Strong Organic Revenue Growth and Operating

Efficiencies Drive Double-Digit Growth in Income from Operations

and Diluted Earnings Per Share

WM (NYSE: WM) today announced financial results for the quarter

ended September 30, 2022.

Three Months Ended

Three Months Ended

September

30, 2022

September

30, 2021

(in

millions, except per share amounts)

(in

millions, except per share amounts)

As Reported

As Adjusted(a)

As Reported

As Adjusted(a)

Revenue

$5,075

$5,075

$4,665

$4,665

Income from Operations

$942

$950

$806

$792

Operating EBITDA(b)

$1,445

$1,453

$1,323

$1,309

Operating EBITDA Margin

28.5%

28.6%

28.4%

28.1%

Net Income(c)

$639

$645

$538

$530

Diluted EPS

$1.54

$1.56

$1.28

$1.26

“As we have seen all year, our team delivered strong results in

the third quarter, driven by the strength and resiliency of our

collection and disposal business,” said Jim Fish, WM’s President

and Chief Executive Officer. “Organic revenue growth, diligent

management of controllable costs, and proactive steps to automate

the business translated into an 11% increase in adjusted operating

EBITDA.”(a)

Fish continued, “I am proud of the dedication of our entire

team, particularly our team members in Florida who are rising to

the challenges from Hurricane Ian to support cleanup efforts for

affected communities. The team continues to maintain focus on

meeting the service needs of our customers and executing on pricing

and cost management plans, and they do all of this while advancing

our long-term strategic priorities.”

KEY HIGHLIGHTS FOR THE THIRD QUARTER OF 2022

Revenue

- Core price for the third quarter of 2022 was 8.2% compared to

4.6% in the third quarter of 2021.(d)

- Collection and disposal yield was 7.1% in the third quarter of

2022 compared to 3.6% in the third quarter of 2021.(e)

- Total Company volumes increased 1.0%, or 1.3% on a workday

adjusted basis, in the third quarter of 2022 and collection and

disposal volumes increased 1.4%, or 1.7% on a workday adjusted

basis. Total Company volumes improved 3.2% in the third quarter of

2021, or 3.0% on a workday adjusted basis, and collection and

disposal volumes increased 3.4%, or 3.2% on a workday adjusted

basis, in the third quarter of 2021.(e)

Cost Management

- Operating expenses as a percentage of revenue were 62.2% in the

third quarter of 2022 compared to 62.3% in the third quarter of

2021. The measure improved 70 basis points in the collection and

disposal business as pricing and operating efficiencies worked to

overcome inflationary cost pressures. This improvement was largely

offset by the impacts of a sharp decline in market prices for

recycled commodities.

- SG&A expenses were 9.3% of revenue in the third quarter of

2022 compared to 10.1% in the third quarter of 2021. On an adjusted

basis, SG&A expenses were 9.2% of revenue in the third quarter

of 2022 compared to 9.7% in the third quarter of 2021.(a)

Profitability

- Operating EBITDA in the Company’s collection and disposal

business, adjusted on the same basis as total Company operating

EBITDA, increased by approximately $174 million to $1.59 billion

for the third quarter of 2022. Operating EBITDA as a percentage of

revenue in the Company’s collection and disposal business was 31.8%

for the third quarter of 2022 compared to 31.2% for the third

quarter of 2021.(f)

- Operating EBITDA in the Company’s recycling line of business

decreased by $36 million compared to the third quarter of 2021

primarily driven by a 32% decline in recycled commodity prices and

persistent inflationary cost pressures on operating costs.

- Operating EBITDA in the Company’s renewable energy business was

relatively flat compared to the third quarter of 2021. Results were

generally in line with expectations as the Company sold about 30%

of its renewable natural gas (RNG) under long-term contracts, which

moderated the average price per MMBtu.

Free Cash Flow & Capital

Allocation

- In the third quarter of 2022, net cash provided by operating

activities was $1.18 billion, in line with the third quarter of

2021.

- In the third quarter of 2022, capital expenditures to support

the business were $547 million compared to $448 million in the

third quarter of 2021. In addition, capital expenditures for

sustainability growth investments were $210 million compared to $16

million in the third quarter of 2021.

- In the third quarter of 2022, free cash flow was $432 million

compared to $773 million in the third quarter of 2021.(a) Free cash

flow without sustainability growth investments was $642 million

compared to $789 million in the third quarter of 2021.(a) The

year-over-year decline in free cash flow was primarily driven by

the planned increase in sustainability growth investments and

accelerated capital spending to support the business.

- During the third quarter of 2022, $808 million was returned to

shareholders, including $541 million allocated to share repurchases

and $267 million of cash dividends.

SUSTAINABILITY UPDATE

- The Company released its 2022 Sustainability Report earlier

this month, providing details on its Environmental Social and

Governance (ESG) performance and outlining new 2030 priorities. The

Sustainability Report conveys the strong linkage between the

Company’s ESG goals and its growth strategy, inclusive of the

planned expansion of the Company’s recycling and renewable energy

businesses.

- The Company continues to progress its $1.625 billion

sustainability growth investment program and remains on track to

invest $550 million in 2022. These growth investments are intended

to further WM’s sustainability leadership by increasing recycling

volumes and growing RNG generation. Two of the 17 new RNG projects

and five new or automated material recovery facilities (MRFs) are

expected to be complete in 2022. The Company expects to provide

updates on the timing of future capital investments and earnings

contributions associated with this program by its fourth quarter

earnings announcement in February.

- In response to the recently approved civil rights audit

stockholder proposal, the Company has engaged a team led by former

U.S. Attorney General Loretta Lynch, now a partner at Paul, Weiss,

Rifkind, Wharton & Garrison, to perform an independent

assessment of the impact of WM policies and practices on the civil

rights of Company stakeholders, and to provide recommendations for

further improvement. The assessment will include a broad review and

analysis in the areas of environmental justice and inclusion,

equity, and diversity of employees and suppliers, with input from

internal and external stakeholders. WM expects to publish results

of the assessment before its 2024 Annual Meeting of

Stockholders.

Fish concluded, “WM continues to demonstrate the strength and

reliability of our business model. Our operational performance puts

us on track to achieve the higher full-year outlook we provided

last quarter as the solid waste business delivers strong results

that will work to overcome the headwind we now expect from lower

market prices for recycled commodities.”

(a)

The information labeled as adjusted in

this press release, as well as free cash flow, are non-GAAP

measures. Please see "Non-GAAP Financial Measures" below and the

reconciliations in the accompanying schedules for more

information.

(b)

Management defines operating EBITDA as

GAAP income from operations before depreciation and amortization;

this measure may not be comparable to similarly titled measures

reported by other companies.

(c)

For purposes of this press release, all

references to "Net income" refer to the financial statement line

item "Net income attributable to Waste Management, Inc."

(d)

Core price is a performance metric used by

management to evaluate the effectiveness of our pricing strategies;

it is not derived from our financial statements and may not be

comparable to measures presented by other companies. Core price is

based on certain historical assumptions, which may differ from

actual results, to allow for comparability between reporting

periods and to reveal trends in results over time.

(e)

Beginning in the fourth quarter of 2021,

changes in the Company’s renewable energy revenue are reflected as

components of the changes in revenue attributable to yield

(included in “Fuel & Other”) and volume. The Company has

restated the prior periods to be consistent with the current year

presentation.

(f)

In the fourth quarter of 2021, the Company

updated its collection and disposal operating EBITDA calculation

with a more accurate allocation of costs to this line of business.

The Company has restated the prior periods to be consistent with

the current year presentation.

The Company will host a conference call at 10 a.m. ET today to

discuss the third quarter results. Information contained within

this press release will be referenced and should be considered in

conjunction with the call.

Listeners can access a live audio webcast of the conference call

by visiting investors.wm.com and selecting “Events &

Presentations” from the website menu. A replay of the audio webcast

will be available at the same location following the conclusion of

the call.

Conference call participants must register to obtain their dial

in and passcode details. This new, streamlined process improves

security and eliminates wait times when joining the call.

ABOUT WASTE MANAGEMENT

WM (WM.com) is North America's largest comprehensive waste

management environmental solutions provider. Previously known as

Waste Management and based in Houston, Texas, WM is driven by

commitments to put people first and achieve success with integrity.

The company, through its subsidiaries, provides collection,

recycling and disposal services to millions of residential,

commercial, industrial and municipal customers throughout the U.S.

and Canada. With innovative infrastructure and capabilities in

recycling, organics and renewable energy, WM provides environmental

solutions to and collaborates with its customers in helping them

achieve their sustainability goals. WM has the largest disposal

network and collection fleet in North America, is the largest

recycler of post-consumer materials and is the leader in beneficial

reuse of landfill gas, with a growing network of renewable natural

gas plants and the most gas-to-electricity plants in North America.

WM's fleet includes nearly 11,000 natural gas trucks – the largest

heavy-duty natural gas truck fleet of its kind in North America –

where more than half are fueled by renewable natural gas. To learn

more about WM and the company's sustainability progress and

solutions, visit Sustainability.WM.com.

FORWARD-LOOKING STATEMENTS

The Company, from time to time, provides estimates of financial

and other data, comments on expectations relating to future periods

and makes statements of opinion, view or belief about current and

future events. This press release contains a number of such

forward-looking statements, including but not limited to all

statements regarding future performance or financial results of our

business; achievement of financial outlook and guidance; future

commodity prices and ability to overcome lower commodity prices;

the amount, timing and results of future sustainability growth

investments and RNG projects; general economic activity; timing and

results from the civil rights assessment; and future execution of

strategic priorities, including pricing, cost management, and

results. You should view these statements with caution. They are

based on the facts and circumstances known to the Company as of the

date the statements are made. These forward-looking statements are

subject to risks and uncertainties that could cause actual results

to be materially different from those set forth in such

forward-looking statements, including but not limited to failure to

implement our optimization, growth, and cost savings initiatives

and overall business strategy; failure to identify acquisition

targets, consummate and integrate acquisitions; failure to obtain

the results anticipated from acquisitions; environmental and other

regulations, including developments related to emerging

contaminants, gas emissions and renewable fuel; significant

environmental, safety or other incidents resulting in liabilities

or brand damage; failure to obtain and maintain necessary permits;

failure to attract, hire and retain key team members and a high

quality workforce; changes in wage and labor related regulations;

significant storms and destructive climate events; public health

risk and other impacts of COVID-19 or similar pandemic conditions,

including related regulations, resulting in increased costs and

social, labor and commercial disruption; macroeconomic pressures

and market disruption resulting in labor, supply chain and

transportation constraints and inflationary cost pressure;

increased competition; pricing actions; commodity price

fluctuations; impacts from Russia’s invasion of Ukraine and the

resulting geopolitical conflict and international response,

including increased risk of cyber incidents and exacerbation of

market disruption, inflationary cost pressure and changes in

commodity prices, fuel and other energy costs; international trade

restrictions; disposal alternatives, waste diversion and

diminishing disposal capacity; declining waste volumes; weakness in

general economic conditions and capital markets; adoption of new

tax legislation; fuel shortages; failure to develop and protect new

technology; failure of technology to perform as expected, including

implementation of a new enterprise resource planning and human

capital management system; failure to prevent, detect and address

cybersecurity incidents or comply with privacy regulations;

negative outcomes of litigation or governmental proceedings; and

decisions or developments that result in impairment charges. Please

also see the Company’s filings with the SEC, including Part I, Item

1A of the Company’s most recently filed Annual Report on Form 10-K,

for additional information regarding these and other risks and

uncertainties applicable to its business. The Company assumes no

obligation to update any forward-looking statement, including

financial estimates and forecasts, whether as a result of future

events, circumstances or developments or otherwise.

NON-GAAP FINANCIAL MEASURES

To supplement its financial information, the Company has

presented, and/or may discuss on the conference call, adjusted

earnings per diluted share, adjusted net income, adjusted income

from operations, adjusted operating EBITDA, adjusted operating

EBITDA margin, adjusted SG&A expenses and free cash flow. All

of these items are non-GAAP financial measures, as defined in

Regulation G of the Securities Exchange Act of 1934, as amended.

The Company reports its financial results in compliance with GAAP

but believes that also discussing non-GAAP measures provides

investors with (i) financial measures the Company uses in the

management of its business and (ii) additional, meaningful

comparisons of current results to prior periods’ results by

excluding items that the Company does not believe reflect its

fundamental business performance and are not representative or

indicative of its results of operations.

The Company discusses free cash flow and provides a projection

of free cash flow because the Company believes that it is

indicative of its ability to pay its quarterly dividends,

repurchase common stock, fund acquisitions and other investments

and, in the absence of refinancings, to repay its debt obligations.

Free cash flow is not intended to replace “Net cash provided by

operating activities,” which is the most comparable GAAP measure.

The Company believes free cash flow gives investors useful insight

into how the Company views its liquidity, but the use of free cash

flow as a liquidity measure has material limitations because it

excludes certain expenditures that are required or that the Company

has committed to, such as declared dividend payments and debt

service requirements. The Company defines free cash flow as net

cash provided by operating activities, less capital expenditures,

plus proceeds from divestitures of businesses and other assets (net

of cash divested); this definition may not be comparable to

similarly-titled measures reported by other companies.

The quantitative reconciliations of non-GAAP measures to the

most comparable GAAP measures are included in the accompanying

schedules. Non-GAAP measures should not be considered a substitute

for financial measures presented in accordance with GAAP.

WASTE MANAGEMENT, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In Millions, Except per Share

Amounts)

(Unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2022

2021

2022

2021

Operating revenues

$

5,075

$

4,665

$

14,763

$

13,253

Costs and expenses:

Operating

3,156

2,906

9,201

8,156

Selling, general and administrative

473

469

1,451

1,372

Depreciation and amortization

503

517

1,493

1,489

Restructuring

1

1

1

6

(Gain) loss from divestitures, asset

impairments and unusual items, net

—

(34)

17

(17)

4,133

3,859

12,163

11,006

Income from operations

942

806

2,600

2,247

Other income (expense):

Interest expense, net

(91)

(87)

(269)

(282)

Loss on early extinguishment of debt

—

—

—

(220)

Equity in net losses of unconsolidated

entities

(17)

(14)

(49)

(34)

Other, net

(6)

1

(7)

(4)

(114)

(100)

(325)

(540)

Income before income taxes

828

706

2,275

1,707

Income tax expense

189

167

535

396

Consolidated net income

639

539

1,740

1,311

Less: Net income attributable to

noncontrolling interests

—

1

1

1

Net income attributable to Waste

Management, Inc.

$

639

$

538

$

1,739

$

1,310

Basic earnings per common share

$

1.55

$

1.28

$

4.20

$

3.11

Diluted earnings per common share

$

1.54

$

1.28

$

4.18

$

3.09

Weighted average basic common shares

outstanding

412.0

419.5

414.0

421.3

Weighted average diluted common shares

outstanding

414.3

422.0

416.2

423.6

WASTE MANAGEMENT, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In Millions)

(Unaudited)

September 30,

December 31,

2022

2021

ASSETS

Current assets:

Cash and cash equivalents

$

137

$

118

Receivables, net

2,676

2,546

Other

451

405

Total current assets

3,264

3,069

Property and equipment, net

14,742

14,419

Goodwill

9,092

9,028

Other intangible assets, net

847

898

Other

1,896

1,683

Total assets

$

29,841

$

29,097

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable, accrued liabilities and

deferred revenues

$

3,576

$

3,374

Current portion of long-term debt

258

708

Total current liabilities

3,834

4,082

Long-term debt, less current portion

13,805

12,697

Other

5,190

5,192

Total liabilities

22,829

21,971

Equity:

Waste Management, Inc. stockholders’

equity

7,010

7,124

Noncontrolling interests

2

2

Total equity

7,012

7,126

Total liabilities and equity

$

29,841

$

29,097

WASTE MANAGEMENT, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In Millions)

(Unaudited)

Nine Months Ended

September 30,

2022

2021

Cash flows from operating activities:

Consolidated net income

$

1,740

$

1,311

Adjustments to reconcile consolidated net

income to net cash provided by operating activities:

Depreciation and amortization

1,493

1,489

Loss on early extinguishment of debt

—

220

Other

199

103

Change in operating assets and

liabilities, net of effects of acquisitions and divestitures

55

224

Net cash provided by operating

activities

3,487

3,347

Cash flows from investing activities:

Acquisitions of businesses, net of cash

acquired

(207)

(11)

Capital expenditures

(1,725)

(1,130)

Proceeds from divestitures of businesses

and other assets, net of cash divested

18

70

Other, net

(122)

(35)

Net cash used in investing activities

(2,036)

(1,106)

Cash flows from financing activities:

New borrowings

5,916

6,428

Debt repayments

(5,429)

(7,237)

Premiums and other paid on early

extinguishment of debt

—

(211)

Common stock repurchase program

(1,061)

(1,000)

Cash dividends

(811)

(730)

Exercise of common stock options

39

60

Tax payments associated with equity-based

compensation transactions

(39)

(28)

Other, net

(6)

32

Net cash used in financing activities

(1,391)

(2,686)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash and cash equivalents

(6)

2

Increase (decrease) in cash, cash

equivalents and restricted cash and cash equivalents

54

(443)

Cash, cash equivalents and restricted cash

and cash equivalents at beginning of period

194

648

Cash, cash equivalents and restricted cash

and cash equivalents at end of period

$

248

$

205

WASTE MANAGEMENT, INC.

SUMMARY DATA SHEET

(In Millions)

(Unaudited)

Operating Revenues by Line of

Business

Three Months Ended

Nine Months Ended

September 30,

September 30,

2022

2021

2022

2021

Commercial

$

1,392

$

1,214

$

4,034

$

3,523

Industrial

966

829

2,744

2,383

Residential

846

795

2,483

2,371

Other collection

187

140

521

391

Total collection

3,391

2,978

9,782

8,668

Landfill

1,197

1,100

3,442

3,090

Transfer

562

550

1,602

1,547

Recycling

420

464

1,341

1,203

Other

614

551

1,785

1,541

Intercompany (a)

(1,109)

(978)

(3,189)

(2,796)

Total

$

5,075

$

4,665

$

14,763

$

13,253

Internal Revenue Growth

Period-to-Period Change for

the Three Months

Period-to-Period Change for

the Nine Months

Ended September 30, 2022 vs.

2021

Ended September 30, 2022 vs.

2021

As a % of

As a % of

As a % of

As a % of

Related

Total

Related

Total

Amount

Business(b)

Amount

Company(c)

Amount

Business(b)

Amount

Company(c)

Collection and disposal

$

280

7.1

%

$

722

6.3

%

Recycling (d)

(54)

(11.6)

158

13.7

Fuel surcharges and other (e)

132

54.0

375

57.1

Total average yield (f)

$

358

7.7

%

$

1,255

9.5

%

Volume (e)

47

1.0

264

2.0

Internal revenue growth

405

8.7

1,519

11.5

Acquisitions

15

0.3

20

0.1

Divestitures

(2)

—

(13)

(0.1)

Foreign currency translation

(8)

(0.2)

(16)

(0.1)

Total

$

410

8.8

%

$

1,510

11.4

%

Period-to-Period Change for

the Three Months

Ended September 30, 2022 vs.

2021

Period-to-Period Change for

the Nine Months

Ended September 30, 2022 vs.

2021

As a % of Related

Business(b)

As a % of Related

Business(b)

Yield

Volume(g)

Yield

Volume(g)

Commercial

9.8

%

—

%

8.7

%

1.6

%

Industrial

11.0

1.1

9.9

0.9

Residential

6.3

(3.0)

5.5

(3.2)

Total collection

8.7

0.2

7.8

0.7

MSW

6.5

0.9

6.1

1.9

Transfer

5.5

(3.7)

4.2

(1.2)

Total collection and disposal

7.1

%

1.7

%

6.3

%

2.5

%

(a)

Intercompany revenues between lines of

business are eliminated in the Condensed Consolidated Financial

Statements included herein.

(b)

Calculated by dividing the increase or

decrease for the current year period by the prior year period’s

related business revenue adjusted to exclude the impacts of

divestitures for the current year period.

(c)

Calculated by dividing the increase or

decrease for the current year period by the prior year period’s

total Company revenue adjusted to exclude the impacts of

divestitures for the current year period.

(d)

Includes combined impact of commodity

price variability and changes in fees.

(e)

Beginning in the fourth quarter of 2021,

includes changes in our revenue attributable to our WM Renewable

Energy business. We have revised our prior year results to conform

with the current year presentation.

(f)

The amounts reported herein represent the

changes in our revenue attributable to average yield for the total

Company.

(g)

Workday adjusted volume impact.

WASTE MANAGEMENT, INC.

SUMMARY DATA SHEET

(In Millions)

(Unaudited)

Free Cash Flow(a)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2022

2021

2022

2021

Net cash provided by operating

activities

$

1,182

$

1,184

$

3,487

$

3,347

Capital expenditures, excluding

sustainability growth investments

(547)

(448)

(1,403)

(1,094)

Proceeds from divestitures of businesses

and other assets, net of cash divested

7

53

18

70

Free cash flow without sustainability

growth investments

642

789

2,102

2,323

Capital expenditures - sustainability

growth investments

(210)

(16)

(322)

(36)

Free cash flow

$

432

$

773

$

1,780

$

2,287

Three Months Ended

Nine Months Ended

September 30,

September 30,

2022

2021

2022

2021

Supplemental Data

Internalization of waste, based on

disposal costs

68.6

%

68.6

%

68.6

%

68.5

%

Landfill amortizable tons (in

millions)

32.1

32.6

93.9

92.3

Acquisition Summary(b)

Gross annualized revenue acquired

$

132

$

—

$

135

$

8

Total consideration, net of cash

acquired

210

—

216

11

Cash paid for acquisitions consummated

during the period, net of cash acquired

197

—

202

9

Cash paid for acquisitions including

contingent consideration and other items from prior periods, net of

cash acquired

197

1

207

11

Landfill Amortization and Accretion

Expenses:

Three Months Ended

Nine Months Ended

September 30,

September 30,

2022

2021

2022

2021

Landfill amortization expense:

Cost basis of landfill assets

$

149

$

146

$

435

$

413

Asset retirement costs

34

54

103

128

Total landfill amortization expense(c)

183

200

538

541

Accretion expense

29

28

84

82

Landfill amortization and accretion

expense

$

212

$

228

$

622

$

623

(a)

The summary of free cash flow has been

prepared to highlight and facilitate understanding of the principal

cash flow elements. Free cash flow is not a measure of financial

performance under generally accepted accounting principles and is

not intended to replace the consolidated statement of cash flows

that was prepared in accordance with generally accepted accounting

principles.

(b)

Represents amounts associated with

business acquisitions consummated during the applicable period

except where noted.

(c)

For the third quarter of 2022, the

decrease in landfill amortization was primarily driven by a prior

year charge of $15 million due to management’s decision to close a

landfill earlier than expected, resulting in acceleration of the

timing of capping, closure and post-closure activities during the

third quarter of 2021. For the nine months of 2022, the decrease in

landfill amortization was somewhat offset by landfill volume

increases.

WASTE MANAGEMENT, INC.

RECONCILIATION OF CERTAIN

NON-GAAP MEASURES

(In Millions, Except Per Share

Amounts)

(Unaudited)

Three Months Ended September

30, 2022

Income from

Pre-tax

Tax

Net

Diluted Per

Operations

Income

Expense

Income(a)

Share Amount

As reported amounts

$

942

$

828

$

189

$

639

$

1.54

Adjustment:

Enterprise resource planning system

implementation-related costs

8

8

2

6

0.02

As adjusted amounts

$

950

$

836

$

191

(b)

$

645

$

1.56

Depreciation and amortization

503

Adjusted operating EBITDA

$

1,453

Three Months Ended September

30, 2021

Income from

Pre-tax

Tax

Net

Diluted Per

Operations

Income

Expense

Income(a)

Share Amount

As reported amounts

$

806

$

706

$

167

$

538

$

1.28

Adjustments:

Advanced Disposal integration-related

costs

10

10

2

8

Enterprise resource planning system

implementation-related costs

9

9

2

7

Gain from divestitures and other,

net(c)

(33)

(33)

(10)

(23)

(14)

(14)

(6)

(8)

(0.02)

As adjusted amounts

$

792

$

692

$

161

(b)

$

530

$

1.26

Depreciation and amortization

517

Adjusted operating EBITDA

$

1,309

(a)

For purposes of this press release table,

all references to “Net income” refer to the financial statement

line item “Net income attributable to Waste Management, Inc.”

(b)

The Company calculates its effective tax

rate based on actual dollars. When the effective tax rate is

calculated by dividing the Tax Expense amount in the table above by

the Pre-tax Income amount, differences occur due to rounding, as

these items have been rounded in millions. The third quarter 2022

and 2021 adjusted effective tax rates were 22.8% and 23.3%,

respectively.

(c)

Primarily driven by (i) a pre-tax gain

from the recognition of cumulative translation adjustments on the

divestiture of certain non-strategic Canadian operations in 2021

which was not taxable and (ii) a change from our initial

expectations of the tax effects of the Advanced Disposal

acquisition and related divestitures.

WASTE MANAGEMENT, INC.

RECONCILIATION OF CERTAIN

NON-GAAP MEASURES

(In Millions)

(Unaudited)

Three Months Ended

Three Months Ended

September 30, 2022

September 30, 2021

As a % of

As a % of

Amount

Revenues

Amount

Revenues

Adjusted Operating Expenses and

Adjusted Operating Expenses Margin

Operating revenues, as reported

$

5,075

$

4,665

Operating expenses, as reported

$

3,156

62.2

%

$

2,906

62.3

%

Adjustments:

Advanced Disposal integration-related

costs

(2)

Multiemployer pension plan withdrawal

(1)

Adjusted operating expenses

$

2,903

62.2

%

Three Months Ended

September 30, 2022

September 30, 2021

As a % of

As a % of

Amount

Revenues

Amount

Revenues

Adjusted SG&A Expenses and Adjusted

SG&A Expenses Margin

Operating revenues, as reported

$

5,075

$

4,665

SG&A expenses, as reported

$

473

9.3

%

$

469

10.1

%

Adjustments:

Enterprise resource planning system

implementation-related costs

(8)

(9)

Advanced Disposal integration-related

costs

—

(7)

Adjusted SG&A expenses

$

465

9.2

%

$

453

9.7

%

2022 Projected Free Cash Flow

Reconciliation(a)

Scenario 1

Scenario 2

Net cash provided by operating

activities

$

4,525

$

4,675

Capital expenditures, excluding

sustainability growth investments

(1,950)

(2,050)

Proceeds from divestitures of businesses

and other assets, net of cash divested

25

75

Free cash flow without sustainability

growth investments

$

2,600

$

2,700

Capital expenditures - sustainability

growth investments

(550)

(550)

Free cash flow

$

2,050

$

2,150

(a)

The reconciliation includes two scenarios

that illustrate our projected free cash flow range for 2022. The

amounts used in the reconciliation are subject to many variables,

some of which are not under our control and, therefore, are not

necessarily indicative of actual results.

WASTE MANAGEMENT, INC.

SUPPLEMENTAL INFORMATION PROVIDED FOR

ILLUSTRATIVE PURPOSES ONLY

(In Millions)

(Unaudited)

Diversity in the structure of recycling contracts results in

different accounting treatment for commodity rebates. In accordance

with revenue recognition guidance, our Company records gross

recycling revenue and records rebates paid to customers as cost of

goods sold. Other contract structures allow for netting of rebates

against revenue.

Additionally, there are differences in whether companies adjust

for accretion expense in their calculation of EBITDA. Our Company

does not adjust for landfill accretion expenses when calculating

operating EBITDA, while other companies do adjust it for the

calculation of their EBITDA measure.

The table below illustrates the impact that differing contract

structures and treatment of accretion expense has on the Company’s

adjusted operating EBITDA margin results. This information has been

provided to enhance comparability and is not intended to replace or

adjust GAAP reported results.

Three Months Ended

September 30, 2022

September 30, 2021

Amount

Change in Adjusted Operating

EBITDA Margin

Amount

Change in Adjusted Operating

EBITDA Margin

Recycling commodity rebates

$

209

1.3%

$

234

1.4%

Accretion expense

$

29

0.6%

$

28

0.7%

Nine Months Ended

September 30, 2022

September 30, 2021

Amount

Change in Adjusted Operating

EBITDA Margin

Amount

Change in Adjusted Operating

EBITDA Margin

Recycling commodity rebates

$

661

1.3%

$

565

1.3%

Accretion expense

$

84

0.6%

$

82

0.7%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221025006055/en/

Waste Management

Website www.wm.com

Analysts Ed Egl 713.265.1656 eegl@wm.com

Media Toni Werner media@wm.com

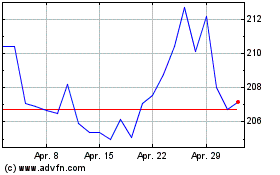

Waste Management (NYSE:WM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Waste Management (NYSE:WM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024