U.S. Physical Therapy Announces Closing of New Credit Facility

21 Juni 2022 - 1:00PM

Business Wire

Borrowing capacity increases by $175

million

Base interest rate fixed on $150

million

U.S. Physical Therapy, Inc. ("USPH" or the “Company”) (NYSE:

USPH), a national operator of outpatient physical therapy clinics

and provider of industrial injury prevention services, today

announced the closing of a $325 million, five-year credit facility

that includes a $150 million term loan and a $175 million revolver.

Based on strong lender support, the credit facility was upsized

from its $300 million launch amount. This is an increase and

extension of the Company’s previous $150 million credit facility.

The Company concurrently announced that it entered into an interest

rate swap agreement in May, with a June 30 effective date, to lock

the 1-month term SOFR rate on $150 million of its debt at a 5-year

swap rate of 2.815%. The total interest rate in any particular

period will also include an applicable margin based on the

Company’s consolidated leverage ratio.

Carey P. Hendrickson, Chief Financial Officer, stated, “The

successful closing of this transaction demonstrates our continued

proactive approach to managing our balance sheet to support the

Company’s growth, drive shareholder returns and enhance liquidity.

It improves our long-term capital structure and, together with our

strong cash flow, expands our ability to continue growing our

portfolio of physical therapy and industrial injury prevention

services businesses. Also, the related swap agreement effectively

manages our interest rate risk over the term of the facility, which

is particularly important in the current rising interest rate

environment.”

The credit facility was arranged by BofA Securities, Inc., and

Regions Capital Markets, a division of Regions Bank, as Joint Lead

Arrangers. BofA Securities, Inc. was the sole Bookrunner, and Bank

of America, N.A. is the Administrative Agent.

About U.S. Physical Therapy,

Inc.

Founded in 1990, U.S. Physical Therapy, Inc. operates 608

outpatient physical therapy clinics in 38 states. The Company's

clinics provide preventative and post-operative care for a variety

of orthopedic-related disorders and sports-related injuries,

treatment for neurologically-related injuries and rehabilitation of

injured workers. In addition to owning and operating clinics, the

Company manages 38 physical therapy facilities for unaffiliated

third parties, including hospitals and physician groups. The

Company also has an industrial injury prevention business which

provides onsite services for clients’ employees including injury

prevention and rehabilitation, performance optimization, post-offer

employment testing, functional capacity evaluations, and ergonomic

assessments.

More information about U.S. Physical Therapy, Inc. is available

at www.usph.com. The information

included on that website is not incorporated into this press

release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220620005052/en/

U.S. Physical Therapy, Inc. Carey P. Hendrickson, Chief

Financial Officer email: chendrickson@usph.com Chris Reading, Chief

Executive Officer (713) 297-7000 Three Part Advisors Joe Noyons

(817) 778-8424

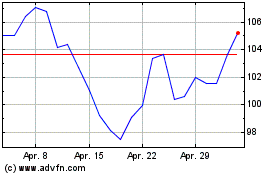

US Physical Therapy (NYSE:USPH)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

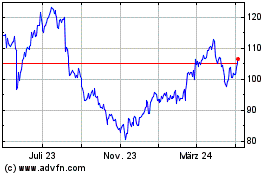

US Physical Therapy (NYSE:USPH)

Historical Stock Chart

Von Apr 2023 bis Apr 2024