Organic Revenue Growth Drives Increases in

Income from Operations, Operating EBITDA, and Diluted Earnings per

Share

WM Recognized by Forbes as One of the Best

Employers for Diversity

WM (NYSE: WM) today announced financial results for the quarter

ended March 31, 2023.

Three Months Ended

Three Months Ended

March

31, 2023 (in millions, except per

share amounts)

March

31, 2022

(in

millions, except per share amounts)

As Reported

As Adjusted(a)

As Reported

As Adjusted(a)

Revenue

$4,892

$4,892

$4,661

$4,661

Income from Operations

$825

$828

$768

$803

Operating EBITDA(b)

$1,330

$1,333

$1,250

$1,285

Operating EBITDA Margin

27.2%

27.2%

26.8%

27.6%

Net Income(c)

$533

$535

$513

$540

Diluted EPS

$1.30

$1.31

$1.23

$1.29

“Our performance to start 2023 delivered results in line with

our expectations, keeping us on track to achieve the full-year

guidance provided at the end of January,” said Jim Fish, WM’s

President and Chief Executive Officer. “In the first quarter, our

teams executed well, delivering organic revenue growth in the

collection and disposal business of 7.0%. As we move into the

second quarter where we begin to see the seasonal uptick in our

business, we remain laser focused on our three top priorities for

the year—cost management and leveraging technology and automation

to drive permanent cost reductions, disciplined pricing, and

execution on our sustainability growth investments.”

KEY HIGHLIGHTS FOR THE FIRST QUARTER OF 2023

Revenue

- Core price for the first quarter of 2023 was 7.4% compared to

7.3% in the first quarter of 2022.(d)

- Collection and disposal yield was 6.2% compared to 5.5% in the

first quarter of 2022.

- Total Company volumes increased 1.2%, or 0.9% on a workday

adjusted basis, compared to 3.6% in the first quarter of 2022, or

3.2% on a workday adjusted basis.

- Collection and disposal volumes increased 1.1%, or 0.8% on a

workday adjusted basis, compared to 4.2% in the first quarter of

2022, or 3.8% on a workday adjusted basis.

Cost Management

- Operating expenses as a percentage of revenue increased 80

basis points to 63.1% in the first quarter of 2023 when compared to

the first quarter of 2022, or 70 basis points to 63.0% on an

adjusted basis.(a) The increase in operating expense margin in the

first quarter, when compared to the prior year, was primarily due

to wage increases, the impact of inflationary cost pressures on

repair and maintenance and subcontractor costs, and margin dilutive

impacts from recently closed acquisitions.

- SG&A expenses were 9.7% of revenue compared to 10.5%, or

10.1% on an adjusted basis, in the first quarter of 2022.(a) The

improvement reflects the Company’s progress in lowering SG&A

expenses through technology and automation.

Profitability

- Operating EBITDA in the Company’s collection and disposal

business, adjusted on the same basis as total Company operating

EBITDA, was $1.5 billion, or 30.6% of revenue, for the first

quarter of 2023, compared to $1.4 billion, or 31.3% of revenue, for

the first quarter of 2022.(e)

- Operating EBITDA in the Company’s recycling line of business

declined by $42 million compared to the first quarter of 2022,

largely in line with expectations. The decline was primarily driven

by the approximately 60% decrease in market prices for

single-stream recycled commodities.

- Operating EBITDA in the Company’s renewable energy business

declined as expected by $20 million compared to the first quarter

of 2022, primarily driven by decreases in the value of renewable

fuel standard credits and lower energy prices.

Free Cash Flow & Capital

Allocation

Three Months Ended

March 31,

(in millions)

2023

2022

Net cash provided by operating

activities

$

1,044

$

1,258

Capital expenditures to support the

business

(504

)

(371

)

Proceeds from divestitures of businesses

and other assets,

net of cash divested

11

5

Free cash flow without sustainability

growth investments

551

892

Capital expenditures - sustainability

growth investments

(156

)

(47

)

Free cash flow

$

395

$

845

- Free cash flow declined in the first quarter primarily due to

higher capital expenditures related to sustainability growth

investments and the timing of collection vehicle deliveries,

increased cash interest, and higher incentive compensation

payments.

- During the first quarter of 2023, $639 million was returned to

shareholders, including $350 million of share repurchases and $289

million of cash dividends.

Fish concluded, “In addition to our solid financial performance,

we’re also proud to be named by Forbes as one of the Best Employers

for Diversity in 2023. Inclusion and Diversity are core values at

WM, and we are pleased to be recognized as a company dedicated to

building a culture that welcomes and supports diverse employees at

all levels.”

-----------------------------------------------------------------------------------------------------------------

(a)

The information labeled as adjusted in

this press release, as well as free cash flow, are non-GAAP

measures. Please see "Non-GAAP Financial Measures" below and the

reconciliations in the accompanying schedules for more

information.

(b)

Management defines operating EBITDA as

GAAP income from operations before depreciation, depletion and

amortization; this measure may not be comparable to

similarly-titled measures reported by other companies.

(c)

For purposes of this press release, all

references to "Net income" refer to the financial statement line

item "Net income attributable to Waste Management, Inc."

(d)

Core price is a performance metric

measuring cumulative price changes net of churn plus price changes

from ancillary fees excluding fuel surcharges. It is used by

management to evaluate the effectiveness of our pricing strategies;

it is not derived from our financial statements and may not be

comparable to measures presented by other companies. Core price is

based on certain historical assumptions, which may differ from

actual results, to allow for comparability between reporting

periods and to reveal trends in results over time.

(e)

In the first quarter of 2023, the Company

updated its collection and disposal operating EBITDA calculation

with a more accurate allocation of costs to this line of business.

The Company has restated the prior periods to be consistent with

the current year presentation.

The Company will host a conference call at 10 a.m. ET on April

27, 2023 to discuss the first quarter results. Information

contained within this press release will be referenced and should

be considered in conjunction with the call.

Listeners can access a live audio webcast of the conference call

by visiting investors.wm.com and selecting “Events &

Presentations” from the website menu. A replay of the audio webcast

will be available at the same location following the conclusion of

the call.

Conference call participants must register to obtain their dial

in and passcode details. This streamlined process improves security

and eliminates wait times when joining the call.

ABOUT WASTE MANAGEMENT

WM (WM.com) is North America's leading provider of comprehensive

environmental solutions. Previously known as Waste Management and

based in Houston, Texas, WM is driven by commitments to put people

first and achieve success with integrity. The company, through its

subsidiaries, provides collection, recycling, and disposal services

to millions of residential, commercial, industrial, and municipal

customers throughout the U.S. and Canada. With innovative

infrastructure and capabilities in recycling, organics, and

renewable energy, WM provides environmental solutions to and

collaborates with its customers in helping them achieve their

sustainability goals. WM has the largest disposal network and

collection fleet in North America, is the largest recycler of

post-consumer materials, and is the leader in beneficial use of

landfill gas, with a growing network of renewable natural gas

plants and the most landfill gas-to-electricity plants in North

America. WM's fleet includes nearly 11,000 natural gas trucks – the

largest heavy-duty natural gas truck fleet of its kind in North

America. To learn more about WM and the company's sustainability

progress and solutions, visit Sustainability.WM.com.

FORWARD-LOOKING STATEMENTS

The Company, from time to time, provides estimates of financial

and other data, comments on expectations relating to future periods

and makes statements of opinion, view or belief about current and

future events. This press release contains a number of such

forward-looking statements, including but not limited to all

statements regarding future performance or financial results of our

business; achievement of financial guidance; and future execution

of strategic priorities, including business optimization,

investments and sustainability projects and growth. You should view

these statements with caution. They are based on the facts and

circumstances known to the Company as of the date the statements

are made. These forward-looking statements are subject to risks and

uncertainties that could cause actual results to be materially

different from those set forth in such forward-looking statements,

including but not limited to failure to implement our optimization,

automation, growth, and cost savings initiatives and overall

business strategy; failure to obtain the results anticipated from

strategic initiatives, investments, acquisitions or new lines of

business; failure to identify acquisition targets, consummate and

integrate acquisitions; environmental and other regulations,

including developments related to emerging contaminants, gas

emissions, renewable energy and environmental, social, and

governance (“ESG”), performance and disclosure; significant

environmental, safety or other incidents resulting in liabilities

or brand damage; failure to obtain and maintain necessary permits

due to land scarcity, public opposition or otherwise; diminishing

landfill capacity, resulting in increased costs and the need for

disposal alternatives; failure to attract, hire and retain key team

members and a high quality workforce; increases in labor costs due

to union organizing activities or changes in wage and labor related

regulations; disruption and costs resulting from extreme weather

and destructive climate events; failure to achieve our

sustainability goals or execute on our sustainability-related

strategy and initiatives; public health risk, increased costs and

disruption due to a future resurgence of pandemic conditions and

restrictions; macroeconomic conditions, geopolitical conflict and

market disruption resulting in labor, supply chain and

transportation constraints, inflationary cost pressures and

fluctuations in commodity prices, fuel and other energy costs;

increased competition; pricing actions; impacts from international

trade restrictions; competitive disposal alternatives, diversion of

waste from landfills and declining waste volumes; weakness in

general economic conditions and capital markets, including

potential for an economic recession; instability of financial

institutions; adoption of new tax legislation; fuel shortages;

failure to develop and protect new technology; failure of

technology to perform as expected; failure to prevent, detect and

address cybersecurity incidents or comply with privacy regulations;

negative outcomes of litigation or governmental proceedings; and

decisions or developments that result in impairment charges. Please

also see the Company’s filings with the SEC, including Part I, Item

1A of the Company’s most recently filed Annual Report on Form 10-K,

as updated by subsequent Quarterly Reports on Form 10-Q, for

additional information regarding these and other risks and

uncertainties applicable to its business. The Company assumes no

obligation to update any forward-looking statement, including

financial estimates and forecasts, whether as a result of future

events, circumstances or developments or otherwise.

NON-GAAP FINANCIAL MEASURES

To supplement its financial information, the Company has

presented, and/or may discuss on the conference call, adjusted

earnings per diluted share, adjusted net income, adjusted income

from operations, adjusted operating EBITDA, adjusted operating

EBITDA margin, adjusted operating expenses, adjusted SG&A

expenses, and free cash flow, as well as projections of adjusted

operating EBITDA and free cash flow for 2023. All of these items

are non-GAAP financial measures, as defined in Regulation G of the

Securities Exchange Act of 1934, as amended. The Company reports

its financial results in compliance with GAAP but believes that

also discussing non-GAAP measures provides investors with (i)

financial measures the Company uses in the management of its

business and (ii) additional, meaningful comparisons of current

results to prior periods’ results by excluding items that the

Company does not believe reflect its fundamental business

performance and are not representative or indicative of its results

of operations.

In addition, the Company’s projected future operating EBITDA is

anticipated to exclude the effects of other events or circumstances

that are not representative or indicative of the Company’s results

of operations. Such excluded items are not currently determinable,

but may be significant, such as asset impairments and one-time

items, charges, gains or losses from divestitures or litigation,

and other items. Due to the uncertainty of the likelihood, amount

and timing of any such items, the Company does not have information

available to provide a quantitative reconciliation of such

projection to the comparable GAAP measure.

The Company discusses free cash flow and provides a projection

of free cash flow because the Company believes that it is

indicative of its ability to pay its quarterly dividends,

repurchase common stock, fund acquisitions and other investments

and, in the absence of refinancings, to repay its debt obligations.

Free cash flow is not intended to replace “Net cash provided by

operating activities,” which is the most comparable GAAP measure.

The Company believes free cash flow gives investors useful insight

into how the Company views its liquidity, but the use of free cash

flow as a liquidity measure has material limitations because it

excludes certain expenditures that are required or that the Company

has committed to, such as declared dividend payments and debt

service requirements. The Company defines free cash flow as net

cash provided by operating activities, less capital expenditures,

plus proceeds from divestitures of businesses and other assets (net

of cash divested); this definition may not be comparable to

similarly-titled measures reported by other companies.

The quantitative reconciliations of non-GAAP measures to the

most comparable GAAP measures are included in the accompanying

schedules, with the exception of projected adjusted operating

EBITDA. Non-GAAP measures should not be considered a substitute for

financial measures presented in accordance with GAAP.

WASTE MANAGEMENT, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In Millions, Except per Share

Amounts)

(Unaudited)

Three Months Ended

March 31,

2023

2022

Operating revenues

$

4,892

$

4,661

Costs and expenses:

Operating

3,086

2,903

Selling, general and administrative

476

491

Depreciation, depletion and

amortization

505

482

Restructuring

3

—

(Gain) loss from divestitures, asset

impairments and unusual items, net

(3

)

17

4,067

3,893

Income from operations

825

768

Other income (expense):

Interest expense, net

(120

)

(85

)

Equity in net losses of unconsolidated

entities

(11

)

(15

)

Other, net

2

3

(129

)

(97

)

Income before income taxes

696

671

Income tax expense

164

157

Consolidated net income

532

514

Less: Net income (loss) attributable to

noncontrolling interests

(1

)

1

Net income attributable to Waste

Management, Inc.

$

533

$

513

Basic earnings per common share

$

1.31

$

1.24

Diluted earnings per common share

$

1.30

$

1.23

Weighted average basic common shares

outstanding

407.4

415.7

Weighted average diluted common shares

outstanding

409.0

417.8

WASTE MANAGEMENT, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In Millions)

(Unaudited)

March 31,

December 31,

2023

2022

ASSETS

Current assets:

Cash and cash equivalents

$

257

$

351

Receivables, net

2,608

2,752

Other

506

448

Total current assets

3,371

3,551

Property and equipment, net

15,705

15,719

Goodwill

9,344

9,323

Other intangible assets, net

823

827

Other

2,047

1,947

Total assets

$

31,290

$

31,367

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable, accrued liabilities and

deferred revenues

$

3,520

$

3,980

Current portion of long-term debt

336

414

Total current liabilities

3,856

4,394

Long-term debt, less current portion

15,034

14,570

Other

5,592

5,539

Total liabilities

24,482

24,503

Equity:

Waste Management, Inc. stockholders’

equity

6,794

6,849

Noncontrolling interests

14

15

Total equity

6,808

6,864

Total liabilities and equity

$

31,290

$

31,367

WASTE MANAGEMENT, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In Millions)

(Unaudited)

Three Months Ended

March 31,

2023

2022

Cash flows from operating activities:

Consolidated net income

$

532

$

514

Adjustments to reconcile consolidated net

income to net cash provided by operating activities:

Depreciation, depletion and

amortization

505

482

Other

107

80

Change in operating assets and

liabilities, net of effects of acquisitions and divestitures

(100

)

182

Net cash provided by operating

activities

1,044

1,258

Cash flows from investing activities:

Acquisitions of businesses, net of cash

acquired

(34

)

(9

)

Capital expenditures

(660

)

(418

)

Proceeds from divestitures of businesses

and other assets, net of cash divested

11

5

Other, net

(95

)

(150

)

Net cash used in investing activities

(778

)

(572

)

Cash flows from financing activities:

New borrowings

6,885

2,362

Debt repayments

(6,548

)

(2,471

)

Common stock repurchase program

(350

)

(250

)

Cash dividends

(289

)

(275

)

Exercise of common stock options

12

9

Tax payments associated with equity-based

compensation transactions

(28

)

(34

)

Other, net

(1

)

24

Net cash used in financing activities

(319

)

(635

)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash and cash equivalents

—

1

(Decrease) increase in cash, cash

equivalents and restricted cash and cash equivalents

(53

)

52

Cash, cash equivalents and restricted cash

and cash equivalents at beginning of period

445

194

Cash, cash equivalents and restricted cash

and cash equivalents at end of period

$

392

$

246

WASTE MANAGEMENT, INC.

SUMMARY DATA SHEET

(In Millions)

(Unaudited)

Operating Revenues by Line of

Business

Three Months Ended

March 31,

2023

2022

Commercial

$

1,412

$

1,287

Industrial

933

836

Residential

854

805

Other collection

172

153

Total collection

3,371

3,081

Landfill

1,152

1,051

Transfer

540

486

Recycling

358

453

Other

613

575

Intercompany(a)

(1,142

)

(985

)

Total

$

4,892

$

4,661

Internal Revenue Growth

Period-to-Period Change for

the Three Months Ended March 31, 2023 vs. 2022

As a % of

As a % of

Related

Total

Amount

Business(b)

Amount

Company(c)

Collection and disposal

$

244

6.2

%

Recycling and WM Renewable Energy(d)

(e)

(141

)

(28.0

)

Fuel surcharges and mandated fees(e)

44

21.1

Total average yield(f)

$

147

3.1

%

Volume

55

1.2

Internal revenue growth

202

4.3

Acquisitions

43

0.9

Divestitures

(2

)

—

Foreign currency translation

(12

)

(0.2

)

Total

$

231

5.0

%

Period-to-Period Change for

the

Three Months Ended

March 31, 2023 vs.

2022

As a % of Related

Business(b)

Yield

Volume(g)

Commercial

7.2

%

(0.9

)

%

Industrial

10.0

(1.8

)

Residential

5.6

(2.9

)

Total collection

7.2

(1.0

)

MSW

5.4

2.7

Transfer

8.9

1.8

Total collection and disposal

6.2

%

0.8

%

_____________________________________

(a)

Intercompany revenues between lines of

business are eliminated in the Condensed Consolidated Financial

Statements included herein.

(b)

Calculated by dividing the increase or

decrease for the current year period by the prior year period’s

related business revenue adjusted to exclude the impacts of

divestitures for the current year period.

(c)

Calculated by dividing the increase or

decrease for the current year period by the prior year period’s

total Company revenue adjusted to exclude the impacts of

divestitures for the current year period.

(d)

Includes combined impact of commodity

price variability in both our recycling and WM Renewable Energy

businesses, as well as changes in fees in our recycling

business.

(e)

Beginning in 2023, Recycling and WM

Renewable Energy includes changes in our revenue attributable to

our WM Renewable Energy business. Previously these changes in

revenues were included in fuel surcharges and mandated fees. We

have revised our prior year results to conform with the current

year presentation.

(f)

The amounts reported herein represent the

changes in our revenue attributable to average yield for the total

Company.

(g)

Workday adjusted volume impact.

WASTE MANAGEMENT, INC.

SUMMARY DATA SHEET

(In Millions)

(Unaudited)

Three Months Ended

March 31,

2023

2022

Supplemental Data

Internalization of waste, based on

disposal costs

68.5

%

68.4

%

Landfill depletable tons (in millions)

29.3

29.1

Acquisition Summary(a)

Gross annualized revenue acquired

$

18

$

3

Total consideration, net of cash

acquired

34

6

Cash paid for acquisitions consummated

during the period, net of cash acquired

31

5

Cash paid for acquisitions including

contingent consideration and other items from prior periods, net of

cash acquired

34

4

Landfill Amortization and Accretion

Expenses:

Three Months Ended

March 31,

2023

2022

Landfill depletion expense:

Cost basis of landfill assets

$

142

$

134

Asset retirement costs

36

33

Total landfill depletion expense(b)

178

167

Accretion expense

32

28

Landfill depletion and accretion

expense

$

210

$

195

__________________________

(a)

Represents amounts associated with

business acquisitions consummated during the applicable period

except where noted.

(b)

The increase in landfill depletion expense

during the first quarter of 2023, as compared with the first

quarter of 2022, was primarily due to the reopening of a previously

closed landfill in our East Tier segment

WASTE MANAGEMENT, INC.

RECONCILIATION OF CERTAIN

NON-GAAP MEASURES

(In Millions, Except Per Share

Amounts)

(Unaudited)

Three Months Ended March 31,

2023

Income from

Pre-tax

Tax

Net

Diluted Per

Operations

Income

Expense

Income(a)

Share Amount

As reported amounts

$

825

$

696

$

164

$

533

$

1.30

Adjustments:

Labor dispute

6

6

2

4

Reversal of legacy loss contingency

reserve

(3

)

(3

)

(1

)

(2

)

Restructuring

3

3

1

2

Gain from asset impairments and unusual

items, net

(3

)

(3

)

(1

)

(2

)

3

3

1

2

0.01

As adjusted amounts

$

828

$

699

$

165

(b)

$

535

$

1.31

Depreciation, depletion and

amortization

505

As adjusted operating EBITDA

$

1,333

Three Months Ended March 31,

2022

Income from

Pre-tax

Tax

Net

Diluted Per

Operations

Income

Expense

Income(a)

Share Amount

As reported amounts

$

768

$

671

$

157

$

513

$

1.23

Adjustments:

Enterprise resource planning system

implementation-related costs

15

15

4

11

Advanced Disposal integration-related

costs

4

4

1

3

Other, net(c)

16

16

3

13

35

35

8

27

0.06

As adjusted amounts

$

803

$

706

$

165

(b)

$

540

$

1.29

Depreciation, depletion and

amortization

482

As adjusted operating EBITDA

$

1,285

_________________________

(a)

For purposes of this press release table,

all references to "Net income" refer to the financial statement

line item "Net income attributable to Waste Management, Inc."

(b)

The Company calculates its effective tax

rate based on actual dollars. When the effective tax rate is

calculated by dividing the Tax Expense amount in the table above by

the Pre-tax Income amount, differences occur due to rounding, as

these items have been rounded in millions. The first quarter 2023

and 2022 adjusted effective tax rates were 23.6% and 23.5%,

respectively.

(c)

Includes a $17 million charge to increase

the recorded liability for a subsidiary’s estimated potential share

of a proposed environmental remediation plan at a closed site.

WASTE MANAGEMENT, INC.

RECONCILIATION OF CERTAIN

NON-GAAP MEASURES

(In Millions, Except Per Share

Amounts)

(Unaudited)

Three Months Ended

March 31, 2023

March 31, 2022

As a % of

As a % of

Amount

Revenues

Amount

Revenues

Adjusted Operating Expenses and

Adjusted Operating Expenses Margin

Operating revenues, as reported

$

4,892

$

4,661

Operating expenses, as reported

$

3,086

63.1

%

$

2,903

62.3

%

Adjustments:

Labor dispute

(6

)

Reversal of legacy loss contingency

reserve

3

Operating expenses, as adjusted

$

3,083

63.0

%

2023 Projected Free Cash Flow

Reconciliation(a)

Scenario 1

Scenario 2

Net cash provided by operating

activities

$

4,600

$

4,725

Capital expenditures to support the

business

(2,015

)

(2,100

)

Proceeds from divestitures of businesses

and other assets, net of cash divested

15

75

Free cash flow without sustainability

growth investments

$

2,600

$

2,700

Capital expenditures - sustainability

growth investments

(1,100

)

(1,100

)

Free cash flow

$

1,500

$

1,600

_________________________

(a) The reconciliation includes two

scenarios that illustrate our projected free cash flow range for

2023. The amounts used in the reconciliation are subject to many

variables, some of which are not under our control and, therefore,

are not necessarily indicative of actual results.

WASTE MANAGEMENT, INC.

SUPPLEMENTAL INFORMATION

PROVIDED FOR ILLUSTRATIVE PURPOSES ONLY

(In Millions)

(Unaudited)

Diversity in the structure of recycling

contracts results in different accounting treatment for commodity

rebates. In accordance with revenue recognition guidance, our

Company records gross recycling revenue and records rebates paid to

customers as cost of goods sold. Other contract structures allow

for netting of rebates against revenue.

Additionally, there are differences in

whether companies adjust for accretion expense in their calculation

of EBITDA. Our Company does not adjust for landfill accretion

expenses when calculating operating EBITDA, while other companies

do adjust it for the calculation of their EBITDA measure.

The table below illustrates the impact

that differing contract structures and treatment of accretion

expense has on the Company’s adjusted operating EBITDA margin

results. This information has been provided to enhance

comparability and is not intended to replace or adjust GAAP

reported results.

Three Months Ended March

31,

2023

2022

Amount

Change in Adjusted Operating

EBITDA Margin

Amount

Change in Adjusted Operating

EBITDA Margin

Recycling commodity rebates

$

141

0.9%

$

223

1.4%

Accretion expense

$

32

0.6%

$

28

0.6%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230426005810/en/

WM Website www.wm.com Analysts Ed Egl

713.265.1656 eegl@wm.com Media Toni Werner media@wm.com

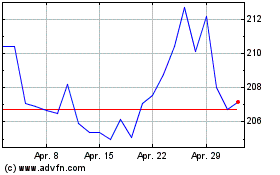

Waste Management (NYSE:WM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Waste Management (NYSE:WM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024