U.S. Bank Launches Nation’s First Spanish-Language Voice Assistant for Banking

26 April 2022 - 2:00PM

Business Wire

We are making it easier and simpler for our Spanish-speaking

customers to bank digitally

U.S. Bank is the first financial institution in the United

States to offer an experience Spanish-speaking customers have never

had before: the ability to bank via mobile app in their preferred

language – just by speaking it.1

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20220426005029/en/

U.S. Bank has launched Asistente

Inteligente de U.S. Bank™, a Spanish-language version of our

best-in-class Smart Assistant in the U.S. Bank Mobile App.

U.S. Bank has launched Asistente Inteligente de U.S. Bank™, a

Spanish-language version of our best-in-class Smart Assistant in

the U.S. Bank Mobile App. Smart Assistant is one of just two

banking voice assistants awarded Corporate Insight’s highest rating

of “Excellent,” and Asistente Inteligente has all the same features

and functionality as the popular English language version.

Customers who set their language preference to Spanish in the

U.S. Bank Mobile App will now be able to do dozens of things – like

check their balance and transactions, transfer and send money,

track their credit score, lock and unlock their card, make

payments, and quickly search for and complete many other functions

– just by talking into their smartphone in Spanish. And if they’d

prefer to text instead of talk, Asistente Inteligente supports that

too.1

“Asistente Inteligente is the first Spanish language virtual

assistant of its kind in the United States, offering

Spanish-speaking customers the very best digital banking tools from

U.S. Bank,” said Dominic Venturo, chief digital officer at U.S.

Bank. “This not only builds on U.S. Bank Access Commitment™, our

long-term approach to help diverse customers build wealth, but also

demonstrates our continued emphasis on putting customer experience

first, by creating new digital tools that enable them to bank

however, whenever and wherever is best for them.”

A standard of high quality

Asistente Inteligente was launched with the expertise of Spanish

speakers, and Hispanic employees in the U.S. Bank Nosotros Latinos

Business Resource Group helped test it, to ensure customers always

experience the proper language usage in its proper context. U.S.

Bank designers and developers took great care to ensure accuracy

and a consistent tone and nomenclature.

“Translation apps sometimes struggle to decipher words with more

than one meaning, such as ‘balance’ – are we talking about your

equilibrium or how much money is in your account?” said Richard

Weeks, head of conversational experiences and capabilities at U.S.

Bank. “Our software engineers solved for that through a hybrid

approach using smart technology, natural language processing and

real-time interpretation.”

By talking or texting with Asistente Inteligente, Spanish

speaking customers have an incredibly easy and simple way to

navigate the numerous features of the award-winning U.S. Bank

Mobile App.2 It’s part of the bank’s broader effort to provide

leading Spanish-language digital capabilities to Hispanic

customers.

“Sometimes language can be a barrier to accessing best-in-class

financial services, and U.S. Bank is focused on eliminating

barriers,” said Ramiro Padilla Klein, U.S. Bank vice president for

Hispanic segment strategy. “Asistente Inteligente is an innovative

first-in-the-industry technology, which shows Latino and Hispanic

Americans that we’re here for them. They can confidently ask

questions in their preferred language with this new financial

tool.”

Meeting diverse needs

Spanish is the second most-spoken language in the United States

- more than 13% of the population uses it, according to the U.S.

Census.

Service in Spanish is Hispanic customers’ second-highest

priority when choosing a bank, behind only branch location,

according to MRI-Simmons’ National Consumer Study.

When it comes to digital banking, mobile devices play a larger

role for Hispanic adults compared with white adults. A quarter of

Hispanics are “smartphone-only” internet users – meaning they own a

smartphone but don’t have traditional home broadband services,

according to a Pew Research Center survey. That is compared with

just 12% of white adults and 17% of Black adults.

“Asistente Inteligente is not only cutting-edge technology,”

Padilla Klein said, “but precisely the kind of technology Hispanic

Americans find particularly valuable.”

About U.S. Bank

U.S. Bancorp, with nearly 70,000 employees and $587 billion in

assets as of March 31, 2022, is the parent company of U.S. Bank

National Association. The Minneapolis-based company serves millions

of customers locally, nationally and globally through a diversified

mix of businesses: Consumer and Business Banking; Payment Services;

Corporate & Commercial Banking; and Wealth Management and

Investment Services. The company has been recognized for its

approach to digital innovation, social responsibility, and customer

service, including being named one of the 2022 World’s Most Ethical

Companies and Fortune’s most admired superregional bank. Learn more

at usbank.com/about.

_____________________________________________________________________________________

1. Some services may only be available in English. 2. Industry

benchmarking firm Keynova Group ranked U.S. Bank No. 1 for mobile

app in its Q1 2022 Mobile Banker Scorecard. Member FDIC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220426005029/en/

David McCoy U.S. Bank Public Affairs & Communications

david.mccoy1@usbank.com 612-599-8815

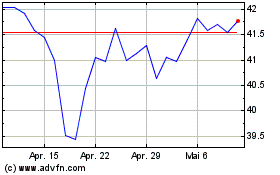

US Bancorp (NYSE:USB)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

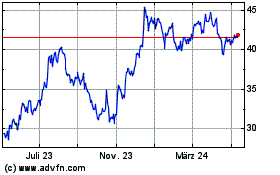

US Bancorp (NYSE:USB)

Historical Stock Chart

Von Apr 2023 bis Apr 2024