Current Report Filing (8-k)

01 Juli 2022 - 10:26PM

Edgar (US Regulatory)

0001439288

false

--12-31

ZURN WATER SOLUTIONS CORP

0001439288

2022-07-01

2022-07-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 1, 2022

ZURN

ELKAY WATER SOLUTIONS CORPORATION

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-35475 |

|

20-5197013 |

(State or other jurisdiction of

incorporation

or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

511

W. Freshwater Way

Milwaukee,

Wisconsin |

|

53204 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (855) 480-5050

ZURN WATER SOLUTIONS CORPORATION

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common

Stock $.01 par value |

|

ZWS |

|

The

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

EXPLANATORY NOTE

As previously disclosed, on February 12, 2022,

Zurn Elkay Water Solutions Corporation (formerly known as Zurn Water Solutions Corporation) (“Zurn” or the “Company”)

entered into a definitive agreement to combine with Elkay Manufacturing Company (“Elkay”), pursuant to an Agreement and Plan

of Merger (the “Merger Agreement”) by and among Zurn, Elkay, Zebra Merger Sub, Inc., a wholly owned subsidiary of Zurn (“Merger

Sub”), and Elkay Interior Systems International, Inc., as representative of the stockholders of Elkay. The Merger Agreement provides

that among other matters, and subject to the satisfaction or waiver of the conditions set forth in the Merger Agreement, Elkay would

merge with Merger Sub, with Elkay surviving as a wholly owned subsidiary of Zurn (the “Merger”).

On July 1, 2022, the Company and Elkay announced

that they had closed the Merger.

| Item 1.01 | Entry into a Material Definitive

Agreement. |

Registration Rights Agreement

Prior to the consummation of the Merger, on July

1, 2022, Zurn and certain stockholders of Elkay entered into a Registration Rights Agreement, pursuant to which Zurn will grant such

stockholders a right to demand, at any time after the date that is 180 days after the closing of the Merger, registration of their Registrable

Securities (as defined in the Registration Rights Agreement) within the first three years following the closing, subject to certain minimum

and maximum thresholds and other customary conditions. Zurn will pay certain expenses of the parties incurred in connection with the

exercise of their rights under the Registration Rights Agreement and indemnify them for certain securities law matters in connection

with any registration statement. The Registration Rights Agreement also amended the Standstill and Lock-Up Agreements, each dated as

of February 12, 2022, between the Company and certain stockholders of Elkay (the “Lock-Up Amendments”), to change certain

of the mechanics for the release of shares of Zurn common stock to be received in the Merger from the lock-up restrictions.

The foregoing description of the Registration

Rights Agreement (including the Lock-Up Amendments) is qualified in its entirety by reference to the full text of the Registration Rights

Agreement, a copy of which is filed as Exhibit 10.1 hereto, and incorporated herein by reference.

Amendment No. 1 to Fourth Amended and Restated

First Lien Credit Agreement

In connection with the consummation of the Merger,

on July 1, 2022, ZBS Global, Inc., Zurn Holdings, Inc., Zurn LLC, Elkay and the other loan parties party thereto entered into that

certain Amendment No. 1 to Fourth Amended and Restated First Lien Credit Agreement (the “Amendment”) pursuant to which Elkay

joined that certain Fourth Amended and Restated First Lien Credit Agreement dated as of October 4, 2021 (the “Credit Agreement”)

as a Borrower. Elkay and its domestic subsidiaries also granted security interests in substantially all of their personal property assets

to secure the obligations under the Credit Agreement pursuant to that certain Supplement No. 1 dated as of July 1, 2022 to the Third

Amended and Restated Guarantee and Collateral Agreement dated as of October 4, 2021 and

certain other collateral documents.

The foregoing description of the Amendment is

qualified in its entirety by reference to the full text of the Amendment, a copy of which is filed as Exhibit 10.2 hereto, and incorporated

herein by reference.

| Item 2.01 | Completion of Acquisition or Disposition

of Assets. |

On July 1, 2022, in accordance with the terms and

conditions of the Merger Agreement, the Company completed the Merger. As permitted by Item 9.01(a)(3) of Form 8-K, the financial statements

required by this Item will be filed by amendment to this Current Report on Form 8-K within 71 days following the date on which this Current

Report on Form 8-K is required to be filed.

The foregoing description of the Merger is qualified

in its entirety by reference to the Merger Agreement, a copy of which is included as Exhibit 2.1 hereto, and incorporated herein by reference.

| Item 5.02 | Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers. |

Director Appointments

As previously announced, upon the effective time

of the Merger (the “Effective Time”), and in accordance with the terms and conditions of the Merger Agreement, each of Errol

R. Halperin and Timothy Jahnke were appointed to the Board of the Directors of the Company (the “Board”) to serve until the

end of their respective terms and until their successors are elected and qualified. As of the Effective Time, the Company increased the

size of its Board to eleven members.

Other than the Merger Agreement, there are no

arrangements or understandings between Mr. Halperin and Mr. Jahnke and any other person pursuant to which such person was selected to

serve on the Board. Neither Mr. Halperin nor Mr. Jahnke has any family relationship (within the meaning of Item 401(d) of Regulation

S-K) with any director or executive officer of Zurn. There are no transactions in which Zurn is or was a participant and in which Mr.

Halperin and Mr. Jahnke or any of their immediate family members (within the meaning of Item 404 of Regulation S-K) had or will have

a direct or indirect material interest subject to disclosure under Item 404(a) of Regulation S-K.

Adoption of the Amendment to the Performance

Incentive Plan

On April 4, 2022, the Board approved an amendment

to the Zurn Elkay Water Solutions Corporation Performance Incentive Plan (as amended and restated, the “Plan”) to increase

the number of shares of Zurn’s Common Stock, par value $0.01 per share, issuable under the Plan (including the number of shares

issuable upon the exercise of incentive stock options) by 1,500,000 shares and to make corresponding changes to certain share limitations

under the Plan. The Plan was approved by the Company’s stockholders at a special meeting of its stockholders on May 26, 2022, and

became effective upon the closing of the Merger.

A complete copy of the Plan is filed herewith

as Exhibit 10.3 and incorporated herein by reference. The above summary of the Plan does not purport to be complete and is qualified

in its entirety by reference to such exhibit.

| Item 5.03 | Amendments to Articles of Incorporation

or Bylaws; Change in Fiscal Year. |

Change of Name

Effective as of July 1, 2022, the Board approved

(i) an amendment to the Company’s certificate of incorporation (the “Charter”) changing the Company’s name from

“Zurn Water Solutions Corporation” to “Zurn Elkay Water Solutions Corporation”, and (ii) an amendment and restatement

of the Company’s by-laws (the “By-Laws”) to reflect the new name of the Company. Copies of the Charter and By-Laws

are filed as Exhibit 3.1 and Exhibit 3.2, respectively, hereto and are incorporated herein by reference.

Press Release

On July 1, 2022, the Company issued a press release

announcing the consummation of the Merger. A copy of the press release is furnished as Exhibit 99.1 hereto and is incorporated herein

by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Exhibit No. |

|

Description |

| |

|

|

| 2.1* |

|

Agreement and Plan of Merger, dated

as of February 12, 2022, by and among Zurn, Elkay, Merger Sub, and Elkay Interior Systems International, Inc. (incorporated by reference

to Exhibit 2.1 to the Current Report on Form 8-K filed by Zurn Water Solutions Corporation on February 14, 2022) |

| 3.1 |

|

Certificate of Amendment to the Amended and Restated Certificate of

Incorporation of the Company, as amended through July 1, 2022 |

| 3.2 |

|

Amended and Restated By-Laws of the Company, as amended through July 1, 2022 |

| 10.1* |

|

Registration Rights Agreement, dated as of July 1, 2022, by and between Zurn and certain stockholders

of Elkay party thereto (includes amendments to the Standstill and Lock-Up Agreements, dated as of February 12, 2022, between the

Company and certain former stockholders of Elkay) |

| 10.2 |

|

Amendment No. 1 to Fourth Amended and Restated

First Lien Credit Agreement, dated as of July 1, 2022, by and between ZBS Global, Inc., Zurn Holdings, Inc., Zurn LLC, Elkay

and the other loan parties party thereto |

| 10.3 |

|

Zurn Elkay Water Solutions Corporation Performance Incentive Plan (as amended and restated) |

| 99.1 |

|

Press Release of the Company, dated as of July 1, 2022 |

| 104 |

|

Cover Page Inline XBRL data |

*Schedules and exhibits to this Exhibit have

been omitted in accordance with Regulation S-K Items 601(a)(5) and/or 601(b)(2). The Registrant agrees to furnish supplementally a copy

of all omitted schedules to the Securities and Exchange Commission on a confidential basis upon request.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, Zurn Elkay Water Solutions Corporation has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized this 1st day of July, 2022.

| |

ZURN ELKAY WATER SOLUTIONS CORPORATION |

| |

|

| |

By: |

/s/ Todd A. Adams |

| |

Name: |

Todd A. Adams |

| |

Title: |

Chair of the Board and Chief Executive Officer |

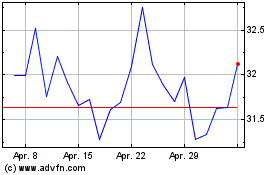

Zurn Elkay Water Solutions (NYSE:ZWS)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

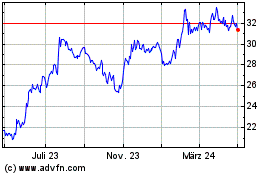

Zurn Elkay Water Solutions (NYSE:ZWS)

Historical Stock Chart

Von Apr 2023 bis Apr 2024