Statement of Changes in Beneficial Ownership (4)

23 Mai 2022 - 10:33PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Fisher Joseph D |

2. Issuer Name and Ticker or Trading Symbol

UDR, Inc.

[

UDR

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

President and CFO |

|

(Last)

(First)

(Middle)

1745 SHEA CENTER DRIVE, SUITE 200 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

5/19/2022 |

|

(Street)

HIGHLANDS RANCH, CO 80129

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Class 2 Performance LTIP Units (1) | (2)(3)(4)(5)(6) | 5/19/2022 | | A | | 607532.0000 (7)(8)(9)(10) | | (2)(3)(4)(5)(6)(7)(8)(9)(10) | 5/19/2038 | Common Stock (2)(3)(4)(5)(6) | 607532.0000 (3)(4) | $0.0000 | 1456541.0000 | D |

|

| Explanation of Responses: |

| (1) | Represents Class 2 Performance LTIP Units in United Dominion Realty, L.P., a Delaware limited partnership (the "UDR Partnership"). UDR, Inc. (the "Company") is the parent company and sole general partner of the UDR Partnership. |

| (2) | Subject to the conditions set forth in the Eleventh Amendment to the Amended and Restated Agreement of Limited Partnership of the UDR Partnership, each Class 2 Performance LTIP Unit may be converted, at the election of the holder, into a Class 2 LTIP Unit at any time (i) on or after when the Class 2 Performance LTIP Unit has vested (as described in footnotes 8, 9 & 10 below) and (ii) before the expiration date of the Class 2 Performance LTIP Unit. |

| (3) | Class 2 Performance LTIP Units convert to a number of Class 2 LTIP Units equal to (i) the applicable Performance LTIP Unit Value, which is calculated as the product of (x) the excess (if any) of the REIT Share Value over the Issue Price for the Class 2 Performance Unit and (y) the Conversion Factor, multiplied by (ii) the number of Class 2 Performance LTIP Units being converted, and divided by (iii) the REIT Share Value on the Conversion Date, as such terms are defined in the Amended and Restated Agreement of Limited Partnership of the UDR Partnership. |

| (4) | Subject to the conditions set forth in the Eleventh Amendment to the Amended and Restated Agreement of Limited Partnership of the UDR Partnership and subject to any vesting conditions specified with respect to each Class 2 LTIP Unit, each Class 2 LTIP Unit may be converted, at the election of the holder, into a unit of limited partnership of the UDR Partnership (a "Partnership Common Unit"), provided that such Class 2 LTIP Unit has been outstanding for at least two years from the date of grant. |

| (5) | A holder of Partnership Common Units has the right to require the UDR Partnership to redeem all or a portion of the Partnership Common Units held by the holder in exchange for a cash payment based on the market value of the Company's Common Stock at the time of redemption, as defined in the Amended and Restated Agreement of Limited Partnership of the UDR Partnership (the "Cash Amount"). However, the UDR Partnership's obligation to pay the Cash Amount is subject to the prior right of the Company to acquire such Partnership Common Units in exchange for either the Cash Amount or shares of the Company's Common Stock, as described in footnote 6 below. |

| (6) | The Company, as the general partner of the UDR Partnership, may, in its sole discretion, purchase the Partnership Common Units by paying the limited partner either the Cash Amount or the REIT Share Amount (generally one share of the Company's Common Stock for each Partnership Common Unit), as such terms are defined in the Amended and Restated Agreement of Limited Partnership of the UDR Partnership. The right to convert the Class 2 LTIP Units into Partnership Common Units and the right to receive the Cash Amount or the REIT Share Amount (in the Company's sole discretion) in exchange for Partnership Common Units do not have expiration dates. |

| (7) | Amount represents the maximum award (including dividends) that could be earned, which is subject to forfeiture when the performance results are determined. |

| (8) | The Class 2 Performance LTIP Units will vest on the sixth anniversary of the date of grant only to the extent that pre-established stock price hurdles are achieved over the five year measurement period commencing on May 19, 2023 and ending on May 18, 2028, subject to continuing employment. Except as otherwise set forth in the UDR, Inc. 1999 Long-Term Incentive Plan, as amended from time to time, except Section 14.9 thereof, the Amended and Restated Agreement of Limited Partnership of the UDR Partnership, or as determined by the Compensation Committee of the Company's Board of Directors (the "Committee"), in its sole discretion, vesting of the Class 2 Performance LTIP Units shall cease upon the date of termination for any reason other than in the event of a change of control of the Company, and no unvested Class 2 Performance LTIP Units shall thereafter become vested. |

| (9) | In the event of a change of control of the Company, the Class 2 Performance LTIP Units will vest only if the holder's employment or other service relationship with the Company is terminated by the Company without cause, or by the holder for good reason, in each case on or within 12 months following the date of a change of control. Further, all restrictions on outstanding awards that have been earned shall lapse upon the Company's termination of the holder's employment without cause or the holder's termination of employment for good reason. |

| (10) | The following specified amounts of the Class 2 Performance LTIP Units will be earned, and then vest on the sixth anniversary of the date of grant, only if the corresponding common stock price hurdles are achieved, and the Company's Common Stock closing price is maintained at or above that Common Stock price hurdle for 20 consecutive trading days during the performance period beginning on May 19, 2023 and ending on May 18, 2028: (i) $60.00, 151,883 Units; (ii) $62.50, 151,883 Units; (iii) $67.50, 151,883 Units; and (iv) $75.00, 151,883 Units. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Fisher Joseph D

1745 SHEA CENTER DRIVE

SUITE 200

HIGHLANDS RANCH, CO 80129 |

|

| President and CFO |

|

Signatures

|

| Joseph D. Fisher | | 5/23/2022 |

| **Signature of Reporting Person | Date |

| Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly. |

| * | If the form is filed by more than one reporting person, see Instruction 4(b)(v). |

| ** | Intentional misstatements or omissions of facts constitute Federal Criminal Violations. See 18 U.S.C. 1001 and 15 U.S.C. 78ff(a). |

| Note: | File three copies of this Form, one of which must be manually signed. If space is insufficient, see Instruction 6 for procedure. |

| Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

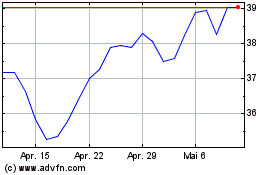

UDR (NYSE:UDR)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

UDR (NYSE:UDR)

Historical Stock Chart

Von Apr 2023 bis Apr 2024