UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 20, 2022

ZURN WATER

SOLUTIONS CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-35475 |

|

20-5197013 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

511 W. Freshwater Way

Milwaukee, Wisconsin |

|

53204 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (855) 480-5050

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock $.01 par value |

|

ZWS |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

EXPLANATORY NOTE

As previously disclosed, on February 12, 2022, Zurn Water Solutions

Corporation (“Zurn” or the “Company”) entered into a definitive agreement to combine with Elkay Manufacturing

Company (“Elkay”), pursuant to an Agreement and Plan of Merger (the “Merger Agreement”) by and among Zurn, Elkay,

Zebra Merger Sub, Inc., a wholly-owned subsidiary of Zurn (“Merger Sub”), and Elkay Interior Systems International, Inc.,

as representative of the stockholders of Elkay. The Merger Agreement provides that among other matters, and subject to the satisfaction

or waiver of the conditions set forth in the Merger Agreement, Elkay would merge with Merger Sub, with Elkay surviving as a wholly-owned

subsidiary of Zurn (the “Merger”).

On April 26, 2022, Zurn filed a proxy statement/prospectus/consent

solicitation statement (the “Proxy Statement”) with the U.S. Securities and Exchange Commission.

Item 8.01 Other Events.

Three complaints have been filed alleging

that the Proxy Statement is materially deficient and omits and/or misrepresents material information: two filed in the United States District

Court for the Eastern District of New York, and one filed in the United States District Court for the Eastern District of Pennsylvania

(together, the “Complaints”).

The Company denies that it has violated any

laws and believes that the claims asserted in these Complaints are without merit. The Company believes that the Proxy Statement contains

all material information required to be disclosed and that no supplemental disclosure is required to the Proxy Statement under any applicable

law, rule or regulation. Nevertheless, solely to avoid the possibility of delays to the closing of the Merger, and to eliminate the

burden and expense of possible litigation, the Company has decided to make the following supplemental disclosures. Nothing in this Form 8-K

shall be deemed an admission of the legal necessity or materiality under applicable laws of any of the disclosures set forth herein.

SUPPLEMENT TO PROXY

STATEMENT

This supplemental information should be

read in conjunction with the Proxy Statement, which should be read in its entirety. Page references in the below disclosures are

to pages in the Proxy Statement, and defined terms used but not defined herein have the meanings set forth in the Proxy Statement.

To the extent the following information differs from or conflicts with the information contained in the Proxy Statement, the information

set forth below shall be deemed to supersede the respective information in the Proxy Statement. The Company denies any alleged violations

of law or any legal or equitable duty. Without admitting in any way and expressly denying that the disclosures below are material or otherwise

required by law, the Company makes the following supplemental disclosure solely for the purpose of mooting any alleged disclosure issues

asserted in the Complaints.

The text on pages 56 and 57 of the Proxy Statement under the

heading “Elkay” is revised as follows:

Elkay

Evercore reviewed and compared certain financial

information of Elkay to corresponding financial multiples and ratios for the following selected publicly traded companies in the water

products and plumbing industries (referred to as the “Selected Companies (Elkay)”):

| · | Watts Water Technologies Inc. |

| · | Zurn Water Solutions Corporation |

For each of the Selected Companies (Elkay) and

Elkay, Evercore calculated:

| · | total enterprise value (defined as fully diluted equity market capitalization plus total debt plus after-tax underfunded pension obligation

plus non-controlling interest, less cash and cash equivalents) as a multiple of estimated calendar year 2022 Adjusted EBITDA (defined

as earnings before interest, taxes, depreciation and amortization burdened by stock-based compensation) (referred to as “TEV / 2022E

EBITDA”) based on FactSet consensus estimates; and |

| · | total enterprise value (defined as fully diluted equity market capitalization plus total debt plus after-tax underfunded pension obligation

plus non-controlling interest, less cash and cash equivalents) as a multiple of estimated calendar year 2023 Adjusted EBITDA (defined

as earnings before interest, taxes, depreciation and amortization burdened by stock-based compensation) (referred to as “TEV / 2023E

EBITDA”) based on FactSet consensus estimates;. |

This analysis indicated the following:

| Company | |

TEV / 2022E

EBITDA | | |

TEV / 2023E

EBITDA | |

| A.O. Smith Corporation | |

14.1x | | |

13.3x | |

| Hayward Holdings, Inc. | |

11.8x | | |

11.5x | |

| Pentair plc | |

13.7x | | |

12.9x | |

| Watts Water Technologies Inc. | |

16.3x | | |

15.3x | |

| Zurn Water Solutions Corporation (Consensus) | |

20.2x | | |

17.9x | |

| | |

| |

| | |

| 2022E |

| | |

| 2023E |

| |

| TEV / 2022E | | |

| TEV / 2023E | |

| Company | |

| TEV |

| | |

| EBITDA |

| | |

| EBITDA |

| |

| EBITDA | | |

| EBITDA | |

| A.O. Smith Corporation | |

$ | 11,580 |

| | |

$ | 823 |

| | |

$ | 872 |

| |

| 14.1x | | |

| 13.3x | |

| Hayward Holdings, Inc. | |

$ | 5,424 |

| | |

$ | 461 |

| | |

$ | 473 |

| |

| 11.8x | | |

| 11.5x | |

| Pentair plc | |

$ | 11,315 |

| | |

$ | 826 |

| | |

$ | 876 |

| |

| 13.7x | | |

| 12.9x | |

| Watts Water Technologies Inc. | |

$ | 5,210 |

| | |

$ | 321 |

| | |

$ | 341 |

| |

| 16.3x | | |

| 15.3x | |

| Zurn Water Solutions Corporation (Consensus) | |

$ | 4,589 |

| | |

$ | 228 |

| | |

$ | 256 |

| |

| 20.2x | | |

| 17.9x | |

| Metric | |

Median | |

| TEV / 2022E EBITDA | |

| 14.1x | |

| TEV / 2023E EBITDA | |

| 13.3x | |

The text on pages 57 and 58 of the Proxy Statement under the

heading “Zurn” is revised as follows:

Zurn

Evercore reviewed and compared certain financial

information of Zurn to corresponding financial multiples and ratios for the following selected publicly traded companies in the water

products and solutions industry (referred to as the “Selected Companies (Zurn)”):

| · | Evoqua Water Technologies Corp. |

| · | Watts Water Technologies Inc. |

For each of the Selected Companies (Zurn) and

Zurn, Evercore calculated:

| · | total enterprise value (defined as fully diluted equity market capitalization plus total debt plus after-tax underfunded pension obligation

plus non-controlling interest, less cash and cash equivalents) as a multiple of estimated calendar year 2022 Adjusted EBITDA (defined

as earnings before interest, taxes, depreciation and amortization burdened by stock-based compensation) (referred to as “TEV / 2022E

EBITDA”) based on FactSet consensus estimates; and |

| · | total enterprise value (defined as fully diluted equity market capitalization plus total debt plus after-tax underfunded pension obligation

plus non-controlling interest, less cash and cash equivalents) as a multiple of estimated calendar year 2023 Adjusted EBITDA (defined

as earnings before interest, taxes, depreciation and amortization burdened by stock-based compensation) (referred to as “TEV / 2023E

EBITDA”) based on FactSet consensus estimates;. |

This analysis indicated the following:

| Company | |

TEV / 2022E

EBITDA | | |

TEV / 2023E

EBITDA | |

| A.O. Smith Corporation | |

| 14.1x | | |

| 13.3x | |

| Badger Meter Inc. | |

| 26.0x | | |

| 24.3x | |

| Evoqua Water Technologies Corp. | |

| 22.3x | | |

| 20.3x | |

| Pentair plc | |

| 13.7x | | |

| 12.9x | |

| Watts Water Technologies Inc. | |

| 16.3x | | |

| 15.3x | |

| Xylem Inc. | |

| 22.1x | | |

| 19.0x | |

| |

| |

| |

| | |

| 2022E |

| | |

| 2023E |

| |

TEV / 2022E |

|

TEV / 2023E |

| Company |

| |

| TEV |

| | |

| EBITDA |

| | |

| EBITDA |

| |

EBITDA |

|

EBITDA |

| A.O. Smith Corporation |

| |

$ | 11,580 |

| | |

$ | 823 |

| | |

$ | 872 |

| |

14.1x |

|

13.3x |

| Badger Meter Inc. |

| |

$ | 2,963 |

| | |

$ | 114 |

| | |

$ | 122 |

| |

26.0x |

|

24.3x |

| Evoqua Water Technologies Corp. |

| |

$ | 6,454 |

| | |

$ | 290 |

| | |

$ | 318 |

| |

22.3x |

|

20.3x |

| Pentair plc |

| |

$ | 11,315 |

| | |

$ | 826 |

| | |

$ | 876 |

| |

13.7x |

|

12.9x |

| Watts Water Technologies Inc. |

| |

$ | 5,210 |

| | |

$ | 321 |

| | |

$ | 341 |

| |

16.3x |

|

15.3x |

| Xylem Inc. |

| |

$ | 18,794 |

| | |

$ | 850 |

| | |

$ | 991 |

| |

22.1x |

|

19.0x |

| Metric | |

Median | |

Zurn

Management Forecasts | |

Zurn Analyst

Estimate Consensus |

| TEV / 2022E EBITDA | |

19.2x | |

19.6x | |

20.2x |

| TEV / 2023E EBITDA | |

17.1x | |

17.0x | |

17.9x |

The text on pages 59 and 60 of the Proxy Statement under the

heading “Elkay (Selected Precedent Transactions)” is revised as follows:

Elkay (Selected Precedent Transactions)

Evercore reviewed publicly available information

related to certain precedent acquisition transactions involving drinking water and plumbing targets in the preceding five years. Evercore

chose the precedent transactions it deemed to be relevant transactions in the drinking water and plumbing industries and excluded transactions

involving minority investments from its analysis. For each precedent transaction, Evercore calculated the total enterprise value as a

multiple of trailing twelve-month EBITDA (defined as earnings before interest, taxes, depreciation and amortization burdened by stock-based

compensation) (referred to as “LTM EBITDA” and such multiple referred to as “TEV / LTM EBITDA”). The precedent

transactions reviewed by Evercore had a median TEV / LTM EBITDA of 16.8x and an average TEV / LTM EBITDA of 17.5x. and

indicated the following (dollars in millions):

| Announcement Date | |

Acquiror | |

Target | |

TEV /

LTM EBITDA |

| May 25, 2021 | |

BDT Capital Partners, LLC | |

Culligan International | |

16.2x |

| January 13, 2020 | |

Cott Corporation | |

Primo Water Corporation(1) | |

17.4x |

| December 23, 2019 | |

Culligan International | |

Quench(2) | |

18.9x |

| August 20, 2018 | |

PepsiCo | |

SodaStream | |

24.7x |

| May 24, 2018 | |

Reliance Worldwide Corp. | |

John Guest Holdings | |

12.4x |

| July 4, 2017 | |

Culligan International | |

Zip Water | |

15.4x |

| Median | |

| |

| |

16.8x |

| Average | |

| |

| |

17.5x |

| Announcement Date | |

Acquiror | |

Target | |

TEV | | |

LTM

EBITDA | | |

TEV

/LTM EBITDA |

| May 25,

2021 | |

BDT

Capital Partners, LLC | |

Culligan

International | |

$ | 6,000 | | |

$ | 369 | | |

16.2x |

| January 13,

2020 | |

Cott

Corporation | |

Primo

Water Corporation(1) | |

$ | 798 | | |

$ | 46 | | |

17.4x |

| December 23,

2019 | |

Culligan

International | |

Quench(2) | |

$ | 612 | | |

$ | 32 | | |

18.9x |

| August 20,

2018 | |

PepsiCo | |

SodaStream | |

$ | 3,136 | | |

$ | 127 | | |

24.7x |

| May 24,

2018 | |

Reliance

Worldwide Corp. | |

John

Guest Holdings | |

$ | 919 | | |

$ | 74 | | |

12.4x |

| July 4,

2017 | |

Culligan

International | |

Zip

Water | |

$ | 550 | | |

$ | 36 | | |

15.4x |

| Median | |

| |

| |

| | | |

| | | |

16.8x |

| Average | |

| |

| |

| | | |

| | | |

17.5x |

| (1) | Derived based on publicly disclosed LTM Adjusted EBITDA less stock-based compensation. |

| (2) | The figure in this table represents the implied Quench transaction multiple only pro forma for Culligan’s subsequent sale of

Seven Seas Water. |

Based on the multiples it derived from the selected

transactions and based on its professional judgment and experience, Evercore selected a reference range of TEV / LTM EBITDA multiples

of 18.0x to 20.0x and applied this range of multiples to Elkay’s estimated 2022 EBITDA based on the Forecasts of Elkay provided

by Zurn management. Evercore then discounted this value back to December 31, 2021 based on the mid-point of Elkay’s estimated

weighted average cost of capital of 9.5%. Key inputs to Evercore’s estimation of Elkay’s weighted average cost of capital

included the following based on publicly available information as of February 9, 2022: (i) a risk free investment rate of 2.31%,

based on the 20-year US Treasury Rate, (ii) unlevered asset beta of 1.021, based on the median rate for selected peers, (iii) a

debt to equity ratio of 2.86%, based on the median rate for selected peers, (iv) a tax rate of 27.00%, (v) a sensitivity to

market risk premium range of 6.00% to 7.25% and a size of market capitalization premium of 1.37%, and (vi) an after-tax cost of debt

of 2.3%, based on the BBB US Corporate bond yield. This analysis indicated the following range of approximate implied aggregate equity

value of Elkay:

| Metric | |

Range of Implied

Aggregate Equity

Value of Elkay (in billions) |

| TEV / 2022E EBITDA | |

$1.770 - $1.965 |

No company or transaction utilized in the precedent

transactions analysis is identical or directly comparable to Elkay or the Merger. In evaluating the precedent transactions, Evercore made

judgments and assumptions with regard to general business, market and financial conditions and other matters, which are beyond the control

of Elkay, such as the impact of competition on the business of Elkay, or the industry generally, industry growth and the absence of any

material adverse change in the financial condition of Elkay or the industry or in the financial markets in general, which could affect

the value of the companies and the aggregate value of the transactions to which the Merger is being compared.

The text on page 60 of the Proxy Statement under the heading

“Elkay” is revised as follows:

Elkay

Evercore performed a discounted cash flow analysis

using both the perpetuity growth rate method and the terminal multiple method of Elkay to calculate the estimated present value of the

standalone unlevered, after-tax free cash flows that Elkay was forecasted to generate during Elkay’s fiscal years 2022 through 2026

based on the Forecasts. Evercore calculated Elkay’s standalone unlevered, after-tax free cash flow by applying Elkay’s cash

tax rate to its earnings before interest and taxes, adding depreciation and amortization, deducting capital expenditures and adding or

deducting changes in net working capital, as applicable. Evercore calculated terminal values for Elkay using the perpetuity growth rate

method by applying perpetuity growth rates of 4.00% to 4.50% and using the terminal multiple method by applying multiples of 13.5x to

15.5x, which ranges were selected based on Evercore’s professional judgment and experience, to a terminal year estimate of the unlevered,

after-tax free cash flows that Elkay was forecasted to generate based on the Forecasts. Evercore calculated Elkay’s standalone

unlevered, after-tax free cash flow in the terminal year to be $101 million by applying Elkay’s cash tax rate to its earnings before

interest and taxes, adding depreciation and amortization and deducting capital expenditures and changes in net working capital. In the

terminal multiple method, Evercore utilized Elkay’s 2026 EBITDA of $168 million to derive terminal value. The cash flows and

terminal values in each case were then discounted to present value as of December 31, 2021 using discount rates ranging from 9.00%

to 10.00%, which were based on an estimate of Elkay’s weighted average cost of capital, and the mid-year cash flow discounting convention.

Key inputs to this analysis were calculated using publicly available information as of February 9, 2022 and included (i) a

risk free investment rate of 2.31%, based on the 20-year US Treasury Rate, (ii) unlevered asset beta of 1.021, based on the median

rate for selected peers, (iii) a debt to equity ratio of 2.86%, based on the median rate for selected peers, (iv) a tax rate

of 27.00%, (v) a sensitivity to market risk premium range of 6.00% to 7.25% and a size of market capitalization premium of 1.37%,

and (vi) an after-tax cost of debt of 2.23%, based on the BBB US Corporate bond yield. After giving effect to the discounting of

cash flows at Elkay’s weighted average cost of capital, Evercore implied a range of enterprise values of $1,465 million to $1,926

million and $1,731 million to $2,023 million in the perpetuity growth rate method and the terminal multiple method, respectively.

Based on this range of implied enterprise values, and Elkay’s estimated net debt and debt-like items as

of December 31, 2021 (assumed to be zero), in each case as provided to Evercore by Zurn management, this analysis indicated the following

ranges of approximate implied aggregate equity value of Elkay for the perpetuity growth rate method and the terminal multiple method:

| Discounted Cash Flow Analysis Method | |

Range of Implied

Aggregate Equity

Value of Elkay (in billions) |

| Perpetuity Growth Rate Method | |

$1.465 - $1.925 |

| Terminal Multiple Method | |

$1.730 - $2.025 |

The text on page 61 of the Proxy Statement under the heading

“Zurn” is revised as follows:

Zurn

Evercore performed a discounted cash flow analysis

using both the perpetuity growth rate method and the terminal multiple method of Zurn to calculate the estimated present value of the

standalone unlevered, after-tax free cash flows that Zurn was forecasted to generate during Zurn’s fiscal years 2022 through 2026

based on the Forecasts. Evercore calculated Zurn’s standalone unlevered, after-tax free cash flow by applying Zurn’s cash

tax rate to its earnings before interest and taxes, adding depreciation and amortization and deducting capital expenditures and changes

in net working capital. Evercore calculated terminal values for Zurn using the perpetuity growth rate method by applying perpetuity growth

rates of 4.00% to 4.50% and using the terminal multiple method by applying multiples of 16.5x to 18.5x, which ranges were selected based

on Evercore’s professional judgment and experience, to a terminal year estimate of the unlevered, after-tax free cash flows that

Zurn was forecasted to generate based on the Forecasts. Evercore calculated Zurn’s standalone unlevered, after-tax free cash

flow in the terminal year to be $246 million by applying Zurn’s cash tax rate to its earnings before interest and taxes, adding

depreciation and amortization and deducting capital expenditures, stock-based compensation expense and changes in net working capital.

In the terminal multiple method, Evercore utilized Zurn’s 2026 EBITDA burdened by stock-based compensation of $370 million to derive

terminal value. The cash flows and terminal values in each case were then discounted to present value as of December 31, 2021

using discount rates ranging from 8.50% to 9.50%, which were based on an estimate of Zurn’s weighted average cost of capital, and

the mid-year cash flow discounting convention. Based on this range of implied enterprise value, Zurn’s estimated net debt

and after tax underfunded pension obligation as of December 31, 2021 Key inputs to this analysis were calculated using

publicly available information as of February 9, 2022 and included (i) a risk free investment rate of 2.31%, based on the 20-year

US Treasury Rate, (ii) unlevered asset beta of 1.051, based on the median rate for selected peers, (iii) a debt to equity ratio

of 13.16%, based on Zurn’s debt to equity ratio, (iv) a tax rate of 27.90%, (v) a sensitivity to market risk premium range

of 6.00% to 7.25% and a size of market capitalization premium of 0.75%, and (vi) an after-tax cost of debt of 2.23%, based on the

BBB US Corporate bond yield. After giving effect to the discounting of cash flows at Zurn’s weighted average cost of capital, Evercore

implied a range of enterprise values of $3,851 million to $5,231 million and $4,635 million to $5,328 million in the perpetuity growth

rate method and the terminal multiple method, respectively. Based on this range of implied enterprise values, Zurn’s estimated cash

of $97 million, debt of $540 million and after-tax underfunded pension obligation of $46 million as of December 31, 2021, in each

case as provided to Evercore by Zurn management, this analysis indicated the following ranges of approximate implied aggregate equity

value of Zurn for the perpetuity growth rate method and the terminal multiple method:

| Discounted Cash Flow Analysis Method | |

Range of Implied

Aggregate Equity

Value of Zurn (in billions) |

| Perpetuity Growth Rate Method | |

$3.360 - $4.740 |

| Terminal Multiple Method | |

$4.145 - $4.840 |

The text on pages 61 and 62 of the Proxy Statement under the

heading “Equity Research Analyst Price Targets — Zurn” is revised as follows:

Equity Research Analyst Price Targets — Zurn

Evercore reviewed selected public market trading

price targets for the shares of Zurn Common Stock prepared and published by equity research analysts prior to February 2, 2022. These

price targets reflect each analyst’s estimate of the future public market trading price of the shares of Zurn Common Stock at the

time the price target was published. Between February 1, 2022 and February 2, 2022, the range of selected equity research analyst

price targets per share of Zurn Common Stock was $38.00 to $43.00 per share, implying aggregate equity values of approximately $4.9 billion

to approximately $5.6 billion. The selected equity research analyst price targets per share of Zurn Common Stock that Evercore observed

are shown below:

| Broker | |

Date | |

Rating | |

Price

Target | |

| Oppenheimer | |

2/2/22 | |

Buy | |

$ | 42.00 | |

| Baird | |

2/2/22 | |

Hold | |

$ | 38.00 | |

| Goldman Sachs | |

2/2/22 | |

Buy | |

$ | 38.00 | |

| KeyBanc | |

2/1/22 | |

Buy | |

$ | 43.00 | |

| Mean | |

| |

| |

$ | 40.25 | |

| Median | |

| |

| |

$ | 40.00 | |

The public market trading price targets published

by equity research analysts do not necessarily reflect current market trading prices for the shares of Zurn Common Stock and these target

prices and the analysts’ earnings estimates on which they were based are subject to risk and uncertainties, including factors affecting

the financial performance of Zurn and future general industry and market conditions.

– END OF SUPPLEMENT TO PROXY STATEMENT

–

Forward-Looking Statements

This communication contains forward-looking statements, within the

meaning of Section 21E of the Securities Exchange Act of 1934, as amended, which reflect current estimates, expectations and projections

about the combined company’s future results, performance, prospects and opportunities. Such forward-looking statements may include,

among other things, statements about the proposed acquisition of Elkay, the benefits and synergies of the Merger, future opportunities

for the combined company, and any other statements regarding the combined company’s future operations, anticipated business levels,

future earnings, planned activities, anticipated growth, market opportunities, strategies, competition and other expectations and estimates

for future periods. Forward-looking statements include statements that are not historical facts and can be identified by forward-looking

words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,”

“plan,” “may,” “should,” “will,” “would,” “project,” “forecast,”

and similar expressions. These forward-looking statements are based upon information currently available to the Company and are subject

to a number of risks, uncertainties, and other factors that could cause the combined company’s actual results, performance, prospects,

or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. Important factors that

could cause the combined company’s actual results to differ materially from the results referred to in the forward-looking statements

in this communication include: the possibility that the conditions to the consummation of the Merger will not be satisfied; failure to

obtain shareholder or stockholder approvals being sought in connection with the Merger; risks relating to any unforeseen changes to or

the effects on liabilities, future capital expenditures, revenue, expenses, synergies, indebtedness, financial condition, losses and future

prospects; the possibility that the combined company may be unable to achieve expected synergies and operating efficiencies in connection

with the Merger within the expected time-frames or at all and to successfully integrate the Elkay business; expected or targeted future

financial and operating performance and results; operating costs, customer loss and business disruption (including, without limitation,

difficulties in maintaining relationships with employees, customers, clients or suppliers) being greater than expected following the Merger;

failure to consummate or delay in consummating the Merger for other reasons; the combined company's ability to retain key executives and

employees; risks associated with litigation related to the Merger; the continued financial and operational impacts of and uncertainties

relating to the COVID-19 pandemic on customers and suppliers and the geographies in which they operate; uncertainties regarding the ability

to execute restructuring plans within expected costs and timing; actions taken by competitors and their ability to effectively compete

in the increasingly competitive water solutions industries; the ability to develop new products based on technological innovation, such

as the Internet of Things, and marketplace acceptance of new and existing products, including products related to technology not yet adopted

or utilized in geographic locations in which the combined company does business; fluctuations in commodity prices and raw material costs;

dependence on significant customers; risks associated with global manufacturing, including risks associated with public health crises;

issues and costs arising from the integration of acquired companies and businesses and the timing and impact of purchase accounting adjustments;

prolonged declines in one or more markets; economic changes in global markets, such as reduced demand for products, currency exchange

rates, inflation rates, interest rates, recession, government policies, including policy changes affecting taxation, trade, tariffs, immigration,

customs, border actions and the like, and other external factors that the Company cannot control; product liability and other litigation,

or claims by end users, government agencies or others that products or customers’ applications failed to perform as anticipated,

particularly in high volume applications or where such failures are alleged to be the cause of property or casualty claims; unanticipated

liabilities of acquired businesses; unanticipated adverse effects or liabilities from business exits or divestitures; unanticipated costs

or expenses that may be incurred related to product warranty issues; dependence on key suppliers and the potential effects of supply disruptions;

infringement of intellectual property by third parties, challenges to intellectual property, and claims of infringement on third party

technologies; effects on earnings of any significant impairment of goodwill or intangible assets; losses from failures, breaches, attacks

or disclosures involving information technology infrastructure and data; cyclical downturns affecting the global market for capital goods;

and other risks and uncertainties including, but not limited, to those described in the section entitled “Risk Factors” in

Zurn’s Annual Reports on Form 10-K on file with the SEC and from time to time in other filed reports including Zurn’s

Quarterly Reports on Form 10-Q. For a more detailed description of the risk factors associated with Zurn, please refer to Zurn’s

Annual Report on Form 10-K for the fiscal year ended December 31, 2021 on file with the SEC, Zurn’s Quarterly Report on

Form 10-Q for the period ended March 31, 2022 on file with the SEC, and subsequent SEC filings. Shareholders, potential investors,

and other readers are urged to consider these factors in evaluating the forward-looking statements and are cautioned not to place undue

reliance on such forward-looking statements. The forward-looking statements included in this communication are made only as of the date

of this communication, and Zurn undertakes no obligation to update any forward-looking information contained in this communication or

with respect to the announcements described herein to reflect subsequent events or circumstances.

Additional Information about the Proposed Merger and Where to Find

It

In connection with the Merger, Zurn has filed with the Securities and

Exchange Commission (“SEC”), a Registration Statement on Form S-4 (Reg. No. 333-264125) containing a proxy statement/prospectus/consent

solicitation statement relating to the Merger. SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS/CONSENT SOLICITATION

STATEMENT (AND ANY OTHER RELEVANT DOCUMENTS WHEN THEY BECOME AVAILABLE) BECAUSE IT CONTAINS IMPORTANT INFORMATION ABOUT ZURN, ELKAY AND

THE MERGER. The Proxy Statement has been sent to stockholders of Zurn seeking approval of the Merger Share Issuance Proposal (as defined

in the Proxy Statement). The documents relating to the Merger can be obtained free of charge from the SEC’s website at www.sec.gov.

These documents can also be obtained free of charge by contacting us by written request to Zurn Water Solutions Corporation, Investor

Relations, 511 Freshwater Way, Milwaukee, WI 53204, or by calling (855) 480-5050.

Participants in the Solicitation

This communication is not a solicitation of a proxy from any security

holder. Zurn and its directors, executive officers, other members of management and employees may be deemed to be participants in the

solicitation of proxies from Zurn’s stockholders in connection with the Merger. Information regarding the names and interests in

the proposed Merger of Zurn’s directors and officers is contained Zurn’s filings with the SEC. Additional information regarding

the interests of potential participants in the solicitation process is also included in the proxy statement/prospectus/consent solicitation

statement relating to the Merger and other relevant documents filed with the SEC. These documents can be obtained free of charge from

the sources indicated above.

No Offer or Solicitation

This communication does not constitute an offer to sell or the solicitation

of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the

Securities Act of 1933, as amended.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, Zurn Water Solutions Corporation has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized this 20th day of May, 2022.

| |

ZURN WATER SOLUTIONS CORPORATION |

| |

|

| |

By: |

/s/ Jeffrey J. LaValle |

| |

Name: |

Jeffrey J. LaValle |

| |

Title: |

Vice President, General Counsel and Secretary |

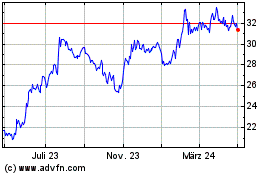

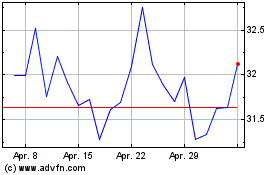

Zurn Elkay Water Solutions (NYSE:ZWS)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Zurn Elkay Water Solutions (NYSE:ZWS)

Historical Stock Chart

Von Apr 2023 bis Apr 2024