Amended Statement of Beneficial Ownership (sc 13d/a)

02 Mai 2022 - 12:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

UNDER THE SECURITIES ACT OF 1933

(Amendment No. 3)

USA

Compression Partners, LP

(Name of issuer)

Common Units Representing Limited Partner Interests

(Title of class of securities)

90290N109

(CUSIP number)

Sean Murphy, Chief Compliance Officer

c/o EIG Veteran Equity Aggregator, L.P.

600 New Hampshire Ave NW, STE. 1200

Washington, DC 20037

(202) 600-3304

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

April 27, 2022

(Date of Event which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

| (1) |

|

Names of Reporting Person

EIG Veteran Equity Aggregator, L.P. |

| (2) |

|

Check the appropriate box

if a member of a group (see instructions) (a) ☐ (b) ☐

|

| (3) |

|

SEC use only

|

| (4) |

|

Source of funds (see

instructions) OO |

| (5) |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| (6) |

|

Citizenship or place of

organization Delaware |

|

|

|

|

|

|

|

| Number of

shares beneficially

owned by each

reporting person

with: |

|

(7) |

|

Sole voting power

22,876,252 (1) |

| |

(8) |

|

Shared voting power

0 |

| |

(9) |

|

Sole dispositive power

22,876,252 (1) |

| |

(10) |

|

Shared dispositive power

0 |

|

|

|

|

|

|

|

| (11) |

|

Aggregate amount beneficially owned by each reporting person

22,876,252 (1) |

| (12) |

|

Check if the aggregate

amount in Row (11) excludes certain shares (see instructions)

☐ |

| (13) |

|

Percent of class

represented by amount in Row (11) 19.0% (2) |

| (14) |

|

Type of reporting person

(see instructions) PN |

| (1) |

As of April 27, 2022, EIG Veteran Equity Aggregator, L.P. holds (A) a warrant (the

“Warrant”) to acquire 8,413,281 Common Units (as defined below) at an exercise price of $19.59 per unit, (B) Preferred Units (i) 140,215 of which (the “2021 Preferred Units”) became convertible on and after April 2,

2021 for an aggregate of 7,006,721 Common Units and (ii) 140,215 of which (the “2022 Preferred Units”) became convertible on or after April 2, 2022 for an aggregate of 7,006,721 Common Units, and (C) 449,529 Common Units . Each 2021

Preferred Unit and 2022 Preferred Unit may be converted into a number of Common Units equal to $1,000 (plus accrued and unpaid distributions) divided by $20.0115. The Warrant became exercisable on April 2, 2019 and will expire on April 2,

2028. |

| (2) |

Percentage calculation is based on the number of Common Units outstanding as of February 10, 2022, as

reported in the Issuer’s Annual Report on Form 10-K filed on February 15, 2022, adjusted to include the Common Units issuable upon exercise of the Warrant and conversion of the 2021 Preferred Units

and 2022 Preferred Units, as well as the Common Units issued to the Reporting Person upon exercise of the Exercised Warrant (as defined below). |

Item 1. Security and Issuer.

This Amendment No. 3 (“Amendment No. 3”) amends and supplements the statement on Schedule 13D filed by the Reporting Person on

February 4, 2019, as previously amended by Amendment No. 1 filed by the Reporting Person on February 1, 2021 and Amendment No. 2 filed by the Reporting Person on February 1, 2022 (the “Original Statement”),

relating to the common units (the “Common Units”) representing limited partnership interests of USA Compression Partners, LP, a Delaware limited partnership (the “Issuer”), with principal executive offices at 111 Congress Avenue,

Suite 2400, Austin, Texas 78701.

Except as specifically provided herein, this Amendment No. 3 does not modify any of the information previously

reported on the Original Statement. Capitalized terms used but not otherwise defined in this Amendment No. 3 shall have the meanings ascribed to them in the Original Statement.

Item 2. Identity and Background.

No change.

Item 3. Source and Amount of Funds or Other Consideration.

Item 3 of this Schedule 13D is hereby amended to include the following:

On April 27, 2022, the Reporting Person exercised in full its warrant (the “Exercised Warrant”) to acquire 4,206,641 Common Units at an

exercise price of $17.03 per Common Unit. The Exercised Warrant was settled in accordance with the terms of the Exercised Warrant using the net unit settlement method. The description of the exercise of the Exercised Warrant set forth in Item 4 of

this Amendment No. 3 is hereby incorporated by reference into this Item 3.

Item 4. Purpose of Transaction.

Item 4 of this Schedule 13D is hereby amended to include the following:

On April 27, 2022, the Reporting Person exercised the Exercised Warrant to acquire an aggregate of

4,206,641 Common Units using the net unit settlement method, pursuant to which the Issuer withheld an aggregate of 3,757,111 Common Units, valued at $19.07 per Common Unit pursuant to the terms of the Exercised Warrant, in satisfaction of the

aggregate exercise price of the Exercised Warrant.

Item 5. Interest in Securities of the Issuer.

Item 5(a) of the Statement is hereby amended and restated with the following:

| (a) |

As of the date of this Statement, the Reporting Person beneficially owns an aggregate of 22,876,252 Common

Units, or 19.0% of the total number of Common Units outstanding (adjusted to include the Common Units issuable upon conversion of the Warrant, the 2021 Preferred Units, the 2022 Preferred Units and the Common Units issued pursuant to the Exercised

Warrant). The Warrant may be exercised at an exercise price of $19.59 per unit beginning on April 2, 2019 and will expire on April 2, 2028. Each 2021 Preferred Unit became convertible into a number of Common Units equal to $1,000 (plus

accrued and unpaid distributions) divided by $20.0115 on and after April 2, 2021. Each 2022 Preferred Unit became convertible into a number of Common Units equal to $1,000 (plus accrued and unpaid distributions) divided by $20.0115 on and after

April 2, 2022. Common Units which are to be issued upon exercise of the Warrant and conversion of the 2021 Preferred Units and 2022 Preferred Units are beneficially owned by the Reporting Person. |

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

No change.

Item 7. Materials to be Filed as Exhibits.

None.

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this Amendment No. 3 is true, complete

and correct.

Date: April 29, 2022

|

|

|

| EIG VETERAN EQUITY AGGREGATOR, L.P. |

|

|

| By: |

|

EIG Veteran Equity GP, LLC, its general partner |

|

|

| By: |

|

EIG Asset Management, LLC, its managing member |

|

|

| By: |

|

/s/ Randall S. Wade |

| Name: |

|

Randall S. Wade |

| Title |

|

President |

|

|

| By: |

|

/s/ Sean Murphy |

| Name: |

|

Sean Murphy |

| Title: |

|

Chief Compliance Officer |

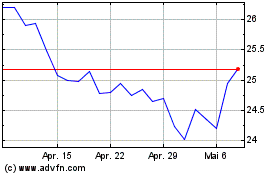

USA Compression Partners (NYSE:USAC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

USA Compression Partners (NYSE:USAC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024