Algoma Steel Announces Final Results of Substantial Issuer Bid

02 August 2022 - 1:42PM

Algoma Steel Group Inc. (NASDAQ, TSX: ASTL) (“Algoma” or the

“Corporation”) today announced the final results of its substantial

issuer bid (the “Offer”) under which it has purchased for

cancellation 41,025,641 of its common shares (“Shares”) at a

purchase price of US$9.75 per Share, for an aggregate purchase

price of approximately US$400 million. Shares purchased under the

Offer represent approximately 27.9% of the issued and outstanding

Shares at the time that the Offer was commenced. Immediately

following completion of the Offer on July 27, 2022, 105,403,930

Shares were issued and outstanding.

Based on the final count by TSX Trust Company,

the depositary for the Offer (the “Depositary”), a total of

60,835,820 Shares were properly tendered and not withdrawn. As the

Offer was oversubscribed, shareholders who made auction tenders at

a price of US$9.75 or less per Share and purchase price tenders

will have approximately 94.68% of their successfully tendered

Shares purchased by Algoma (other than “odd lot” holders, whose

Shares will be purchased on a priority basis). Shareholders who

made auction tenders at a price in excess of US$9.75 per Share will

have their Shares returned by the Depositary. Payment for the

Shares accepted for purchase under the Offer will occur in

accordance with the terms of the Offer and applicable law.

The Corporation expects to be eligible to

recommence purchases under its normal course issuer bid after all

Shares accepted for purchase under the Offer have been taken

up.

To assist shareholders in determining the

Canadian tax consequences of the Offer, Algoma estimates that for

the purposes of the Income Tax Act (Canada), the paid-up capital

per Share is approximately C$5.43 (or US$4.22, based on the Bank of

Canada daily average foreign exchange rate as at the expiry of the

Offer). Given that the purchase price of US$9.75 per Share exceeds

the paid-up capital per Share, shareholders who have sold Shares to

Algoma under the Offer will be deemed to have received a taxable

dividend as a result of such sale for Canadian federal income tax

purposes. The dividend deemed to have been paid by Algoma to

Canadian resident persons is designated as an “eligible dividend”

for purposes of the Income Tax Act (Canada) and any corresponding

provincial and territorial tax legislation.

The “specified amount” for purposes of

subsection 191(4) of the Income Tax Act (Canada) is US$9.42 (or

C$12.13, based on the Bank of Canada daily average foreign exchange

rate as at the expiry of the Offer). Shareholders should consult

with their own tax advisors with respect to the income tax

consequences of the disposition of their Shares under the

Offer.

This news release is for informational purposes

only and is not intended to and does not constitute an offer to

purchase or the solicitation of an offer to sell Shares.

ADVISORY REGARDING FORWARD-LOOKING

STATEMENTS - This news release contains forward-looking

statements or information (collectively, “forward-looking

statements”) within the meaning of applicable securities

legislation, including Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended. Forward-looking statements include: timing for payment

for the Shares accepted for purchase under the Offer, timing for

Shares returned by the Depositary, estimated paid-up capital per

Share and the recommencement of the Corporation’s normal course

issuer bid, including the benefits and value to the Corporation’s

shareholders as a result thereof. Forward-looking statements

involve assumptions, risks and uncertainties that may cause such

statements not to occur or results to differ materially. These

assumptions include: number of Shares properly tendered and not

properly withdrawn prior to expiration of the Offer. Risks and

uncertainties include: changes in or interpretation of laws or

regulations; and other risks and uncertainties as described in the

Annual Report on Form 20-F filed by Algoma with the Ontario

Securities Commission (the “OSC”) (available under Algoma’s SEDAR

profile at www.sedar.com) and with the Securities and Exchange

Commission (the “SEC”) (available at www.sec.gov), as well as in

the other documents Algoma has filed with the OSC and the SEC.

Forward-looking statements speak only as of the date they are

made.

Although Algoma believes such forward-looking

statements are reasonable, there can be no assurance they will

prove to be correct. The above assumptions, risks and uncertainties

are not exhaustive. Forward-looking statements are made as of the

date hereof and, except as required by law, Algoma undertakes no

obligation to update or revise any forward-looking statements.

About Algoma Steel

Based in Sault Ste. Marie, Ontario, Canada,

Algoma is a fully integrated producer of hot and cold rolled steel

products including sheet and plate. With a current raw steel

production capacity of an estimated 2.8 million tons per year,

Algoma’s size and diverse capabilities enable it to deliver

responsive, customer-driven product solutions straight from the

ladle to direct applications in the automotive, construction,

energy, defense, and manufacturing sectors. Algoma is a key

supplier of steel products to customers in Canada and Midwest USA

and is the only producer of plate steel products in Canada.

Algoma’s mill is one of the lowest cost producers of hot rolled

sheet steel (HRC) in North America owing in part to its

state-of-the-art Direct Strip Production Complex (“DSPC”), which is

the newest thin slab caster in North America with direct coupling

to a basic oxygen furnace (BOF) melt shop.

Algoma has achieved several meaningful

improvements over the last several years that are expected to

result in enhanced long-term profitability for the business. Algoma

has upgraded its DSPC facility and recently installed its No. 2

Ladle Metallurgy Furnace. Additionally, Algoma has cost cutting

initiatives underway and is in the process of modernizing its plate

mill facilities.

Today Algoma is on a transformation journey,

investing in its people and processes, optimizing and modernizing

to secure a sustainable future. Our customer focus, growing

capability and courage to meet the industry’s challenges head-on

position us firmly as your partner in steel.

For more information, please contact:

| Mike MoracaTreasurer and

Investor Relations OfficerAlgoma Steel Inc.Phone:

705.945.3300E-mail: IR@algoma.com |

|

|

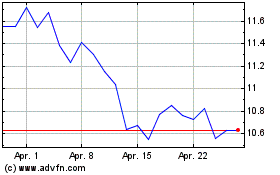

Algoma Steel (TSX:ASTL)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Algoma Steel (TSX:ASTL)

Historical Stock Chart

Von Apr 2023 bis Apr 2024