Cardinal Energy Ltd. ("

Cardinal" or the

"

Company") (TSX: CJ) is pleased to present the

results of its independent reserve report effective December 31,

2021. One hundred percent of Cardinal's year-end 2021 reserves were

evaluated by independent reserves evaluator GLJ Ltd. ("GLJ") with

an effective date of December 31, 2021 (the "2021 Reserve Report").

The 2021 financial information in this news release is unaudited

and accordingly, such financial information is subject to change

based on the results of the Company's year-end audit.

Cardinal’s 2021 year-end reserves reflect the

resilience, quality and sustainability of our low decline asset

base. In 2021, Cardinal’s focus was to preserve financial

liquidity, capture cost savings while keeping our operations safe

and maintaining and improving on the long term value of our

assets.

RESERVE REPORT HIGHLIGHTS

All reserves information contained in this news

release are gross reserves and are based on the 2021 Reserve

Report.

- Cardinal’s

Proved Developed Producing ("PDP") reserves increased to 74 mmboe,

representing a 16% increase year over year, through the addition of

17 mmboe, replacing 2.5x production.

- PDP reserves

were added at Finding, Development and Acquisition ("FD&A")

costs(1) of $5.66/boe, resulting in a recycle ratio(1) of 5.2

times. PDP Finding and Development ("F&D") costs(1) were

$4.54/boe, resulting in a recycle ratio(1) of 6.5 times.

- The before tax

Net Present Value ("NPV"), discounted at 10% ("NPV10") of our

reserves increased 75% to $1,050 million, and 71% to $1,217 million

for our PDP and Proved Plus Probable Producing ("P+PDP") reserves

respectively.

- PDP reserves per

diluted share(2) increased by 9%, and the associated PDP NPV10 per

diluted share(2) increased by 66%.

- The debt

adjusted, NPV10 of the Company's PDP reserves was $5.48 per basic

share(3)(4), a 254% increase over 2020 and PDP reserves increased

134% on a debt adjusted basic per share basis(3)(4).

- On a Proved plus

Probable ("TPP") basis, Cardinal’s reserves increased to 110 mmboe,

an 11% increase year over year, an addition of 18 mmboe at a

FD&A cost(1) of $5.17/boe.

- NPV10 of TPP

reserves increased 70% to $1,376 million, a 37% increase on an

NPV10 per basic share basis(2) and a 243% change on a debt adjusted

basic per share basis(3)(4).

- Cardinal

maintains a high percentage of reserves as producing with the P+PDP

reserves accounting for 87% of the Company's total reserves.

- 90% of

Cardinal's TPP reserves are associated with oil and natural gas

liquids.

| Notes: |

| |

(1) |

|

FD&A

costs, F&D costs and recycle ratios are non-GAAP financial

ratios. Operating netback, development costs and net acquisition

costs are non-GAAP financial measures and are used as a components

of the non-GAAP financial ratio. See "Oil and Gas Metrics" and

"Non-GAAP and Other Financial Measures" in this news release for

information relating to these non-GAAP financial ratios and

measures. |

| |

(2) |

|

At year-end 2021 there were 150.4 million basic outstanding

shares and 165.8 million diluted shares outstanding. |

| |

(3) |

|

Debt adjusted basic outstanding shares of 191.7 million were

calculated by dividing the unaudited year-end net debt of

approximately $178 million by the closing price of our common

shares on the Toronto Stock Exchange at December 31, 2021 of

$4.32/share and adding this to the basic outstanding shares. |

| |

(4) |

|

Debt adjusted reserves per share is a non-GAAP financial ratio

that is not a standardized financial measure under IFRS and may not

be comparable to similar financial measures disclosed by other

issuers. Net debt, a non-GAAP financial ratio, is used as a

component of this non-GAAP financial ratio. See "Non-GAAP and Other

Financial Measures" in this news release for information relating

to this non-GAAP financial ratio. |

| |

(5) |

|

See also "Note Regarding Forward Looking Statements", "Reserves

Advisories" and "Reserve Definitions". |

CARDINAL’S TOP TIER RESERVE LIFE

ASSETS

- Cardinal

continues to maintain a long producing reserve life index

("RLI")(1) of 9.9 years PDP and 12.7 years P+PDP based on fourth

quarter 2021 production of 20,525 boe/d(2) which reflects the low

decline, low risk, predictable nature of our asset base.

- Cardinal’s three

year average of FD&A costs(3) for PDP reserves is $8.78/boe,

reflecting the success of strategically acquiring, optimizing and

developing long life, oil focused assets.

- We effect a

measured approach to developing our reserves. Our undeveloped

drilling locations are booked (72 net)(4) based on a five year

inventory. These locations only represent a small percentage of our

overall economic drilling inventory, leaving substantial room for

future reserve additions within our existing asset base.

| Notes: |

| |

(1) |

|

See "Oil and

Gas Metrics". |

| |

(2) |

|

See "Supplemental Information Regarding Product Types". |

| |

(3) |

|

FD&A costs is a non-GAAP financial ratio. Operating

netback, development costs and net acquisition costs are non-GAAP

financial measures are used as a components of this non-GAAP

financial ratio. See "Oil and Gas Metrics" and "Non-GAAP and Other

Financial Measures" in this news release for information relating

to this non-GAAP financial ratio and measure. |

| |

(4) |

|

See "Drilling Locations". |

| |

(5) |

|

See also "Note Regarding Forward Looking Statements", "Reserves

Advisories" and "Reserve Definitions". |

OPERATIONAL UPDATE

Cardinal produced 20,525 boe/d in the fourth

quarter of 2021, averaging 19,090 boe/d for the year(1). The

Company drilled ten wells in 2021 consisting of eight producing

wells and two injection wells. In aggregate the eight producing

wells have delivered production at rates above expectation with

average capital efficiency based upon the first 90 days of

production ("IP90") of under $8,500/boe per day(2). At current

commodity prices, the entire 2021 drilling program is forecast to

pay out in the second quarter of this year. Wells of note include a

three leg multilateral Ellerslie oil well at our Southern Alberta

Tide Lake property which averaged 428 boe/d(1) (IP90) and a

nine leg horizontal at our legacy Central Alberta Chauvin property

which averaged 386 bbls/d(1) (IP90). The two injectors were drilled

at Midale, Saskatchewan further optimizing our CO2 flood with

offsetting incremental oil production being realized ahead of

schedule, at rates above expectation.

Current production based on field estimates is

20,500 boe/d(2). Optimization efforts through the first quarter

across our asset base have continued to reduce Cardinal’s already

top decile base decline rate. Year to date, as part of our 18 well

2022 budget, Cardinal has drilled and completed four six-leg

Clearwater oil wells at Nipisi, two development Dunvegan light oil

wells at Elmworth and a follow-up three leg multilateral Ellerslie

oil well at Tide Lake. Each of these wells are expected to be

on-stream prior to the end of the first quarter with the first

wells beginning production this week.

| Notes: |

| |

(1) |

|

See

"Supplemental Information Regarding Product Types". |

| |

(2) |

|

See "Oil and Gas Metrics". |

OIL AND GAS RESERVES

The 2021 Reserve Report encompasses 100% of

Cardinal's oil and gas properties and was prepared in accordance

with definitions, standards and procedures contained in the

Canadian Oil and Gas Evaluation Handbook ("COGEH") and National

Instrument 51-101 - Standards of Disclosure for Oil and Gas

Activities ("NI 51-101"). Please also refer to "Note Regarding

Forward Looking Statements", "Reserves Advisories" and "Reserve

Definitions" in this news release.

Reserves Detail

Our 2021 Reserve Report uses the price forecast

of the three consultant's average (GLJ, McDaniel & Associates

Consultants Ltd. and Sproule Associates Ltd.) used by GLJ. The

forecast crude oil reference prices are higher as compared to the

2020 Reserve Report forecast. Improvement in pricing along with our

2021 acquisitions, successful drilling program and continued

optimization of our enhanced recovery schemes have added 18 million

boe of TPP reserves.

In the 2021 Reserve Report, Cardinal has

included all abandonment, decommissioning and reclamation ("ADR")

costs for active and inactive wells, pipelines and facilities. The

ADR costs for the active assets are considered in the PDP reserves

category. Full inclusion of all ADR costs is recommended by COGEH.

Cardinal's full inclusion of costs exceeds the NI 51-101 minimum

requirement of ADR for only those assets assigned reserves. At

year-end 2021, the 2021 Reserve Report included TPP ADR costs

discounted at 10% of $85 million.

Consistent with prior years and in accordance

with COGEH recommendations, Cardinal has included all operating

costs for active and inactive assets. The Company also includes the

consideration of future maintenance costs which is included as part

of the operating costs or as FDC.

Summary of Oil and Gas

Reserves(1)(3)

The following tables summarize certain

information contained in the 2021 Reserve Report. Reserves included

below are the Company's estimated gross reserves as at December 31,

2021, as evaluated in the 2021 Reserve Report.

|

Reserves Category |

|

Light and Medium Oil (Mbbl) |

Heavy Oil (Mbbl) |

Natural Gas Liquids (Mbbl) |

ConventionalNatural

Gas(2)

(MMcf) |

Total BOE (Mboe) |

|

Proved Developed Producing |

|

41,227 |

23,719 |

2,934 |

39,325 |

74,434 |

|

Proved Developed Non-Producing |

|

820 |

105 |

49 |

4,611 |

1,743 |

|

Proved Undeveloped |

|

5,032 |

1,604 |

195 |

2,184 |

7,196 |

|

Total Proved |

|

47,080 |

25,427 |

3,178 |

46,120 |

83,372 |

|

Probable |

|

16,484 |

6,690 |

1,068 |

16,665 |

27,019 |

|

Total Proved Plus Probable |

|

63,563 |

32,117 |

4,246 |

62,785 |

110,391 |

|

|

|

|

|

|

|

|

|

|

|

Notes: |

|

(1) |

|

Total values may not add due to rounding. |

|

(2) |

|

Includes non-associated gas, associated gas and solution gas. |

|

(3) |

|

In addition to the gross reserves indicated in the above table, the

Company has 162 Mboe TPP royalty interest reserves comprised of 143

Mbbl light and medium crude oil and 109 MMcf of conventional

natural gas. |

Summary of Net Present Values of Future Net Revenue

(Before Tax)

(Based on forecast price and costs)

|

As at December 31, 2021(1)(2)(3) |

|

|

|

|

Discounted at: |

|

Reserves Category |

0.0% (M$) |

5.0% (M$) |

10.0% (M$) |

15.0% (M$) |

20.0% (M$) |

|

Proved Developed Producing |

1,767,568 |

1,344,496 |

1,049,772 |

865,183 |

741,952 |

|

Proved Developed Non-Producing(4) |

(143,410) |

(65,374) |

(38,976) |

(27,140) |

(20,907) |

|

Proved Undeveloped |

225,428 |

140,807 |

98,946 |

73,344 |

56,027 |

|

Total Proved |

1,849,585 |

1,419,929 |

1,109,742 |

911,388 |

777,072 |

|

Probable |

1,000,553 |

449,302 |

266,079 |

182,723 |

136,747 |

|

Total Proved Plus Probable |

2,850,138 |

1,869,231 |

1,375,820 |

1,094,111 |

913,819 |

|

|

|

|

|

|

|

|

|

|

Notes: |

|

(1) |

|

Total values may not add due to rounding. |

|

(2) |

|

Based on three consultant's average, as defined below, December 31,

2021 forecast prices and costs. See below for "Price

Forecast". |

|

(3) |

|

Future net revenue has been reduced for future abandonment costs

and estimated capital for future development associated with the

reserves. |

|

(4) |

|

The Proved Developed Non-Producing NPV includes the consideration

of the inactive ADR costs of the Company. Excluding these costs the

NPV10 of these reserves would be $21.9 million. Full ADR costs are

included in the Total Proved reserves case. |

Reconciliations of Changes in

Reserves

The following table sets out a reconciliation of

the changes in the Corporation's gross reserves as at December 31,

2021 against such reserves at December 31, 2020 based on forecast

prices and cost assumptions in effect at the applicable reserve

evaluation date:

|

|

Total Proved |

|

|

Light and Medium Crude

Oil(Mbbl) |

Heavy Crude Oil(Mbbl) |

Conventional Natural

Gas(MMcf) |

Natural Gas Liquids (Mbbl) |

MBOE(Mboe) |

|

December 31, 2020 |

42,069 |

21,790 |

46,963 |

3,389 |

75,074 |

|

Technical Revisions(1) |

1,874 |

170 |

(1,635) |

165 |

1,937 |

|

Extensions and Infill Drilling |

268 |

250 |

297 |

9 |

575 |

|

Dispositions |

(71) |

- |

(3,716) |

(358) |

(1,048) |

|

Acquisitions |

4,614 |

2,293 |

6,059 |

105 |

8,022 |

|

Economic Factors(2) |

2,066 |

2,962 |

3,338 |

168 |

5,752 |

|

Production |

(3,738) |

(2,037) |

(5,186) |

(301) |

(6,940) |

|

December 31, 2021 |

47,080 |

25,427 |

46,120 |

3,178 |

83,372 |

|

|

|

|

Total Proved Plus Probable |

|

|

|

|

Light and Medium Crude

Oil(Mbbl) |

Heavy Crude Oil(Mbbl) |

Conventional Natural

Gas(MMcf) |

Natural Gas Liquids (Mbbl) |

MBOE(Mboe) |

|

December 31, 2020 |

56,249 |

28,141 |

62,420 |

4,465 |

99,258 |

|

Technical Revisions(1) |

2,055 |

(296) |

(2,666) |

133 |

1,448 |

|

Extensions and Infill Drilling |

439 |

321 |

395 |

11 |

838 |

|

Dispositions |

(89) |

- |

(4,485) |

(432) |

(1,269) |

|

Acquisitions |

6,154 |

2,930 |

7,819 |

153 |

10,541 |

|

Economic Factors(2) |

2,494 |

3,057 |

4,488 |

216 |

6,515 |

|

Production |

(3,738) |

(2,037) |

(5,186) |

(301) |

(6,940) |

|

December 31, 2021 |

63,563 |

32,117 |

62,785 |

4,246 |

110,391 |

|

|

|

|

|

|

|

|

|

|

Notes: |

|

(1) |

|

Positive or negative revisions are due to variations in performance

versus previous forecasts. |

|

(2) |

|

Economic factors have been calculated as the difference in reserves

using the 2021 Reserve Report price forecast with the 2020 Reserve

Report reserve forecasts. There is no consideration of changes in

operating costs or price offset changes that occurred in 2021. |

Price Forecast

The following table summarizes Consultant's

average commodity price forecast and foreign exchange rate

assumptions as at December 31, 2021, as applied in the 2021 Reserve

Report, for the next five years.

|

Consultants Average Price

Forecast(1) |

|

|

|

|

Exchange Rate |

WTI @ Cushing |

Canadian Light Sweet 40° API |

Western Canada Select 20.5° API |

Medium at Cromer 29° API |

Natural gas AECO – C spot |

|

Year |

($US/$C) |

($US/bbl) |

($C/bbl) |

$C/bbl) |

($C/bbl) |

($C/MMbtu) |

|

2022 |

0.7967 |

72.83 |

86.82 |

74.43 |

83.94 |

3.56 |

|

2023 |

0.7967 |

68.78 |

80.73 |

69.17 |

78.06 |

3.20 |

|

2024 |

0.7967 |

66.76 |

78.01 |

66.54 |

75.43 |

3.05 |

|

2025 |

0.7967 |

68.09 |

79.57 |

67.87 |

76.94 |

3.10 |

|

2026 |

0.7967 |

69.45 |

81.16 |

69.23 |

78.48 |

3.17 |

|

|

|

|

|

|

|

|

|

|

|

Note: |

|

(1) |

|

Inflation is accounted for at 0% for 2022, 2.3% for 2023, and 2%

thereafter. |

Future Development Costs

Cardinal has conservatively booked undeveloped

locations, reflecting our current drilling plans for the next four

to five years. Significant potential drilling inventory exits

beyond those locations and the associated reserves currently

booked. Cardinal has identified over 400 net unbooked potential

locations(1) which provide long term confidence in the

sustainability of our production base and the potential to deliver

future organic growth. There are 72 net future locations(1)

included in the 2021 Reserve Report (including future CO2

injectors).

| Note: |

| |

(1) |

|

See "Drilling

Locations". |

FDC reflects the best estimate of the capital

cost required to produce the reserves. The FDC associated with the

TPP reserves at year-end 2021 is $222 million undiscounted ($152

million discounted at 10%).

|

millions $ |

PDP |

Total Proved |

Total Proved plus Probable |

|

Total FDC, Undiscounted |

67.3 |

181.1 |

222.3 |

|

Total FDC, Discounted at 10% |

35.2 |

126.7 |

152.3 |

FDC included at year-end 2021 for CO2 purchases,

maintenance and facility capital in PDP, TP and TPP were $67

million, $70 million and $78 million, respectively. This represents

35% of Cardinal's TPP FDC of $222 million.

Note Regarding Forward Looking

Statements

This news release contains forward-looking

statements and forward-looking information (collectively

"forward-looking information") within the meaning of applicable

securities laws relating to the Cardinal's plans and other aspects

of Cardinal's anticipated future operations, management focus,

objectives, strategies, financial, operating and production

results. Forward-looking information typically uses words such as

"anticipate", "believe", "project", "expect", "goal", "plan",

"intend", " may", "would", "could" or "will" or similar words

suggesting future outcomes, events or performance. The

forward-looking statements contained in this news release speak

only as of the date thereof and are expressly qualified by this

cautionary statement.Specifically, this news release contains

forward-looking statements relating to: our business strategies,

plans and objectives; that our 2021 drilling program will pay out

in the second quarter of 2022; production decline rates; our 2022

drilling budget and plans; expectations with respect to when

certain wells will be on-stream and producing; future drilling

locations; the sustainability of our production base and the

potential to deliver future organic growth; our asset base and its

future potential and opportunities; and our plans to continually

improve our environmental, safety and governance mandate and

operate our assets in a responsible and environmentally sensitive

manner.

In addition, information and statements relating

to reserves are deemed to be forward-looking statements, as they

involve implied assessment, based on certain estimates and

assumptions, that the reserves described exist in quantities

predicted or estimated, and that the reserves can be profitably

produced in the future.

Forward-looking statements regarding Cardinal

are based on certain key expectations and assumptions of Cardinal

concerning anticipated financial performance, business prospects,

strategies, regulatory developments, current and future commodity

prices and exchange rates, applicable royalty rates, tax laws,

future well production rates and reserve volumes, future operating

costs, the performance of existing and future wells, the success of

its exploration and development activities, the sufficiency and

timing of budgeted capital expenditures in carrying out planned

activities, the availability and cost of labor and services, the

impact of competition, conditions in general economic and financial

markets, access to markets, availability of drilling and related

equipment, effects of regulation by governmental agencies, the

ability to obtain financing on acceptable terms which are subject

to change based on commodity prices, market conditions and

potential timing delays.

These forward-looking statements are subject to

numerous risks and uncertainties, certain of which are beyond

Cardinal's control. Such risks and uncertainties include, without

limitation: the impact of general economic conditions; volatility

in market prices for crude oil and natural gas; industry

conditions; currency fluctuations; imprecision of reserve

estimates; liabilities inherent in crude oil and natural gas

operations; environmental risks; incorrect assessments of the value

of acquisitions and exploration and development programs;

competition from other producers; the lack of availability of

qualified personnel, drilling rigs or other services; changes in

income tax laws or changes in royalty rates and incentive programs

relating to the oil and gas industry; hazards such as fire,

explosion, blowouts, and spills, each of which could result in

substantial damage to wells, production facilities, other property

and the environment or in personal injury; and ability to access

sufficient capital from internal and external sources.

Management has included the forward-looking

statements above and a summary of assumptions and risks related to

forward-looking statements provided in this news release in order

to provide readers with a more complete perspective on Cardinal's

future operations and such information may not be appropriate for

other purposes. Cardinal's actual results, performance or

achievement could differ materially from those expressed in, or

implied by, these forward-looking statements and, accordingly, no

assurance can be given that any of the events anticipated by the

forward-looking statements will transpire or occur, or if any of

them do so, what benefits that Cardinal will derive there from.

Readers are cautioned that the foregoing lists of factors are not

exhaustive. These forward-looking statements are made as of the

date of this news release and Cardinal disclaims any intent or

obligation to update publicly any forward-looking statements,

whether as a result of new information, future events or results or

otherwise, other than as required by applicable securities

laws.

Initial Production

Any references in this news release to initial

production rates are useful in confirming the presence of

hydrocarbons, however, such rates are not determinative of the

rates at which such wells will continue production and decline

thereafter. While encouraging, readers are cautioned not to place

reliance on such rates in calculating the aggregate production for

Cardinal.

Oil and Gas Metrics The term

"boe" or barrels of oil equivalent may be misleading, particularly

if used in isolation. A boe conversion ratio of six thousand cubic

feet of natural gas to one barrel of oil equivalent (6 Mcf: 1 bbl)

is based on an energy equivalency conversion method primarily

applicable at the burner tip and does not represent a value

equivalency at the wellhead. Additionally, given that the value

ratio based on the current price of crude oil, as compared to

natural gas, is significantly different from the energy equivalency

of 6:1; utilizing a conversion ratio of 6:1 may be misleading as an

indication of value.

This news release contains metrics commonly used

in the oil and natural gas industry which have been prepared by

management, such as "capital efficiency", "development costs",

"F&D costs", "FD&A costs", "operating netback", "recycle

ratio" and "reserve life index". These terms do not have a

standardized meaning and may not be comparable to similar measures

presented by other companies, and therefore should not be used to

make such comparisons.

"Capital efficiency" means the development cost

divided by the production added over a defined period of time.

"Development costs" means the aggregate

exploration and development costs including land and seismic

incurred in the financial year on reserves that are characterized

as development, but exclude capitalized general and administration

costs. The aggregate of the development costs incurred in the most

recent financial year and the change during that year in estimated

future development costs generally will not reflect total finding

and development costs related to reserves additions for that year.

See "Non-GAAP Financial Measures".

"Net Acquisition costs" means the total

consideration paid for corporate acquisitions plus net debt

acquired in the acquisition plus property acquisitions less the

proceeds from property dispositions. See "Non-GAAP Financial

Measures".

"F&D costs" are calculated as the sum of

development costs plus the change in FDC for the period when

appropriate, divided by the change in reserves within the

applicable reserves category, excluding those reserves acquired or

disposed.

"FD&A costs" are calculated as the sum of

development costs plus net acquisition costs plus the change in FDC

for the period when appropriate, divided by the change in reserves

within the applicable reserves category, inclusive of changes due

to acquisitions and dispositions.

"Operating netback" is a non-GAAP financial

measure. See "Non-GAAP Financial Measures".

"Recycle ratio" is calculated by dividing an

unaudited operating netback for 2021 of $29.68/boe by F&D costs

per boe or FD&A costs per boe for the year.

"Reserve life index" or "RLI" is calculated by

dividing the applicable reserves by 2021 fourth quarter production

of 20,525 boe/d.

Management uses these oil and gas metrics for

its own performance measurements and to provide shareholders with

measures to compare our operations over time. Readers are cautioned

that the information provided by these metrics, or that can be

derived from the metrics presented in this news release, should not

be relied upon for investment or other purposes.

Unaudited Financial

Information

Certain financial and operating information

included in this news release for the year ended December 31, 2021

are based on estimated unaudited financial results for the year

then ended, and are subject to the same limitations as discussed

under "Note Regarding Forward Looking Statements". These estimated

amounts may change upon the completion of audited financial

statements for the year ended December 31, 2021 and

changes could be material.

Supplemental Information Regarding

Product Types

This news release includes references 2021

production. The following table is intended to provide the product

type composition as defined by NI 51-101.

|

|

Light/medium Crude Oil |

Heavy Oil |

NGL |

Conventional Natural Gas |

Total (boe/d) |

|

|

|

|

|

|

|

|

Q4/21 |

51% |

34% |

4% |

11% |

20,525 |

|

2021 average |

54% |

29% |

4% |

13% |

19,090 |

|

Current production |

54% |

29% |

4% |

13% |

20,500 |

|

Ellerslie oil well at Tide Lake |

89% |

- |

- |

11% |

428 |

|

Chauvin drill |

- |

100% |

- |

- |

386 |

Reserves Advisories

Unless otherwise indicated, all reserves

reported in this news release are Company share gross reserves

which represent Cardinal's total working interest reserves prior to

the deduction of royalties payable.

Future net revenue is a forecast of revenue,

estimated using forecast prices and costs arising from the

anticipated development and production of resources, net of

associated royalties, operating costs, development costs and all

corporate abandonment and reclamation costs for all active and

inactive wells, pipelines and facilities. It should not be assumed

that the future net revenues undiscounted and discounted at 10%

included in this news release represent the fair market value of

the reserves.

Reserve Definitions

"Proved" reserves are those reserves that can be

estimated with a high degree of certainty to be recoverable. It is

likely that the actual remaining quantities recovered will exceed

the estimated proved reserves.

"Probable" reserves are those additional

reserves that are less certain to be recovered than proved

reserves. It is equally likely that the actual remaining quantities

recovered will be greater or less than the sum of the estimated

proved plus probable reserves.

"Developed" reserves are those reserves that are

expected to be recovered from existing wells and installed

facilities or, if facilities have not been installed, that would

involve a low expenditure (e.g. when compared to the cost of

drilling a well) to put the reserves on production.

"Developed Producing" reserves are those

reserves that are expected to be recovered from completion

intervals open at the time of the estimate. These reserves may be

currently producing or, if shut-in, they must have previously been

on production, and the date of resumption of production must be

known with reasonable certainty.

"Developed Non-Producing" reserves are those

reserves that either have not been on production, or have

previously been on production, but are shut in, and the date of

resumption of production is unknown.

"Undeveloped" reserves are those reserves

expected to be recovered from known accumulations where a

significant expenditure (for example, when compared to the cost of

drilling a well) is required to render them capable of production.

They must fully meet the requirements of the reserves

classification (proved, probable, possible) to which they are

assigned.

Drilling Locations

This news release discloses Cardinal's inventory

of approximate 472 net drilling locations, of which 53 net

locations are booked proved undeveloped, 19 net are booked probable

undeveloped locations and 400 are unbooked. The booked locations

are derived from the 2021 Reserve Report and account for drilling

locations that have associated proved and/or probable reserves, as

applicable. Unbooked locations are internal estimates based on the

Company's prospective acreage and an assumption as to the number of

wells that can be drilled per section based on industry practice

and internal review. Unbooked locations do not have attributed

reserves. Unbooked locations have been identified by management as

an estimation of the Company's multi-year drilling activities based

on evaluation of applicable geologic, seismic, engineering,

production and reserves information. There is no certainty that the

Company will drill all unbooked drilling locations and if drilled

there is no certainty that such locations will result in additional

oil and gas reserves, resources or production. The drilling

locations on which the Company will actually drill wells, including

the number and timing thereof is ultimately dependent upon the

availability of funding, regulatory approvals, seasonal

restrictions, oil and natural gas prices, costs, actual drilling

results, additional reservoir information that is obtained and

other factors. While a certain number of the unbooked drilling

locations have been derisked by drilling existing wells in relative

close proximity to such unbooked drilling locations, the majority

of other unbooked drilling locations are farther away from existing

wells where management has less information about the

characteristics of the reservoir and therefore there is more

uncertainty whether wells will be drilled in such locations and if

drilled there is more uncertainty that such wells will result in

additional oil and gas reserves, resources or production.

Non-GAAP and Other Financial

Measures

Throughout this news release and in other

materials disclosed by the Company, Cardinal employs certain

measures to analyze its financial performance, financial position,

and cash flow. These non-GAAP and other financial measures are not

standardized financial measures under International Financial

Reporting Standards ("IFRS" or, alternatively, "GAAP") and may not

be comparable to similar financial measures disclosed by other

issuers. The non-GAAP and other financial measures should not be

considered to be more meaningful than generally accepted accounting

principles ("GAAP") measures which are determined in accordance

with IFRS, such as net income (loss) and cash flow from operating

activities as indicators of Cardinal's performance.

Non-GAAP Financial Measures

"Development costs" means the aggregate

property, property plant and equipment expenditures including land

and seismic incurred in the financial year on reserves that are

characterized as development but exclude capitalized general and

administration costs.

"Net Acquisition costs" means the total

consideration paid for corporate acquisitions plus net debt

acquired in the acquisition plus property acquisitions less the

proceeds from property dispositions.

"Operating netback" is determined by deducting

royalties, net operating expenses, and transportation expenses from

petroleum and natural gas revenue. Operating netback is a per boed

measure utilized by Cardinal to better analyze the operating

performance of its petroleum and natural gas assets against prior

periods.

The following table sets forth a reconciliation

of petroleum and natural gas revenues to operating netback on a per

boe basis (all figures unaudited):

|

$/boe |

2021 |

|

Petroleum and natural gas revenue |

63.88 |

|

Royalties |

(11.49) |

|

Net operating expenses |

(22.22) |

|

Transportation expenses |

(0.49) |

|

Netback |

29.68 |

"Net debt" is calculated as bank debt plus the

secured notes and adjusted working capital deficiency which is

current liabilities less current assets (adjusted for the fair

value of financial instruments, the current portion of lease

liabilities and the current portion of the decommissioning

obligation). Net debt is used by management to analyze the

financial position, liquidity and leverage of Cardinal.

The following table sets forth a reconciliation

of bank debt to net debt (all figures unaudited):

|

$ millions |

2021 |

|

Bank debt |

142.4 |

|

Secured notes |

12.5 |

|

Adjusted working capital deficiency |

23.2 |

|

Net debt |

178.2 |

Non-GAAP Financial Ratios

"Development capital", "F&D costs",

"FD&A costs", "Recycle ratio", "debt adjusted reserves per

share" are non-GAAP financial ratios. See "Oil and Gas Advisories".

Management uses F&D costs as a measure of capital efficiency

for organic reserves development. Management uses FD&A costs as

a measure of capital efficiency for organic and acquired reserves

development. Management uses recycle ratio to relate the cost of

adding reserves to the expected cash flows to be generated.

Management uses debt adjusted reserves per share as a metric to

compare reserve valuation when taking into account changes in share

price, outstanding shares and ending net debt levels.

About Cardinal Energy Ltd.

One of Cardinal's goals is to continually

improve our Environmental, Safety and Governance mandate and

operate our assets in a responsible and environmentally sensitive

manner. As part of this mandate, Cardinal injects and conserves

more carbon than it emits making us one of the few Canadian energy

companies to have a negative carbon footprint.

Cardinal is a Canadian oil focused company built

to provide investors with a stable platform for dividend income.

Cardinal's operations are focused in low decline light and medium

quality oil in Western Canada.

For further information: M.

Scott Ratushny, CEO or Shawn Van Spankeren, CFO or Laurence Broos,

VP Finance Email: info@cardinalenergy.caPhone: (403) 234-8681

Website: www.cardinalenergy.ca

Notes: (1) FD&A costs, F&D costs and recycle ratios

are non-GAAP financial ratios. Operating netback, development costs

and net acquisition costs are non-GAAP financial measures and are

used as a components of the non-GAAP financial ratio. See "Oil and

Gas Metrics" and "Non-GAAP and Other Financial Measures" in this

news release for information relating to these non-GAAP financial

ratios and measures (2) At year-end 2021 there were 150.4 million

basic outstanding shares and 165.8 million diluted shares

outstanding (3) Debt adjusted basic outstanding shares of 191.7

million were calculated by dividing the unaudited year-end net debt

of approximately $178 million by the closing price of our common

shares on the Toronto Stock Exchange at December 31, 2021 of

$4.32/share and adding this to the basic outstanding shares. (4)

Debt adjusted reserves per share is a non-GAAP financial ratio that

is not a standardized financial measure under IFRS and may not be

comparable to similar financial measures disclosed by other

issuers. Net debt, a non-GAAP financial ratio, is used as a

component of this non-GAAP financial ratio. See "Non-GAAP and Other

Financial Measures" in this news release for information relating

to this non-GAAP financial ratio. (5) See also "Note Regarding

Forward Looking Statements", "Reserves Advisories" and "Reserve

Definitions"

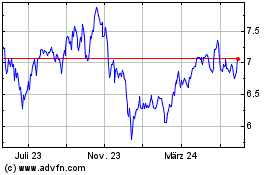

Cardinal Energy (TSX:CJ)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

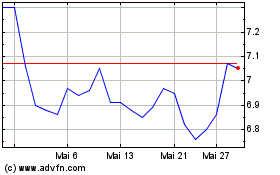

Cardinal Energy (TSX:CJ)

Historical Stock Chart

Von Nov 2023 bis Nov 2024