Amended Statement of Beneficial Ownership (sc 13d/a)

18 August 2022 - 10:26PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 13D

(Rule 13d-101)

Under the Securities Exchange Act of 1934

(Amendment No. 9)

ADVANCED DRAINAGE SYSTEMS INC.

(Name of Issuer)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

00790R104

(CUSIP Number)

Sharlyn C. Heslam

Berkshire Partners Holdings LLC

200 Clarendon Street, 35th Floor

Boston, MA 02116

(617) 227-0050

with a copy to:

Edward S. Horton, Esq.

Seward & Kissel LLP

One Battery Park Plaza

New York, NY 10004

(212) 574-1265

(Name, Address and Telephone Number of

Person Authorized to Receive Notices and Communications)

August 16, 2022

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement on Schedule 13G to

report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f)

or 240.13d-1(g), check the following box. ¨

Note. Schedule filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See § 240.13d-7 for other parties to whom copies are

to be sent.

* The remainder of this cover

page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for

any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not

be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended ("Act"),

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

| CUSIP No. 00790R104 |

13D |

Page 2 of 16 |

| 1 |

Names of Reporting Persons

Berkshire Partners LLC

|

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ☐ (b)

☑

|

| 3 |

SEC Use Only

|

| 4 |

Source of Funds

OO

|

| 5 |

Check if Disclosure of Legal Proceedings is Required Pursuant to Item 2(d)

or 2(e)

☐

|

| 6 |

Citizenship or Place of Organization

Massachusetts

|

| Number of Shares Beneficially Owned by Each Reporting Person With |

7 |

Sole Voting Power

0

|

| 8 |

Shared Voting Power

1,968,728 |

| 9 |

Sole Dispositive Power

0

|

| 10 |

Shared Dispositive Power

1,968,728 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,968,728 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

☐

|

| 13 |

Percent of Class Represented by Amount in Row (11)

2.4%* |

| 14 |

Type of Reporting Person

IA |

| |

|

|

|

| * |

Percentage calculations are based on the number of shares of Common Stock outstanding as of July 27, 2022, as reported in the Issuer's Quarterly Report on Form 10-Q for the quarterly fiscal period ended June 30, 2022. |

| CUSIP No. 00790R104 |

13D |

Page 3 of 16 |

| 1 |

Names of Reporting Persons

Berkshire Fund IX, L.P.

|

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ☐ (b)

☑

|

| 3 |

SEC Use Only

|

| 4 |

Source of Funds

OO

|

| 5 |

Check if Disclosure of Legal Proceedings is Required Pursuant to Item 2(d)

or 2(e)

☐

|

| 6 |

Citizenship or Place of Organization

Delaware

|

| Number of Shares Beneficially Owned by Each Reporting Person With |

7 |

Sole Voting Power

0

|

|

| 8 |

Shared Voting Power

1,351,338 |

|

| 9 |

Sole Dispositive Power

0

|

|

| 10 |

Shared Dispositive Power

1,351,338 |

|

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,351,338 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

☐

|

| 13 |

Percent of Class Represented by Amount in Row (11)

1.6%*

|

| 14 |

Type of Reporting Person

PN

|

| |

|

|

|

|

| * |

Percentage calculations are based on the number of shares of Common Stock outstanding as of July 27, 2022, as reported in the Issuer's Quarterly Report on Form 10-Q for the quarterly fiscal period ended June 30, 2022. |

| CUSIP No. 00790R104 |

13D |

Page 4 of 16 |

| 1 |

Names of Reporting Persons

Berkshire Fund IX-A, L.P.

|

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ☐ (b)

☑

|

| 3 |

SEC Use Only

|

| 4 |

Source of Funds

OO

|

| 5 |

Check if Disclosure of Legal Proceedings is Required Pursuant to Item 2(d)

or 2(e)

☐

|

| 6 |

Citizenship or Place of Organization

Delaware

|

| Number of Shares Beneficially Owned by Each Reporting Person With |

7 |

Sole Voting Power

0

|

| 8 |

Shared Voting Power

553,573 |

| 9 |

Sole Dispositive Power

0

|

| 10 |

Shared Dispositive Power

553,573 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

553,573 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

☐

|

| 13 |

Percent of Class Represented by Amount in Row (11)

0.7%*

|

| 14 |

Type of Reporting Person

PN

|

| |

|

|

|

| * |

Percentage calculations are based on the number of shares of Common Stock outstanding as of July 27, 2022, as reported in the Issuer's Quarterly Report on Form 10-Q for the quarterly fiscal period ended June 30, 2022 |

| CUSIP No. 00790R104 |

13D |

Page 5 of 16 |

| 1 |

Names of Reporting Persons

Berkshire Investors III LLC

|

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ☐ (b)

☑

|

| 3 |

SEC Use Only

|

| 4 |

Source of Funds

OO

|

| 5 |

Check if Disclosure of Legal Proceedings is Required Pursuant to Item 2(d)

or 2(e)

☐

|

| 6 |

Citizenship or Place of Organization

Massachusetts

|

| Number of Shares Beneficially Owned by Each Reporting Person With |

7 |

Sole Voting Power

0

|

| 8 |

Shared Voting Power

32,736 |

| 9 |

Sole Dispositive Power

0

|

| 10 |

Shared Dispositive Power

32,736 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

32,736 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

☐

|

| 13 |

Percent of Class Represented by Amount in Row (11)

Less than 0.1%*

|

| 14 |

Type of Reporting Person

OO

|

| |

|

|

|

| * |

Percentage calculations are based on the number of shares of Common Stock outstanding as of July 27, 2022, as reported in the Issuer's Quarterly Report on Form 10-Q for the quarterly fiscal period ended June 30, 2022 |

| CUSIP No. 00790R104 |

13D |

Page 6 of 16 |

| 1 |

Names of Reporting Persons

Berkshire Investors IV LLC

|

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ☐ (b)

☑

|

| 3 |

SEC Use Only

|

| 4 |

Source of Funds

OO

|

| 5 |

Check if Disclosure of Legal Proceedings is Required Pursuant to Item 2(d)

or 2(e)

☐

|

| 6 |

Citizenship or Place of Organization

Delaware

|

| Number of Shares Beneficially Owned by Each Reporting Person With |

7 |

Sole Voting Power

0

|

| 8 |

Shared Voting Power

31,081 |

| 9 |

Sole Dispositive Power

0

|

| 10 |

Shared Dispositive Power

31,081 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

31,081 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

☐

|

| 13 |

Percent of Class Represented by Amount in Row (11)

Less than 0.1%*

|

| 14 |

Type of Reporting Person

OO

|

| |

|

|

|

| * |

Percentage calculations are based on the number of shares of Common Stock outstanding as of July 27, 2022, as reported in the Issuer's Quarterly Report on Form 10-Q for the quarterly fiscal period ended June 30, 2022 |

| CUSIP No. 00790R104 |

13D |

Page 7 of 16 |

| 1 |

Names of Reporting Persons

Stockbridge Fund, L.P.

|

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ☐ (b)

☑

|

| 3 |

SEC Use Only

|

| 4 |

Source of Funds

OO

|

| 5 |

Check if Disclosure of Legal Proceedings is Required Pursuant to Item 2(d)

or 2(e)

☐

|

| 6 |

Citizenship or Place of Organization

Delaware

|

| Number of Shares Beneficially Owned by Each Reporting Person With |

7 |

Sole Voting Power

0

|

| 8 |

Shared Voting Power

1,958,463 |

| 9 |

Sole Dispositive Power

0

|

| 10 |

Shared Dispositive Power

1,958,463 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,958,463 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

☐

|

| 13 |

Percent of Class Represented by Amount in Row (11)

2.3%*

|

| 14 |

Type of Reporting Person

PN

|

| |

|

|

|

| * |

Percentage calculations are based on the number of shares of Common Stock outstanding as of July 27, 2022, as reported in the Issuer's Quarterly Report on Form 10-Q for the quarterly fiscal period ended June 30, 2022 |

| CUSIP No. 00790R104 |

13D |

Page 8 of 16 |

| 1 |

Names of Reporting Persons

Stockbridge Partners LLC

|

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ☐ (b)

☑

|

| 3 |

SEC Use Only

|

| 4 |

Source of Funds

OO

|

| 5 |

Check if Disclosure of Legal Proceedings is Required Pursuant to Item 2(d)

or 2(e)

☐

|

| 6 |

Citizenship or Place of Organization

Delaware

|

| Number of Shares Beneficially Owned by Each Reporting Person With |

7 |

Sole Voting Power

0

|

| 8 |

Shared Voting Power

2,222,369 |

| 9 |

Sole Dispositive Power

0

|

| 10 |

Shared Dispositive Power

2,222,369 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,222,369

|

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

☐

|

| 13 |

Percent of Class Represented by Amount in Row (11)

2.7%*

|

| 14 |

Type of Reporting Person

IA

|

| |

|

|

|

| * |

Percentage calculations are based on the number of shares of Common Stock outstanding as of July 27, 2022, as reported in the Issuer's Quarterly Report on Form 10-Q for the quarterly fiscal period ended June 30, 2022 |

| CUSIP No. 00790R104 |

13D |

Page 9 of 16 |

| 1 |

Names of Reporting Persons

Berkshire Partners Holdings LLC

|

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ☐ (b)

☑

|

| 3 |

SEC Use Only

|

| 4 |

Source of Funds

OO

|

| 5 |

Check if Disclosure of Legal Proceedings is Required Pursuant to Item 2(d)

or 2(e)

☐

|

| 6 |

Citizenship or Place of Organization

Delaware

|

| Number of Shares Beneficially Owned by Each Reporting Person With |

7 |

Sole Voting Power

0

|

| 8 |

Shared Voting Power

4,191,097 |

| 9 |

Sole Dispositive Power

0

|

| 10 |

Shared Dispositive Power

4,191,097 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

4,191,097 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

☐

|

| 13 |

Percent of Class Represented by Amount in Row (11)

5.0%*

|

| 14 |

Type of Reporting Person

OO

|

| |

|

|

|

| * |

Percentage calculations are based on the number of shares of Common Stock outstanding as of July 27, 2022, as reported in the Issuer's Quarterly Report on Form 10-Q for the quarterly fiscal period ended June 30, 2022 |

| CUSIP No. 00790R104 |

13D |

Page 10 of 16 |

| 1 |

Names of Reporting Persons

BPSP, L.P.

|

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ☐ (b)

☑

|

| 3 |

SEC Use Only

|

| 4 |

Source of Funds

OO

|

| 5 |

Check if Disclosure of Legal Proceedings is Required Pursuant to Item 2(d)

or 2(e)

☐

|

| 6 |

Citizenship or Place of Organization

Delaware

|

| Number of Shares Beneficially Owned by Each Reporting Person With |

7 |

Sole Voting Power

0

|

| 8 |

Shared Voting Power

4,191,097 |

| 9 |

Sole Dispositive Power

0

|

| 10 |

Shared Dispositive Power

4,191,097 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

4,191,097 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

☐

|

| 13 |

Percent of Class Represented by Amount in Row (11)

5.0%*

|

| 14 |

Type of Reporting Person

PN

|

| |

|

|

|

| * |

Percentage calculations are based on the number of shares of Common Stock outstanding as of July 27, 2022, as reported in the Issuer's Quarterly Report on Form 10-Q for the quarterly fiscal period ended June 30, 2022 |

| CUSIP No. 00790R104 |

13D |

Page 11 of 16 |

EXPLANATORY NOTE

This Amendment No. 9

("Amendment No. 9") amends the Schedule 13D first filed on August 8, 2017, as amended on May 31, 2018, August 30, 2018,

December 14, 2020, March 12, 2021, July 26, 2021, September 16, 2021, December 15, 2021 and June 14, 2022 (the "Schedule 13D"),

and is being filed jointly by the following (each, a "Reporting Person" and collectively, the "Reporting Persons"):

Berkshire Partners LLC ("BP" ), Berkshire Fund IX, L.P. ("BF IX" ), Berkshire Fund IX-A, L.P. ("BF

IX-A" ), Berkshire Investors III LLC ("BI III"), Berkshire Investors IV LLC ("BI IV"), Stockbridge

Fund, L.P. (f/k/a Stockbridge Special Situations Fund, L.P.) ("SF"), Stockbridge Partners LLC ("SP"),

BPSP, L.P. ("BPSP") and Berkshire Partners Holdings LLC ("BPH"). Unless otherwise indicated, all

capitalized terms not used and not defined herein have the respective meanings provided to them in the Schedule 13D.

Certain of the Reporting

Persons filed a statement on Schedule 13G on August 27, 2015, as amended on February 16, 2016 and February 14, 2017 (the "Original

Schedule 13G") with the U.S. Securities and Exchange Commission (the "SEC") pursuant to Section 13(d) of the

Act and Rule 13d-1(c) thereunder, with respect to their ownership of the shares of Common Stock.

| CUSIP No. 00790R104 |

13D |

Page 12 of 16 |

| Item 5. | Interest in Securities of the Issuer |

The twelfth paragraph

of Item 5(a) and (b) is amended and restated in its entirety to read as follows:

Percentage calculations are based on the number

of shares of Common Stock outstanding as of July 27, 2022, as reported in the Issuer's Quarterly Report on Form 10-Q for the quarterly

fiscal period ended June 30, 2022.

As disclosed in the Issuer's

Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2022, there were 83,571,171 shares of Common Stock issued and outstanding

as of July 27, 2022. Accordingly, the shares of Common Stock beneficially owned by the Reporting Persons, in the aggregate, represent

approximately 5.0% of the outstanding shares of Common Stock, which is broken out by Reporting Person as follows:

| i. | BPH beneficially owns 5.0% of the Issuer's Common Stock. |

| ii. | BPSP beneficially owns 5.0% of the Issuer's Common Stock. |

| iii. | BP beneficially owns 2.4% of the Issuer's Common Stock. |

| iv. | SP beneficially owns 2.7% of the Issuer's Common Stock. |

| v. | BF IX beneficially owns 1.6% of the Issuer's Common Stock. |

| vi. | BF IX-A beneficially owns 0.7% of the Issuer's Common Stock. |

| vii. | SF beneficially owns 2.3% of the Issuer's Common Stock. |

| viii. | BI III beneficially owns less than 0.1% of the Issuer's Common Stock. |

| ix. | BI IV beneficially owns less than 0.1% of the Issuer's Common Stock. |

Item 5(c) is amended

to add the following at the end thereof:

On August 16, 2022

each of BF IX, BF IX-A, BI III and BI IV completed a pro rata in-kind distribution of 687,577, 281,664, 15,260 and 15,499 shares of Common

Stock, respectively, to their respective limited partners or members. Except as described in this Item 5(c), the Reporting Persons have

not effected any transactions in the Common Stock during the 60-day period ended August 18, 2022.

Item 7. Material

to be Filed as Exhibits.

Exhibit A Joint

Filing Agreement

| CUSIP No. 00790R104 |

13D |

Page 13 of 16 |

SIGNATURES

After reasonable inquiry and to the best of its

knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: August

18, 2022

| |

|

BERKSHIRE PARTNERS LLC |

| |

|

|

| |

|

By: BPSP, L.P., |

| |

|

its managing member |

| |

|

|

| |

|

By: Berkshire Partners Holdings LLC, |

| |

|

its general partner |

| |

|

|

| |

|

By: /s/ Kenneth S. Bring |

| |

|

Name: Kenneth S. Bring |

| |

|

Title: Managing Director |

| |

|

|

|

| |

|

|

|

| |

|

BERKSHIRE FUND IX, L.P. |

| |

|

|

|

| |

|

By: Ninth Berkshire Associates LLC, |

| |

|

its general partner |

| |

|

|

|

| |

|

By: /s/ Kenneth S. Bring |

| |

|

Name: Kenneth S. Bring |

| |

|

Title: Managing Director |

| |

|

|

|

| |

|

|

|

| |

|

BERKSHIRE FUND IX-A, L.P. |

| |

|

|

|

| |

|

By: Ninth Berkshire Associates LLC, |

| |

|

its general partner |

| |

|

|

|

| |

|

By: /s/ Kenneth S. Bring |

| |

|

Name: Kenneth S. Bring |

| |

|

Title: Managing Director |

| |

|

|

|

| |

|

|

|

| |

|

BERKSHIRE INVESTORS IV LLC |

| |

|

|

|

| |

|

By: /s/ Kenneth S. Bring |

| |

|

Name: Kenneth S. Bring |

| |

|

Title: Managing Director |

| |

|

|

|

| |

|

|

|

| |

|

BERKSHIRE INVESTORS III LLC |

| |

|

|

|

| |

|

By: /s/ Kenneth S. Bring |

| |

|

Name: Kenneth S. Bring |

| |

|

Title: Managing Director |

| |

|

|

[Signature Page to Schedule 13D]

| CUSIP No. 00790R104 |

13D |

Page 14 of 16 |

| |

|

STOCKBRIDGE FUND, L.P. |

| |

|

|

|

| |

|

By: Stockbridge Associates LLC, |

| |

|

its general partner |

| |

|

|

|

| |

|

By: /s/ Kenneth S. Bring |

| |

|

Name: Kenneth S. Bring |

| |

|

Title: Managing Director |

| |

|

|

|

| |

|

STOCKBRIDGE PARTNERS LLC

By: BPSP, L.P.,

its managing member

By: Berkshire

Partners Holdings LLC,

its general partner

By: /s/ Kenneth

S. Bring

Name: Kenneth S. Bring

Title: Managing Director

BERKSHIRE PARTNERS HOLDINGS LLC

By: /s/ Kenneth

S. Bring

Name: Kenneth S. Bring

Title: Managing Director

BPSP, L.P.

By: Berkshire

Partners Holdings LLC,

its general partner

By: /s/ Kenneth

S. Bring

Name: Kenneth S. Bring

Title: Managing Director |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

| |

|

|

|

|

[Signature Page to Schedule 13D]

| CUSIP No. 00790R104 |

13D |

Page 15 of 16 |

JOINT

FILING AGREEMENT

This will confirm the agreement by and among all

the undersigned that the Schedule 13D filed on or about this date and any amendments thereto with respect to the beneficial ownership

by the undersigned of shares of common stock, $0.01 par value per share, of Advanced Drainage Systems, Inc. is being filed on behalf of

each of the undersigned in accordance with Rule 13d-1(k)(1) under the Securities Exchange Act of 1934. This agreement may be executed

in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

The execution and filing of this agreement shall not be construed as an admission that the undersigned are a group, or have agreed to

act as a group.

Dated: August

18, 2022

| |

|

BERKSHIRE PARTNERS LLC

By: BPSP, L.P.,

its managing member

By: Berkshire

Partners Holdings LLC,

its general partner

By: /s/ Kenneth

S. Bring

Name: Kenneth S. Bring

Title: Managing Director

BERKSHIRE FUND IX, L.P.

By: Ninth Berkshire

Associates LLC,

its general partner

By: /s/ Kenneth

S. Bring

Name: Kenneth S. Bring

Title: Managing Director

BERKSHIRE FUND IX-A, L.P.

By: Ninth Berkshire

Associates LLC,

its general partner

By: /s/ Kenneth

S. Bring

Name: Kenneth S. Bring

Title: Managing Director

BERKSHIRE INVESTORS IV LLC

By: /s/ Kenneth

S. Bring

Name: Kenneth S. Bring

Title: Managing Director

BERKSHIRE INVESTORS III LLC

By:

/s/ Kenneth S. Bring

Name: Kenneth S. Bring

Title: Managing Director

|

[Signature Page to Schedule 13D - Joint Filing

Agreement]

| CUSIP No. 00790R104 |

13D |

Page 16 of 16 |

| |

|

STOCKBRIDGE FUND, L.P.

By: Stockbridge

Associates LLC,

its general partner

By: /s/ Kenneth

S. Bring

Name: Kenneth S. Bring

Title: Managing Director

STOCKBRIDGE PARTNERS LLC

By: BPSP, L.P.,

its managing member

By: Berkshire

Partners Holdings LLC,

its general partner

By: /s/ Kenneth

S. Bring

Name: Kenneth S. Bring

Title: Managing Director

BERKSHIRE PARTNERS HOLDINGS LLC

By: /s/ Kenneth

S. Bring

Name: Kenneth S. Bring

Title: Managing Director

BPSP, L.P.

By: Berkshire

Partners Holdings LLC,

its general partner

By: /s/ Kenneth

S. Bring

Name: Kenneth S. Bring

Title: Managing Director

|

[Signature Page to Schedule 13D - Joint Filing Agreement]

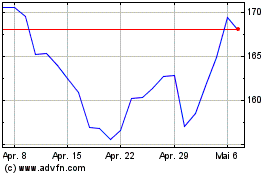

Advanced Drainage Systems (NYSE:WMS)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Advanced Drainage Systems (NYSE:WMS)

Historical Stock Chart

Von Apr 2023 bis Apr 2024