Two Harbors Investment Corp. Announces Preliminary Financial Results for Fourth Quarter 2022

20 Januar 2023 - 12:11AM

Business Wire

Two Harbors Investment Corp. (NYSE: TWO), an

Agency + MSR mortgage real estate investment trust, today announced

preliminary estimated financial results for the quarter ended

December 31, 2022.

Quarterly Estimates(1)

- Book value per common share was estimated to be between $17.70

and $17.74 per common share as of December 31, 2022, after

deducting for fourth quarter 2022 common and preferred dividends

declared.

- Comprehensive Income was estimated to be between $1.83 and

$1.87 per weighted average basic common share.

- Earnings Available for Distribution was estimated to be between

$0.25 and $0.27 per weighted average basic common share.(2)

- GAAP debt-to-equity was estimated to be 4.4x and economic

debt-to-equity was estimated to be 6.3x as of December 31,

2022.(3)

- Estimate quarter-to-date book value increase of approximately

3% through January 18, 2023.

These preliminary estimated financial results for the fourth

quarter of 2022 are unaudited and subject to change as the

company’s quarter end closing process is completed. While the

company believes the estimates are based on reasonable assumptions,

actual results may vary and such variations may be material.

Factors that could cause actual results to differ from estimates

include, but are not limited to: (i) adjustments in the calculation

of, or application of accounting principles for, the financial

results for the quarter ended December 31, 2022; (ii) the discovery

of new information that impacts the valuation methodologies

underlying these results; (iii) errors in the assessment of

portfolio value; and (iv) accounting changes required by GAAP. The

company undertakes no obligation to update or revise these

estimates, and investors should not place undue reliance on these

estimates because they may prove to be materially inaccurate.

Fourth quarter actual results remain subject to the review by the

company’s independent auditors.

As previously disclosed, the company will report full fourth

quarter financial results on February 8, 2023 and will host a

conference call on February 9, 2023 at 9:00 a.m. ET. The conference

call will be webcast live and accessible in the Investors section

of the company’s website at www.twoharborsinvestment.com/investors.

To participate in the teleconference, please call toll-free (877)

502-7185 approximately 10 minutes prior to the above start time.

For those unable to attend, a telephone playback will be available

beginning February 9, 2023 at 12:00 p.m. ET through February 23,

2023 at 12:00 p.m. ET. The playback can be accessed by calling

(877) 660-6853 and providing the Conference Code 13734900. The call

will also be archived on the company’s website in the News &

Events section.

_________________

(1)

On November 1, 2022, the company completed

its previously announced one-for-four reverse stock split of its

outstanding shares of common stock. In accordance with generally

accepted accounting principles, all common share and per common

share amounts presented herein have been adjusted on a retroactive

basis to reflect the reverse stock split.

(2)

Earnings Available for Distribution, or

EAD, is a non-GAAP measure defined as comprehensive loss

attributable to common stockholders, excluding realized and

unrealized gains and losses on the aggregate portfolio, provision

for (reversal of) credit losses, reserve expense for representation

and warranty obligations on MSR, non-cash compensation expense

related to restricted common stock and other nonrecurring expenses.

As defined, EAD includes net interest income, accrual and

settlement of interest on derivatives, dollar roll income on TBAs,

U.S. Treasury futures income, servicing income, net of estimated

amortization on MSR and recurring cash related operating expenses.

EAD provides supplemental information to assist investors in

analyzing the company’s results of operations and helps facilitate

comparisons to industry peers. EAD is one of several measures the

company’s board of directors considers to determine the amount of

dividends to declare on the company’s common stock and should not

be considered an indication of taxable income or as a proxy for the

amount of dividends the company may declare.

(3)

Defined as total borrowings to fund RMBS,

MSR and Agency Derivatives, plus the implied debt on net TBA cost

basis and net payable (receivable) for unsettled RMBS, divided by

total equity. Effective as of December 31, 2022, net payable

(receivable) on unsettled RMBS is now included in the calculation

for economic debt-to-equity.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the safe harbor provisions of the United States

Private Securities Litigation Reform Act of 1995. Actual results

may differ from expectations, estimates and projections and,

consequently, readers should not rely on these forward-looking

statements as predictions of future events. Words such as “expect,”

“target,” “assume,” “estimate,” “project,” “budget,” “forecast,”

“anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,”

“believe,” “predicts,” “potential,” “continue,” and similar

expressions are intended to identify such forward-looking

statements. These forward-looking statements involve significant

risks and uncertainties that could cause actual results to differ

materially from expected results.

Readers are cautioned not to place undue reliance upon any

forward-looking statements, which speak only as of the date made.

Two Harbors does not undertake or accept any obligation to release

publicly any updates or revisions to any forward-looking statement

to reflect any change in its expectations or any change in events,

conditions or circumstances on which any such statement is based.

Additional information concerning these and other risk factors is

contained in the company’s most recent filings with the Securities

and Exchange Commission. All subsequent written and oral

forward-looking statements concerning the company or matters

attributable to the company or any person.

Two Harbors Investment Corp.

Two Harbors Investment Corp., a Maryland corporation, is a real

estate investment trust that invests in residential mortgage-backed

securities, mortgage servicing rights and other financial assets.

Two Harbors is headquartered in St. Louis Park, MN.

Additional Information

Stockholders of Two Harbors and other interested persons may

find additional information regarding the company at

www.twoharborsinvestment.com, at the Securities and Exchange

Commission’s Internet site at www.sec.gov or by directing requests

to: Two Harbors Investment Corp., 1601 Utica Avenue South, Suite

900, St. Louis Park, MN 55416, telephone (612) 453-4100.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230119005929/en/

Margaret Karr, Head of Investor Relations, Two Harbors

Investment Corp., (612) 453-4080,

Margaret.Karr@twoharborsinvestment.com

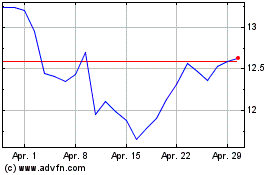

Two Harbors Investment (NYSE:TWO)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Two Harbors Investment (NYSE:TWO)

Historical Stock Chart

Von Apr 2023 bis Apr 2024