Statement of Ownership (sc 13g)

11 Februar 2022 - 10:06PM

Edgar (US Regulatory)

|

|

UNITED STATES

|

|

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

|

|

Washington, D.C. 20549

|

|

|

|

|

|

SCHEDULE 13G

(Rule 13d–102)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT TO §240.13d-1(b), (c) AND (d) AND

AMENDMENTS THERETO FILED PURSUANT TO §240.13d-2.

(Amendment No.___)

Waterdrop

Inc.

(Name of Issuer)

Class A Ordinary

Shares, par value US$ 0.000005 per share

(Title of Class of Securities)

94132V105

(CUSIP Number)

December

31, 2021

(Date of Event Which Requires Filing of this Statement)

Check the appropriate box to designate the rule pursuant to which this

Schedule is filed:

|

o

|

Rule 13d-1(b)

|

|

o

|

Rule 13d-1(c)

|

|

x

|

Rule 13d-1(d)

|

The remainder of this cover page shall be filled

out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter the disclosures provided in a prior cover page.

The information required in the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

|

CUSIP No. 94132V105

|

|

|

|

|

1.

|

Names of Reporting Persons

Gaorong Technology Consulting Limited

|

|

|

|

|

2.

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

o

|

|

|

|

(b)

|

x(1)

|

|

|

|

|

3.

|

SEC Use Only

|

|

|

|

|

4.

|

Citizenship or Place of Organization

British Virgin Islands

|

|

|

|

|

|

Number of Shares Beneficially Owned by Each Reporting Person With

|

5.

|

Sole Voting Power

0

|

|

|

6.

|

Shared Voting Power

118,230,053

Class A ordinary shares (2)

|

|

|

|

|

7.

|

Sole Dispositive Power

0

|

|

|

|

|

8.

|

Shared Dispositive Power

118,230,053

Class A ordinary shares (2)

|

|

|

|

|

9.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

118,230,053

Class A ordinary shares (2)

|

|

|

|

|

|

|

10.

|

Check if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) x(3)

|

|

|

|

|

|

|

11.

|

Percent of Class Represented by Amount in Row (9)

3.77% of Class A ordinary shares (or 3.00% of the total ordinary

shares) (4)

|

|

|

|

|

|

|

12.

|

Type of Reporting Person (See Instructions)

CO

|

|

|

|

|

|

|

|

|

|

(1)

|

This statement on Schedule 13G is filed by Gaorong Technology Consulting Limited (“Gaorong Technology”),

Suzhou Industry Park Gaorong Growth Investment Center (Limited Partnership) (“Suzhou Gaorong”), Xizang Gaorong Capital Management

Co., Ltd. (“Xizang Gaorong”), Beijing Gaorong Capital Management Consulting Co., Ltd (“Beijing Gaorong”), Gaorong

Group Holdings Limited (“Gaorong Holdings”), Banyan Partners Fund III, L.P. (“Banyan Fund III”), Banyan Partners

Fund III-A, L.P. (“Banyan Fund III-A”) and Banyan Partners III Ltd. (“Banyan III GP”, collectively with Gaorong

Technology, Suzhou Gaorong, Xizang Gaorong, Beijing Gaorong, Gaorong Holdings, Banyan Fund III, Banyan Fund III-A, the “Reporting

Persons”). The Reporting Persons expressly disclaim status as a “group” for purposes of this Schedule 13G.

|

|

|

(2)

|

Represents 118,230,053 Class A ordinary shares directly held by Gaorong Technology. Gaorong Technology

is wholly owned by Suzhou Gaorong whose general partner is Xizang Gaorong. Xizang Gaorong is wholly owned by Beijing Gaorong. As such,

Suzhou Gaorong, Xizang Gaorong and Beijing Gaorong may exercise voting and dispositive power over the ordinary shares held by Gaorong

Technology. Gaorong Holdings directly holds 86,052,718 Class A ordinary shares. Banyan Fund III and Banyan Fund III-A hold 79.33% and

14.00% of the total share capital of Gaorong Holdings, respectively, and as such Banyan Fund III may exercise voting and dispositive power

over the ordinary shares held by Gaorong Holdings. Banyan Fund III directly holds 31,880,733 Class A ordinary shares and Banyan Fund III-A

directly holds 2,039,576 Class A ordinary shares. Banyan III GP is the general partner of both Banyan Fund III and Banyan Fund III-A,

and as such, may exercise voting and dispositive power over the ordinary shares held by Banyan Fund III, Banyan Fund III-A and Gaorong

Holdings.

|

|

|

(3)

|

Gaorong Technology disclaims beneficial ownership over shares reported herein that are directly held by

Gaorong Holdings, Banyan Fund III and Banyan Fund III-A.

|

|

|

(4)

|

Calculation is based on 3,941,265,290 ordinary

shares issued and outstanding (assuming the underwriters did not exercise their option to purchase additional American depositary shares

of the Issuer), consisting of 3,139,360,311 Class A ordinary shares and 801,904,979 Class B ordinary shares, as reported in the Issuer’s

final prospectus filed with the Securities and Exchange Commission pursuant to Rule 424(b)(4) on May 7, 2021 (the “Issuer’s

424B4 Filing”). Each Class A ordinary share is entitled to one vote, and each Class B ordinary share is entitled to nine votes and

is convertible into one Class A ordinary share at any time by the holder thereof. Class A ordinary shares are not convertible into Class

B ordinary shares under any circumstances. Accordingly, and based on the foregoing, the Class A ordinary shares beneficially owned by

the Gaorong Technology represent approximately 1.14% of the aggregate voting power of the total issued and outstanding ordinary shares

of the Issuer.

|

|

CUSIP No. 94132V105

|

|

|

|

|

1.

|

Names of Reporting Persons

Suzhou Industry Park Gaorong Growth Investment Center (Limited Partnership)

|

|

|

|

|

2.

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

o

|

|

|

|

(b)

|

x(1)

|

|

|

|

|

3.

|

SEC Use Only

|

|

|

|

|

4.

|

Citizenship or Place of Organization

People’s Republic of China

|

|

|

|

|

|

Number of Shares Beneficially Owned by Each Reporting Person With

|

5.

|

Sole Voting Power

0

|

|

|

|

|

6.

|

Shared Voting Power

118,230,053

Class A ordinary shares (2)

|

|

|

|

|

7.

|

Sole Dispositive Power

0

|

|

|

|

|

8.

|

Shared Dispositive Power

118,230,053

Class A ordinary shares (2)

|

|

|

|

|

9.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

118,230,053 Class A ordinary shares (2)

|

|

|

|

|

|

|

10.

|

Check if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) x(3)

|

|

|

|

|

|

|

11.

|

Percent of Class Represented by Amount in Row (9)

3.77% of Class A ordinary shares (or 3.00% of the total ordinary

shares) (4)

|

|

|

|

|

|

|

12.

|

Type of Reporting Person (See Instructions)

PN

|

|

|

|

|

|

|

|

|

|

(1)

|

This statement on Schedule 13G is filed by the Reporting Persons. The Reporting Persons expressly disclaim

status as a “group” for purposes of this Schedule 13G.

|

|

|

(2)

|

Represents 118,230,053 Class A ordinary shares directly held by Gaorong Technology. Gaorong Technology

is wholly owned by Suzhou Gaorong whose general partner is Xizang Gaorong. Xizang Gaorong is wholly owned by Beijing Gaorong. As such,

Suzhou Gaorong, Xizang Gaorong and Beijing Gaorong may exercise voting and dispositive power over the ordinary shares held by Gaorong

Technology. Gaorong Holdings directly holds 86,052,718 Class A ordinary shares. Banyan Fund III and Banyan Fund III-A hold 79.33% and

14.00% of the total share capital of Gaorong Holdings, respectively, and as such Banyan Fund III may exercise voting and dispositive power

over the ordinary shares held by Gaorong Holdings. Banyan Fund III directly holds 31,880,733 Class A ordinary shares and Banyan Fund III-A

directly holds 2,039,576 Class A ordinary shares. Banyan III GP is the general partner of both Banyan Fund III and Banyan Fund III-A,

and as such, may exercise voting and dispositive power over the ordinary shares held by Banyan Fund III, Banyan Fund III-A and Gaorong

Holdings.

|

|

|

(3)

|

Suzhou Gaorong disclaims beneficial ownership over shares reported herein that are directly held by Gaorong

Holdings, Banyan Fund III and Banyan Fund III-A.

|

|

|

(4)

|

Calculation is based on 3,941,265,290 ordinary

shares issued and outstanding (assuming the underwriters did not exercise their option to purchase additional American depositary shares

of the Issuer), consisting of 3,139,360,311 Class A ordinary shares and 801,904,979 Class B ordinary shares, as reported in the Issuer’s

424B4 Filing. Each Class A ordinary share is entitled to one vote, and each Class B ordinary share is entitled to nine votes and

is convertible into one Class A ordinary share at any time by the holder thereof. Class A ordinary shares are not convertible into Class

B ordinary shares under any circumstances. Accordingly, and based on the foregoing, the Class A ordinary shares beneficially owned by

the Suzhou Gaorong represent approximately 1.14% of the aggregate voting power of the total issued and outstanding ordinary shares of

the Issuer.

|

|

CUSIP No. 94132V105

|

|

|

|

|

1.

|

Names of Reporting Persons

Xizang Gaorong Capital Management Co., Ltd.

|

|

|

|

|

2.

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

o

|

|

|

|

(b)

|

x(1)

|

|

|

|

|

3.

|

SEC Use Only

|

|

|

|

|

4.

|

Citizenship or Place of Organization

People’s Republic of China

|

|

|

|

|

|

Number of Shares Beneficially Owned by Each Reporting Person With

|

5.

|

Sole Voting Power

0

|

|

|

|

|

6.

|

Shared Voting Power

118,230,053

Class A ordinary shares (2)

|

|

|

|

|

7.

|

Sole Dispositive Power

0

|

|

|

|

|

8.

|

Shared Dispositive Power

118,230,053

Class A ordinary shares (2)

|

|

|

|

|

9.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

118,230,053

Class A ordinary shares (2)

|

|

|

|

|

|

|

10.

|

Check if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) x(3)

|

|

|

|

|

|

|

11.

|

Percent of Class Represented by Amount in Row (9)

3.77% of Class A ordinary shares (or 3.00% of the total ordinary

shares) (4)

|

|

|

|

|

|

|

12.

|

Type of Reporting Person (See Instructions)

CO

|

|

|

|

|

|

|

|

|

|

(1)

|

This statement on Schedule 13G is filed by the Reporting Persons. The Reporting Persons expressly disclaim

status as a “group” for purposes of this Schedule 13G.

|

|

|

(2)

|

Represents 118,230,053 Class A ordinary shares directly held by Gaorong Technology. Gaorong Technology

is wholly owned by Suzhou Gaorong whose general partner is Xizang Gaorong. Xizang Gaorong is wholly owned by Beijing Gaorong. As such,

Suzhou Gaorong, Xizang Gaorong and Beijing Gaorong may exercise voting and dispositive power over the ordinary shares held by Gaorong

Technology. Gaorong Holdings directly holds 86,052,718 Class A ordinary shares. Banyan Fund III and Banyan Fund III-A hold 79.33% and

14.00% of the total share capital of Gaorong Holdings, respectively, and as such Banyan Fund III may exercise voting and dispositive power

over the ordinary shares held by Gaorong Holdings. Banyan Fund III directly holds 31,880,733 Class A ordinary shares and Banyan Fund III-A

directly holds 2,039,576 Class A ordinary shares. Banyan III GP is the general partner of both Banyan Fund III and Banyan Fund III-A,

and as such, may exercise voting and dispositive power over the ordinary shares held by Banyan Fund III, Banyan Fund III-A and Gaorong

Holdings.

|

|

|

(3)

|

Xizang Gaorong disclaims beneficial ownership over shares reported herein that are directly held by Gaorong

Holdings, Banyan Fund III and Banyan Fund III-A.

|

|

|

(4)

|

Calculation is based on 3,941,265,290 ordinary

shares issued and outstanding (assuming the underwriters did not exercise their option to purchase additional American depositary shares

of the Issuer), consisting of 3,139,360,311 Class A ordinary shares and 801,904,979 Class B ordinary shares, as reported in the Issuer’s

424B4 Filing. Each Class A ordinary share is entitled to one vote, and each Class B ordinary share is entitled to nine votes and

is convertible into one Class A ordinary share at any time by the holder thereof. Class A ordinary shares are not convertible into Class

B ordinary shares under any circumstances. Accordingly, and based on the foregoing, the Class A ordinary shares beneficially owned by

the Xizang Gaorong represent approximately 1.14% of the aggregate voting power of the total issued and outstanding ordinary shares of

the Issuer.

|

|

CUSIP No. 94132V105

|

|

|

|

|

1.

|

Names of Reporting Persons

Beijing Gaorong Capital Management Consulting Co., Ltd.

|

|

|

|

|

2.

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

o

|

|

|

|

(b)

|

x(1)

|

|

|

|

|

3.

|

SEC Use Only

|

|

|

|

|

4.

|

Citizenship or Place of Organization

People’s Republic of China

|

|

|

|

|

|

Number of Shares Beneficially Owned by Each Reporting Person With

|

5.

|

Sole Voting Power

0

|

|

|

|

|

6.

|

Shared Voting Power

118,230,053

Class A ordinary shares (2)

|

|

|

|

|

7.

|

Sole Dispositive Power

0

|

|

|

|

|

8.

|

Shared Dispositive Power

118,230,053

Class A ordinary shares (2)

|

|

|

|

|

9.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

118,230,053 Class A ordinary shares (2)

|

|

|

|

|

|

|

10.

|

Check if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) x(3)

|

|

|

|

|

|

|

11.

|

Percent of Class Represented by Amount in Row (9)

3.77% of Class A ordinary shares (or 3.00% of the total ordinary

shares) (4)

|

|

|

|

|

|

|

12.

|

Type of Reporting Person (See Instructions)

CO

|

|

|

|

|

|

|

|

|

|

(1)

|

This statement on Schedule 13G is filed by the Reporting Persons. The Reporting Persons expressly disclaim

status as a “group” for purposes of this Schedule 13G.

|

|

|

(2)

|

Represents 118,230,053 Class A ordinary shares directly held by Gaorong Technology. Gaorong Technology

is wholly owned by Suzhou Gaorong whose general partner is Xizang Gaorong. Xizang Gaorong is wholly owned by Beijing Gaorong. As such,

Suzhou Gaorong, Xizang Gaorong and Beijing Gaorong may exercise voting and dispositive power over the ordinary shares held by Gaorong

Technology. Gaorong Holdings directly holds 86,052,718 Class A ordinary shares. Banyan Fund III and Banyan Fund III-A hold 79.33% and

14.00% of the total share capital of Gaorong Holdings, respectively, and as such Banyan Fund III may exercise voting and dispositive power

over the ordinary shares held by Gaorong Holdings. Banyan Fund III directly holds 31,880,733 Class A ordinary shares and Banyan Fund III-A

directly holds 2,039,576 Class A ordinary shares. Banyan III GP is the general partner of both Banyan Fund III and Banyan Fund III-A,

and as such, may exercise voting and dispositive power over the ordinary shares held by Banyan Fund III, Banyan Fund III-A and Gaorong

Holdings.

|

|

|

(3)

|

Beijing Gaorong disclaims beneficial ownership over shares reported herein that are directly held by Gaorong

Holdings, Banyan Fund III and Banyan Fund III-A.

|

|

|

(4)

|

Calculation is based on 3,941,265,290 ordinary

shares issued and outstanding (assuming the underwriters did not exercise their option to purchase additional American depositary shares

of the Issuer), consisting of 3,139,360,311 Class A ordinary shares and 801,904,979 Class B ordinary shares, as reported in the Issuer’s

424B4 Filing. Each Class A ordinary share is entitled to one vote, and each Class B ordinary share is entitled to nine votes and

is convertible into one Class A ordinary share at any time by the holder thereof. Class A ordinary shares are not convertible into Class

B ordinary shares under any circumstances. Accordingly, and based on the foregoing, the Class A ordinary shares beneficially owned by

the Beijing Gaorong represent approximately 1.14% of the aggregate voting power of the total issued and outstanding ordinary shares of

the Issuer.

|

|

CUSIP No. 94132V105

|

|

|

|

|

1.

|

Names of Reporting Persons

Gaorong Group Holdings Limited

|

|

|

|

|

2.

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

o

|

|

|

|

(b)

|

x(1)

|

|

|

|

|

3.

|

SEC Use Only

|

|

|

|

|

4.

|

Citizenship or Place of Organization

British Virgin Islands

|

|

|

|

|

|

Number of Shares Beneficially Owned by Each Reporting Person With

|

5.

|

Sole Voting Power

0

|

|

|

|

|

6.

|

Shared Voting Power

86,052,718

Class A ordinary shares (2)

|

|

|

|

|

7.

|

Sole Dispositive Power

0

|

|

|

|

|

8.

|

Shared Dispositive Power

86,052,718

Class A ordinary shares (2)

|

|

|

|

|

9.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

86,052,718 Class A ordinary shares (2)

|

|

|

|

|

|

|

10.

|

Check if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) x(3)

|

|

|

|

|

|

|

11.

|

Percent of Class Represented by Amount in Row (9)

2.74% of Class A ordinary shares (or 2.18% of the total ordinary

shares) (4)

|

|

|

|

|

|

|

12.

|

Type of Reporting Person (See Instructions)

CO

|

|

|

|

|

|

|

|

|

|

(1)

|

This statement on Schedule 13G is filed by the Reporting Persons. The Reporting Persons expressly disclaim

status as a “group” for purposes of this Schedule 13G.

|

|

|

(2)

|

Represents 86,052,718 Class A ordinary shares directly held by Gaorong Holdings. Banyan Fund III and Banyan

Fund III-A hold 79.33% and 14.00% of the total share capital of Gaorong Holdings, respectively, and as such Banyan Fund III may exercise

voting and dispositive power over the ordinary shares held by Gaorong Holdings. Banyan Fund III directly holds 31,880,733 Class A ordinary

shares and Banyan Fund III-A directly holds 2,039,576 Class A ordinary shares. Banyan III GP is the general partner of both Banyan Fund

III and Banyan Fund III-A, and as such, may exercise voting and dispositive power over the ordinary shares held by Banyan Fund III, Banyan

Fund III-A and Gaorong Holdings. Gaorong Technology directly holds 118,230,053 Class A ordinary shares. Gaorong Technology is wholly owned

by Suzhou Gaorong whose general partner is Xizang Gaorong. Xizang Gaorong is wholly owned by Beijing Gaorong. As such, Suzhou Gaorong,

Xizang Gaorong and Beijing Gaorong may exercise voting and dispositive power over the ordinary shares held by Gaorong Technology.

|

|

|

(3)

|

Gaorong Holdings disclaims beneficial ownership over shares reported herein that are directly held by

Gaorong Technology, Banyan Fund III and Banyan Fund III-A.

|

|

|

(4)

|

Calculation is based on 3,941,265,290 ordinary

shares issued and outstanding (assuming the underwriters did not exercise their option to purchase additional American depositary shares

of the Issuer), consisting of 3,139,360,311 Class A ordinary shares and 801,904,979 Class B ordinary shares, as reported in the Issuer’s

424B4 Filing. Each Class A ordinary share is entitled to one vote, and each Class B ordinary share is entitled to nine votes and

is convertible into one Class A ordinary share at any time by the holder thereof. Class A ordinary shares are not convertible into Class

B ordinary shares under any circumstances. Accordingly, and based on the foregoing, the Class A ordinary shares beneficially owned by

the Gaorong Holdings represent approximately 0.83% of the aggregate voting power of the total issued and outstanding ordinary shares of

the Issuer.

|

|

CUSIP No. 94132V105

|

|

|

|

|

1.

|

Names of Reporting Persons

Banyan Partners Fund III, L.P.

|

|

|

|

|

2.

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

o

|

|

|

|

(b)

|

x(1)

|

|

|

|

|

3.

|

SEC Use Only

|

|

|

|

|

4.

|

Citizenship or Place of Organization

Cayman Islands

|

|

|

|

|

|

Number of Shares Beneficially Owned by Each Reporting Person With

|

5.

|

Sole Voting Power

0

|

|

|

|

|

6.

|

Shared Voting Power

117,933,451

Class A ordinary shares (2)

|

|

|

|

|

7.

|

Sole Dispositive Power

0

|

|

|

|

|

8.

|

Shared Dispositive Power

117,933,451

Class A ordinary shares (2)

|

|

|

|

|

9.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

117,933,451 Class A ordinary shares (2)

|

|

|

|

|

|

|

10.

|

Check if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) x (3)

|

|

|

|

|

|

|

11.

|

Percent of Class Represented by Amount in Row (9)

3.76% of Class A ordinary shares (or 2.99% of the total ordinary

shares) (4)

|

|

|

|

|

|

|

12.

|

Type of Reporting Person (See Instructions)

PN

|

|

|

|

|

|

|

|

|

|

(1)

|

This statement on Schedule 13G is filed by the Reporting Persons. The Reporting Persons expressly disclaim

status as a “group” for purposes of this Schedule 13G.

|

|

|

(2)

|

Consists of (i) 86,052,718 Class A ordinary shares directly held by Gaorong Holdings and (ii) 31,880,733

Class A ordinary shares directly held by Banyan Fund III. Banyan Fund III and Banyan Fund III-A hold 79.33% and 14.00% of the total share

capital of Gaorong Holdings, respectively, and as such Banyan Fund III may exercise voting and dispositive power over the ordinary shares

held by Gaorong Holdings. Banyan Fund III-A directly holds 2,039,576 Class A ordinary shares. Banyan III GP is the general partner of

both Banyan Fund III and Banyan Fund III-A, and as such, may exercise voting and dispositive power over the ordinary shares held by Banyan

Fund III, Banyan Fund III-A and Gaorong Holdings. Gaorong Technology directly holds 118,230,053 Class A ordinary shares. Gaorong Technology

is wholly owned by Suzhou Gaorong whose general partner is Xizang Gaorong. Xizang Gaorong is wholly owned by Beijing Gaorong. As such,

Suzhou Gaorong, Xizang Gaorong and Beijing Gaorong may exercise voting and dispositive power over the ordinary shares held by Gaorong

Technology.

|

|

|

(3)

|

Banyan Fund III disclaims beneficial ownership over shares reported herein that are directly held by Gaorong

Technology and Banyan Fund III-A.

|

|

|

(4)

|

Calculation is based on 3,941,265,290 ordinary

shares issued and outstanding (assuming the underwriters did not exercise their option to purchase additional American depositary shares

of the Issuer), consisting of 3,139,360,311 Class A ordinary shares and 801,904,979 Class B ordinary shares, as reported in the Issuer’s

424B4 Filing. Each Class A ordinary share is entitled to one vote, and each Class B ordinary share is entitled to nine votes and

is convertible into one Class A ordinary share at any time by the holder thereof. Class A ordinary shares are not convertible into Class

B ordinary shares under any circumstances. Accordingly, and based on the foregoing, the Class A ordinary shares beneficially owned by

the Banyan Fund III represent approximately 1.14% of the aggregate voting power of the total issued and outstanding ordinary shares of

the Issuer.

|

|

CUSIP No. 94132V105

|

|

|

|

|

1.

|

Names of Reporting Persons

Banyan Partners Fund III-A, L.P.

|

|

|

|

|

2.

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

o

|

|

|

|

(b)

|

x(1)

|

|

|

|

|

3.

|

SEC Use Only

|

|

|

|

|

4.

|

Citizenship or Place of Organization

Cayman Islands

|

|

|

|

|

|

Number of Shares Beneficially Owned by Each Reporting Person With

|

5.

|

Sole Voting Power

0

|

|

|

|

|

6.

|

Shared Voting Power

2,039,576

Class A ordinary shares (2)

|

|

|

|

|

7.

|

Sole Dispositive Power

0

|

|

|

|

|

8.

|

Shared Dispositive Power

2,039,576

Class A ordinary shares (2)

|

|

|

|

|

9.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

2,039,576 Class A ordinary shares (2)

|

|

|

|

|

|

|

10.

|

Check if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) x (3)

|

|

|

|

|

|

|

11.

|

Percent of Class Represented by Amount in Row (9)

0.06% of Class A ordinary shares (or 0.05% of the total ordinary

shares) (4)

|

|

|

|

|

|

|

12.

|

Type of Reporting Person (See Instructions)

PN

|

|

|

|

|

|

|

|

|

|

(1)

|

This statement on Schedule 13G is filed by the Reporting Persons. The Reporting Persons expressly disclaim

status as a “group” for purposes of this Schedule 13G.

|

|

|

(2)

|

Represents 2,039,576 Class A ordinary shares directly held by Banyan Fund III-A. Banyan Fund III directly

holds 31,880,733 Class A ordinary shares. Gaorong Holdings directly holds 86,052,718 Class A ordinary shares. Banyan Fund III and Banyan

Fund III-A hold 79.33% and 14.00% of the total share capital of Gaorong Holdings, respectively, and as such Banyan Fund III may exercise

voting and dispositive power over the ordinary shares held by Gaorong Holdings. Banyan III GP is the general partner of both Banyan Fund

III and Banyan Fund III-A, and as such, may exercise voting and dispositive power over the ordinary shares held by Banyan Fund III, Banyan

Fund III-A and Gaorong Holdings. Gaorong Technology directly holds 118,230,053 Class A ordinary shares. Gaorong Technology is wholly owned

by Suzhou Gaorong whose general partner is Xizang Gaorong. Xizang Gaorong is wholly owned by Beijing Gaorong. As such, Suzhou Gaorong,

Xizang Gaorong and Beijing Gaorong may exercise voting and dispositive power over the ordinary shares held by Gaorong Technology.

|

|

|

(3)

|

Banyan Fund III-A disclaims beneficial ownership over shares

reported herein that are directly held by Gaorong Technology, Gaorong Holdings and Banyan Fund III.

|

|

|

(4)

|

Calculation is based on 3,941,265,290 ordinary shares issued and outstanding (assuming the underwriters

did not exercise their option to purchase additional American depositary shares of the Issuer), consisting of 3,139,360,311 Class A ordinary

shares and 801,904,979 Class B ordinary shares, as reported in the Issuer’s 424B4 Filing. Each Class A ordinary share is entitled

to one vote, and each Class B ordinary share is entitled to nine votes and is convertible into one Class A ordinary share at any time

by the holder thereof. Class A ordinary shares are not convertible into Class B ordinary shares under any circumstances. Accordingly,

and based on the foregoing, the Class A ordinary shares beneficially owned by the Banyan Fund III-A represent approximately 0.02% of the

aggregate voting power of the total issued and outstanding ordinary shares of the Issuer.

|

|

CUSIP No. 94132V105

|

|

|

|

|

1.

|

Names of Reporting Persons

Banyan Partners III Ltd.

|

|

|

|

|

2.

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

o

|

|

|

|

(b)

|

x(1)

|

|

|

|

|

3.

|

SEC Use Only

|

|

|

|

|

4.

|

Citizenship or Place of Organization

Cayman Islands

|

|

|

|

|

|

Number of Shares Beneficially Owned by Each Reporting Person With

|

5.

|

Sole Voting Power

0

|

|

|

|

|

6.

|

Shared Voting Power

119,973,027

Class A ordinary shares (2)

|

|

|

|

|

7.

|

Sole Dispositive Power

0

|

|

|

|

|

8.

|

Shared Dispositive Power

119,973,027

Class A ordinary shares (2)

|

|

|

|

|

9.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

119,973,027 Class A ordinary shares (2)

|

|

|

|

|

|

|

10.

|

Check if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) x(3)

|

|

|

|

|

|

|

11.

|

Percent of Class Represented by Amount in Row (9)

3.82% of Class A ordinary shares (or 3.04% of the total ordinary

shares) (4)

|

|

|

|

|

|

|

12.

|

Type of Reporting Person (See Instructions)

CO

|

|

|

|

|

|

|

|

|

|

(1)

|

This statement on Schedule 13G is filed by the Reporting Persons. The Reporting Persons expressly disclaim

status as a “group” for purposes of this Schedule 13G.

|

|

|

(2)

|

Consists of (i) 86,052,718 Class A ordinary shares directly held by Gaorong Holdings, (ii) 31,880,733

Class A ordinary shares directly held by Banyan Fund III, and (iii) 2,039,576 Class A ordinary shares directly held by Banyan Fund III-A.

Banyan Fund III and Banyan Fund III-A hold 79.33% and 14.00% of the total share capital of Gaorong Holdings, respectively, and as such

Banyan Fund III may exercise voting and dispositive power over the ordinary shares held by Gaorong Holdings. Banyan III GP is the general

partner of both Banyan Fund III and Banyan Fund III-A, and as such, may exercise voting and dispositive power over the ordinary shares

held by Banyan Fund III, Banyan Fund III-A and Gaorong Holdings. Gaorong Technology directly holds 118,230,053 Class A ordinary shares.

Gaorong Technology is wholly owned by Suzhou Gaorong whose general partner is Xizang Gaorong. Xizang Gaorong is wholly owned by Beijing

Gaorong. As such, Suzhou Gaorong, Xizang Gaorong and Beijing Gaorong may exercise voting and dispositive power over the ordinary shares

held by Gaorong Technology.

|

|

|

(3)

|

Banyan III GP disclaims beneficial ownership over shares reported herein that are directly held by Gaorong

Technology.

|

|

|

(4)

|

Calculation is based on 3,941,265,290 ordinary shares issued and outstanding (assuming the underwriters

did not exercise their option to purchase additional American depositary shares of the Issuer), consisting of 3,139,360,311 Class A ordinary

shares and 801,904,979 Class B ordinary shares, as reported in the Issuer’s 424B4 Filing. Each Class A ordinary share is entitled

to one vote, and each Class B ordinary share is entitled to nine votes and is convertible into one Class A ordinary share at any time

by the holder thereof. Class A ordinary shares are not convertible into Class B ordinary shares under any circumstances. Accordingly,

and based on the foregoing, the Class A ordinary shares beneficially owned by the Banyan III GP represent approximately 1.16% of the aggregate

voting power of the total issued and outstanding ordinary shares of the Issuer.

|

|

Item 1.

|

|

|

(a)

|

Name of Issuer

Waterdrop Inc.

|

|

|

(b)

|

Address of Issuer’s Principal Executive Offices

Block C, Wangjing Science and Technology Park

No. 2 Lize Zhonger Road

Chaoyang District, Beijing

People’s Republic of China

|

|

Item 2.

|

|

|

(a)

|

Name of Person Filing

Gaorong Technology Consulting Limited (“Gaorong Technology”)

Suzhou Industry Park Gaorong Growth Investment Center (Limited Partnership)

(“Suzhou Gaorong”)

Xizang Gaorong Capital Management Co., Ltd. (“Xizang Gaorong”)

Beijing Gaorong Capital Management Consulting Co., Ltd. (“Beijing

Gaorong”)

Gaorong Group Holdings Limited (“Gaorong Holdings”)

Banyan Partners Fund III, L.P. (“Banyan Fund III”)

Banyan Partners Fund III-A, L.P. (“Banyan Fund III-A”)

Banyan Partners III Ltd. (“Banyan III GP”)

|

|

|

(b)

|

Address of Principal Business Office or, if none, Residence

The address of each of Gaorong Technology Consulting Limited and Gaorong

Group Holdings Limited is:

OMC Chambers

Wickhams Cay 1

Road Town, Tortola

British Virgin Islands

The address of Suzhou Industry Park Gaorong Growth Investment Center

(Limited Partnership) is:

Unit 01, 33/F, Yuanrong Centre

Xingzuo Commercial Plaza, Building 1

269 Wangdun Road

Suzhou Industrial Park

Wuzhong District, Suzhou

Jiangsu Province

People’s Republic of China

The address of Xizang Gaorong Capital Management Co., Ltd. is:

2-14-10C, Chuangye Jidi Mansion

Dazi County Industrial Park

Lhasa City, Tibet Autonomous Region

People’s Republic of China

The address of Beijing Gaorong Capital Management Consulting Co., Ltd.

is:

503, 4/F,

Building 1

6 Danling Street

Haidian District, Beijing

People’s Republic of China

The address of each of Banyan Partners Fund III, L.P., Banyan Partners

Fund III-A, L.P. and Banyan Partners III Ltd. is:

c/o Walkers Corporate Limited

190 Elgin Avenue

George Town

Grand Cayman, KY1-9008

Cayman Islands

|

|

|

(c)

|

Citizenship

Gaorong Technology Consulting Limited: British Virgin Islands

Suzhou Industry Park Gaorong Growth Investment Center (Limited Partnership):

People’s Republic of China

Xizang Gaorong Capital Management Co., Ltd.: People’s Republic

of China

Beijing Gaorong Capital Management Consulting Co., Ltd.: People’s

Republic of China

Gaorong Group Holdings Limited: British Virgin Islands

Banyan Partners Fund III, L.P.: Cayman Islands

Banyan Partners Fund III-A, L.P.: Cayman Islands

Banyan Partners III Ltd.: Cayman Islands

|

|

|

(d)

|

Title of Class of Securities

Class A Ordinary

Shares, par value US$ 0.000005 per share

|

|

|

(e)

|

CUSIP Number

94132V105

|

|

|

|

Item 3.

|

If this statement is filed pursuant to §§240.13d-1(b) or 240.13d-2(b) or (c), check whether the person filing is a:

|

|

|

Not applicable.

|

The following information with

respect to the ownership of Class A ordinary shares by the Reporting Persons filing this statement on Schedule 13G is provided as of December

31, 2021:

|

Reporting Persons

|

|

Ordinary

Shares Held

Directly (1)

|

|

|

Shared

Voting

Power (1)

|

|

|

Shared

Dispositive

Power (1)

|

|

|

Beneficial

Ownership (1)

|

|

|

Percentage

of Class A

Ordinary

Shares(1)(5)

|

|

|

Percentage

of Total

Ordinary

Shares (1)(5)

|

|

|

Percentage

of the

Aggregate

Voting

Power(1)(5)

|

|

|

Gaorong Technology Consulting Limited

|

|

|

118,230,053

|

|

|

|

118,230,053

|

|

|

|

118,230,053

|

|

|

|

118,230,053

|

|

|

|

3.77

|

%

|

|

|

3.00

|

%

|

|

|

1.14

|

%

|

|

Suzhou Industry Park Gaorong Growth Investment Center (Limited Partnership)(2)

|

|

|

0

|

|

|

|

118,230,053

|

|

|

|

118,230,053

|

|

|

|

118,230,053

|

|

|

|

3.77

|

%

|

|

|

3.00

|

%

|

|

|

1.14

|

%

|

|

Xizang Gaorong Capital Management Co., Ltd.(2)

|

|

|

0

|

|

|

|

118,230,053

|

|

|

|

118,230,053

|

|

|

|

118,230,053

|

|

|

|

3.77

|

%

|

|

|

3.00

|

%

|

|

|

1.14

|

%

|

|

Beijing Gaorong Capital Management Consulting Co., Ltd.(2)

|

|

|

0

|

|

|

|

118,230,053

|

|

|

|

118,230,053

|

|

|

|

118,230,053

|

|

|

|

3.77

|

%

|

|

|

3.00

|

%

|

|

|

1.14

|

%

|

|

Gaorong Group Holdings Limited

|

|

|

86,052,718

|

|

|

|

86,052,718

|

|

|

|

86,052,718

|

|

|

|

86,052,718

|

|

|

|

2.74

|

%

|

|

|

2.18

|

%

|

|

|

0.83

|

%

|

|

Banyan Partners Fund III, L.P.(3)

|

|

|

31,880,733

|

|

|

|

117,933,451

|

|

|

|

117,933,451

|

|

|

|

117,933,451

|

|

|

|

3.76

|

%

|

|

|

2.99

|

%

|

|

|

1.14

|

%

|

|

Banyan Partners Fund III-A, L.P.

|

|

|

2,039,576

|

|

|

|

2,039,576

|

|

|

|

2,039,576

|

|

|

|

2,039,576

|

|

|

|

0.06

|

%

|

|

|

0.05

|

%

|

|

|

0.02

|

%

|

|

Banyan Partners III Ltd. (4)

|

|

|

0

|

|

|

|

119,973,027

|

|

|

|

119,973,027

|

|

|

|

119,973,027

|

|

|

|

3.82

|

%

|

|

|

3.04

|

%

|

|

|

1.16

|

%

|

|

|

(1)

|

Represents the number of shares beneficially owned by the Reporting Persons as of December 31, 2021.

|

|

|

(2)

|

Gaorong Technology is wholly owned by Suzhou Gaorong whose general partner is Xizang Gaorong. Xizang Gaorong is wholly owned by Beijing

Gaorong. As such, Suzhou Gaorong, Xizang Gaorong and Beijing Gaorong may exercise voting and dispositive power over the ordinary shares

held by Gaorong Technology.

|

|

|

(3)

|

Banyan Fund III and Banyan Fund III-A hold 79.33% and 14.00% of the total share capital of Gaorong Holdings, respectively, and as

such Banyan Fund III may exercise voting and dispositive power over the ordinary shares held by Gaorong Holdings.

|

|

|

(4)

|

Banyan III GP is the general partner of both Banyan Fund III and Banyan Fund III-A, and as such, may exercise voting and dispositive

power over the ordinary shares held by Banyan Fund III, Banyan Fund III-A and Gaorong Holdings.

|

|

|

(5)

|

The Reporting Persons in the aggregate beneficially own 7.59% of the outstanding Class A ordinary shares,

6.04% of the total outstanding ordinary shares and 2.30% of the aggregate voting power. The Reporting Persons expressly disclaim status

as a “group” for purposes of this Schedule 13G. In addition, Gaorong Technology disclaims beneficial ownership over the shares

reported herein directly held by Gaorong Holdings, Banyan Fund III and Banyan Fund III-1; Gaorong Holdings disclaims beneficial ownership

over the shares reported herein directly held by Gaorong Technology, Banyan Fund III and Banyan Fund III-A; Banyan Fund III disclaims

beneficial ownership over the shares reported herein directly held by Gaorong Technology and Banyan Fund III-A; and Banyan Fund III-A

disclaims beneficial ownership over the shares reported herein directly held by Gaorong Technology, Gaorong Holdings and Banyan Fund III.

Each of the Reporting Persons may be deemed to beneficially own the percentage of Class A ordinary shares listed above which is calculated

based on 3,139,360,311 outstanding Class A ordinary shares (assuming the underwriters did not exercise their option to purchase additional

American depositary shares of the Issuer) as reported in the Issuer’s 424B4 Filing. Each of the Reporting Persons may be deemed

to beneficially own the percentage of the total ordinary shares listed above which is calculated based on 3,139,360,311 outstanding Class

A ordinary shares (assuming the underwriters did not exercise their option to purchase additional American depositary shares of the Issuer)

and 801,904,979 outstanding Class B ordinary shares as reported in the Issuer’s 424B4 Filing. Each Class A ordinary share is entitled

to one vote, and each Class B ordinary share is entitled to nine votes. Accordingly, and based on the foregoing, each of the Reporting

Persons may be deemed to beneficially own the percentage of the aggregate voting power of the total issued and outstanding ordinary shares

of the Issuer listed above. Each ordinary share (Class A ordinary share or Class B ordinary share) has a par value of US$0.000005.

|

|

Item 5.

|

Ownership of Five Percent or Less of a Class

|

|

If this statement is being filed to report the fact that as of the date hereof the reporting person has ceased to be the beneficial owner of more than five percent of the class of securities, check the following o.

|

|

Item 6.

|

Ownership of More than Five Percent on Behalf of Another Person

|

|

Not Applicable

|

|

|

|

Item 7.

|

Identification and Classification of the Subsidiary Which Acquired the Security Being Reported on By the Parent Holding Company or Control Person

|

|

Not Applicable

|

|

|

|

Item 8.

|

Identification and Classification of Members of the Group

|

|

Not Applicable

|

|

|

|

Item 9.

|

Notice of Dissolution of Group

|

|

Not Applicable

|

|

|

|

Item 10.

|

Certification

|

|

Not Applicable

|

Exhibits:

|

Exhibit I:

|

Joint Filing Agreement by and among Gaorong Technology Consulting Limited, Suzhou Industry Park Gaorong Growth Investment Center (Limited Partnership), Xizang Gaorong Capital Management Co., Ltd., Beijing Gaorong Capital Management Consulting Co., Ltd., Gaorong Group Holdings Limited, Banyan Partners Fund III, L.P., Banyan Partners Fund III-A, L.P., and Banyan Partners III Ltd.

|

SIGNATURES

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: February 11, 2022

Gaorong Technology Consulting

Limited

|

By:

|

/s/ Peter Wong

|

|

|

Name:

|

Peter Wong

|

|

|

Title:

|

Authorized Signatory

|

|

Suzhou Industry Park Gaorong

Growth Investment Center (Limited Partnership)

|

By:

|

Xizang Gaorong Capital Management Co., Ltd.

|

|

|

|

|

|

|

By:

|

/s/ Peter Wong

|

|

|

Name:

|

Peter Wong

|

|

|

Title:

|

Authorized Signatory

|

|

Xizang Gaorong Capital Management

Co., Ltd.

|

By:

|

/s/ Peter Wong

|

|

|

Name:

|

Peter Wong

|

|

|

Title:

|

Authorized Signatory

|

|

Beijing Gaorong Capital Management

Consulting Co., Ltd.

|

By:

|

/s/ Peter Wong

|

|

|

Name:

|

Peter Wong

|

|

|

Title:

|

Authorized Signatory

|

|

Gaorong Group Holdings Limited

|

By:

|

/s/ Peter Wong

|

|

|

Name:

|

Peter Wong

|

|

|

Title:

|

Authorized Signatory

|

|

Banyan Partners Fund III,

L.P.

By: Banyan Partners III Ltd.

|

By:

|

/s/ Peter Wong

|

|

|

Name:

|

Peter Wong

|

|

|

Title:

|

Authorized Signatory

|

|

Banyan Partners Fund III-A,

L.P.

By: Banyan Partners III Ltd.

|

By:

|

/s/ Peter Wong

|

|

|

Name:

|

Peter Wong

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

Banyan Partners III Ltd.

|

By:

|

/s/ Peter Wong

|

|

|

Name:

|

Peter Wong

|

|

|

Title:

|

Authorized Signatory

|

|

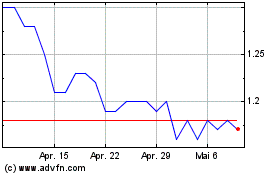

Waterdrop (NYSE:WDH)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Waterdrop (NYSE:WDH)

Historical Stock Chart

Von Apr 2023 bis Apr 2024