growth at ITC and the western Canadian

utilities, and higher sales in the Caribbean. Growth was partially

offset by lower hydroelectric production in Belize, and lower

earnings at Central Hudson mainly due to the costs of implementing

a new customer information system.

Earnings in Arizona were broadly consistent with

the first quarter of 2021. The impact of higher electricity sales

and lower planned generation maintenance costs was offset by the

timing of earnings related to the Oso Grande wind generating

facility, as expected. Losses on retirement investments also

unfavourably impacted earnings at UNS Energy in the quarter.

Net earnings per common share also reflected an

increase in the weighted average number of common shares

outstanding largely associated with the Corporation's dividend

reinvestment plan.

Adjusted Net

Earnings2Adjusted net earnings

attributable to common equity shareholders ("Adjusted Net

Earnings") excludes the impact of mark-to-market accounting of

natural gas derivatives at Aitken Creek. Adjusted Net Earnings of

$369 million for the first quarter, or $0.78 per common share, were

$9 million, or $0.01 per common share higher than the same

period in 2021. The increase reflected growth as described for Net

Earnings.

_____________________

1 Financial information is presented in

Canadian dollars unless otherwise specified.2 Non-U.S. GAAP

Measures - Fortis uses financial measures that do not have a

standardized meaning under generally accepted accounting principles

in the United States of America and may not be comparable to

similar measures presented by other entities. Fortis presents these

non-U.S. GAAP measures because management and external stakeholders

use them in evaluating the Corporation's financial performance and

prospects. Refer to the Non-U.S. GAAP Reconciliation provided

herein.

| Non-U.S. GAAP

Reconciliation |

|

|

|

|

|

| Quarter ended March 31 |

|

|

($ millions, except earnings per share) |

2022 |

|

2021 |

|

Variance |

|

|

Adjusted Net Earnings |

|

|

|

|

|

| Net Earnings |

350 |

|

355 |

|

(5 |

) |

| Adjusting item: |

|

|

|

|

|

|

Unrealized loss on mark-to-market of derivatives3 |

19 |

|

5 |

|

14 |

|

|

Adjusted Net Earnings |

369 |

|

360 |

|

9 |

|

|

Adjusted net earnings per share ($) |

0.78 |

|

0.77 |

|

0.01 |

|

|

|

|

|

|

|

|

| Capital

Expenditures: |

|

|

|

|

|

| Additions to property, plant

and equipment |

866 |

|

764 |

|

102 |

|

| Additions to intangible

assets |

49 |

|

40 |

|

9 |

|

| Adjusting item: |

|

|

|

|

|

|

Wataynikaneyap Transmission Power Project4 |

49 |

|

76 |

|

(27 |

) |

|

Capital Expenditures |

964 |

|

880 |

|

84 |

|

SustainabilityIn March 2022,

the Corporation made significant progress on its commitment as a

Task Force for Climate-Related Financial Disclosures ("TCFD")

supporter, with the release of its first TCFD and Climate

Assessment Report.

Today Fortis further demonstrated its commitment

to build a clean energy future by announcing a 2050 net-zero direct

greenhouse gas ("GHG") emissions target. With a clear path to

achieve the Corporation’s mid-term target of reducing GHG emissions

75% by 2035 compared to 2019 levels without the use of carbon

offsets, the Corporation has established this additional target to

reinforce its commitment to decarbonize over the long-term, while

preserving customer reliability and affordability.

Capital ExpendituresFortis'

$4.0 billion annual capital plan remains on track with

approximately $1.0 billion invested during the first quarter.

In April 2022, Woodfibre LNG Limited ("Woodfibre

LNG") issued a Notice to Proceed to its prime contractor for the

proposed liquefied natural gas site in Squamish, British Columbia.

This announcement brings FortisBC’s Eagle Mountain Woodfibre Gas

Line project one step closer to construction, though the project

remains contingent on Woodfibre LNG making a final investment

decision.

During the quarter, progress continued on

incremental opportunities not included in the Corporation's $20.0

billion 2022-2026 capital plan. In March 2022, the Province of

Ontario issued an Order in Council and Ministerial Directive from

the Minister of Energy, instructing the Independent Electricity

System Operator ("IESO") to negotiate and, if certain conditions

are met, enter into a procurement contract on or before August 15,

2022, for the transmission capabilities of the Lake Erie Connector

project. The proposed 1,000 megawatt, bi-directional, high-voltage

direct current underwater transmission line will provide the first

direct interconnection between the wholesale electricity markets

operated by the IESO in Ontario and the PJM Interconnection in the

United States.

Also during the quarter, the Midwest Independent

System Operator ("MISO”) advanced its long-range transmission plan

("LRTP"), announcing the first tranche of projects across the MISO

Midwest subregion comprised of 18 transmission projects with total

associated costs estimated at US$10 billion. These projects require

MISO board approval which is currently anticipated in July 2022.

Six of these projects run through ITC’s MISO operating companies’

service territories, including Michigan and Iowa, where right of

first refusal provisions exist for incumbent transmission owners.

Other projects within this portfolio may be subject to competitive

bidding, depending on the state in which they are located. Based on

this preliminary information, ITC estimates transmission

investments of US$1 billion to US$1.5 billion through 2030

associated with these projects. Given the preliminary analysis

around the transmission investment, at this time Fortis cannot

state with certainty the impact of the estimated capital

expenditures in connection with the LRTP on the Corporation's

five-year capital plan. _______________________

3 Represents timing differences related to

the accounting of natural gas derivatives at Aitken Creek, net of

income tax recovery of $7 million for the three months ended March

31, 2022 (net of income tax recovery of $2 million for the three

months ended March 31, 2021) 4 Represents Fortis' 39% share of

capital spending for the Wataynikaneyap Transmission Power

ProjectCredit RatingsIn March 2022, Standard &

Poor's Financial Services confirmed the Corporation's 'A-' issuer

and 'BBB+' senior unsecured debt credit ratings and stable

outlook.

Regulatory UpdatesIn March

2022, the Alberta Utilities Commission issued a decision extending

the existing allowed rate of return on common equity ("ROE") of

8.5% using a 37% equity component of capital structure through

2023.

In March 2022, the Federal Energy Regulatory

Commission approved the settlement agreement for formula

transmission rates at Tucson Electric Power ("TEP"), including an

ROE of 9.79%.

On May 2, 2022, TEP submitted a notice of intent

with the Arizona Corporation Commission to file a general rate

application in June 2022. TEP will request that new rates become

effective no later than September 1, 2023. TEP's proposed rates

will be based on a 2021 test year and will include infrastructure

investments made since the last rate case, as well as changes in

fuel and non-fuel operating expenses. The filing will also include

proposals to eliminate certain adjustor mechanisms, as well as

modify an existing adjustor to provide more timely recovery of

clean energy investments.

OutlookThe Corporation's

long-term outlook remains unchanged. Fortis continues to enhance

shareholder value through the execution of its capital plan, the

balance and strength of its diversified portfolio of utility

businesses, and growth opportunities within and proximate to its

service territories. While energy price volatility, global supply

chain constraints and rising inflation are issues of potential

concern that continue to evolve, including from the effects of the

COVID-19 pandemic, war in Eastern Europe, economic sanctions and

geopolitical tensions, the Corporation does not currently expect

there to be a material impact on operations or financial results in

2022.

Fortis is executing on the transition to a clean

energy future and is on track to achieve its corporate-wide target

to reduce GHG emissions by 75% by 2035. Upon achieving this target,

99% of the Corporation's assets will be focused on energy delivery

and renewable, carbon-free generation. The Corporation's additional

2050 net-zero direct GHG emissions target reinforces Fortis'

commitment to decarbonize over the long-term, while preserving

customer reliability and affordability.

The Corporation's $20 billion five-year capital

plan is expected to increase midyear rate base from

$31.1 billion in 2021 to $41.6 billion by 2026,

translating into a five-year compound annual growth rate of

approximately 6%. Above and beyond the five-year capital plan,

Fortis continues to pursue additional energy infrastructure

opportunities.

Additional opportunities to expand and extend

growth include: further expansion of the electric transmission grid

in the United States to facilitate the interconnection of cleaner

energy including infrastructure investments associated with MISO's

LRTP; natural gas resiliency investments in pipelines and liquefied

natural gas infrastructure in British Columbia; the fully

permitted, cross-border, Lake Erie Connector electric transmission

project in Ontario; and the acceleration of cleaner energy

infrastructure investments across our jurisdictions.

Fortis expects long-term growth in rate base

will support earnings and dividend growth. Fortis is targeting

average annual dividend growth of approximately 6% through 2025.

This dividend growth guidance is premised on the assumptions

listed under "Forward-Looking Information".

About FortisFortis is a

well-diversified leader in the North American regulated electric

and gas utility industry with 2021 revenue of $9.4 billion and

total assets of $58 billion as at March 31, 2022.

The Corporation's 9,100 employees serve utility customers in

five Canadian provinces, nine U.S. states and three Caribbean

countries.Forward-Looking InformationFortis

includes forward-looking information in this media release within

the meaning of applicable Canadian securities laws and

forward-looking statements within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995 (collectively referred to

as "forward-looking information"). Forward-looking information

reflects expectations of Fortis management regarding future growth,

results of operations, performance and business prospects and

opportunities. Wherever possible, words such as anticipates,

believes, budgets, could, estimates, expects, forecasts, intends,

may, might, plans, projects, schedule, should, target, will, would

and the negative of these terms and other similar terminology or

expressions have been used to identify the forward-looking

information, which includes, without limitation: forecast capital

expenditures for 2022 and 2022-2026; targeted average annual

dividend growth through 2025; the 2050 net-zero direct GHG

emissions target; the 2035 GHG emissions reduction target and

projected asset mix; the expected timing, outcomes and impacts of

regulatory proceedings; the nature, timing, benefits and expected

costs of certain capital projects, including FortisBC's Eagle

Mountain Woodfibre Gas Line project, and additional opportunities

beyond the capital plan, including the Lake Erie Connector Project

and the MISO LRTP; the expected sources of funding for the

2022-2026 capital plan; the expectation that volatility in energy

prices, global supply chain constraints and rising inflation will

not have a material impact on operations or financial results in

2022; forecast rate base and rate base growth rate; additional

growth and expansion opportunities beyond the capital plan; and the

expectation that long-term growth in rate base will support

earnings and dividend growth.

Forward-looking information involves significant

risks, uncertainties and assumptions. Certain material factors or

assumptions have been applied in drawing the conclusions contained

in the forward-looking information, including, without limitation:

no material impact from volatility in energy prices, global supply

chain constraints and rising inflation; reasonable outcomes for

regulatory proceedings and the expectation of regulatory stability;

the successful execution of the five-year capital plan; no material

capital project and financing cost overrun; sufficient human

resources to deliver service and execute the capital plan; the

realization of additional opportunities; the impact of fluctuations

in foreign exchange; no significant variability in interest rates;

and the Board exercising its discretion to declare dividends,

taking into account the business performance and financial

condition of the Corporation. Fortis cautions readers that a number

of factors could cause actual results, performance or achievements

to differ materially from the results discussed or implied in the

forward-looking information. For additional information with

respect to certain risk factors, reference should be made to the

continuous disclosure materials filed from time to time by the

Corporation with Canadian securities regulatory authorities and the

Securities and Exchange Commission. All forward-looking information

herein is given as of the date of this media release. Fortis

disclaims any intention or obligation to update or revise any

forward-looking information, whether as a result of new

information, future events or otherwise.

Teleconference to Discuss First Quarter

2022 ResultsA teleconference and webcast will be held on

May 4, 2022 at 8:30 a.m. (Eastern). David Hutchens, President

and Chief Executive Officer and Jocelyn Perry, Executive Vice

President and Chief Financial Officer, will discuss the

Corporation's first quarter results.

Shareholders, analysts, members of the media and

other interested parties in North America are invited

to participate by calling 1.877.223.4471. International

participants may participate by calling 647.788.4922. Please dial

in 10 minutes prior to the start of the call. No passcode is

required.

A live and archived audio webcast of the

teleconference will be available on the Corporation's website,

www.fortisinc.com. A replay of the teleconference will be available

two hours after the conclusion of the call until June 5, 2022.

Please call 1.800.585.8367 or 416.621.4642 and enter passcode

3996811.

Additional Information

This media release should be read in conjunction

with the Corporation's March 31, 2022 Interim Management Discussion

and Analysis and Condensed Consolidated Financial Statements. This

and additional information can be accessed at www.fortisinc.com,

www.sedar.com, or www.sec.gov.

A .pdf version of this press release is available

at: http://ml.globenewswire.com/Resource/Download/c20f4199-99fb-4da0-92a6-063f96d7c65e

For more information, please contact:

|

Investor Enquiries |

Media Enquiries |

| Ms. Stephanie Amaimo |

Ms. Karen McCarthy |

| Vice President, Investor

Relations |

Vice President, Communications

& Corporate Affairs |

| Fortis Inc. |

Fortis Inc. |

| 248.946.3572 |

709.737.5323 |

|

investorrelations@fortisinc.com |

media@fortisinc.com |

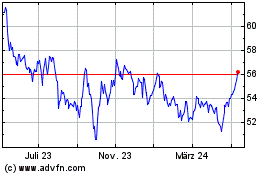

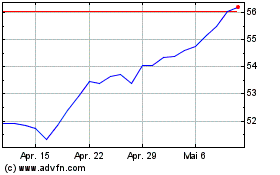

Fortis (TSX:FTS)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Fortis (TSX:FTS)

Historical Stock Chart

Von Apr 2023 bis Apr 2024