2021

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2021

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 333-151440

United States Steel Corporation

Savings Fund Plan for Salaried Employees

(Full title of the Plan)

United States Steel Corporation

600 Grant Street

Pittsburgh, PA 15219-2800

(Name of issuer of securities held pursuant to plan and

the address of its principal executive offices)

United States Steel Corporation

Savings Fund Plan for Salaried Employees

Index to Financial Statements and Supplementary Information

December 31, 2021, and 2020

Page (s)

| | | | | |

| Report of Independent Registered Public Accounting Firm | |

| Financial Statements | |

| Statements of Net Assets Available for Benefits at December 31, 2021 and 2020 | |

| Statement of Changes in Net Assets Available for Benefits for the year ended December 31, 2021 | |

| Notes to Financial Statements | |

| |

| Supplemental Schedule | |

| Schedule H, line 4i - Schedule of Assets (Held at End of Year) at December 31, 2021 | |

Note: Other schedules required by Section 2520.103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under ERISA have been omitted as they are not applicable.

The Corporation

United States Steel Corporation is a Delaware corporation. It has executive offices at 600 Grant Street, Pittsburgh, PA 15219-2800. The terms "Corporation," "Company," "U. S. Steel" and "United States Steel" when used herein refer to United States Steel Corporation or United States Steel Corporation and subsidiaries as required by the context. The term "Plan" when used herein refers to United States Steel Corporation Savings Fund Plan For Salaried Employees.

Report of Independent Registered Public Accounting Firm

To the Administrator and Plan Participants of United States Steel Corporation Savings Fund Plan for Salaried Employees

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of United States Steel Corporation Savings Fund Plan for Salaried Employees (the “Plan”) as of December 31, 2021 and 2020 and the related statement of changes in net assets available for benefits for the year ended December 31, 2021, including the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2021 and 2020, and the changes in net assets available for benefits for the year ended December 31, 2021 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental schedule of Form 5500, Schedule H, Part IV, Line 4i — Schedule of Assets (Held at End of Year) as of December 31, 2021 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental schedule reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental schedule, we evaluated whether the supplemental schedule, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental schedule is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ PricewaterhouseCoopers LLP

Pittsburgh, Pennsylvania

June 17, 2022

We have served as the Plan’s auditor since at least 1981. We have not been able to determine the specific year we began serving as auditor of the Plan.

UNITED STATES STEEL CORPORATION SAVINGS FUND PLAN FOR SALARIED EMPLOYEES

Statements of Net Assets Available for Benefits

($ in thousands)

| | | | | | | | |

| December 31, |

| 2021 | 2020 |

| Assets | | |

| Investments: | | |

| Investments, at fair value (see Notes 9 & 11) | $ | 1,575,864 | | $ | 1,396,535 | |

| | |

| Receivables: | | |

| Participant Loans (see Note 10) | 8,186 | | 9,481 | |

| Investment Sales | 72 | | 514 | |

| Total Receivables | 8,258 | | 9,995 | |

| Net assets available for benefits | $ | 1,584,122 | | $ | 1,406,530 | |

The accompanying notes are an integral part of these financial statements.

Statement of Changes in Net Assets Available for Benefits

($ in thousands)

| | | | | |

| Year Ended December 31, |

| 2021 |

| Additions | |

| Earnings on investments: | |

| Interest | $ | 3,244 | |

| Dividends | 29,723 | |

| Net appreciation in fair value of investments | 206,483 | |

| Total earnings on investments | 239,450 | |

| |

| Contributions received from: | |

| Employers (see Note 1) | 32,620 | |

| Participants (including rollovers) | 39,200 | |

| Total contributions | 71,820 | |

| Total additions | 311,270 | |

| |

| Deductions | |

| Benefit payments directly to participants or beneficiaries | 133,210 | |

| Administration expenses | 471 | |

| Total deductions | 133,681 | |

| |

| Net additions | 177,589 | |

| Net transfers to the plan (see Note 4) | 3 | |

| Net assets available for benefits: | |

| Beginning of year | 1,406,530 | |

| End of year | $ | 1,584,122 | |

| |

The accompanying notes are an integral part of these financial statements.

UNITED STATES STEEL CORPORATION SAVINGS FUND PLAN FOR SALARIED EMPLOYEES

NOTES TO FINANCIAL STATEMENTS

December 31, 2021 and 2020

1. Plan description - The following description provides general information regarding the United States Steel Corporation Savings Fund Plan for Salaried Employees (the Plan), a defined contribution plan which covers substantially all domestic non-union salaried employees of United States Steel Corporation (the Company or the Plan Sponsor) and designated Employing Companies. Eligibility begins in the month following the month of hire. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (ERISA). Participants should refer to the Summary Plan Description and the Plan Text for a complete description of the Plan. These documents are available from the United States Steel and Carnegie Pension Fund (the Plan Administrator).

a.Contributions - The Plan receives (1) Participant contributions (a) as pre-tax, after-tax and/or Roth 401(k) savings, and/or (b) rollover contributions, and (2) Employer contributions, as matching contributions and/or non-contributory defined contribution Retirement Account contributions. Each component of contributions is described in further detail below. Eligible employees may save from 1 percent to 16 percent of base salary (35 percent if annual base salary in the immediately preceding year is equal to or less than the threshold amount for determining highly compensated employees for the year preceding the year in which savings occur) in half percent increments on a pre-tax basis, an after-tax basis, as after-tax Roth 401(k) savings or a combination thereof. Other qualified plan limits include:

| | | | | | | | |

| 2021 | 2020 |

| Dollar Limit on IRC Sec. 401(k) pre-tax contributions | $ | 19,500 | | $ | 19,500 | |

| Dollar Limit on IRC Sec. 414(v) catch-up contributions | $ | 6,500 | | $ | 6,500 | |

| Maximum covered compensation [IRC 401(a)(17)] | $ | 290,000 | | $ | 285,000 | |

| Highly Compensated Employee Definition | $ | 130,000 | | $ | 130,000 | |

The Plan has an auto-enrollment feature where eligible employees are automatically enrolled in the Plan at a pre-tax contribution percentage of 3 percent per pay period, unless they select a different pre-tax contribution percentage amount or make an affirmative election not to contribute to the Plan. Additionally, the Plan has an auto-escalation feature where the initial 3 percent pre-tax contribution percentage will automatically increase by 1 percent on the enrollment anniversary date each year until the contribution percentage reaches 6 percent. Participants may, at any time, change their contribution percentage or suspend any future deductions from their pay. The auto-escalation feature is available to all participants, even if they were not automatically enrolled. The annual increase feature applies to Roth 401(k) savings where a participant has a Roth 401(k) savings election, but not a pre-tax savings election.

Savings on the first 6 percent of base salary are matched by company contributions on a dollar-for-dollar basis. Matching company contributions, which vest when a participant attains three years of continuous service, are initially invested in United States Steel Corporation common stock, whereas each participating employee has the option of having savings invested in full increments of 1 percent among thirty active investment options as of December 31, 2021 (see Notes 1(f), 9 and 11). Eligible participants may also contribute amounts representing the direct rollover of pre-tax funds from a qualified retirement plan sponsored by any previous employer or a conduit IRA, or from the United States Steel Corporation Plan for Employee Pension Benefits (Revision of 2003). The Plan allows direct rollovers of a lump-sum distribution from a designated Roth account under a qualified 401(k) plan sponsored by any of the employee’s previous employers. All investments are participant directed.

Separate investment elections may be made for Employee Savings (pre-tax savings, after-tax savings, Roth 401(k) savings, catch-up contributions and Roth 401(k) catch-up contributions), Retirement Account contributions, rollover account contributions and Roth 401(k) rollover account contributions. All contributions are deposited in the trust on a monthly basis (more frequently in the case of employee contributions for eligible employees paid on a more frequent basis). Monies deposited are reinvested by Fidelity Management Trust Company (the "Trustee”) in the investment options specified.

Eligible employees under the Plan (except for union-represented guardworkers at U. S. Steel Tubular Products, Inc.'s Lone Star Plant at Lone Star Tubular Operations until October 31, 2020) participate in a non-contributory defined contribution Retirement Account maintained under the Plan. With respect to the defined contribution Retirement Account, the Employing Companies make contributions, depending on age and base salary, to the employee’s account on a monthly basis. Percentages are based upon the age of the participant as of the first day of the month and eligible salary at the time of the contribution, as noted below:

UNITED STATES STEEL CORPORATION SAVINGS FUND PLAN FOR SALARIED EMPLOYEES

NOTES TO FINANCIAL STATEMENTS

December 31, 2021 and 2020

| | | | | |

| Age | Percentage of Monthly Base Salary |

| Less than 35 | 4.75% |

| 35 to less than 40 | 6% |

| 40 to less than 45 | 7.25% |

| 45 and above | 8.5% |

Participants become fully vested in the value of the Retirement Account after attaining three years of continuous service.

b.Payment of benefits - Unmatched after-tax savings can be withdrawn at any time. Pre-tax savings and earnings thereon and Roth 401(k) savings and earnings thereon are available only for withdrawal at termination of employment or age 59½, except under certain financial hardship conditions. Vested company contributions and earnings are available for withdrawal, upon vesting, except that vested company contributions and a participant’s matched after-tax savings cannot be withdrawn in a partial withdrawal within 24 months after the contribution is made. Terminated employees with a vested account balance of more than $1,000 (including any unpaid loan balance) may defer distribution until age 70 ½ (age 72 if the participant was born after June 30, 1949). A participant who terminates employment for any reason, and who, on the effective date of termination, had three or more years of continuous service, is entitled to receive his or her entire account balance, including all company contributions. A participant who terminates employment for any reason with less than three years of continuous service will forfeit nonvested company contributions unless termination is by reason of permanent layoff, total and permanent disability, involuntary termination of employment under circumstances which would satisfy paragraph 2.1 (a) of the United States Steel Corporation Supplemental Unemployment Benefit Program for Non-Union Employees, or death. Forfeiture occurs as of the date on which the participant (i) incurs five consecutive one-year breaks in continuous service, or (ii) if earlier, receives a distribution of the entire vested portion of his account.

c.Forfeited accounts - Any forfeited nonvested company contributions ($1.093 million in 2021 and $859 thousand in 2020), from either matching company contributions or Retirement Account contributions, are credited to the Company and applied to reduce any subsequent company contributions required under the Plan and forfeitures or starting January 1, 2015 be applied to plan expenses. In 2021 and 2020, company contributions were reduced by $1.010 million and $1.150 million, respectively, from forfeited nonvested accounts.

d.Participant accounts - Under the investment transfer provisions, and absent any trade restrictions under Section 16b of the Securities Exchange Act, a participant can elect to transfer funds (including matching company contributions) between investments on a daily basis. Transfer requests made before the time that markets close on a day stock markets are open are processed after markets close that same day. All other transfer requests are processed after markets close on the next day that the stock markets are open. Transfers are permitted on a daily basis but may be subject to fund specific restrictions and limited by other pending transfers.

In addition, Fidelity has implemented an excessive trading policy in the mutual funds it offers under the Plan that also applies to certain non-Fidelity funds at the request of the applicable fund manager or Plan Sponsor. Final regulations under ERISA section 408(b)(2) require Fidelity to disclose to participants the following information: 1) a description of any compensation that will be charged directly against the amount invested in connection with the acquisition, sale, transfer of, or withdrawal from an investment; 2) a description of the annual operating expenses if the return is not fixed; and 3) a description of any ongoing expenses in addition to annual operating expenses.

All or part of the taxable portion of a lump-sum distribution from the United States Steel Corporation Plan for Employee Pension Benefits may be rolled over into an eligible participant’s account within 60 days following receipt of the distribution. Eligible participants may also roll over assets from the qualified plans of their immediately preceding employer (or from a conduit IRA solely containing such assets and earnings). Rollovers into the Plan for 2021 and 2020 totaled $13.5 million and $12.4 million, of which $9.7 million and $10.4 million were transferred from the United States Steel Corporation Plan for Employee Pension Benefits, respectively.

e. Notes receivable from participants - The loan program enables participants to borrow up to 50 percent of the value of their vested account (other than the Retirement Account and the Retiree Health Care Account) subject to certain provisions. The maximum loan amount is $50,000 and the minimum loan amount is $500. Repayments of loans are made in level monthly installments over a period of not less than twelve months or more than 60 months. A maximum of two loans can be outstanding at any one time. The interest rate on loans is the Prime Rate as provided by Reuters as of market close on the last business day of the prior month plus one percent and remains fixed for the duration of the loan. The loans bear interest at rates that range from 4.25 to 6.50 percent on loans outstanding December 31, 2021 and 2020. Prepayment of the entire outstanding loan can be made at any time without penalty. When payments are not timely received, the loan amount outstanding at that time becomes subject to taxation. Loans are recorded at net realizable value in the financial statements.

UNITED STATES STEEL CORPORATION SAVINGS FUND PLAN FOR SALARIED EMPLOYEES

NOTES TO FINANCIAL STATEMENTS

December 31, 2021 and 2020

f. Investment options - Please refer to the Summary Plan Description for details on the investment options offered by the Plan.

2. Accounting policies:

a.Basis of accounting - Financial statements are prepared under the accrual method of accounting in accordance with accounting principles generally accepted in the United States of America (US GAAP).

b.Use of estimates - The preparation of the financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amount of assets, liabilities, and changes therein, and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

c.Investment valuation - The Plan’s investments are stated at fair value as defined by Accounting Standards Codification (ASC) Topic 820, Fair Value Measurement (see Note 11).

d.Net appreciation/depreciation - The Plan presents in the accompanying Statements of Changes in Net Assets Available for Benefits the net appreciation/depreciation in the fair value of its investments which consists of the net realized gains or losses and the net unrealized appreciation or depreciation on those investments.

e.Investment by the trustee - The Trustee shall invest any monies received with respect to any investment option in the appropriate shares, units or other investments as soon as practicable. Purchases and sales of securities are recorded on a trade-date basis.

f.Administrative expenses - Plan administrative costs may include legal, accounting, trustee, recordkeeping, and other administrative fees and expenses associated with maintaining the Plan. Beginning January 1, 2021, an annual administrative fee of $35 was added to cover the Plan’s administrative costs. The administrative fee is deducted in quarterly increments ($8.75 per quarter) from all participant accounts.

Beginning January 1, 2021, for one investment option, a quarterly revenue credit is allocated to accounts if held during the prior quarter. Revenue credits may help reduce overall net cost to invest and represent the allocation of a portion of the revenue associated with the option based in part on a Participant's average daily balance in the fund.

g.Payment of benefits - Benefits are recorded when paid.

h.Income recognition - Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date.

i.Participant loans - Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Interest income is recorded on the accrual basis. Loans in default are classified as benefit payments to the participants based upon the terms of the Plan.

j.Excess contributions payable - Amounts payable to participants for contributions in excess of amounts allowed by the IRS are recorded as a liability with a corresponding reduction to contributions.

k.Subsequent events - The Plan has evaluated subsequent events through June 17, 2022, the date on which the financial statements were available to be issued.

3.Plan amendments - Effective July 28, 2021 as of the closing of the sale of Transtar, LLC and subsidiaries (Transtar), the Plan was amended to indicate that Transtar salaried employees are no longer eligible, are fully vested (if not already), and have the right to termination withdrawals.

Effective January 1, 2021 (except as otherwise noted), the Plan was amended and restated to add/increase fees and update

references to default investment options resulting from investment option changes.

Effective January 1, 2021, Plan provisions regarding timely elections by transferred and reemployed employees were clarified and unnecessary language related to the 2020 cessation and subsequent restoration of company matching and retirement account contributions was removed.

4.Transfers to the plan - Net transfers to the plan total $7 thousand in 2021 and $196 thousand in 2020. For both years the transfers were primarily related to voluntary direct plan transfers from the USS 401(k) Plan for USW-Represented Employees for employees who transferred from union positions to eligible non-represented positions.

UNITED STATES STEEL CORPORATION SAVINGS FUND PLAN FOR SALARIED EMPLOYEES

NOTES TO FINANCIAL STATEMENTS

December 31, 2021 and 2020

5.Employer-related investments - Purchases and sales of Company common stock in accordance with provisions of the Plan are permitted under ERISA.

6.Tax status - The Internal Revenue Service (IRS) has determined and informed the Plan Sponsor by letter dated January 30, 2014, that the Plan, as amended and restated effective January 1, 2013, continues to qualify under §401(a) of the Internal Revenue Code (IRC) of 1986, as amended, and its related trust is exempt from tax under §501(a) of the IRC of 1986, as amended. The Plan has been amended subsequent to the amendments taken into account by the IRS in conjunction with its issuance of the January 30, 2014 determination letter. The Plan Sponsor and Tax Counsel for the Plan believe the Plan is designed and is currently being operated in compliance with the applicable requirements of the IRC and therefore, believe that the Plan is qualified, and the related trust is tax-exempt.

US GAAP requires plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. The Plan Sponsor has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2021, and 2020, there were no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no active audits in progress for any tax periods. The Plan Sponsor believes it is no longer subject to examinations by the IRS for the years prior to 2018.

7.Plan termination - The Plan Sponsor believes the existence of the Plan is in the best interest of its employees and, although it has no intention of discontinuing it, the Plan Sponsor has the right under the Plan to terminate the Plan in whole or in part at any time for any reason. However, in the event of Plan termination, participants would become 100% vested in their employer contributions and the net value of the assets of the Plan shall be allocated among the participants and beneficiaries of the Plan in compliance with ERISA.

8.Risks and uncertainties - Investments are exposed to various risks, such as interest rate, market and credit risks. Due to the level of risk associated with these investments and the level of uncertainty related to changes in the value of these investments, it is at least reasonably possible that changes in the near term could materially affect participants’ account balances and the amounts reported in the Statements of Net Assets Available for Benefits and the Statements of Changes in Net Assets Available for Benefits.

9.Stable value common collective trust - The Plan invests in a stable value common collective trust, the Fidelity Managed Income Portfolio II - Class 3 (MIP II). MIP II is managed by the Trustee and invests in assets (typically fixed-income securities or bond funds and may include derivative instruments such as futures contracts and swap agreements), enters into “wrap” contracts issued by third parties, and invests in cash equivalents represented by shares in money market funds. The Plan’s investment in MIP II is presented at the net asset value of units of a bank collective trust. The net asset value, as provided by the Trustee, is based on the fair value of the underlying investments held by MIP II less its liabilities.

As an investment option in the Plan, there are no restrictions on redemptions for this fund. If the Plan were to initiate a full redemption of the collective trust, then the investment adviser reserves the right to temporarily delay withdrawal from the trust in order to ensure that securities liquidations will be carried out in an orderly business manner. There are no unfunded commitments related to this investment.

10.Related party and party-in-interest transactions - Certain investments of the Plan are mutual funds and common collective trusts managed by Fidelity Investments. Therefore, these transactions qualify as party-in-interest transactions. The Trustee collects management fees by offsetting the investment return in an amount as noted by the investment’s expense ratio. Therefore, the Plan is not directly billed for these fees.

One investment fund option available to participants is Company common stock. As a result, transactions related to this investment fund qualify as party-in-interest transactions (see Note 5). Dividends received for 2021 were $0.585 million and 2020 were $0.347 million. Purchases and sales for 2021 were $57.7 million and $87.6 million, respectively, and purchases and sales for 2020 were $36.5 million and $32.9 million, respectively. The total realized gains and unrealized gains during 2021 were $26.7 million and $34.6 million, respectively.

The Plan also holds notes receivable totaling $8.2 million and $9.5 million in 2021 and 2020, respectively, representing participant loans that qualify as party-in-interest transactions.

11.Fair value measurement - ASC Topic 820 establishes a single definition of fair value, creates a three-tier hierarchy as a framework for measuring fair value based on inputs used to value the Plan’s investments, and requires additional disclosure about fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (level 1) and the lowest priority to unobservable inputs (level 3). The three levels of the fair value hierarchy are summarized below.

UNITED STATES STEEL CORPORATION SAVINGS FUND PLAN FOR SALARIED EMPLOYEES

NOTES TO FINANCIAL STATEMENTS

December 31, 2021 and 2020

•Level 1 - Inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active markets that the Partnership has the ability to access.

•Level 2 - Inputs to the valuation methodology include

▪Quoted prices for similar assets or liabilities in active markets;

▪ Quoted prices for identical or similar assets or liabilities in inactive markets;

▪ Inputs other than quoted prices that are observable for the asset or liability;

▪Inputs that are derived principally from or corroborated by observable market data by correlation or other means.

If the asset or liability has a specified (contractual) term, the level 2 input must be observable for substantially the full term of the asset or liability.

•Level 3 - Inputs to the valuation methodology are unobservable and significant to the fair value measurement.

The Plan’s assets are classified as follows:

| | |

| Level 1 |

| Interest-bearing cash |

| Common stock |

| Mutual Funds |

An instrument’s level is based on the lowest level of any input that is significant to the fair value measurement. Interest-bearing cash is an investment in a short-term money market fund that is valued at $1 per share, which approximates fair value. Common stock is valued at the closing price reported on the active market on which the individual securities are traded. Mutual funds are valued at the daily closing price as reported by the fund. Mutual funds held by the Plan are open-ended mutual funds that are registered with the U.S. Securities and Exchange Commission. These funds are required to publish their daily net asset value and to transact at that price. The mutual funds held by the Plan are deemed to be actively traded.

Common collective trusts are valued at the net asset value of units of the bank collective trust. Refer to Note 9 for a description of the stable value common collective trust. The net asset value is used as a practical expedient to estimate fair value. This practical expedient would not be used if it is determined to be probable that the fund will sell the investment for an amount different from the reported net asset value. Participant transactions (purchases and sales) may occur daily. If the Plan initiates a full redemption of the collective trust, the issuer reserves the right to require 12 months’ notification in order to ensure that securities liquidations will be carried out in an orderly business manner.

The preceding valuation methods described may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, although the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

There were no Level 2 or 3 assets at December 31, 2021 or December 31, 2020.

There were no transfers to Level 3 during the year ended December 31, 2021.

UNITED STATES STEEL CORPORATION SAVINGS FUND PLAN FOR SALARIED EMPLOYEES

NOTES TO FINANCIAL STATEMENTS

December 31, 2021 and 2020

The following is a summary of the Plan’s assets carried at fair value:

| | | | | | | | |

| Investments at Fair Value at December 31, 2021 |

| ($ in thousands) |

| Asset Classes | Total | Quoted Prices

(Level 1) |

|

| Interest-bearing cash | $ | 21,350 | | $ | 21,350 | |

| Common stock | 169,779 | | 169,779 | |

| Mutual Funds | 276,404 | | 276,404 | |

| Total assets in the fair value hierarchy | $ | 467,533 | | $ | 467,533 | |

Investments measured at net asset value (a) | 1,108,331 | | |

| Investments at fair value | $ | 1,575,864 | | |

| | | | | | | | |

| Investments at Fair Value at December 31, 2020 |

| ($ in thousands) |

| Asset Classes | Total | Quoted Prices

(Level 1) |

|

| Interest-bearing cash | $ | 26,507 | | $ | 26,507 | |

| Common stock | 138,217 | | 138,217 | |

| Mutual Funds | 1,030,637 | | 1,030,637 | |

| Total assets in the fair value hierarchy | $ | 1,195,361 | | $ | 1,195,361 | |

Investments measured at net asset value (a) | 201,174 | | |

| Investments at fair value | $ | 1,396,535 | | |

(a)In accordance with Subtopic 820-10, certain investments that were measured at net asset value per share (or its equivalent) have not been classified in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the line items presented in the Statements of Net Assets Available for Benefits. These investments represent holdings in the stable value common collective trust.

UNITED STATES STEEL CORPORATION SAVINGS FUND PLAN FOR SALARIED EMPLOYEES

EIN 25-1897152/PN 003

Schedule H, Line 4i - Schedule of Assets (Held at End of Year)

December 31, 2021

| | | | | | | | | | | |

| (a) | (b) | (c) | (e) |

| Identity of Issuer, Borrower, Lessor or Similar Party | Description of Investment, Including Maturity Date, Rate of Interest, Collateral, Par or Maturity Value | Current Value |

| * | U. S. Steel Stock Fund - Common Stock | Employer-related security | 169,767,880 | |

| * | U. S. Steel Stock Fund - Stock Purchase Account | Employer-related security | 10,678 | |

| T. Rowe Price Emerging Markets Stock Fund I Class | Mutual fund | 33,483,683 | |

| Vanguard Windsor II Fund - Admiral Shares | Mutual fund | 57,762,917 | |

| Vanguard Explorer Fund - Admiral Shares | Mutual fund | 57,056,266 | |

| Janus Henderson Enterprise Fund Class N | Mutual fund | 97,225,086 | |

| * | Fidelity Real Estate Investment Portfolio | Mutual fund | 30,875,973 | |

| * | Fidelity Low Priced Stock Pool | Common/Collective Trust | 19,951,101 | |

| * | Fidelity® Contrafund® Commingled Pool | Common/Collective Trust | 156,621,517 | |

| * | Fidelity Freedom Index Income Fund | Common/Collective Trust | 6,206,239 | |

| State Street Global All Cap Equity Ex-U.S. Index Fund Class II - CIT | Common/Collective Trust | 4,648,293 | |

| State Street Russell Small/Mid Cap Index Fund CIT | Common/Collective Trust | 3,161,303 | |

| State Street S&P 500® Index Securities Lending Series Fund Class II | Common/Collective Trust | 228,866,396 | |

| State Street U.S. Bond Index Securities Lending Series Fund Class XIV | Common/Collective Trust | 65,927,537 | |

| State Street U.S. Inflation Protected Bond Index Securities Lending Series Fund Class II | Common/Collective Trust | 25,234,958 | |

| * | Fidelity® Diversified International Commingled Pool | Common/Collective Trust | 55,532,776 | |

| * | FIAM Index Target Date 2005 Commingled Pool Class T | Common/Collective Trust | 2,866,987 | |

| * | FIAM Index Target Date 2010 Commingled Pool Class T | Common/Collective Trust | 5,736,665 | |

| * | FIAM Index Target Date 2015 Commingled Pool Class T | Common/Collective Trust | 8,063,172 | |

| * | FIAM Index Target Date 2020 Commingled Pool Class T | Common/Collective Trust | 24,167,951 | |

| * | FIAM Index Target Date 2025 Commingled Pool Class T | Common/Collective Trust | 47,208,868 | |

| * | FIAM Index Target Date 2030 Commingled Pool Class T | Common/Collective Trust | 58,470,212 | |

| * | FIAM Index Target Date 2035 Commingled Pool Class T | Common/Collective Trust | 56,682,104 | |

| * | FIAM Index Target Date 2040 Commingled Pool Class T | Common/Collective Trust | 41,165,074 | |

| * | FIAM Index Target Date 2045 Commingled Pool Class T | Common/Collective Trust | 39,646,772 | |

| * | FIAM Index Target Date 2050 Commingled Pool Class T | Common/Collective Trust | 37,170,020 | |

| * | FIAM Index Target Date 2055 Commingled Pool Class T | Common/Collective Trust | 19,529,245 | |

| * | FIAM Index Target Date 2060 Commingled Pool Class T | Common/Collective Trust | 4,428,026 | |

| * | FIAM Index Target Date 2065 Commingled Pool Class T | Common/Collective Trust | 190,795 | |

| * | Fidelity Managed Income Portfolio II - Class 3 | Common/Collective Trust | 196,854,709 | |

| Vanguard Treasury Money Market | Interest-bearing cash | 21,351,098 | |

| * | Participant Loans | Maturity dates of 0 - 5 years with interest rates ranging from 4.25% to 6.5% | 8,185,908 | |

| Total Investments at 12/31/21 | | $ | 1,584,050,209 | |

| * Party-in-interest | | |

| | | |

| All investments are participant directed. | | |

UNITED STATES STEEL CORPORATION SAVINGS FUND PLAN FOR SALARIED EMPLOYEES

Index to Exhibits

The following exhibit is filed as part of this Form 11-K.

| | | | | | | | |

| Exhibit Number | | Exhibit Description |

| 23.1 | | |

| | |

| | |

| | |

SIGNATURES

THE PLAN. Pursuant to the requirements of the Securities Exchange Act of 1934, the administrator of the United States Steel Corporation Savings Fund Plan For Salaried Employees has duly caused this annual report to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Pittsburgh, Commonwealth of Pennsylvania, on June 17, 2022.

UNITED STATES STEEL AND CARNEGIE PENSION FUND, AS PLAN ADMINISTRATOR

| | | | | |

| By: | /s/ Tiffany L. Green |

| Tiffany L. Green, |

| Comptroller |

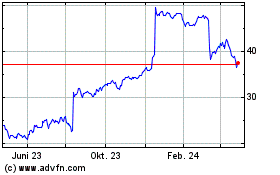

US Steel (NYSE:X)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

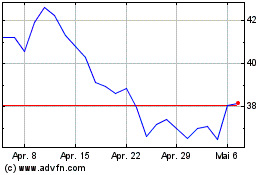

US Steel (NYSE:X)

Historical Stock Chart

Von Apr 2023 bis Apr 2024