Extendicare Inc. (“Extendicare” or the “Company”) (TSX: EXE) today

reported results for the three months ended March 31, 2022. Results

are presented in Canadian dollars unless otherwise noted.

First Quarter Highlights

- High community transmission of the

Omicron variant resulted in increased outbreaks and high

absenteeism across the organization. Consequently, home health care

average daily volumes (“ADV”) were 4.8% lower than Q4 2021 and our

long-term care (“LTC”) average occupancy dropped by 120 bps.

- The sale of the Esprit retirement

living portfolio is scheduled to close on or about May 16, 2022,

for estimated net proceeds of approximately $125.0 million.

- Process to seek regulatory approvals

for Revera and Axium transactions is underway in Manitoba and

Ontario. If approved, Extendicare will assume operational

responsibility for Revera’s 56 long-term care homes, acquire a 15%

managed interest in the 24 homes that will be owned in partnership

with Axium; enter into a joint venture with Axium in respect of

certain Extendicare redevelopment projects.

- The Province of Ontario announced an

additional 2,624 new and redeveloped beds for 12 of our LTC

redevelopment projects in 2022, bringing the total new and

redeveloped beds awarded to Extendicare to 4,248 for 20 LTC

redevelopment projects, including the three LTC projects currently

under construction.

“The marked increase in COVID-19 cases since the beginning of

the year driven by the highly contagious Omicron variant, was a

setback to the positive recovery in occupancy and home health care

volumes we had experienced in the latter part of 2021,” said

President and Chief Executive Officer, Dr. Michael Guerriere.

“Thanks to vaccinations, the impact of the virus was much milder

than in previous waves. Nevertheless, high numbers of staff

absences because of illness or isolation requirements drove higher

sick pay, overtime and temporary replacement costs in the quarter.

Demand for our services remains high and when the pandemic

subsides, we expect our recovery to resume.”

“With the pending sale of the retirement portfolio, the ongoing

work to obtain regulatory approval for our

Revera and Axium transactions and the new bed allocations

from the Government of Ontario, our strategic transition to focus

on growth in long-term care and home health care is gathering

momentum. We are dedicated to advancing the delivery of

high-quality care and services across our LTC homes and home care

districts,” added Guerriere.

Protecting Our Residents, Clients and

Caregivers

The highly transmissible Omicron variant began to emerge in

December and drove a significant increase in COVID-19 infections in

Q1 2022. Vaccinations and boosters have helped to mitigate the

incidence of serious illness and hospitalization among our

residents and staff. Despite milder symptoms, we experienced a high

level of staff absenteeism during Q1, creating staffing challenges

and increased labour costs.

As of May 11, 2022, 27 of our 69 LTC homes and retirement

communities are in outbreak.

We continue to remain vigilant and focus on key prevention and

control measures to minimize the spread of the virus, understanding

that even milder variants can still pose a serious risk to the most

vulnerable members of our community.

Repositioning Extendicare to Focus on Growth in

Long-term Care and Home Health Care

The need for home care services is growing. The Ontario

government recognizes the critical role home health care plays in

the continuum of care, as evidenced by its recent announcement to

invest $1 billion more over the next three years to expand home

care services in the province.

In response to the increasing demand, Extendicare is refocusing

its business on providing high quality home health care and

long-term care. In the first quarter we announced the entering into

agreements for the sale of our Esprit retirement living portfolio

and for the acquisition of a 15% managed interest in 24 Revera LTC

homes, management of an additional 32 Revera LTC homes and a

redevelopment joint venture with Axium. This strategy allows us to

grow while providing the flexibility to allocate capital for

strategic initiatives, including acquisitions. Operating and

building new long-term care homes is a key pillar of our growth

agenda, and these new relationships allow us to achieve that

objective, while substantially reducing the amount of capital we

must invest to redevelop our Class C portfolio.

Based on the anticipated revenue of the 56 managed LTC homes and

the Company’s incremental costs in respect of such management, the

Revera Transactions would have generated for 2022 approximately

$17.0 million in incremental annual revenue in our Other Operations

segment and, excluding integration costs, NOI and AFFO of

approximately $7.6 million and $4.3 million ($0.042 AFFO per basic

share), respectively. In additional, an estimated $1.0 million in

AFFO ($0.01 AFFO per basic share) would have been received in 2022

through distributions in respect of our 15% interest in the 26 LTC

homes to be jointly owned with Axium. Total aggregate consideration

to be paid on closing of these transactions is approximately $70.0

million, subject to customary adjustments.

Closing of the previously announced sale of our Esprit

retirement communities in Ontario and Saskatchewan to Sienna-Sabra

LP for an aggregate purchase price of $307.5 million is scheduled

to close on or about May 16, 2022. All regulatory approvals have

been obtained and closing is subject only to customary closing

conditions.. The estimated net proceeds, net of debt repayments,

taxes, certain closing adjustments and transactions costs, is

approximately $125.0 million, subject to customary post-closing

working capital adjustments. The Company classified its retirement

living segment as discontinued in Q1 2022. These operations

contributed $1.3 million to AFFO(1) in Q1 2022 and $7.1 million

($0.08 AFFO per basic share) for the year ended December 31,

2021.

Commitment to Long-term Care Redevelopment

We continue to advance our redevelopment strategy to replace our

older Class C LTC beds in Ontario. We have been awarded 4,248 new

or replacement beds across 20 redevelopment projects, which would

replace all of our 3,285 existing Class C beds, including three

projects currently under construction that will replace a total of

624 Class C LTC beds with 704 new beds, requiring a net investment

of $178.9 million. Our new homes are being constructed exclusively

with single patient rooms to maximize privacy, safety and resident

comfort.

We are actively engaged with our industry partners and the

government to identify and implement necessary enhancements to the

government’s capital development funding program to make these

projects economically feasible given the construction cost

inflation being experienced by all operators. We continue to work

through Ontario Ministry of Long-Term Care (“MLTC”) and municipal

approval processes and are targeting to have six more projects

ready for construction before the end of 2023.

COVID-19 Financial Impacts

The resurgence of COVID-19 outbreaks within our homes

necessitated increased pandemic-related spending in Q1 2022.

We recognized $13.3 million in prevention and containment

funding in Q1 2022 that related to spending in 2021, resulting in

net recovery of COVID costs from continuing operations in Q1 2022

of $8.5 million, compared to net unfunded COVID costs of $0.2

million in Q1 2021.

Since the beginning of the pandemic, we have received funding to

cover a large portion of our pandemic-related costs. Exclusive of

government funding for pandemic pay programs, $196.0 million (90%)

of our $217.8 million in costs incurred to the end of Q1 2022 have

been funded, leaving cumulative unfunded pandemic costs in our

Adjusted EBITDA(1) from continuing operations of $21.8 million. We

will continue to incur elevated costs in our ongoing efforts to

protect our residents, clients and staff until the threat of the

pandemic has abated.

Subsequent to Q1 2022, the MLTC announced additional COVID-19

prevention and containment funding of $278.0 million for April 1,

2022 through to March 31, 2023. The Alberta and Manitoba

governments have indicated their intention to continue to provide

funding support on a retroactive basis for COVID-19 costs incurred

through to March 31, 2022. While we are encouraged by these

announcements, we expect ongoing volatility in our operating and

financial results until the effects of COVID-19 are behind us.

In Ontario, occupancy targets were reinstated on February 1,

2022, requiring LTC homes to achieve an average occupancy of 97%,

adjusted to exclude the third and fourth beds in ward rooms, in

order to maintain full funding. The adjusted average occupancy of

our Ontario LTC homes for the two months ended March 31, 2022, was

94.9%, down from 95.8% in December 2021.

Q1 2022 Financial Highlights (all comparisons

with Q1 2021(2))

- Revenue increased 3.7% or $10.8

million to $305.7 million, driven by LTC funding enhancements,

including $2.9 million in retroactive LTC funding, and home health

care billing rate increases, partially offset by lower COVID-19

funding of $3.9 million and the impact of timing of flow-through

funding.

- Net operating income (“NOI”)(1)

decreased $3.3 million to $33.0 million; excluding the Canada

Emergency Wage Subsidy (“CEWS”) of $9.7 million received by ParaMed

in Q1 2021, NOI would have increased by $6.4 million, driven by

higher net COVID-19 recoveries of $7.9 million and retroactive LTC

funding of $2.9 million, partially offset by higher operating costs

and the impact of the loss of occupancy protection for Ontario LTC

homes on February 1st.

- Adjusted EBITDA(1) decreased $4.2

million to $19.6 million, reflecting the decline in NOI noted above

and increased administrative costs related to transaction-related

professional fees of $0.6 million and increased information

technology costs, partially offset by lower COVID-19 related costs

of $0.8 million.

- Earnings from continuing operations

decreased $3.5 million to $4.0 million, driven by the after-tax

impact of the decline in Adjusted EBITDA noted above.

- AFFO(1) of $12.0 million ($0.13 per

basic share) was down $7.5 million, reflecting the decline in

earnings and higher maintenance capex.

Business Updates

The following is a summary of the Company’s revenue, NOI(1) and

NOI margins(1) by business segment for the three months ended March

31, 2022 and 2021.

|

|

Three months ended March 31 |

| (unaudited) |

2022 |

|

2021(2) |

|

(millions of dollars unless otherwise noted) |

Revenue |

NOI |

Margin |

|

Revenue |

NOI |

Margin |

|

Long-term care |

199.8 |

26.6 |

13.3% |

|

189.8 |

15.8 |

8.3% |

| Home health care |

98.6 |

2.7 |

2.7% |

|

97.7 |

16.0 |

16.3% |

| Other

Operations |

7.3 |

3.7 |

51.0% |

|

7.4 |

4.6 |

61.7% |

|

|

305.7 |

33.0 |

10.8% |

|

294.9 |

36.3 |

12.3% |

|

Note: Totals may not sum due to rounding. |

|

|

|

|

Long-Term Care

The surge in COVID-19 related outbreaks across our LTC homes

halted the occupancy recovery and contributed to a sequential

decline in average occupancy by 120 bps to 88.6% in Q1 2022, down

from 89.8% in Q4 2021. Average occupancy increased by 520 bps from

the same prior year period.

NOI and NOI margin in Q1 2022 were $26.6 million and 13.3%,

respectively, up from $15.8 million and 8.3% in Q1 2021, due to

higher net COVID-19 recoveries of $9.9 million and funding

enhancements (including retroactive funding in Manitoba of $2.9

million), partially offset by higher costs of labour and utilities,

and the impact of the loss of occupancy protection for the Ontario

LTC homes on February 1st.

Home Health Care

Referral activity remains above pre-COVID-19 levels as strong

demand for our services continues. However, service delivery has

been impacted by the reduction in workforce capacity experienced in

Q1 2022 and Q2 2022 caused by absenteeism related to the Omicron

variant. As many as 900 staff in late January 2022 were on paid

sick leave due to COVID. As a result, our Q1 2022 ADV of 24,552 was

down 4.8% from Q4 2021, up modestly from Q1 2021 ADV by 0.8%.

In Q1 2021, ParaMed revenue was $98.6 million, up 1.0% from Q1

2021, driven by billing rate increases and an increase in ADV of

0.8%, partially offset by reduced COVID-19 and pandemic pay funding

of $1.2 million.

NOI and NOI margin were $2.7 million and 2.7%, respectively, in

Q1 2022, compared to $6.3 million and 6.4% in Q1 2021, excluding

CEWS payments received by ParaMed in Q1 2021 of $9.7 million. The

$3.6 million decline in NOI was largely due to an increase in

unfunded COVID-19 costs of $2.0 million and higher costs to address

staffing capacity challenges, resulting in higher wages and

benefits, recruitment, travel and training costs, and higher

information technology costs.

Other Operations

Revenue declined by 2.1% to $7.3 million from Q1 2021, largely

due to lower management services revenue. NOI declined by $0.9

million or 19.0% to $3.7 million, due to increased staff and

information technology costs in support of growth initiatives. The

number of third-party residents served by SGP increased to

approximately 98,800 at the end of Q1 2022, up 21.9% from Q1 2021

and 6.0% from Q4 2021.

Financial Position

Extendicare is well positioned with strong liquidity, which

included cash and cash equivalents on hand of $118.4 million and

access to a further $72.8 million in undrawn demand credit

facilities as at March 31, 2022. Estimated net proceeds from the

sale of the Esprit retirement operations of $125.0 million will

further increase our cash and cash equivalents subsequent to March

31, 2022.

In addition, the Company has undrawn construction financing in

the aggregate of $150.6 million available for its ongoing

Stittsville, Sudbury and Kingston LTC redevelopment projects.

Select Financial Information

The following is a summary of the Company’s consolidated

financial information for the three months ended March 31, 2022 and

2021.

|

(unaudited) |

Three months ended March 31 |

|

(thousands of dollars unless otherwise noted) |

2022 |

|

2021(2) |

|

Revenue |

305,710 |

|

294,861 |

|

|

Operating expenses |

272,734 |

|

258,542 |

|

|

NOI(1) |

32,976 |

|

36,319 |

|

|

NOI margin(1) |

10.8 |

% |

12.3 |

% |

|

Administrative costs |

13,413 |

|

12,541 |

|

|

Adjusted EBITDA(1) |

19,563 |

|

23,778 |

|

|

Adjusted EBITDA margin(1) |

6.4 |

% |

8.1 |

% |

|

Earnings from continuing operations |

4,045 |

|

7,512 |

|

|

per basic and diluted share($) |

0.04 |

|

0.08 |

|

|

Earnings from discontinued operations, net of

tax |

75 |

|

811 |

|

|

Net earnings |

4,120 |

|

8,323 |

|

|

per basic and diluted share($) |

0.04 |

|

0.09 |

|

|

AFFO(1) |

12,048 |

|

19,545 |

|

|

per basic share($) |

0.13 |

|

0.22 |

|

|

per diluted share($) |

0.13 |

|

0.21 |

|

|

Maintenance capex |

1,412 |

|

1,033 |

|

|

Cash dividends declared per share |

0.12 |

|

0.12 |

|

|

Payout ratio(1) |

89 |

% |

55 |

% |

|

Weighted average number of shares(thousands) |

|

|

| Basic |

90,075 |

|

89,929 |

|

|

Diluted |

101,190 |

|

100,520 |

|

Extendicare’s disclosure documents, including its Management’s

Discussion and Analysis (“MD&A”), may be found on SEDAR’s

website at www.sedar.com under the Company’s issuer profile and on

the Company’s website at www.extendicare.com under the

“Investors/Financial Reports” section.

May Dividend Declared

The Board of Directors of Extendicare today declared a cash

dividend of $0.04 per share for the month of May 2022, which is

payable on June 15, 2022, to shareholders of record at the close of

business on May 31, 2022. This dividend is designated as an

“eligible dividend” within the meaning of the Income Tax Act

(Canada).

Conference Call and Webcast

On May 13, 2022, at 11:30 a.m. (ET), Extendicare will hold a

conference call to discuss its 2022 first quarter results. The call

will be webcast live and archived online at www.extendicare.com

under the “Investors/Events & Presentations” section.

Alternatively, the call-in number is 1-800-319-4610 or

416-915-3239. A replay of the call will be available approximately

two hours after completion of the live call until midnight on May

27, 2022. To access the rebroadcast dial 1-800-319-6413 followed by

the passcode 8865#.

About Extendicare

Extendicare is a leading provider of care and services for

seniors across Canada, operating under the Extendicare, Esprit

Lifestyle, ParaMed, Extendicare Assist, and SGP Purchasing Partner

Network brands. We are committed to delivering quality care

throughout the health continuum to meet the needs of a growing

seniors population. We operate or provide contract services to a

network of 119 long-term care homes and retirement communities (69

owned/50 contract services), provide approximately 9.2 million

hours of home health care services annually, and provide group

purchasing services to third parties representing approximately

98,800 senior residents across Canada. Extendicare proudly employs

approximately 20,000 qualified, highly trained and dedicated

individuals who are passionate about providing high quality care

and services to help people live better.

Non-GAAP Measures

Certain measures used in this press release, such as “net

operating income”, “NOI”, “NOI margin”, “Adjusted EBITDA”,

“Adjusted EBITDA margin”, “AFFO”, and “payout ratio”, including any

related per share amounts, are not measures recognized under GAAP

and do not have standardized meanings prescribed by GAAP. These

measures may differ from similar computations as reported by other

issuers and, accordingly, may not be comparable to similarly titled

measures as reported by such issuers. These measures are not

intended to replace earnings (loss) from continuing operations, net

earnings (loss), cash flow, or other measures of financial

performance and liquidity reported in accordance with GAAP. Such

items are presented in this document because management believes

that they are a relevant measure of Extendicare’s operating

performance and ability to pay cash dividends.

Management uses these measures to exclude the impact of certain

items, because it believes doing so provides investors a more

effective analysis of underlying operating and financial

performance and improves comparability of underlying financial

performance between periods. The exclusion of certain items does

not imply that they are non-recurring or not useful to

investors.

Detailed descriptions of these measures can be found in

Extendicare’s Q1 2022 MD&A (refer to “Non-GAAP Measures”),

which is available on SEDAR’s website at www.sedar.com and on

Extendicare’s website at www.extendicare.com.

The reconciliations for certain non-GAAP measures included in

this press release are outlined as follows:

The following table provides a reconciliation of “earnings from

continuing operations before income taxes” to Adjusted EBITDA and

“net operating income”, which excludes discontinued operations.

|

(unaudited) |

Three months ended March 31 |

|

(thousands of dollars) |

2022 |

|

2021(2) |

|

Earnings from continuing

operations before income taxes |

6,264 |

|

10,650 |

|

| Add: |

|

|

|

|

| Depreciation and

amortization |

8,251 |

|

7,726 |

|

| Net finance costs |

5,048 |

|

5,402 |

|

|

Adjusted EBITDA |

19,563 |

|

23,778 |

|

|

Administrative costs |

13,413 |

|

12,541 |

|

|

Net operating income |

32,976 |

|

36,319 |

|

The following table provides a reconciliation of AFFO, which

includes discontinued operations, to “net cash from (used in)

operating activities”, which the Company believes is the most

comparable GAAP measure to AFFO.

|

(unaudited) |

Three months ended March 31 |

|

(thousands of dollars) |

2022 |

|

2021 |

|

|

Net cash from (used in) operating activities |

50,224 |

|

(13,147 |

) |

| Add

(Deduct): |

|

|

| Net change in operating assets

and liabilities, including interest, and taxes |

(37,222 |

) |

32,931 |

|

| Depreciation for office

leases |

(657 |

) |

(727 |

) |

| Depreciation for FFEC

(maintenance capex) |

(1,862 |

) |

(1,965 |

) |

| Additional maintenance capex |

450 |

|

932 |

|

| Principal portion of government

capital funding |

1,115 |

|

1,521 |

|

|

AFFO |

12,048 |

|

19,545 |

|

Forward-looking Statements

This press release contains forward-looking statements

concerning anticipated future events, results, circumstances,

economic performance or expectations with respect to Extendicare

and its subsidiaries, including, without limitation, statements

regarding its business operations, business strategy, growth

strategy, results of operations and financial condition, including

anticipated timelines, costs and financial returns in respect of

development projects, statements relating to the agreements entered

into with Revera Inc. and its affiliates (“Revera”) and Axium

Infrastructure Inc. and its affiliates (“Axium”) in respect of the

ownership, operation and redevelopment of LTC homes in Ontario and

Manitoba; statements relating to the Retirement Living Sale;

statements relating to the Saskatchewan LTC Home Transition; and in

particular statements in respect of the impact of measures taken to

mitigate the impact of COVID-19, the availability of various

government programs and financial assistance announced in respect

of COVID-19, the impact of COVID-19 on the Company’s operating

costs, staffing, procurement, occupancy levels and volumes in its

home health care business, the impact on the capital and credit

markets and the Company’s ability to access the credit markets as a

result of COVID-19, increased litigation and regulatory exposure

and the outcome of any litigation and regulatory proceedings.

Forward-looking statements can often be identified by the

expressions “anticipate”, “believe”, “estimate”, “expect”,

“intend”, “objective”, “plan”, “project”, “will” or other similar

expressions or the negative thereof. These forward-looking

statements reflect the Company’s current expectations regarding

future results, performance or achievements and are based upon

information currently available to the Company and on assumptions

that the Company believes are reasonable. The Company assumes no

obligation to update or revise any forward-looking statement,

except as required by applicable securities laws. These statements

are not guarantees of future performance and involve known and

unknown risks, uncertainties and other factors that may cause

actual results, performance or achievements of the Company to

differ materially from those expressed or implied in the

statements. In particular, risks and uncertainties related to the

effects of COVID-19 on the Company include the length, spread and

severity of the pandemic; the nature and extent of the measures

taken by all levels of governments and public health officials,

both short and long term, in response to COVID-19; domestic and

global credit and capital markets; the Company’s ability to access

capital on favourable terms or at all due to the potential for

reduced revenue and increased operating expenses as a result of

COVID-19; the availability of insurance on favourable terms;

litigation and/or regulatory proceedings against or involving the

Company, regardless of merit; the health and safety of the

Company’s employees and its residents and clients; and domestic and

global supply chains, particularly in respect of personal

protective equipment. Given the evolving circumstances surrounding

COVID-19, it is difficult to predict how significant the adverse

impact will be on the global and domestic economy and the business

operations and financial position of Extendicare. For further

information on the risks, uncertainties and assumptions that could

cause Extendicare’s actual results to differ from current

expectations, refer to “Risk and Uncertainties” and “Forward

Looking-Statements” in Extendicare’s Q1 2022 MD&A filed by

Extendicare with the securities regulatory authorities, available

at www.sedar.com and on Extendicare’s website at

www.extendicare.com. Given these risks and uncertainties, readers

are cautioned not to place undue reliance on Extendicare’s

forward-looking statements.

Extendicare contact:David Bacon, Senior Vice

President and Chief Financial OfficerPhone: (905) 470-4000; Fax:

(905) 470-5588Email:

david.bacon@extendicare.comwww.extendicare.com

|

Endnotes |

|

(1) |

|

See the “Non-GAAP Measures” section of this press release and the

Company’s Q1 2022 MD&A, which includes the reconciliation of

such non-GAAP measures to the most directly comparable GAAP

measures. |

|

(2) |

|

In connection with the February

3, 2022 announcement that the Company has agreed to sell its Esprit

retirement living portfolio, the Company classified its retirement

living segment as discontinued in Q1 2022 and re-presented its

comparative consolidated financial statements, including the

comparative financial information. For additional details refer to

the “Discontinued Operations” section in the Company’s Q1 2022

MD&A and Note 14 of the unaudited interim condensed

consolidated financial statements for the three months ended March

31, 2022. |

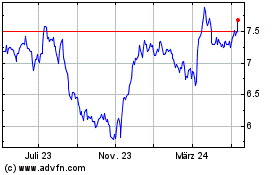

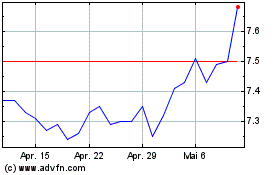

Extendicare (TSX:EXE)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Extendicare (TSX:EXE)

Historical Stock Chart

Von Apr 2023 bis Apr 2024