Current Report Filing (8-k)

03 Juni 2022 - 3:00PM

Edgar (US Regulatory)

0001163302

false

0001163302

2022-05-27

2022-05-27

0001163302

exch:XNYS

2022-05-27

2022-05-27

0001163302

exch:XCHI

2022-05-27

2022-05-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the

Securities Exchange Act of 1934

Date of

report (Date of earliest event reported): June 3, 2022 (May 27, 2022)

United States Steel Corporation

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

1-16811 |

|

25-1897152 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

600 Grant Street,

Pittsburgh, PA 15219-2800

(Address of Principal Executive Offices,

and Zip Code)

(412) 433-1121

Registrant’s Telephone Number,

Including Area Code

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ¨ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

|

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name

of each exchange on which

registered |

| Common Stock |

X |

New York Stock Exchange

|

| Common Stock |

X |

Chicago Stock Exchange |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2

of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth

company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry into a Material Definitive Agreement.

Sixth Amended and Restated Credit Agreement

On May 27, 2022, United States Steel Corporation

(the “Corporation”), as the borrower, and certain subsidiary guarantors entered into a Sixth Amended and Restated Credit Agreement

dated as of May 27, 2022 (the “Sixth Amended and Restated Credit Agreement”) with the lenders party thereto, certain LC issuing

banks party thereto and JPMorgan Chase Bank, N.A., as administrative agent and collateral agent. In addition, J.P. Morgan Securities LLC

and ING Capital LLC served as joint sustainability structuring agents. The Sixth Amended and Restated Credit Agreement amends and restates

the Corporation’s Fifth Amended and Restated Credit Agreement, dated as of October 25, 2019 and subsequently amended as of September

30, 2020 (the “Prior Credit Agreement”).

The Sixth Amended and Restated Credit Agreement

provides for a $1.75 billion sustainability-linked loan facility, with a scheduled maturity date of May 27, 2027. Similar to the Prior

Credit Agreement, the Sixth Amended and Restated Credit Agreement may be terminated prior to its scheduled maturity date if, under certain

circumstances, the Corporation does not meet certain liquidity requirements set forth therein.

Similar to the Prior Credit Agreement, the fixed

charge coverage ratio must not be less than 1.00 to 1.00 when aggregate facility availability is less than the greater of (i) 10% of the

maximum facility availability (an amount equal to the lesser of the aggregate lender commitments on such date and the aggregate borrowing

base on such date) and (ii) $140 million (revised from $200 million in the Prior Credit Agreement).

The Sixth Amended and Restated Credit Agreement

also includes other changes to the negative covenants, such as revising the liens covenant to govern liens on assets constituting collateral,

principal properties and equity interests of subsidiaries that own principal properties (as opposed to liens on any assets). In addition,

the Sixth Amended and Restated Credit Agreement includes a new covenant in respect of certain specified receivables financings, which

restricts proceeds of certain transferred receivables from remaining deposited in collection accounts and limits the aggregate amount

of certain receivables.

Amended and Restated Security Agreements

In connection with the Sixth Amended and Restated

Credit Agreement, the Corporation entered into a Third Amended and Restated Borrower Security Agreement, certain of the Corporation’s

subsidiaries (collectively, the “Subsidiary Grantors”) entered into a Third Amended and Restated Subsidiary Security Agreement

and the Corporation entered into a Second Amended and Restated Borrowed Canadian Security Agreement, each dated as of May 27, 2022 (collectively,

the “Amended and Restated Security Agreements”), with JPMorgan Chase Bank, N.A. as collateral agent. Pursuant to the Amended

and Restated Security Agreements, the Corporation and the Subsidiary Grantors granted to the collateral agent for the benefit of the Secured

Parties (as defined in the Amended and Restated Security Agreements) liens on substantially all inventory of the Corporation and the Subsidiary

Grantors, trade accounts receivable and other related assets.

The foregoing descriptions of the Sixth Amended

and Restated Credit Agreement and the Amended and Restated Security Agreements do not purport to be complete and are qualified in their

entireties by the copies of such agreements filed herewith as Exhibits 10.1, 10.2, 10.3 and 10.4.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation

under an Off Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01 of this

Current Report on Form 8-K is incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

On June 1, 2022, the Corporation issued a press

release announcing the closing of the Sixth Amended and Restated Credit Agreement. A copy of the press release is furnished as Exhibit

99.1 hereto.

In accordance with General Instruction B.2 of

Form 8-K, the information contained in this Item 7.01 and Exhibit 99.1 is being furnished under Item 7.01 of Form 8-K and shall not be

deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of that section, nor shall such information and exhibits be incorporated by reference into any

filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference

in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| Exhibit Number |

Description |

| |

|

| 10.1 |

Sixth Amended and Restated Credit Agreement, dated as of May 27, 2022, among United States Steel Corporation, the Subsidiary Guarantors from time to time party thereto, the Lenders party thereto, the LC Issuing Banks party thereto, and JPMorgan Chase Bank, N.A., as Administrative and Collateral Agent. |

| |

|

| 10.2 |

Third Amended and Restated Borrower Security Agreement, dated as of May 27, 2022, between United States Steel Corporation and JPMorgan Chase Bank, N.A., as Collateral Agent. |

| |

|

| 10.3 |

Third Amended and Restated Subsidiary Security Agreement, dated as of May 27, 2022, between the Subsidiary Guarantors and JPMorgan Chase Bank, N.A., as Collateral Agent. |

| |

|

| 10.4 |

Second Amended and Restated Borrower Canadian Security Agreement, dated as of May 27, 2022, between United States Steel Corporation and JPMorgan Chase Bank, N.A., as Collateral Agent. |

| |

|

| 99.1 |

Press Release. |

| |

|

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

UNITED STATES STEEL CORPORATION

| By: |

/s/ Manpreet S. Grewal |

|

| |

Name: Manpreet S. Grewal |

|

| |

Title: Vice President, Controller & Chief Accounting Officer |

|

| |

|

|

| Dated: |

June 3, 2022 |

|

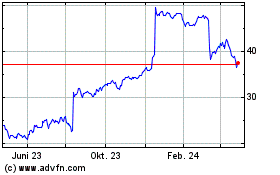

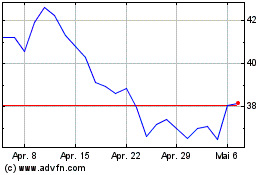

US Steel (NYSE:X)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

US Steel (NYSE:X)

Historical Stock Chart

Von Apr 2023 bis Apr 2024