Additional Proxy Soliciting Materials (definitive) (defa14a)

16 Mai 2022 - 2:20PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☒ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

White Mountains Insurance Group, Ltd.

(Name of Registrant as Specified In Its Charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

Robert L. Seelig

Executive Vice President &

General Counsel

May 13, 2022

Glass Lewis HQ – California

255 California Street, Suite 1100

San Francisco, CA 94111

Re: 2022 Glass Lewis Report on White Mountains Insurance Group, Ltd.

To Whom It May Concern:

White Mountains Insurance Group, Ltd. (“White Mountains”) appreciates the opportunity to respond to the Glass Lewis proxy research report on White Mountains that was published on May 4, 2022. We would like to highlight important facts about our executive compensation program and our extensive shareholder engagement efforts for your reference and the reference of our shareholders.

We respectfully request that you (i) publish an updated version of the research report that includes this information and (ii) revise your report to recommend FOR our Advisory Vote to Ratify Named Executive Officers’ Compensation.

Design of our Executive Compensation Program

•We utilize a pay-for-performance compensation program that closely aligns the financial interests of management with those of our shareholders.

•We emphasize variable long-term compensation rather than fixed entitlements. Salaries are limited to a maximum of $500,000, which is generally below market.

•For details, see pages 27-28 in our 2022 Proxy Statement.

For 2021, Named Executive Officers (“NEOs”) Did Not Receive Annual Bonuses

•Under our entirely formulaic annual bonus program, the level of payout is determined by reference to the Company’s growth in compensation value per share (“CVPS”). We use this metric because it is the most pertinent metric to our business as a whole and what we focus on the most.

•Because our 2021 growth in CVPS was below the pre-established threshold for bonuses to be earned, the CNG Committee awarded the NEOs bonuses of 0% of target.

•For details, see pages 33-34 in our 2022 Proxy Statement.

| | | | | | | | |

Corporate Headquarters: White Mountains Insurance Group, Ltd. A.S. Cooper Building 26 Reid Street Hamilton, HM 11 Bermuda Ph: 441-278-3160 u Fax: 441-278-3170 | | Hanover Office: White Mountains Insurance Group, Ltd. 23 South Main Street, Suite 3B Hanover NH 03755 USA Ph: 603-640-2212 u Fax: 603-640-2250 Email: ir@whitemountains.com |

2019 – 2021 Long-Term Incentives Were Paid in Accordance with Pre-established and Disclosed Formulaic Goals

•As disclosed in previous proxy statements, in 2019 the CNG established 7% annual growth in CVPS as the performance target for a 100% payout of performance shares for the 2019-2021 performance cycle. Annual growth of 12% or more would result in a 200% award for the cycle and annual growth of 2% or less would result in a 0% payout.

•The CNG Committee tied long-term incentive payouts to growth in CVPS because it is the most pertinent metric to our business as a whole. Over the long-term, the market value of our shares has generally moved in tandem with changes in our book value per share metrics. See page 32 of our 2022 Proxy Statement.

•Based on an average annual growth in CVPS of 10.6% from 2019-2021, the formulaic payout earned was 172% of target, as confirmed by the CNG Committee.

Robust and Proactive Shareholder Engagement Program

•As part of our ongoing commitment to better understand the views of our shareholders with respect to our business, governance, and compensation practices, we regularly engage with our shareholders. Over the past several years, feedback received from these discussions has helped guide refinements to our executive compensation programs and governance practices, as well as enhancements to our public disclosures.

•In engagement with several of our largest investors in late-2021, executive compensation was a key topic of discussion, and our management team and CNG Committee Chair received overwhelmingly positive feedback on our executive compensation practices. In fact, no shareholder voiced any concern about White Mountains’ executive compensation practices.

•For details, see pages 26 and 29 in our 2022 Proxy Statement.

Our Executive Compensation Program Works Exactly as Intended and Communicated

•White Mountains’ executive compensation program for 2021 delivered results in the exact manner as was intended and communicated to our shareholders.

•Further, there have been no changes made to our executive compensation program from last year, when Glass Lewis recommended FOR our Say-on-Pay vote and when our Say-on-Pay vote received nearly 98% support from shareholders.

We would welcome the opportunity to discuss the points outlined in this letter to answer any questions you might have, and we appreciate your consideration. If any of our shareholders have any questions regarding our executive compensation practices, please feel free to reach out to me at ir@whitemountains.com or 603-640-2212.

Sincerely,

| | | | | | | | |

Corporate Headquarters: White Mountains Insurance Group, Ltd. A.S. Cooper Building 26 Reid Street Hamilton, HM 11 Bermuda Ph: 441-278-3160 u Fax: 441-278-3170 | | Hanover Office: White Mountains Insurance Group, Ltd. 23 South Main Street, Suite 3B Hanover NH 03755 USA Ph: 603-640-2212 u Fax: 603-640-2250 Email: ir@whitemountains.com |

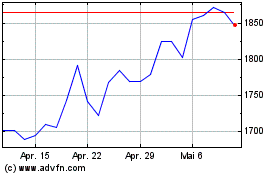

White Moutains Insurance (NYSE:WTM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

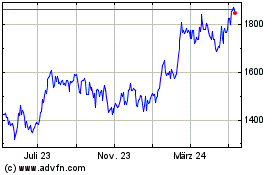

White Moutains Insurance (NYSE:WTM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024