Current Report Filing (8-k)

28 Juni 2022 - 10:32PM

Edgar (US Regulatory)

false000010851600001085162022-06-222022-06-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 22, 2022

WORTHINGTON INDUSTRIES, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

Ohio |

|

1-8399 |

|

31-1189815 |

(State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

200 Old Wilson Bridge Road, Columbus, Ohio 43085

(Address of Principal Executive Offices) (Zip Code)

(614) 438-3210

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Shares, without par value |

WOR |

NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b‑2 of the Securities Exchange Act of 1934 (§240.12b‑2 of this chapter).

|

|

|

Emerging growth company |

|

☐ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

|

☐ |

Item 2.02. Results of Operations and Financial Condition.

Management of Worthington Industries, Inc. (the “Registrant”) conducted a conference call on June 23, 2022, beginning at approximately 8:30 a.m., Eastern Daylight Time, to discuss the Registrant’s unaudited financial results for the fourth quarter and fiscal year ended May 31, 2022. Additionally, the Registrant’s management addressed certain issues related to the outlook for the Registrant and its subsidiaries and their respective markets for the coming months. A copy of the transcript of the conference call is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information contained in this Item 2.02 and in Exhibit 99.1 furnished with this Current Report on Form 8-K, is being furnished pursuant to Item 2.02 and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, unless the Registrant specifically states that the information is to be considered “filed” under the Exchange Act or incorporates the information by reference into a filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act.

In the conference call, management referred to adjusted earnings before interest, taxes, depreciation and amortization (“EBITDA”) for the Registrant’s fourth quarter and the fiscal year ended May 31, 2022. These represent non-GAAP financial measures and are used by management as measures of operating performance. EBITDA is calculated by adding or subtracting, as appropriate, interest expense, income tax expense and depreciation and amortization to/from net earnings attributable to controlling interest and adjusted EBITDA is calculated by adding or subtracting, as appropriate, impairment of long-lived assets, restructuring and other expense (income), net, and incremental expenses related to Nikola gains, in each case pre-tax, to/from EBITDA. A reconciliation from the GAAP-based measure of net earnings attributable to controlling interest to the non-GAAP financial measure of adjusted EBITDA for the fourth quarter and fiscal year ended May 31, 2022, as mentioned in the conference call, is outlined below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fourth |

|

|

Third |

|

|

Second |

|

|

First |

|

|

Fourth |

|

|

|

Quarter |

|

|

Quarter |

|

|

Quarter |

|

|

Quarter |

|

|

Quarter |

|

(In thousands) |

|

2022 |

|

|

2022 |

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings attributable to controlling interest |

|

$ |

80,252 |

|

|

$ |

56,342 |

|

|

$ |

110,301 |

|

|

$ |

132,491 |

|

|

$ |

113,555 |

|

Impairment of long-lived assets (pre-tax) 1 |

|

|

- |

|

|

|

1,938 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Restructuring and other expense (income), net (pre-tax) 1 |

|

|

(2,418 |

) |

|

|

(504 |

) |

|

|

(1,923 |

) |

|

|

(6,328 |

) |

|

|

18,402 |

|

Incremental expenses related to Nikola gains (pre-tax) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(2,676 |

) |

Interest expense |

|

|

8,167 |

|

|

|

8,140 |

|

|

|

7,312 |

|

|

|

7,718 |

|

|

|

7,650 |

|

Income tax expense |

|

|

24,963 |

|

|

|

18,683 |

|

|

|

31,226 |

|

|

|

40,150 |

|

|

|

27,449 |

|

Adjusted earnings before interest and taxes (Adjusted EBIT) 1 |

|

$ |

110,964 |

|

|

$ |

84,599 |

|

|

$ |

146,916 |

|

|

$ |

174,031 |

|

|

$ |

164,380 |

|

Depreciation and amortization |

|

|

28,248 |

|

|

|

27,425 |

|

|

|

21,090 |

|

|

|

22,064 |

|

|

|

21,990 |

|

Adjusted earnings before interest, taxes, depreciation and amortization (Adjusted EBITDA) 1 |

|

$ |

139,212 |

|

|

$ |

112,024 |

|

|

$ |

168,006 |

|

|

$ |

196,095 |

|

|

$ |

186,370 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trailing twelve months adjusted EBITDA 1 |

|

$ |

615,337 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Excludes the impact of the noncontrolling interest. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In the conference call, management also referred to adjusted EBITDA margin, excluding inventory holding gains for the Registrant’s Steel Processing reportable segment for the fiscal year ended May 31, 2022. This represents a non-GAAP financial measure and is used by management as a measure of operating performance. Adjusted EBITDA is calculated as described above. Adjusted EBITDA, excluding inventory holding gains is calculated by subtracting inventory holding gains, pre-tax, from adjusted EBITDA. A reconciliation from the GAAP-based measure of net earnings attributable to controlling interest to the non-GAAP financial measure of adjusted EBITDA margin, excluding inventory holding gains for the Registrant’s Steel Processing reportable segment for the fiscal year ended May 31, 2022, as mentioned in the conference call, is outlined below.

|

|

|

|

|

|

|

Twelve Months Ended |

|

(In thousands) |

|

May 31, 2022 |

|

|

|

|

|

Net sales |

|

$ |

3,933,021 |

|

|

|

|

|

Net earnings attributable to controlling interest |

|

$ |

209,890 |

|

Impairment of long-lived assets (pre-tax) 1 |

|

|

1,937 |

|

Restructuring and other income, net (pre-tax) 1 |

|

|

(8,555 |

) |

Adjusted earnings before interest and taxes (Adjusted EBIT) 1 |

|

$ |

203,272 |

|

Depreciation and amortization |

|

|

55,771 |

|

Adjusted earnings before interest, taxes, depreciation and amortization (Adjusted EBITDA) 1 |

|

$ |

259,043 |

|

Inventory holding gains (pre-tax) |

|

|

(21,867 |

) |

Adjusted EBITDA, excluding inventory holding gains |

|

$ |

237,176 |

|

|

|

|

|

Adjusted EBITDA margin, excluding inventory holding gains |

|

|

6.0 |

% |

|

|

|

|

1 Excludes the impact of the noncontrolling interest. |

|

|

|

In the conference call, management also referred to free cash flow for the three and twelve months ended May 31, 2022. Free cash flow is a non-GAAP financial metric that management believes measures the Registrant’s ability to generate cash beyond what is required for its business operations and capital expenditures. The following provides a reconciliation of free cash flow from net cash provided by operating activities for the fourth quarter and fiscal year ended May 31, 2022.

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

(In thousands) |

|

May 31, 2022 |

|

Net cash provided by operating activities |

|

$ |

164,838 |

|

Investment in property, plant and equipment |

|

|

(22,796 |

) |

Free cash flow |

|

$ |

142,042 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve Months Ended |

|

(In thousands) |

|

May 31, 2022 |

|

Net cash provided by operating activities |

|

$ |

70,112 |

|

Investment in property, plant and equipment |

|

|

(94,600 |

) |

Free cash flow |

|

$ |

(24,488 |

) |

In the conference call, management also referred to net sales, excluding the divestiture of the liquified propane gas (“LPG”) autogas business in Poland, for its Sustainable Energy Solutions (“SES”) reportable segment for the three months ended May 31, 2022, and 2021. This represents a non-GAAP measure and is used by management as a measure of operating performance for the SES business. A reconciliation from the GAAP-based measure of net sales to the non-GAAP measure for the three months ended May 31, 2022, and 2021, as mentioned in the conference call, is outlined below.

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

May 31, |

|

(In thousands) |

|

2022 |

|

|

2021 |

|

Net sales |

|

$ |

41,335 |

|

|

$ |

40,908 |

|

Net sales - LPG autogas divestiture |

|

|

- |

|

|

|

(6,457 |

) |

Net sales, excluding LPG autogas divestiture |

|

$ |

41,335 |

|

|

$ |

34,451 |

|

|

|

|

|

|

|

|

Change |

|

$ |

6,884 |

|

|

|

|

% Change |

|

|

20 |

% |

|

|

|

Additional non-GAAP financial measures referred to by management on the conference call, including reconciliations to the most comparable GAAP financial measures, are included in Exhibit 99.1 to the Registrant’s Current Report on Form 8-K filed on June 22, 2022. Such Exhibit 99.1 includes a copy of the Registrant’s news release issued on June 22, 2022 (the “Financial News Release”) reporting results for the fourth quarter and fiscal year ended May 31, 2022. The Financial News Release was made available on the Registrant’s website during the conference call and remains available on the Registrant’s website.

Item 8.01. Other Events.

On June 22, 2022, the Registrant issued a news release (the “Dividend Release”) reporting that the Registrant’s Board of Directors had declared a quarterly cash dividend of $0.31 per share in respect of the Registrant’s common shares. The dividend was declared on June 22, 2022 and is payable on September 29, 2022 to shareholders of record at the close of business on September 15, 2022. A copy of the Dividend Release is included with this Current Report on Form 8‑K as Exhibit 99.2 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(a) through (c): Not applicable.

(d) Exhibits:

The following exhibits are included with this Current Report on Form 8‑K:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

WORTHINGTON INDUSTRIES, INC. |

|

|

|

|

|

Date: June 28, 2022 |

|

By: |

|

/s/ Patrick J. Kennedy |

|

|

|

|

Patrick J. Kennedy, Vice President - General Counsel and Secretary |

|

|

|

|

|

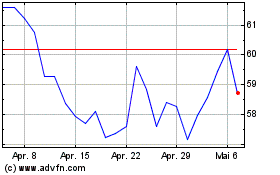

Worthington Enterprises (NYSE:WOR)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Worthington Enterprises (NYSE:WOR)

Historical Stock Chart

Von Apr 2023 bis Apr 2024