UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

(Mark One) | | | | | |

| x | ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2021

OR

| | | | | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from_________ to_________

Commission file number 001-35475

| | | | | |

| A. | Full title of the plan and the address of the plan, if different from that of the issuer named below: |

Zurn 401(k) Plan

| | | | | |

| B. | Name of issuer of the securities held pursuant to the plan and the address of its principal executive office: |

Zurn Water Solutions Corporation

511 West Freshwater Way

Milwaukee, WI 53204

* Other supplemental schedules required by Section 2520.103-10 of the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 have been omitted because they are not applicable.

Report Of Independent

Registered Public Accounting Firm

Benefits Committee of Zurn Water Solutions Corporation and

Plan Participants of Zurn 401(k) Plan

Milwaukee, Wisconsin

Opinion On The Financial Statements

We have audited the accompanying statements of net assets available for benefits of Zurn 401(k) Plan (the Plan) as of December 31, 2021 and 2020, and the related statement of changes in net assets available for benefits for the year ended December 31, 2021, and the related notes (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2021 and 2020, and the changes in net assets available for benefits for the year ended December 31, 2021, in conformity with accounting principles generally accepted in the United States of America.

Basis For Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental information in the accompanying schedule of assets (held at end of year) as of December 31, 2021 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ RubinBrown LLP

We have served as the Plan's auditor since 2008.

Kansas City, Missouri

June 21, 2022

Zurn 401(k) Plan

Statements of Net Assets Available for Benefits

| | | | | | | | | | | | | | |

| | December 31, |

| | 2021 | | 2020 |

| Assets | | | | |

| Investments at fair value: | | | | |

| Mutual funds | | $ | 230,346,707 | | | $ | 445,750,611 | |

| Common/collective trust | | 28,272,274 | | | 46,494,684 | |

| Zurn Stock Fund | | 4,768,236 | | | 7,478,195 | |

| Regal Rexnord Stock Fund | | 3,917,329 | | | — | |

| Investments at fair value | | 267,304,546 | | | 499,723,490 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Receivables: | | | | |

| Notes receivable from participants | | 1,801,968 | | | 8,570,552 | |

| | | | |

| | | | |

| Total receivables | | 1,801,968 | | | 8,570,552 | |

| Net assets available for benefits | | $ | 269,106,514 | | | $ | 508,294,042 | |

The accompanying notes are an integral part of these financial statements.

Zurn 401(k) Plan

Statement of Changes in Net Assets Available for Benefits

For the Year Ended December 31, 2021

| | | | | | | | |

| Additions to net assets attributed to: | | |

| Contributions: | | |

| Employer | | $ | 5,966,415 | |

| Participants | | 17,739,919 | |

| Rollovers | | 3,089,094 | |

| Total contributions | | 26,795,428 | |

| | |

| Deductions from net assets attributed to: | | |

| Benefits paid to participants | | 113,508,757 | |

| Administrative fees | | 603,259 | |

| | |

| Total deductions | | 114,112,016 | |

| | |

| Investment income: | | |

| Interest and dividends | | 1,225,127 | |

| Net appreciation in fair value of investments | | 67,913,494 | |

| Investment income | | 69,138,621 | |

| | |

| Interest income on notes receivable from participants | | 319,044 | |

| Decrease in net assets available for benefits before conversion out | | (17,858,923) | |

| | |

| Conversion out (Note 1) | | (221,328,605) | |

| | |

| Net decrease in net assets available for benefits after conversion out | | (239,187,528) | |

| | |

| Net assets available for benefits - beginning of year | | 508,294,042 | |

| | |

| Net assets available for benefits - end of year | | $ | 269,106,514 | |

The accompanying notes are an integral part of these financial statements.

Zurn 401(k) Plan

Notes to Financial Statements

December 31, 2021 and 2020

1. Description of the Plan

The following description of the Zurn 401(k) Plan, formerly known as the Rexnord LLC 401(k) Plan, (the "Plan") provides only general information. Participants should refer to the Plan Document for more complete information.

On October 4, 2021, Zurn Water Solutions Corporation (formerly known as Rexnord Corporation) (the "Company" or "Zurn") completed a Reverse Morris Trust ("RMT") tax-free spin-off transaction (the “Spin-off Transaction”) in which (i) substantially all the assets and liabilities of the Company's Process & Motion Control business were transferred to a newly created subsidiary, Land Newco, Inc. (“Land”), (ii) the shares of Land were distributed to Zurn Water Solutions Corporation stockholders pro rata, and (iii) Land was merged with a subsidiary of Regal Rexnord Corporation (formerly known as Regal Beloit Corporation) ("Regal Rexnord"), in which the stock of Land was converted into a certain number of shares of Regal Rexnord in accordance with the exchange ratio. Following completion of the Spin-Off Transaction, the Company changed its name to “Zurn Water Solutions Corporation” and the ticker symbol for the Company's shares of common stock trading on the New York Stock Exchange was changed to “ZWS”. In connection with the Spin-Off Transaction, the Company transferred certain employees and benefit plans to Regal Rexnord. Net assets within the Plan associated with employees transferred to Regal Rexnord is reflected as a Conversion out within the statement of changes in net assets available for benefits.

General

The Plan is a defined contribution deferral savings plan administered by the Zurn Water Solutions Corporation Benefits Committee and covers substantially all nonunion employees and a portion of union employees of the Company and its affiliates as defined in the Plan Document.

The Plan is primarily intended to assist employees in supplementing their retirement income by providing a tax-deferred savings vehicle. A participant is eligible to participate in the Plan after 30 days of service. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended ("ERISA"). As of April 20, 2021, the Plan’s trustee and record keeper is Principal Financial Services, Inc. (the "Trustee" or "Principal"). Prior to April 20, 2021, the Plan's trustee and record keeper was Wells Fargo Bank, N.A. ("Wells Fargo").

Contributions

Participants may elect to defer from 1% to 75% of their annual compensation to the Plan limited to the maximum contribution amount as defined by the Internal Revenue Service ("IRS"). As permitted by Section 401(k) of the Internal Revenue Code ("IRC"), the amounts contributed are not taxable until paid out by the Plan. Participants who have attained age 50 before the close of the Plan year may make catch up contributions to the Plan. Participants may also contribute amounts representing distributions from other qualified defined benefit or defined contribution plans ("rollover").

Participants may elect to defer from 1% to 75% of their annual compensation for the Roth 401(k) contribution to the Plan, limited to the maximum contribution amount as defined by the IRS. Participants making Roth 401(k) contributions who have attained the age of 50 are also eligible to make catch-up Roth 401(k) contributions to the Plan. Participants may also contribute amounts representing distributions from other qualified Roth 401(k) plans. A participant's compensation associated with a Roth 401(k) contribution is subjected to federal income taxes in the year of contribution, but the contribution and, in most cases, the earnings on the contribution are not subject to federal income taxes when distributed in accordance with IRS requirements.

All employees that become eligible for the Plan are subject to automatic enrollment. The salary deferral rate at automatic enrollment is set at a 8% pre-tax contribution rate with an auto-escalation feature that increases contributions 1% annually on the enrollment anniversary date each year until the contribution percentage reaches 10%. An employee can change the deferral rate made through automatic enrollment by electing a different percentage, the employee can affirmatively elect not to participate in the Plan or can elect to contribute on an after-tax Roth 401(k) basis. Participants may, at any time, change their contribution percentage or suspend any future deductions from their pay. The auto-escalation feature is available to all participants, even if they were not automatically enrolled. The automatic salary deferral will be invested in a fund allocation based on the employee’s age, unless otherwise directed by the employee.

Zurn matches employee contributions at 50% of the first 8% of eligible wages. Catch-up contributions are not matched by the Company. Participants’ contributions and Company matching contributions are deposited into participant accounts. The Company matching contributions shall be allocated on a calendar quarter basis in the form of Company stock.

Notes to Financial Statements (continued)

Vesting

Participants are immediately vested in their contributions plus actual earnings thereon. The value of Company contributions vests at the earlier to occur of disability, death, attainment of age 65, or three years of service, with some exceptions for certain merged plans. If a participant terminates employment before becoming vested, the value of Company contributions to their account is forfeited.

Participant Accounts

Individual accounts are maintained for each Plan participant. Each participant’s account is credited with the participant’s contributions, allocations of Company matching and discretionary contributions, and Plan earnings, and charged with withdrawals and an allocation of Plan losses and administrative expenses. Allocations are based on participant compensation or account balances, as defined in the Plan. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

Investment Options

Upon enrollment in the Plan, a participant may direct contributions in various investment options maintained by the Trustee. As of December 31, 2021, the Plan offers participants the option to invest their contributions in the following types of investments: mutual funds (24 offered), a common/collective trust (1 offered), and the Zurn Stock Fund (1 offered). Participants may change their investment options with the Trustee at their discretion. Portfolio investment allocation elections by participants can be up to 100% of any investment option except the Zurn Stock Fund, which is restricted to a maximum portfolio investment allocation of 20%. All participants must comply with insider trading laws and the Company’s policies, including its insider trading policy, when making any transactions in the Zurn Stock Fund.

As a result of the Spin-Off Transaction, the former Rexnord Stock Fund split into the Zurn Stock Fund and Regal Rexnord Stock Fund. Participants can decrease, but not increase investment allocation in the Regal Rexnord Stock Fund. The Regal Rexnord Stock Fund will be removed as an investment option on June 30, 2022.

Payment of Benefits

The account balance, to the extent it is vested, will be paid upon request to participants who have retired, become disabled, or otherwise left the Company, or to the beneficiaries of deceased participants.

Upon termination of service, death, disability or retirement, a participant may elect to receive either a lump sum amount equal to the value of the participant’s vested interest in his or her account, or annual installments up to a 15-year period.

The Plan will distribute a participant’s entire account balance to any participant (or to such participant’s beneficiary in the case of death) who has an account balance less than $1,000 following their termination of employment or death. If the participant’s account balance is between $1,000 and $5,000 following their termination of employment or death, the Plan will automatically rollover a participant’s entire account balance to a designated third-party individual retirement plan provider. Distribution or automatic rollovers of small account balances will occur before the end of the second Plan year following the Plan year during which the participant ceases to participate in the Plan.

Participant Hardship Withdrawals

A participant may withdraw all or a portion of their contributions subject to certain hardship withdrawal provisions.

Forfeited Accounts

As of December 31, 2021 and 2020, there were approximately $269,194 and $413,217, respectively, of unallocated forfeited accounts. Forfeited accounts are used to reduce future Company contributions. During the year ended December 31, 2021, $941,575 of forfeitures were used to reduce Company contributions. Subsequent to year end, $162,560 of forfeitures were utilized to fund contributions related to 2021.

Notes Receivable from Participants

Participants may borrow from their accounts up to a maximum of $50,000 or 50% of their vested account balance, whichever is less. The loans are secured by the balance in the participant’s account and bear interest at rates commensurate with local prevailing rates at the time funds are borrowed as determined quarterly by the Plan Administrator. At December 31, 2021, outstanding loans bore interest at rates ranging from 4.25% to 9.25%. Principal and interest are paid ratably through payroll deductions, with maturity dates through June 2035.

Notes to Financial Statements (continued)

Administrative Expenses

Plan administrative expenses are paid by the Company or the Plan, at the Company’s discretion. Administrative expenses paid from plan assets totaled $603,259 for the year ended December 31, 2021.

Plan Termination

Although it has not expressed any intention to do so, the Company has the right to terminate the Plan, subject to the provisions set forth in ERISA. If the Plan is terminated, Plan assets will be distributed to the participants based on the individual participant’s interest in the Plan. In the event the Plan is terminated, all participants at the time of termination, would become 100% vested in their accounts.

Due to the result of the Spin-Off Transaction, a partial plan termination occurred during 2021. All affected participants immediately became 100% vested.

2. Summary of Significant Accounting Policies

Basis of Accounting

The accompanying financial statements have been prepared on the accrual basis of accounting.

Estimates and Assumptions

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of additions to and deductions from net assets during the reporting period. Actual results could differ from those estimates.

Payment of Benefits

Benefit payments to participants are recorded when paid.

Valuation of Investments and Income Recognition

The Plan’s investments are stated at fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. See Note 3 for discussion of fair value measurements.

Investment income is recorded as earned on the accrual basis. Purchases and sales of securities are recorded on a trade-date basis. Dividends are recorded on the ex-dividend date. Net appreciation represents the difference between the aggregate fair value of investments at the end of the year and the values at the beginning of the year, and includes any realized gains and losses and unrealized appreciation or depreciation on those investments.

Certain management fees and operating expenses charged to the Plan for investments are deducted from income earned on a daily basis and are not separately reflected. Consequently, these management fees and operating expenses are reflected as a reduction of net appreciation in the fair value of investments on the Statement of Changes in Net Assets Available for Benefits.

Notes Receivable from Participants

Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Delinquent notes receivable from participants are recorded as a distribution in accordance with the terms of the Plan Document.

Risks and Uncertainties

The Plan invests in various investment securities. Investments, in general, are exposed to various risks, such as interest rate changes, credit risks and overall market volatility. Due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the value of investments will occur in the near term and that such change could materially affect participants’ account balances and the amounts reported in the financial statements.

Notes to Financial Statements (continued)

3. Fair Value Measurements

Accounting Standards Codification 820, Fair Value Measurements and Disclosures ("ASC 820"), defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants. ASC 820 also specifies a fair value hierarchy based upon the observability of inputs used in valuation techniques. Observable inputs (highest level) reflect market data obtained from independent sources, while unobservable inputs (lowest level) reflect internally developed assumptions about the assumptions a market participant would use.

In accordance with ASC 820, fair value measurements are classified under the following hierarchy:

Level 1 Quoted prices for identical instruments in active markets.

Level 2 Quoted prices for similar instruments; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs or significant value-drivers are observable.

Level 3 Model-derived valuations in which one or more inputs or value-drivers are both significant to the fair value measurement and unobservable.

If applicable, the Plan uses quoted market prices in active markets to determine fair value, and therefore classifies such measurements within Level 1. Where market prices are not available, the Plan makes use of observable market based inputs to calculate fair value, in which case the measurements are classified within Level 2. If quoted or observable market prices are not available, fair value is based upon internally developed models that use, where possible, current market-based parameters. These measurements are classified within Level 3 if they use significant unobservable inputs.

A description of the valuation methodologies used for assets measured at fair value is as follows:

•Mutual funds - Valued at the daily closing price as reported by the fund. Mutual funds held by the Plan are open-end mutual funds that are registered with the Securities and Exchange Commission. These funds are required to publish their daily net asset value ("NAV") and to transact at that price. The mutual funds held by the Plan are deemed to be actively traded.

•Common/collective trust - Valued at the NAV of units of the common/collective trust. The NAV, as provided by the trustee, is used as a practical expedient to estimate fair value. The NAV is based on the fair value of the underlying investments held by the fund less its liabilities. This practical expedient is not used when it is determined to be probable that the fund will sell the investment for an amount different than the reported NAV. Participant transactions (purchases and sales) may occur daily. Were the Plan to initiate a full redemption of the common/collective trust fund, the investment advisor reserves the right to temporarily delay withdrawal from the trust in order to ensure that securities liquidations will be carried out in an orderly business manner. A full redemption of the Plan’s interest in the Wells Fargo Stable Return Fund N requires a 12-month notice period. The common/collective trust held by the Plan files an annual return on Form 5500 as a direct filing entity.

•Zurn Stock Fund - The Zurn Stock Fund (the Fund) consists of the Company’s common stock and short-term cash, which provides liquidity for daily trading. The Company’s common stock is valued at the quoted market price from a national securities exchange and the short-term cash investments are held in a money market mutual fund and are valued at fair value based on the NAV per share. A market-based NAV per share is calculated for the Fund periodically, and is the basis for participant transactions. The Fund is valued using the calculated NAV as a practical expedient to estimate fair value.

•Regal Rexnord Stock Fund - The Regal Rexnord Stock Fund consists of Regal Rexnord common stock and short-term cash, which provides liquidity for daily trading. Regal Rexnord’s common stock is valued at the quoted market price from a national securities exchange and the short-term cash investments are held in a money market mutual fund and are valued at fair value based on the NAV per share. A market-based NAV per share is calculated for the Regal Rexnord Stock Fund periodically, and is the basis for participant transactions. The Regal Rexnord Stock Fund is valued using the calculated NAV as a practical expedient to estimate fair value.

Notes to Financial Statements (continued)

The methods described above may produce fair value calculations that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

There have been no changes to the methodologies used at December 31, 2021 or 2020.

The following table sets forth by level, within the fair value hierarchy, the Plan’s assets at fair value as of December 31, 2021:

| | | | | | | | | | | | | | | | | | | | | | | |

| Level 1 | | Level 2 | | Level 3 | | Total |

| Mutual funds | $ | 230,346,707 | | | $ | — | | | $ | — | | | $ | 230,346,707 | |

| Common/collective trust (a) | | | | | | | 28,272,274 | |

| Regal Rexnord Stock Fund (a) | | | | | | | 3,917,329 | |

| Zurn Stock Fund (a) | | | | | | | 4,768,236 | |

| | | | | | | $ | 267,304,546 | |

The following table sets forth by level, within the fair value hierarchy, the Plan’s assets at fair value as of December 31, 2020:

| | | | | | | | | | | | | | | | | | | | | | | |

| Level 1 | | Level 2 | | Level 3 | | Total |

| Mutual funds | $ | 445,750,611 | | | $ | — | | | $ | — | | | $ | 445,750,611 | |

| Common/collective trust (a) | | | | | | | 46,494,684 | |

| Zurn Stock Fund (a) | | | | | | | 7,478,195 | |

| | | | | | | $ | 499,723,490 | |

(a) Certain investments that are measured at fair value using the NAV per share (or its equivalent) practical expedient have not been categorized in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the statements of net assets available for benefits.

4. Related Party Transactions and Party In Interest Transactions

Certain Plan investments are shares of a mutual fund or a common/collective trust managed by the Trustee. In addition, at December 31, 2021 and 2020, Plan investments include 424,368 and 181,982 shares of common stock of Zurn, respectively, the Plan's sponsor. The fair value of these shares was $4,768,236 and $7,186,469, at December 31, 2021 and 2020, respectively. These transactions qualify as party in interest transactions but are exempt from the prohibited transactions regulations under ERISA.

5. Income Tax Status

The IRS has determined and informed the Company by a letter dated October 14, 2014 that the Plan, as then designed, and the related trust satisfy the applicable provisions of the IRC. The Plan has been amended since the date of the opinion letter; however, the Company and the Plan Administrator believe that the Plan and related trust are currently designed and being operated in compliance with the applicable requirements of the IRC and therefore no provision for income taxes has been included in the Plan financial statements.

The Plan's management has reviewed the Plan's tax exempt status and analyzed the tax positions taken by the Plan and has concluded that as of December 31, 2021 and 2020, there are no uncertain tax positions taken or expected to be taken that would require recognition or disclosure in the financial statements during the years ended December 31, 2021 and 2020, respectively. There are currently no audits specific to the Plan for any tax periods in progress from any taxing authorities.

Notes to Financial Statements (continued)

6. Reconciliation of Financial Statements to Form 5500

The following is a reconciliation of net assets available for benefits per the financial statements to Form 5500 for the years ended December 31, 2021 and 2020: | | | | | | | | | | | | | | |

| | 2021 | | 2020 |

| Net assets available for benefits per the financial statements | | $ | 269,106,514 | | | $ | 508,294,042 | |

| Adjustment for deemed distributed loans | | (51,508) | | | (92,597) | |

| Adjustment for other | | (25,057) | | | — | |

| Net assets available for benefits per Form 5500 | | $ | 269,029,949 | | | $ | 508,201,445 | |

The following is a reconciliation of the decrease in net assets after the conversion out per the financial statements to Form 5500 for the year ended December 31, 2021:

| | | | | | | | |

| | 2021 |

| | |

| Decrease in net assets available for benefits after conversion out per the financial statements | | $ | (239,187,528) | |

| Adjustment for net change in deemed distributed loans | | 41,089 | |

| Adjustment for other | | (25,057) | |

| Net loss per Form 5500 | | $ | (239,171,496) | |

7. Subsequent Events

On February 12, 2022, the Company entered into a definitive agreement to combine with Elkay Manufacturing Company (“Elkay”), pursuant to an Agreement and Plan of Merger (the “Merger Agreement”) by and among Zurn, Elkay, Zebra Merger Sub, Inc., a wholly-owned subsidiary of Zurn (“Merger Sub”), and Elkay Interior Systems International, Inc., as representative of the stockholders of Elkay. The Merger Agreement provides that among other matters, and subject to the satisfaction or waiver of the conditions set forth in the Merger Agreement, Elkay would merge with Merger Sub, with Elkay surviving as a wholly-owned subsidiary of Zurn (the “Merger”). The Company anticipates the Merger will close very early in the third quarter of 2022.

Zurn 401(k) Plan

EIN: 04-3722228 PLAN NUMBER: 006

Schedule H, Line 4i - SCHEDULE OF ASSETS HELD (AT END OF YEAR)

December 31, 2021 | | | | | | | | | | | | | | | | | |

| Identity Of Issuer, Borrower, | | | | Current |

| Lessor Or Similar Party | Description Of Investment | Shares | Cost** | Value |

| | | | | |

| Aim Invt Secs Fds Invesco In Glbl Rel Es R6 | Mutual Fund | 59,536 | | $ | 756,103 | |

| Allspring Emerging Growth Fund | Mutual Fund | 195,821 | | 3,133,131 | |

| DFA Commodity Strategy | Mutual Fund | 351,520 | | 1,662,688 | |

| DFA Global Real Estate Securities | Mutual Fund | 216,466 | | 2,911,467 | |

| EuroPacific Growth Fund | Mutual Fund | 32,487 | | 2,102,884 | |

| Goldman Sachs Small Cap Value Fund | Mutual Fund | 49,039 | | 2,837,368 | |

| Invesco Developing Markets Fund | Mutual Fund | 26,868 | | 1,262,777 | |

| Pear Tree Polaris Foreign Value Fund | Mutual Fund | 30,520 | | 369,297 | |

| PGIM High Yield Fund | Mutual Fund | 318,179 | | 1,746,805 | |

| PGIM Total Return Bond Fund | Mutual Fund | 140,768 | | 2,039,723 | |

| PIMCO CommodityRealReturn Strategy Fund | Mutual Fund | 38,858 | | 246,747 | |

| Regal Rexnord Stock Fund | Company Stock Fund | 337,461 | | 3,917,329 | |

| T Rowe Price Blue Chip Growth Fund Inc | Mutual Fund | 82,667 | | 14,733,718 | |

| T Rowe Price International Discovery Fund | Mutual Fund | 11,622 | | 979,247 | |

| Vanguard Equity Income Fund | Mutual Fund | 63,427 | | 5,849,209 | |

| Vanguard Extended Market Index Fund | Mutual Fund | 38,223 | | 5,301,176 | |

| Vanguard High Yield Corporate Fund | Mutual Fund | 929,188 | | 5,528,666 | |

| Vanguard Inflation - Protected | Mutual Fund | 512,308 | | 5,937,653 | |

| Vanguard Institutional Index Fund | Mutual Fund | 26,593 | | 10,791,270 | |

| Vanguard Total Bond Market Index | Mutual Fund | 2,847,355 | | 31,861,902 | |

| Vanguard Total Bond Market Index Fund | Mutual Fund | 123,311 | | 1,379,848 | |

| Vanguard Total International Bond | Mutual Fund | 109,130 | | 3,612,193 | |

| Vanguard Total International Stock | Mutual Fund | 290,283 | | 39,676,910 | |

| Vanguard Total International Stock Index Fund | Mutual Fund | 12,575 | | 1,719,932 | |

| Vanguard Total Stock Market Index | Mutual Fund | 380,430 | | 83,880,936 | |

| * | Wells Fargo Stable Return Fund | Common/Collective Trust | 472,296 | | 28,272,274 | |

| * | Zurn Stock Fund | Company Stock Fund | 424,368 | | 4,768,236 | |

| | | | | |

| | | | | 267,279,489 | |

| | | | | |

| * | Participant Loans | Participant loans with interest rates between 4.25% and 9.25% and with maturity dates through June 2035 | | | 1,750,460 | |

| | | | | |

| | | | | $ | 269,029,949 | |

| | | | | |

| * | Represents a party in interest as defined by ERISA. | | | |

| ** | Cost information was omitted for Plan assets that are participant directed. | | | |

| | | | | |

| The above information is a required disclosure for Form 5500, Schedule H, Part IV, line 4i. | | | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees of the Zurn 401(k) Plan (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| |

Zurn 401(k) Plan | |

| |

| By: | /s/ Jennifer Marifke |

| Name: | Jennifer Marifke | |

| Title: | Director of Total Rewards | |

Date: June 21, 2022

Zurn Water Solutions Corporation

Exhibit List to Form 11-K

| | | | | | | | |

| Exhibit No. | | Description |

| 23.1 | | |

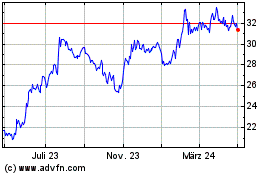

Zurn Elkay Water Solutions (NYSE:ZWS)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

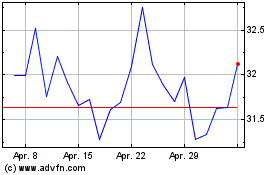

Zurn Elkay Water Solutions (NYSE:ZWS)

Historical Stock Chart

Von Apr 2023 bis Apr 2024