Spectral Medical Inc. (“Spectral” or the “Company”) (TSX:

EDT), a late stage theranostic company advancing

therapeutic options for sepsis and septic shock, as well as

commercializing a new proprietary platform targeting the renal

replacement therapy market through its wholly-owned subsidiary

Dialco Medical Inc. (

“Dialco”), today announced

its financial results for the fourth quarter and for the year ended

December 31, 2021 and provided a corporate update.

Chris Seto, CEO of Spectral Medical, commented,

“2021 was a foundational year for Spectral and Dialco as we

reported key achievements, both clinically and operationally,

despite the headwinds presented by several waves of COVID

variants. While clinical enrollment activity continued to be

negatively impacted, the Company responded quickly and implemented

key tools and changes to aide in advancing our clinical

programs. On the Tigris front, we recently implemented the

FDA protocol amendment allowing sequential organ failure assessment

(SOFA) scoring as an inclusion criteria into the study, in

conjunction with a full complement of Tigris sites engaged.

Along with other sub-study activity, Tigris is well positioned for

an expedient and positive outcome. Tigris enrollment now

stands at 30 patients randomized out of the 150 total patients to

be enrolled. While the sample size is small, we remain highly

encouraged by the preliminary mortality outcome data, which

continues to exceed expectations. Assuming there is no significant

recurrence of COVID-19 variants, we remain committed to completing

Tigris trial enrollment in mid-2023.”

“In terms of our Dialco subsidiary, we have

experienced site initiation challenges related to staffing

shortages across the dialysis clinic industry. Nevertheless, we

have taken a number of steps to help us advance the DIMI trial.

In January 2022, the FDA approved an amendment to the DIMI

home hemodialysis study that simplifies the protocol and allows for

extended use for patients, which should improve enrollment by

addressing both patient and clinical logistics flow issues

experienced throughout the industry. We have progressed to

the site contracting phase and anticipate initial patient enrolment

into our DIMI usability trial for home use in the third quarter of

2022.”

Dr. John Kellum, Chief Medical Officer of

Spectral, further noted, “We are witnessing the positive impact,

including robust use, of the new SOFA scoring as an inclusion

criteria for screening in the Tigris trial, especially in the first

quarter of 2022. Additionally, the initiation of the EDEN sub-study

could have a positive impact on recruitment as these patients will

be considered for the Tigris study. Moreover, our recent

FDA-approved amendment to our DIMI study simplifies the protocol

and allows for extended use for patients, which could have a

positive impact on enrollment.”

Mr. Seto concluded, “Overall, we remain very

encouraged by the outlook for the business. We believe our

clinical programs are on solid footing, backed by great

technologies. Our relationship with our exclusive

distribution partner for PMX in North America continues to

strengthen, as we work closely on pre-launch activities including

developing a broad campaign to bring endotoxins to the forefront

and more broadly explain their role as it relates to the pathology

of certain septic shock. At the same time, we continue to

strengthen our leadership and advisory resources, with the recent

appointment of Blair McInnis as CFO of Spectral, and the formation

of our Dialco Medical Advisory Board comprised of world-class home

hemodialysis experts. We will continue to add key personnel –

specifically executive leadership at Dialco in the coming months,

which will help accelerate both our clinical and commercial

activities around both the DIMI and SAMI devices. In terms of

the SAMI device, we are focused on deploying devices in the field

and gaining clinical awareness, and we are seeing a robust pipeline

of SAMI activities, which we look to capitalize on in 2022. In the

meantime, we continue to carefully manage expenses and have

maintained a solid balance sheet. As a result, we believe

Spectral is well positioned in both the sepsis and home

hemodialysis markets, both of which represent multi-billion-dollar

addressable markets.”

Financial

ReviewRevenue for the three months ended December

31, 2021 was $517,000 compared to $535,000 for the same three month

period last year. Revenue for the year ended December 31, 2021 was

$2,052,000 compared to $2,101,000 for the prior year, representing

a decrease of $49,000, or 2%. The majority of the decrease is due

to the decrease in royalty revenue. This was mitigated by an

increase in product revenue, and revenue from the exclusive

distribution agreement with Baxter International Inc.

(“Baxter”).

For the quarter ended December 31, 2021, the

Company reported operating costs of $3,069,000 compared to

$2,682,000 for the corresponding period in 2020. Operating costs

for the year ended December 31, 2021 amounted to $10,837,000

compared to $11,199,000 in 2020. The decrease relates to

non-recurring fees payable to a financial advisory services firm

incurred in the first quarter of 2020, relating to a legacy

financial advisory agreement. In addition, it incurred

approximately $275,000 in professional fees in connection with a

withdrawn prospectus offering in early March 2020. The decrease was

partially offset by increased clinical trial activity for Tigris,

EDEN and the DIMI usability trials, as well as the fees from a

professional employment organization that manages Dialco’s field

force in the United States.

The Company continues to maintain a low cost

operating structure for its base business operations. The

Company anticipates its operating costs to increase throughout 2022

as Spectral’s Tigris trial enrolment is expected to increase

significantly, combined with incremental costs associated with

Dialco’s upcoming usability trial for DIMI and the increase in

field resources for the marketing and commercialization activities

of its RRT devices.

Loss for the quarter ended December 31, 2021 was

$2,552,000 ($0.010 per share) compared a loss of $2,147,000 ($0.009

per share) for the same quarter last year. For the year ended

December 31, 2021, the Company reported a loss of $8,785,000,

($0.03 per share), compared to a loss of $9,098,000 ($0.04 per

share), for the year ended December 31, 2020.

The Company concluded the 2021 year with cash of

$8,890,000 compared to $5,807,000 cash on hand as of December 31,

2020.

The total number of common shares outstanding

for the Company was 267,886,408 as at December 31, 2021.

CORPORATE HIGHLIGHTS DURING

& SUBSEQUENT TO FOURTH QUARTER AND FISCAL YEAR ENDED DECEMBER

31, 2021

Tigris Trial and Regulatory

Program

- SOFA Score

AmendmentOn November 29, 2021, the Company announced that

the United States Federal Food and Drug Agency (“FDA”) approved a

protocol amendment to its Tigris trial allowing for the use of

sequential organ failure assessment (“SOFA”) scoring as inclusion

criteria into the study, which should have a significantly positive

impact on enrollment.

- Patient

EnrollmentTotal of 30 patients randomized to-date out of

the 150 total to be enrolled in Tigris, with preliminary mortality

outcome data continuing to exceed expectations. Of the three

patients enrolled in early 2022, two were enrolled as a result of

the recent FDA approved protocol amendment allowing for the use of

SOFA scoring as inclusion criteria into the study.

- Tigris SitesAn

investigator meeting was held in February 2022. This meeting along

with the recent protocol amendment acceptance by the FDA has

resulted in trial sites responding by reporting renewed patient

screening activities. The Company is continuing to consider

additional clinical trial sites to allow for the replacement of low

performing sites. This would provide maximum potential from

fifteen active sites to be screening and enrolling.

- TimingThe Company

continues to focus on finalizing the Tigris trial within the

reasonably shortest timelines. Assuming there is no significant

recurrence of COVID-19 cases in the Tigris site ICUs, the Company

continues to target interim enrollment in Q4 2022, and finalizing

its Tigris trial enrollment in the first half of 2023.

- EDEN observational

studyIn March 2022, the Company launched an ancillary

observational study, EDEN, to collect data on patients with sepsis

even if ineligible for Tigris. EDEN will capture much needed

data on the full range of septic shock and its relation to organ

failure and endotoxin activity. These data will inform

subsequent discussions with the FDA on labelling for PMX as well as

to provide the medical community and the Company a better picture

of the addressable population in the U.S. for PMX.

Furthermore, patients enrolled in EDEN will also be considered for

entry into the Tigris study, which provides another tool to support

enrollment.

Dialco

- DIMI Usability

Trial The Dialco team is focused on the DIMI

usability trial to obtain FDA clearance for in home use, and

expects first patient enrollment in Q3 2022 with study duration of

approximately 18 months. The timing of the start of the DIMI

usability trial for home hemodialysis has also been impacted by the

COVID pandemic. Dialysis clinics are experiencing severe

staffing shortages as they work to accommodate current patients as

well as respond to an increase in patients with COVID related

kidney injury requiring dialysis. On January 31, 2022, the

FDA approved an amendment to the DIMI home hemodialysis study that

simplifies the protocol and allows for extended use for

patients. Management believes that the revised protocol

increases study feasibility and should improve

enrollment.

- Medical Advisory

BoardDialco formed a Medical Advisory Board

comprised of leading home hemodialysis experts, with significant

experience in clinical research, patient care and patient-centered

outcomes related to dialysis in the home. The medical

advisory board’s focus will be to support in guiding the DIMI

usability trial and continued clinical development of the DIMI

device.

- DIMI

CommercializationManagement believes the

35-patient usability trial represents a prime commercialization

opportunity to demonstrate positive real-world experience and the

versatility of DIMI amongst Dialco’s clinical trial partners, who

are also potential DIMI customers. In order to support commercial

expansion, and in anticipation to the start-up of the DIMI

usability trial, Dialco is expanding its field force for sales

training and technical support. Dialco currently has field

representatives in Ontario, as well as California, Pennsylvania,

Florida and Michigan, with recruitment initiatives underway for

further expansion.

- SAMI

Commercialization SAMI continues to be launched in Canada

and the U.S. with successful clinical evaluations ongoing in key

hemodialysis centres, as well as expansion of the commercial sales

pipeline. As hospitals are experiencing a significant shortage of

CRRT machines in COVID-19 affected ICUs, there has been increased

activity with respect to the use of SAMI in the treatment of

COVID-19 positive patients. The Company has successfully developed

remote installation, and set-up on-line training for SAMI. The

Company expects to continue to generate revenue in 2022 pursuant to

its existing commercial arrangements for SAMI machines and

disposables.

Addition to Spectral Senior

Leadership Team

On March 21, 2022, the Company announced the

appointment of Blair McInnis as Chief Financial Officer (effective

April 4, 2022). Mr. McInnis brings over 15 years of corporate

finance and financial reporting experience. Most recently, he

served as Vice President Finance at SMTC Corporation, a provider of

global electronics manufacturing services with annualized revenues

in excess of $450 million, where he managed financial reporting,

budgeting, treasury management and forecasting for the

organization. During his tenure, he helped oversee the

financial aspects of the acquisition and privatization of the

Company by H.I.G. Capital, a leading global private equity firm,

prior to which, SMTC was listed on

Nasdaq.

U.S. Listing

Update

Management and the Board believe a senior U.S.

listing aligns with the goals of the business and its stakeholders,

and the Company continues to prepare for a potential listing on a

senior U.S. exchange.

About

Spectral

Spectral is a Phase 3 company seeking U.S. FDA

approval for its unique product for the treatment of patients with

septic shock, Toraymyxin™ (“PMX”). PMX is a

therapeutic hemoperfusion device that removes endotoxin, which can

cause sepsis, from the bloodstream and is guided by the Company’s

Endotoxin Activity Assay (EAA™), the only FDA cleared diagnostic

for the risk of developing sepsis.

PMX is approved for therapeutic use in Japan and

Europe, and has been used safely and effectively on more than

340,000 patients to date. In March 2009, Spectral obtained the

exclusive development and commercial rights in the U.S. for PMX,

and in November 2010, signed an exclusive distribution agreement

for this product in Canada. Approximately 330,000 patients are

diagnosed with severe sepsis and septic shock in North America each

year.

Spectral, through its wholly owned subsidiary,

Dialco Medical Inc., is also commercializing a new set of

proprietary platforms addressing renal replacement therapy

(RRT) across the dialysis spectrum. SAMI is

targeting the acute RRT market, while DIMI is targeting the chronic

RRT market. Dialco is currently pursuing regulatory approval

for U.S. in-home use of DIMI, which is based on the same RRT

platform as SAMI, but will be intended for home hemodialysis

use. DIMI recently received its FDA 510k clearance for use in

hospital and clinical settings, and obtained its Health Canada

license for use within Canadian hospitals, clinics and in home.

Spectral is listed on the Toronto Stock Exchange

under the symbol EDT. For more information please visit

www.spectraldx.com.

Forward-looking

statement

Information in this news release that is not

current or historical factual information may constitute

forward-looking information within the meaning of securities laws.

Implicit in this information, particularly in respect of the future

outlook of Spectral and anticipated events or results, are

assumptions based on beliefs of Spectral's senior management as

well as information currently available to it. While these

assumptions were considered reasonable by Spectral at the time of

preparation, they may prove to be incorrect. Readers are cautioned

that actual results are subject to a number of risks and

uncertainties, including the availability of funds and resources to

pursue R&D projects, the successful and timely completion of

clinical studies, the ability of Spectral to take advantage of

business opportunities in the biomedical industry, the granting of

necessary approvals by regulatory authorities as well as general

economic, market and business conditions, and could differ

materially from what is currently expected.

The TSX has not reviewed and does not accept

responsibility for the adequacy or accuracy of this statement.

For further information, please contact:

|

Chris Seto |

Ali Mahdavi |

David Waldman/Natalya Rudman |

| CEO |

Capital Markets & Investor

Relations |

US Investor Relations |

| Spectral Medical Inc. |

Spinnaker Capital Markets

Inc. |

Crescendo Communications,

LLC |

| 416-626-3233 ext. 2004 |

416-962-3300 |

212-671-1020 |

| cseto@spectraldx.com |

am@spinnakercmi.com |

edt@crescendo-ir.com |

|

Spectral Medical Inc. |

|

Consolidated Statements of Financial Position |

|

|

|

(in thousands of Canadian dollars) |

|

|

December 31, 2021 |

|

December 31, 2020 |

|

|

|

$ |

|

$ |

|

|

|

|

|

| Assets |

|

|

| Current

assets |

|

|

| Cash |

8,890 |

|

5,807 |

|

| Trade and other

receivables |

205 |

|

260 |

|

| Inventories |

293 |

|

348 |

|

| Prepayments and other

assets |

875 |

|

389 |

|

|

|

10,263 |

|

6,804 |

|

| Non-current

assets |

|

|

| Right-of-use-asset |

532 |

|

625 |

|

| Property and equipment |

532 |

|

488 |

|

| Intangible asset |

228 |

|

246 |

|

|

Total assets |

11,555 |

|

8,163 |

|

| |

|

|

|

Liabilities |

|

|

| Current

liabilities |

|

|

| Trade and other payables |

1,522 |

|

2,141 |

|

| Current portion of contract

liabilities |

689 |

|

676 |

|

| Current

portion of lease liability |

92 |

|

85 |

|

| |

2,303 |

|

2,902 |

|

| Non-current

liability |

|

|

| Lease liability |

490 |

|

582 |

|

|

Non-current portion of contract liabilities |

4,679 |

|

5,348 |

|

| Total

liabilities |

7,472 |

|

8,832 |

|

| |

|

|

| Shareholders’ equity

(deficiency) |

|

|

| Share capital |

84,357 |

|

71,870 |

|

| Contributed surplus |

7,985 |

|

7,981 |

|

| Share-based compensation |

7,984 |

|

6,771 |

|

| Warrants |

2,251 |

|

2,418 |

|

|

Deficit |

(98,494 |

) |

(89,709 |

) |

| Total shareholders’

equity (deficiency) |

4,083 |

|

(669 |

) |

|

|

|

|

|

Total liabilities and shareholders’ equity

(deficiency) |

11,555 |

|

8,163 |

|

|

Spectral Medical Inc. |

|

Consolidated Statements of Loss and Comprehensive Loss |

|

For the years ended December 31, 2021 and 2020 |

|

|

|

(in thousands of Canadian dollars, except for share and per share

data) |

|

|

2021 |

|

2020 |

|

|

|

$ |

|

$ |

|

| |

|

|

|

|

|

Revenue |

2,052 |

|

2,101 |

|

| |

|

|

| Expenses |

|

|

| Changes in inventories of

finished goods and work-in-process |

286 |

|

127 |

|

| Raw materials and consumables

used |

546 |

|

501 |

|

| Salaries and benefits |

5,163 |

|

4,750 |

|

| Consulting and professional

fees |

2,707 |

|

4,064 |

|

| Regulatory and investor

relations |

612 |

|

541 |

|

| Travel and entertainment |

270 |

|

146 |

|

| Facilities and

communication |

293 |

|

361 |

|

| Insurance |

389 |

|

248 |

|

| Depreciation and

amortization |

294 |

|

304 |

|

| Interest expense on lease

liability |

28 |

|

32 |

|

| Foreign exchange loss

(gain) |

58 |

|

(7 |

) |

| Other expense |

93 |

|

148 |

|

| Write down of property and

equipment |

181 |

|

- |

|

| Gain on

disposal of property and equipment |

(83 |

) |

(16 |

) |

| |

10,837 |

|

11,199 |

|

|

|

|

|

|

Loss and comprehensive loss for the year |

(8,785 |

) |

(9,098 |

) |

| |

|

|

|

Basic and diluted loss per common share |

(0.03 |

) |

(0.04 |

) |

| |

|

|

|

Weighted average number of common shares outstanding –

basic and diluted |

252,464,462 |

|

232,502,463 |

|

|

Spectral Medical Inc. |

|

Consolidated Statements of Changes in Shareholders’ (Deficiency)

Equity |

|

For the years ended December 31, 2021 and 2020 |

|

|

|

(in thousands of Canadian dollars) |

|

|

Issued capital |

Contributed surplus |

Share-based compensation |

|

Warrants |

|

Deficit |

|

Total Shareholders’ (deficiency) equity |

|

|

|

Number |

$ |

$ |

$ |

|

$ |

|

$ |

|

$ |

|

| Balance, January 1,

2020 |

225,876,683 |

66,837 |

7,981 |

6,183 |

|

1,870 |

|

(80,611 |

) |

2,260 |

|

| Public offering |

8,500,000 |

3,526 |

- |

- |

|

788 |

|

- |

|

4,314 |

|

| Share options exercised |

1,279,062 |

772 |

- |

(292 |

) |

- |

|

- |

|

480 |

|

| Warrants exercised |

1,100,000 |

735 |

- |

- |

|

(240 |

) |

- |

|

495 |

|

| Loss and comprehensive loss

for the year |

- |

- |

- |

- |

|

- |

|

(9,098 |

) |

(9,098 |

) |

| Share-based compensation |

- |

- |

- |

880 |

|

- |

|

- |

|

880 |

|

|

Balance, December 31, 2020 |

236,755,745 |

71,870 |

7,981 |

6,771 |

|

2,418 |

|

(89,709 |

) |

(669 |

) |

| Bought deal offering |

23,530,000 |

7,406 |

- |

- |

|

1,464 |

|

- |

|

8,870 |

|

| Share options exercised |

143,333 |

98 |

- |

(46 |

) |

|

|

- |

|

52 |

|

| Warrants exercised |

7,457,330 |

4,983 |

- |

- |

|

(1,627 |

) |

- |

|

3,356 |

|

| Warrants expired |

- |

- |

4 |

- |

|

(4 |

) |

- |

|

- |

|

| Loss and comprehensive loss

for the year |

- |

- |

- |

- |

|

- |

|

(8,785 |

) |

(8,785 |

) |

|

Share-based compensation |

- |

- |

- |

1,259 |

|

- |

|

- |

|

1,259 |

|

|

Balance, December 31, 2021 |

267,886,408 |

84,357 |

7,985 |

7,984 |

|

2,251 |

|

(98,494 |

) |

4,083 |

|

|

Spectral Medical Inc. |

|

Consolidated Statements of Cash Flows |

|

For the years ended December 31, 2021 and 2020 |

|

|

|

(in thousands of Canadian dollars) |

|

|

2021 |

|

2020 |

|

|

|

$ |

|

$ |

|

| Cash flow provided by

(used in) |

|

|

| |

|

|

| Operating

activities |

|

|

| Loss for the year |

(8,785 |

) |

(9,098 |

) |

| Adjustments for: |

|

|

|

Depreciation on right-of-use asset |

93 |

|

94 |

|

|

Depreciation on property and equipment |

183 |

|

193 |

|

|

Amortization of intangible asset |

18 |

|

17 |

|

|

Interest expense on lease liability |

28 |

|

32 |

|

|

Unrealized foreign exchange loss on cash |

56 |

|

187 |

|

|

Share-based compensation |

1,259 |

|

880 |

|

|

Write down of expired consumables |

106 |

|

- |

|

|

Write down of property and equipment |

181 |

|

- |

|

|

Gain on disposal of property and equipment |

(83 |

) |

(16 |

) |

| Changes in items of working

capital: |

|

|

|

Trade and other receivables |

55 |

|

11 |

|

|

Inventories |

(51 |

) |

(72 |

) |

|

Prepayments and other assets |

(486 |

) |

(234 |

) |

|

Contract asset |

- |

|

519 |

|

|

Trade and other payables |

(619 |

) |

1,139 |

|

|

Contract liabilities |

(656 |

) |

6,024 |

|

|

Net cash used in operating activities |

(8,701 |

) |

(324 |

) |

| |

|

|

| Investing

activities |

|

|

| Proceeds on disposal of

property and equipment |

158 |

|

18 |

|

| Property and equipment

expenditures |

(483 |

) |

(315 |

) |

|

Net cash used in investing activities |

(325 |

) |

(297 |

) |

| |

|

|

| Financing

activities |

|

|

| Proceeds from financing |

10,000 |

|

5,100 |

|

| Transaction costs paid |

(1,130 |

) |

(786 |

) |

| Lease liability payments |

(113 |

) |

(109 |

) |

| Share options exercised |

52 |

|

480 |

|

| Warrants exercised |

3,356 |

|

495 |

|

|

Net cash provided by financing activities |

12,165 |

|

5,180 |

|

| |

|

|

| Increase in cash |

3,139 |

|

4,559 |

|

| Effects of exchange rate

changes on cash |

(56 |

) |

(187 |

) |

| Cash,

beginning of year |

5,807 |

|

1,435 |

|

|

Cash, end of year |

8,890 |

|

5,807 |

|

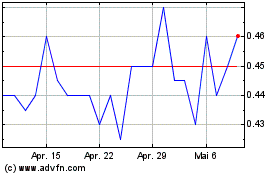

Spectral Medical (TSX:EDT)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Spectral Medical (TSX:EDT)

Historical Stock Chart

Von Apr 2023 bis Apr 2024