false

0000746838

0000746838

2024-12-05

2024-12-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of

earliest event reported): December 5, 2024

UNISYS

CORPORATION

(Exact Name of Registrant as Specified in its

Charter)

| Delaware |

1-8729 |

38-0387840 |

(State or other jurisdiction

of

incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

801 Lakeview Drive, Suite 100

Blue Bell, Pennsylvania 19422

(Address of Principal Executive

Offices) (Zip Code)

(215) 986-4011

(Registrant’s telephone

number, including area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| Title of each

class |

|

Trading symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, par value $.01 |

|

UIS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 5, 2024, the Board of Directors

of Unisys Corporation (the “Company”) promoted Michael M. Thomson to Chief Executive Officer and President and elected Mr. Thomson

as a director of the Company, effective April 1, 2025. As disclosed below, Peter Altabef, the Company’s current Chair of the

Company’s Board of Directors and Chief Executive Officer, will cease serving as the Company’s Chief Executive Officer on March 31,

2025 (the “Transition Date”). Mr. Altabef will remain Chair of the Board following the Transition Date.

Mr. Thomson, age 56, has been President and

Chief Operating Officer of the Company since May 2022. Prior to this role, Mr. Thomson served as the Company’s Chief Financial

Officer since 2019 and as Executive Vice President since 2021 after having served as Senior Vice President since 2019. Mr. Thomson

served as the Company’s Vice President and Corporate Controller from 2015 to 2019. Mr. Thomson served as Controller of Towers

Watson & Co. from 2010 until 2015, and he previously held the same position at Towers Perrin from 2007 until the consummation

of that firm’s merger with Watson Wyatt in 2010. He also served as principal accounting officer of Towers Watson from 2012 until

2015. Prior to that, Mr. Thomson worked for Towers Perrin as Director of Financial Systems from 2001 to 2004 and then Assistant Controller

from 2004 to 2007. Prior to joining Towers Perrin, Mr. Thomson was with RCN Corporation, where he served as Director of Financial

Reporting & Financial Systems from 1997 to 2001.

In connection with the promotion, on December 5,

2024, the Company entered into a letter agreement (the “Offer Letter”). Pursuant to the Offer Letter, effective April 1,

2025, Mr. Thomson will receive an annual base salary of $800,000 and an annual target bonus of 120% of earned base salary under the

Company’s Executive Variable Compensation Plan. Mr. Thomson is also eligible for consideration to receive an equity award at

the next annual grant cycle in 2025 and in subsequent years with a target grant date fair value of $3,881,250 under the same terms and

conditions as all other grant recipients.

Mr. Thomson is eligible for severance benefits

upon a termination without cause equal to two times the sum of his annual base salary and annual target bonus and subsidized healthcare

coverage for up to 24 months following the date of termination. Mr. Thomson is also eligible for change in control payments and benefits

such that if, following a change of control, the Company terminates his employment without “cause” or Mr. Thomson terminates

employment for “good reason” (as defined in the Offer Letter), Mr. Thomson shall be entitled to receive termination benefits

as follows: a pro-rated bonus for the year in which the termination occurs (based on the higher of Mr. Thomson’s target bonus

prior to the change of control, the highest annual bonus paid in the three years prior to the change of control or the bonus paid after

the change of control (the “applicable bonus”), a lump sum payment equal to two and a half times the sum of (1) Mr. Thomson’s

annual base salary plus (2) the applicable bonus, outplacement services, continued health benefits for two years following the termination

of employment and reimbursement therefore, and other benefits under the Company’s plans, including any rights in respect of equity

awards.

There are no arrangements or understandings between

Mr. Thomson and any other person pursuant to which he was selected as an officer or elected a director. Neither Mr. Thomson

nor any of his immediate family has any direct or indirect material interest in any transaction required to be disclosed pursuant to Item

404(a) of Regulation S-K under the Securities Exchange Act of 1934.

On December 5, 2024, the Company entered

into a Transition Agreement and General Release (the “Transition Agreement”) with Mr. Altabef. Upon the Termination Date,

in addition to any benefits to which he is entitled under the Company’s plans in accordance with their terms, Mr. Altabef will

be entitled to receive the benefits applicable upon a termination other than for cause pursuant to his January 1, 2015 letter agreement

with the Company, the form of which was previously filed by the Company as Exhibit 10.1 to its Current Report on Form 8-K on

December 16, 2014. In addition, Mr. Altabef will be entitled to any outstanding awards previously granted to him under the Company’s

long-term incentive plans in accordance with their terms.

The foregoing benefits were provided in consideration

for Mr. Altabef’s execution and non-revocation of a general release of claims in favor of the Company and his continued compliance

with applicable confidentiality, proprietary information, invention, non-competition, non-solicitation or similar obligations.

In connection with service on the Board following

the Transition Date, Mr. Altabef will be entitled to receive the non-employee director compensation described in the Corporation’s

definitive proxy statement on Schedule 14A filed with the U.S. Securities and Exchange Commission on March 22, 2023, under the caption

“Compensation of Directors,” except that he will be entitled to receive an additional cash retainer of $50,000 for service

as Chair of the Board.

The foregoing is a summary description of certain

terms of the Offer Letter and the Transition Agreement. It is qualified in its entirety by the full text of the Offer Letter and the Transition

Agreement, respectfully, copies of which will be filed with the Company’s Annual Report on Form 10-K for the year ending December 31,

2024.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: December 5,

2024

| |

Unisys Corporation |

| |

|

| |

By: |

/s/ Debra McCann |

| |

|

Debra McCann |

| |

|

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

| News

Release |

|

Unisys Appoints Michael M. Thomson as Chief

Executive Officer

Thomson to succeed Peter A. Altabef, effective

April 1, 2025

Altabef, CEO since 2015, to remain as Chair

of the Board

BLUE BELL, Pa., December 5,

2024 — The Unisys (NYSE: UIS) Board of Directors announced today that it unanimously elected Mike Thomson, current

President and Chief Operating Officer at Unisys, to succeed Peter Altabef as the company’s CEO, effective April 1, 2025. Also,

effective April 1, Thomson will join the company’s Board and will retain his current title as President. Altabef, currently

Chair and CEO, will continue as Chair of the Board.

“On behalf of the entire Board, I am delighted to have

a leader of Mike’s caliber to be the next CEO and President of Unisys,” said Altabef. “He is a proven executive who

has exceptional leadership qualities and the experience to continue to advance our company. As our President and COO, Mike has helped

shape and execute the strategies that have driven our strong ongoing performance, and he has a proven track record of operational excellence

– both at Unisys and in other roles throughout his career – that position him well for the company’s next chapter.

Mike’s passion for Unisys and the work we do for our clients, his authentic leadership, and

deep knowledge of the business will make him an excellent CEO.”

Thomson joined Unisys in 2015 as the Corporate Controller and Principal

Accounting Officer, advanced to Chief Financial Officer in 2019, and was named President and COO in 2021, responsible for overseeing

the company's commercial organization and its business units, among other functions. For more than 25 years, Thomson has held progressively

senior roles across a diverse set of industries, in addition to his most recent roles at Unisys, proving his strong ability to advance

and run the operations of a company.

“The selection of the CEO and ensuring a smooth and successful

transition is one of the Board’s most important responsibilities,” said Nate Davis, Lead Independent Director of the Board.

“Mike’s skill at strengthening Unisys’ financial standing and operational capabilities positions him to lead the company

effectively. At the same time, we are fortunate to benefit from Peter’s ongoing and active role as Chair. Peter’s bold vision

to build on the company’s strong roots as an innovator was the catalyst for leading Unisys through a major brand and culture transformation,

with results that made the company more relevant and visible to its clients, prospects, and other stakeholders. Peter has exemplified

the Unisys culture and inspires people with his commitment to preparing for what’s around the corner.”

Altabef has served as CEO since January 2015, and as Board Chair

since April 2018. During his tenure, he has led the way for a new wave of innovation for the 151-year-old company.

“I am honored to step into the CEO role,” said Thomson.

“Peter’s leadership has positioned us well as a company, and I am proud to carry on that leadership legacy for our business

and our people for the next chapter of the Unisys story. Our commitment to excellence and innovation for our clients and the drive for

growth and improved profitability as part of our transformation journey remains strong. I look forward to continuing my relationship

with Peter and working with our exceptional leadership team to deliver on our strategy and be prepared to capitalize on new opportunities

that will propel us forward.”

Unisys’ total company full-year revenue growth and non-GAAP

operating profit margin guidance provided in its third-quarter 2024 earnings announcement on October 29, 2024, has not changed.

###

Forward-Looking Statements

This release contains forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and

the Private Securities Litigation Reform Act of 1995. Words such as “anticipates,” “estimates,” “expects,”

“projects,” “may,” “will,” “intends,” “plans,” “believes,” “should”

and similar expressions may identify forward-looking statements and such forward-looking statements are made based upon management’s

current expectations, assumptions and beliefs as of this date concerning future developments and their potential effect upon Unisys.

There can be no assurance that future developments will be in accordance with management’s expectations, assumptions and beliefs

or that the effect of future developments on Unisys will be those anticipated by management. Forward-looking statements in this release

include, but are not limited to, statements made in Messrs. Altabef, Davis and Thomson’s quotations, any projections or expectations

of growth and profitability, the assumptions and other expectations made in connection with our full-year 2024 financial guidance and

statements regarding future economic conditions or performance.

Additional information and factors that could cause actual results

to differ materially from Unisys’ expectations are contained in Unisys’ filings with the U.S. Securities and Exchange Commission

(SEC), including Unisys’ Annual Reports on Form 10-K and subsequent Quarterly Reports on Form 10-Q, recent Current Reports

on Form 8-K, and other SEC filings, which are available at the SEC’s web site, http://www.sec.gov. Information included in

this release is representative as of the date of this release only and while Unisys periodically reassesses material trends and uncertainties

affecting Unisys’ results of operations and financial condition in connection with its preparation of management's discussion and

analysis of results of operations and financial condition contained in its Quarterly and Annual Reports filed with the SEC, Unisys does

not, by including this statement, assume any obligation to review or revise any particular forward-looking statement referenced herein

in light of future events. All forward-looking statements in this press release are based on information currently available to us, and

we assume no obligation to update these forward-looking statements in light of new information or future events.

About Unisys

Unisys is a global technology solutions company that powers breakthroughs

for the world’s leading organizations. Our solutions – cloud, AI, digital workplace, logistics, and enterprise computing

– help our clients challenge the status quo and unlock their full potential. To learn more about how we’ve been helping clients

push what’s possible for over 150 years, visit unisys.com and follow us on LinkedIn.

Media Contact:

Nathaly Martinez, Unisys

+954-512-3121

Nathaly.Martinez@unisys.com

RELEASE NO.: 1205/9975

Unisys and other Unisys products and services mentioned herein, as well as their respective logos, are trademarks

or registered trademarks of Unisys Corporation. Any other brand or product referenced herein is acknowledged to be a trademark or registered

trademark of its respective holder.

UIS-C

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

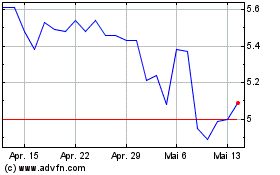

Unisys (NYSE:UIS)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Unisys (NYSE:UIS)

Historical Stock Chart

Von Dez 2023 bis Dez 2024