UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Pursuant to §240.14a-12 |

The Taiwan Fund, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

(4) |

Proposed maximum aggregate value of transaction: |

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule

0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

|

| |

(1) |

Amount previously paid: |

| |

(2) |

Form, Schedule or Registration Statement No.: |

THE TAIWAN FUND, INC.

c/o State Street Bank and Trust Company

P.O. Box 5049, One Lincoln Street,

Boston, Massachusetts 02111-5049

For questions about the Proxy Statement, please call (866) 829-0542

August [ ], 2022

Dear Stockholder:

A Special Meeting of

Stockholders of The Taiwan Fund, Inc. (the “Fund”) will be held on Tuesday, September 6, 2022 at 9:00 a.m., Eastern time. The Meeting will be held virtually. A Notice and Proxy Statement regarding the Meeting, instructions for how to

join the Meeting, the proxy card for your vote, and a postage prepaid envelope in which to return your proxy card are enclosed.

At the

Meeting you, as a stockholder of the Fund, will be asked by the Board of Directors to vote on one Proposal: the approval of a proposed Investment Advisory Agreement between the Fund and Nomura Asset Management U.S.A. Inc.

The Board of Directors recommends that you vote “FOR” the Proposal.

|

| Respectfully, |

|

| Brian F. Link |

| Secretary |

|

| STOCKHOLDERS ARE STRONGLY URGED TO VOTE BY TELEPHONE, BY INTERNET OR BY SIGNING AND MAILING THE ENCLOSED PROXY CARD IN THE ENVELOPE PROVIDED FOR THAT PURPOSE

TO ENSURE A QUORUM AT THE MEETING. |

THE TAIWAN FUND, INC.

Notice of the Special Meeting of Stockholders

August [ ], 2022

To the

Stockholders of The Taiwan Fund, Inc.:

NOTICE IS HEREBY GIVEN that a Special Meeting of Stockholders (the “Meeting”) of The Taiwan Fund, Inc.

(the “Fund”) will be held virtually on September 6, 2022 at 9:00 a.m., local time, for the following purposes:

| |

(1) |

To approve a proposed Investment Advisory Agreement between the Fund and Nomura Asset Management U.S.A. Inc.;

and |

| |

(2) |

To transact such other business as may properly come before the Meeting or any adjournments thereof.

|

The Board of Directors has fixed the close of business on August 5, 2022 as the record date for the determination

of stockholders entitled to notice of and to vote at the Meeting or any adjournments thereof. The enclosed proxy is being solicited by the Board of Directors of the Fund.

The Fund and its management are sensitive to the health and travel concerns of the Fund’s stockholders and the evolving recommendations

from public health officials. Due to the difficulties arising from the novel coronavirus pandemic (“COVID-19”), the Meeting will be conducted virtually. Any stockholder wishing to participate in the

Meeting by means of remote communication can do so. If you were a record holder of Fund shares as of the record date, August 5, 2022, please e-mail AST Fund Solutions, LLC (“AST”) at

attendameeting@astfinancial.com no later than 5 p.m. Eastern Time on [ ], 2022 to register. Please include the Fund’s name in the subject line and provide your name and address in the

body of the e-mail. AST will then e-mail you the meeting login information and instructions for attending and voting at the Meeting.

If you held Fund shares through an intermediary, such as a broker-dealer, as of the record date and you want to participate in the Meeting,

please e-mail AST at attendameeting@astfinancial.com no later than 5 p.m. Eastern Time on [ ], 2022 to register. Please include the Fund’s name in the

subject line and provide your name, address and proof of ownership as of August 5, 2022 from your intermediary. Proof of ownership can be in the form of a copy/photo of your brokerage statement or your vote instruction form, or a letter from

your intermediary. Please be aware that if you wish to vote at the Meeting you must first obtain a legal proxy from your intermediary reflecting the Fund’s name, the number of Fund shares you held and your name and e-mail address. You may forward an e-mail from your intermediary containing the legal proxy or attach an image of the legal proxy via

e-mail to AST at attendameeting@astfinancial.com and put “Legal Proxy” in the subject line. AST will then e-mail you the meeting login

information and instructions for voting during the Meeting.

Stockholders who do not expect to participate in the Meeting are requested to

vote by telephone, by Internet or by completing, dating and signing the enclosed form of proxy and returning it promptly in the envelope provided for that purpose.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE MEETING ON SEPTEMBER 6, 2022:

This Notice and the Proxy Statement are available on the Internet at https://www.proxy-direct.com/twn-[ ].

|

| By order of the Board of Directors |

|

| BRIAN F. LINK |

| Secretary |

August [ ], 2022

PROXY STATEMENT

THE TAIWAN FUND, INC.

INTRODUCTION

This Proxy

Statement is furnished in connection with the solicitation of proxies by the Board of Directors of The Taiwan Fund, Inc. (the “Fund” or “Corporation”) for use at a Special Meeting of Stockholders (the “Meeting”), to be

held virtually on September 6, 2022 at 9:00 a.m., Eastern time, and at any adjournments thereof.

This Proxy Statement and

the form of proxy card are being mailed to stockholders on or about [ ], 2022. Any stockholder giving a proxy has the power to revoke it by

executing a superseding proxy by phone, Internet or mail following the process described on the proxy card or by submitting a notice of revocation to the Fund prior to the date of the Meeting or at the Meeting. All properly executed proxies received

in time for the Meeting will be voted as specified in the proxy or, if no specification is made, FOR the Proposal. If your shares are held by a broker and you do not instruct your broker how you want your shares to be voted, your shares will be

voted as specified by the broker on the Proposal.

The presence at the Meeting or by proxy of stockholders entitled to cast one third of

the votes entitled to be cast thereat constitutes a quorum at all meetings of the stockholders. For purposes of determining the presence of a quorum for transacting business at the Meeting, executed proxies returned without marking a vote on the

Proposal will be treated as shares that are present for quorum purposes. Abstentions are included in the determination of the number of shares present at the Meeting for purposes of determining the presence of a quorum. If a stockholder is

present at the Meeting but does not cast a vote, the stockholder’s shares will count towards a quorum but will have no effect on the Proposal. In the event a quorum is not present at the Meeting, or in the event

that a quorum is present at the Meeting but sufficient votes to approve the Proposal are not received, holders of a majority of the stock present at the Meeting or by proxy have power to adjourn the meeting from time to time to a date not more than

120 days after the original record date without notice other than announcement at the Meeting. The chairman of the Meeting also may adjourn the Meeting from time to time. Any adjournment may be made to a date not more than 120 days after the

original record date without notice other than announcement at the Meeting. At such adjourned meeting at which a quorum is present, any business may be transacted which might have been transacted at the Meeting as originally notified. The Fund may

set a subsequent record date and give notice of it to stockholders, in which case the meeting may be held not more than 120 days beyond the subsequent record date.

The Board of Directors has fixed the close of business on August 5, 2022 as the record date for the determination of stockholders

entitled to notice of and to vote at the Meeting and at any adjournments thereof. Stockholders on the record date will be entitled to one vote for each share held, with no shares having cumulative voting rights. As of the record date, the Fund had

outstanding 7,470,494 shares of common stock.

Management of the Fund knows of no item of business other than the item mentioned in the

Proposal of the Notice of Meeting that will be eligible to be presented for consideration at the Meeting. If any other matter is properly presented, it is the intention of the persons named in the enclosed proxy to vote in accordance with their best

judgment.

The Fund will furnish, without charge, a copy of its semi-annual report for the period ended February 28, 2022 or its

annual report for the fiscal year ended August 31, 2021 to any stockholder requesting such report. Requests for the semi-annual or annual reports should be made in writing to The Taiwan Fund, Inc., c/o State Street Bank and

Trust Company, P.O. Box 5049, One Lincoln Street, Boston, Massachusetts 02111, Attention: Brian F. Link, or by accessing the Fund’s website at www.thetaiwanfund.com or by calling (866)

829-0542.

IMPORTANT INFORMATION

The Proxy Statement discusses important matters affecting the Fund. Please take the time to read the Proxy Statement, and then cast your vote.

You may obtain additional copies of the Notice of Meeting, Proxy Statement and form of proxy card by calling (866) 829-0542 or by accessing

[https://www.proxy-direct.com/twn-30495].

There are multiple ways to vote. Choose the method

that is most convenient for you. To vote by telephone or Internet, follow the instructions provided on the proxy card. To vote by mail, simply fill out the proxy card and return it in the enclosed postage-paid reply envelope. Please do not return

your proxy card if you vote by telephone or Internet. To vote at the Meeting, participate in the Meeting and cast your vote. The Meeting will be held virtually.

PROPOSAL: APPROVAL OF PROPOSED INVESTMENT ADVISORY AGREEMENT

On May 17, 2022, the Fund’s current Investment Adviser, Allianz Global Investors U.S. LLC (“Allianz”) pled guilty in the

U.S. District Court for the Southern District of New York, in a case captioned United States of America v. Allianz Global Investors U.S. LLC, to one count of securities fraud in violation of Title 15, United States Code, Sections

78j(b) and 78ff, Title 17, Code of Federal Regulations, Section 240.10b-5, and Title 18, United States Code, Section 2. The securities fraud charge related to a fraudulent scheme to conceal the

downside risks of a series of private investment funds, the Structured Alpha Funds (“private funds”), sponsored and advised by Allianz. The private funds have since been liquidated. As part of the coordinated settlement with the Securities

and Exchange Commission (the “SEC”) and the Department of Justice, Allianz pleaded guilty to securities fraud, resolved civil fraud charges and agreed to pay approximately $1 billion in penalties and approximately $5 billion in

restitution along with Allianz’ parent, Allianz SE. Under Section 9(a) of the Investment Company Act of 1940, as amended (the “1940 Act”), Allianz was also immediately disqualified from providing advisory services to U.S.

registered investment funds (including the Fund) for the next 10 years (“Section 9 Bar”). The portfolio managers that manage the Fund are employed by Allianz Global Investors Taiwan Limited (“AGI Taiwan”), a Taiwan-based

entity that is indirectly owned by Allianz SE. The Section 9 Bar applies to Allianz or any affiliate of Allianz, including AGI Taiwan.

Also on May 17, 2022, the SEC issued an order under Section 9(c) of the 1940 Act granting temporary exemptive relief from the

Section 9 Bar that permits Allianz and its affiliates to continue to act as an adviser to closed-end investment funds for a period of four months (to September 17, 2022) to allow for an orderly

transition of such services to another investment adviser. As part of the Section 9 Bar, Allianz (or one of its affiliates) will bear all expenses associated with the transition, and the Fund will not directly or indirectly bear any expenses

associated with such transition, including any expenses associated with obtaining necessary stockholder approvals to engage another investment adviser.

With the temporary exemptive relief scheduled to expire on September 17, 2022, the Board undertook a search to identify a replacement

investment manager of the Fund. On July 22, 2022, the Board of Directors, all of whom are Independent Directors, voted to approve and recommend to stockholders the approval of the proposed Investment Advisory Agreement between the Fund and

Nomura Asset Management U.S.A. Inc. (“Nomura”) (the “Proposed Agreement”). If approved by stockholders, the Proposed Agreement will replace the Investment Advisory and Management Agreement dated, June 1, 2019, between the

Fund and Allianz (the “Current Agreement”) that was approved by stockholders on April 24, 2019.

The Proposed Agreement

provides for Nomura to provide substantially the same investment advisory and management services as provided under the Current Agreement. Nomura’s duties under the Proposed Agreement include making investment decisions, supervising the

acquisition and disposition of investments and supervising the selection of brokers or dealers to execute these transactions in accordance with the Fund’s investment objective and policies and within the guidelines and directions established by

the Board.

Under the Proposed Agreement, and similar to the terms of the Current Agreement, Nomura may engage employees of an affiliated non-SEC registered entity through a participating affiliate arrangement to assist Nomura in providing services to the Fund, provided that Nomura supervises the services provided by those employees and such

engagement will not relieve Nomura of its obligations under the Proposed Agreement.

Under the Proposed Agreement, Nomura will bear all expenses arising out of its duties under the

Proposed Agreement but will not be responsible for any expenses of the Fund other than those specifically allocated to Nomura in the Proposed Agreement. In particular, the Fund bears expenses for legal fees and expenses of counsel to the Fund; fees

for directors and officers other than those employed by Nomura; auditing and accounting expenses; taxes and governmental fees; New York Stock Exchange listing fees; dues and expenses incurred in connection with membership in investment company

organizations; fees and expenses of the Fund’s custodian, sub-custodian, transfer agents and registrars; fees and expenses with respect to administration (except as may be expressly provided otherwise);

expenses for portfolio pricing services by a pricing agent, if any; expenses of preparing share certificates and other expenses in connection with the issuance, offering and underwriting of shares issued by the Fund; expenses relating to investor

and public relations; expenses of registering or qualifying securities of the Fund for public sale; freight, insurance and other charges in connection with the shipment of the Fund’s portfolio securities; brokerage commissions or other costs of

acquiring or disposing of any portfolio holding of the Fund; expenses of preparation and distribution of reports, notices and dividends to stockholders; expenses of the Fund’s dividend reinvestment and cash purchase plan; costs of stationery;

any litigation expenses; and costs of stockholder’s and other meetings. Under the Proposed Agreement, as is the case under the Current Agreement, Nomura will pay the salaries and expenses of such of the Fund’s officers and directors who

are directors, officers or employees of Nomura, provided, however, that the Fund, and not Nomura, will bear travel expenses or an appropriate fraction thereof of directors and officers of the Fund who are directors, officers or

employees of Nomura to the extent that such expenses relate to attendance at meetings of the Board or any committee thereof, and provided, further, that such expenses are incurred in accordance with the Fund’s travel policy.

Under the Proposed Agreement, neither Nomura nor its affiliates, directors, employees, or agents will be subject to any liability for any act

or omission, error of judgment or mistake of law, or for any loss suffered by the Fund in the course of, connected with or arising out of any services to be rendered thereunder, except by reason of the Adviser’s willful misfeasance, bad faith

or gross negligence in the performance of its duties or by reason of the Adviser’s reckless disregard of its obligations and duties under the Proposed Agreement.

The Proposed Agreement may be terminated at any time, without payment of penalty, by Nomura, or by the Fund acting pursuant to a vote of the

Board of Directors or by a vote of a majority of the Fund’s outstanding securities (as defined in the 1940 Act) upon sixty days’ written notice, and will terminate automatically in the event of its assignment (as defined in the 1940 Act)

by Nomura.

If approved by stockholders, the Proposed Agreement would remain in effect for an initial period of two years from the date it

becomes effective. Thereafter, the Proposed Agreement would continue in effect from year to year if its continuance is specifically approved at least annually by (i) a vote of a majority of the Independent Directors, cast in person at a meeting

called for the purpose of voting on such approval, and (ii) either a vote of a majority of the Board of Directors as a whole or a majority of the Fund’s outstanding shares of common stock as defined in the 1940 Act.

Fee Provisions

Under the terms of the

Current Agreement, Allianz is entitled to receive a Base Fee for its services, computed daily and payable monthly in US dollars, at the rate of 0.70% per annum of the value of the Fund’s average daily net assets (“Base Fee”).

Effective September 1, 2019, Allianz’ compensation was increased or decreased from the Base Fee by a performance adjustment (“Performance Adjustment”) that depends on whether, and to what extent, the investment performance of the

Fund’s shares exceeds, or is exceeded by, the performance of the TAIEX Total Return Index, expressed in U.S. dollars (the “Index”). The Performance Adjustment is calculated and accrued, according to a schedule that adds or subtracts

an amount at a rate of 0.0005% (0.05 basis points) of the Fund’s average daily assets for the current fiscal year through the prior business day for each 0.01% (1 basis point) of absolute performance by which the total return performance of the

Fund’s shares exceeds or lags the performance of the Index for the period from the beginning of the current performance period (“Performance Period” ) through the prior business day. The original Performance Period was from

September 1, 2019 to August 31, 2020 and thereafter each 12-month period beginning on September 1 immediately following the prior Performance Period through August 31 of the following

year. The maximum Performance Adjustment (positive or negative) will not exceed an annualized rate of +/-0.25% (25 basis points) of the Fund’s average daily net assets, which would occur when the

performance of the Fund’s shares exceeds, or is exceeded by, the performance of the Index by 5 percentage points (500 basis points) for the Performance Period. This Performance Fee will be calculated daily and paid at the end of the Performance

Period.

Under the terms of the Proposed Agreement, Nomura is entitled to receive a Base Fee for its services, computed daily and payable

monthly in US dollars, at the rate of 0.60% per annum of the value of the Fund’s average daily net assets (“Base Fee”). Nomura’s compensation is increased or decreased from the Base Fee by a performance adjustment

(“Performance Adjustment”) that depends on whether, and to what extent, the investment performance of

the Fund’s shares exceeds, or is exceeded by, the performance of the TAIEX Total Return Index, expressed in U.S. dollars (the “Index”). The Performance Adjustment is calculated and

accrued, according to a schedule that adds or subtracts an amount at a rate of 0.0005% (0.05 basis points) of the Fund’s average daily assets for the current fiscal year through the prior business day for each 0.01% (1 basis point) of absolute

performance by which the total return performance of the Fund’s shares exceeds or lags the performance of the Index for the period from the beginning of the current performance period (“Performance Period” ) through the prior business

day. The first Performance Period under the Proposed Agreement is expected to begin on October 1, 2022 and end on August 31, 2023 and thereafter each 12-month period beginning on September 1

immediately following the prior Performance Period through August 31 of the following year. The maximum Performance Adjustment (positive or negative) will not exceed an annualized rate of +/-0.25% (25

basis points) of the Fund’s average daily net assets, which would occur when the performance of the Fund’s shares exceeds, or is exceeded by, the performance of the Index by 5 percentage points (500 basis points) for the Performance

Period. This Performance Fee will be calculated daily and paid at the end of the Performance Period.

The Fund’s total net assets as

of June 30, 2022 were $223.4 million.

For the fiscal year ended August 31, 2021, the aggregate amount of advisory fees

paid by the Fund was $1,789,818. Had the Proposed Agreement been in place for the fiscal year ended August 31, 2021, the advisory fees paid by the Fund (not including any performance adjustment) would have been $1,534,129.

Approval Process and the Factors Considered by the Board of Directors in Approving the Proposed Agreement

Following the announcement of the Section 9 Bar, which disqualified Allianz from providing advisory services to the Fund, the Board

undertook a search to identify a replacement investment manager of the Fund. The Board held a series of special meetings and retained a consultant to assist it in conducting its investment manager search. The consultant initially identified seven

firms that potentially had the ability and willingness to manage the Fund. Based on the responses to screening questions sent to those firms, the consultant sent requests for proposals (“RFPs”) to each of the firms, four of which

responded. The consultant then provided the Board with a summary and evaluation of those responses and with its recommendation for a “short list” of candidates to make presentations to the Board. After reviewing the consultant’s

report, the Board identified three investment manager candidates for the short list. Each candidate was invited to make a presentation to the Board, and on July 22, 2022, each candidate made its presentation to the Board.

Following the presentations a discussion ensued. The Board discussed the relative merits of each candidate and determined that no further

information would be necessary from the candidates. After further discussion, the Board voted to approve and recommend to stockholders the approval of the Proposed Agreement with Nomura, substantially in the same form as the Fund’s Current

Agreement.

In making this selection, the Board noted that Nomura has engaged Nomura Asset Management Taiwan Ltd. (“NAM

Taiwan”), an affiliated non-SEC registered entity, through a participating affiliate arrangement to assist Nomura in providing services to the Fund. NAM Taiwan had total assets under management at

June 30, 2022 of US$18.9 billion including US$5.6 billion invested in Taiwan equity mandates. NAM Taiwan is a Joint Venture between Nomura Asset Management Co., Ltd. (“NAM Tokyo”) and Allshores Group (“Allshores”).

NAM Tokyo holds 51% of the firm’s shares and the remaining ownership is held by Allshores and other entities. NAM Taiwan is one of the largest asset management firms in Taiwan with 280 employees with 48 serving in an investment function and 12

of those employees focused on Taiwan equities. NAM Taiwan manages 48 Taiwan-domiciled funds, as well as separate accounts mainly from institutions including government pension plans. Nomura currently manages two separate accounts for private pension

plans, a Canadian mutual fund and one U.S. closed-end investment company, the Japan Smaller Capitalization Fund Inc. The Board noted that Nomura will supervise the services provided by the employees of NAM

Taiwan and such engagement will not relieve Nomura of its obligations under the Proposed Agreement.

The Board noted that Nomura has a

long and significant history of investing in the Asia-Pacific region. It noted in particular that Nomura, through NAM Taiwan, has one of the largest investment teams in Taiwan. The Board considered the investment experience and expertise of

Ms. Sky Chen, a senior portfolio manager employed by NAM Taiwan, who will be the portfolio manager of the Fund. The Board noted that Ms. Chen has led the NAM Taiwan team since 2007. The Board noted that the NAM Taiwan equity team totals 12

investment professionals and all are located at NAM Taiwan’s Taipei office.

The Board further noted that NAM Taiwan’s investment process and philosophy centers on bottom-up stock picking with a team-based strategy that is broad across capitalizations and is growth-oriented as it invests in companies with high growth momentum and high betas. The Board noted that Nomura’s

goal is to outperform its benchmark by between 200 to 400 basis points per year over three year rolling periods at a tracking error range of between 5% and 20%. The Board further noted that the portfolio would be concentrated as it would hold

between 40 and 50 stocks, similar to the portfolio managed by Allianz. The Board noted NAM Taiwan’s growth investment management style is consistent with Allianz’ investment style and the Taiwanese economy.

The Board also considered the terms and conditions of the Proposed Agreement. The Board noted that the Current Agreement has a base annual fee

of 0.70% per annum of the value of the Fund’s average daily net assets with a performance adjustment of up to +/-0.25% (25 basis points) of the Fund’s average daily net assets. After discussion,

Nomura and the Board agreed to a proposal for advisory services that included a base annual fee of 0.60% of average daily net assets with a performance adjustment of up to +/-0.25% (25 basis points) of the

Fund’s average daily net assets.

At the current and anticipated asset levels of the Fund, and without consideration of the

Fund’s performance adjustment against the TAIEX, the advisory fee rate under the Proposed Agreement is lower than the advisory fee rate under the Current Agreement.

The Board also based its decision on the following considerations, among others, although the Board did not identify any consideration that

was all important or controlling, and each Director may have attributed different weights to the various factors.

Nature, Extent and

Quality of the Services provided by the Investment Adviser. The Board reviewed and considered the nature and extent of the investment management services to be provided by Nomura under the Proposed Agreement. The Board noted the

following:

NAM Taiwan is one of the largest asset management firms in Taiwan with 280 employees with 48 serving in an investment

function and 12 of those employees focused on Taiwan equities. NAM Taiwan manages 48 Taiwan-domiciled funds, as well as separate accounts mainly from institutions including government pension plans. Nomura currently manages two separate accounts for

private pension plans, a Canadian mutual fund and one U.S. closed-end investment company, the Japan Smaller Capitalization Fund Inc.

The

Board noted that Nomura has a long and significant history of investing in the Asia-Pacific region. It noted in particular that Nomura, through NAM Taiwan, has one of the largest investment teams in Taiwan. The Board considered the investment

experience and expertise of Ms. Sky Chen, a senior portfolio manager employed by NAM Taiwan, who will be the portfolio manager of the Fund. The Board noted that Ms. Chen has led the NAM Taiwan team since 2007.

The Board considered Nomura’s and NAM Taiwan’s compliance program and compliance capabilities. The Board noted that NAM Taiwan has a

risk department that is accountable for identifying, measuring and monitoring the investment, operational and information technology risks of NAM Taiwan. Following discussion the Board concluded that Nomura and NAM Taiwan each have compliance

programs that appeared to be reasonably designed to prevent violations of the Federal securities laws.

The Board determined that Nomura

appeared to be capable of providing the Fund with investment management services of above average quality.

Performance, Fees and

Expenses of the Fund. The Board noted that, at the time of Nomura’s selection by the Board, Nomura had not been providing services to the Fund; therefore, there were limitations on the Board’s ability to evaluate the performance

of Nomura in managing the Fund. Based however on Nomura’s performance in managing a Taiwan-domiciled mutual fund called the Nomura Taiwan Superior Equity Fund, which has an investment strategy similar to the one proposed for the Fund, the Board

concluded that there was reason to believe that Nomura could achieve above average performance over the long term in managing the Fund. The Board noted that the Taiwan-domiciled mutual fund ranked in the first quartile of its Lipper Global –

Taiwan Equity universe over the two-and three-year periods ended March 31, 2022 and in the second quartile of its Lipper Global – Taiwan Equity universe for the

one-year period ended March 31, 2022. The Board further noted that other expenses of the Fund were not expected to increase as a result of the retention of Nomura.

As to fees, the Board noted that the Base Fee under the Proposed Agreement is lower than the rate

the Fund is paying under the Current Agreement. It also noted that the performance adjustment component of the fee under the Proposed Agreement , which is the same as the performance adjustment component that the Fund is paying under the Current

Agreement, helps align the interests of Nomura as the Fund’s investment adviser with the interests of the Fund and its stockholders.

Economies of Scale. The Board considered the potential benefits from economies of scale that the Fund’s stockholders could be

afforded. The Board noted that, while the management fee rate under the Proposed Agreement does not decline as the Fund’s assets grow, fixed operating costs are spread over a larger asset base, resulting in a lower per share allocation of such

costs.

Other Benefits of the Relationship. The Board considered whether there were other benefits that Nomura and its affiliates

may derive from its relationship with the Fund and concluded that any such benefits were likely to be minimal.

Resources of the

Proposed Investment Adviser. The Board considered whether Nomura is financially sound and has the resources necessary to perform its obligations under the Proposed Agreement. The Board noted that Nomura appears to have sufficient financial

resources necessary to fulfill its obligations under the Proposed Agreement.

General Conclusions. After considering and

weighing all of the above factors, the Board concluded that it would be in the best interest of the Fund and its stockholders to approve the Proposed Agreement. In reaching this conclusion, the Board did not give particular weight to any single

factor referenced above.

Information About the Proposed Adviser

Nomura, the proposed adviser, is a U.S.-based firm registered as an investment adviser with the SEC. The firm is a wholly owned subsidiary of

NAM Tokyo, which is itself wholly owned by Nomura Holdings, Inc., a Japanese public company focused on the financial services industry. Nomura’s principal offices are located at 309 West 49th

Street, New York, New York 10019.

Principal Executive Officer and Directors of Nomura

The following table sets forth certain information concerning the principal executive officer and each of the directors of Nomura.

|

|

|

|

|

|

|

| Name/Address |

|

Position Held |

|

Since |

|

Principal Occupation or Employment |

| Yuichi Nomoto |

|

President, Chief Executive Officer and Director |

|

2019 |

|

President and Chief Executive Officer of Nomura Asset Management U.S.A. Inc. (‘‘Nomura’’) and Director of Nomura Corporate Research and Asset Management Inc. (‘‘NCRAM’’) since 2019; Head of

Global Business Strategy Department of NAM Tokyo since 2022; Managing Director of Nomura since 2018; Head of Client Services and Marketing of Nomura. from 2016-2020; Executive Director of Nomura from 2016-2018; Head of Investment Trust Marketing

Department of Nomura Asset Management Co., Ltd. (‘‘NAM Tokyo’’) from 2014-2016 |

|

|

|

|

| Zheng Liu |

|

Chief Administrative Officer and Director |

|

2018 |

|

Chief Administrative Officer of Nomura since 2018 and General Manager, Global Business Strategy Department of NAM Tokyo since 2022; Senior Manager of the Corporate Planning Department of NAM Tokyo from 2012-2018 |

|

|

|

|

| Go Hiramatsu |

|

Director |

|

2020 |

|

Senior Managing Director and Co-Head of Global Business Unit of NAM Tokyo since 2022 and Chief Executive Officer of Nomura Asset Management U.K. Ltd. since 2018; Managing Director of NAM

Tokyo’s Investment Department from 2015 to 2018; Head of Client Services and Marketing at Nomura from 2012 to 2015 |

|

|

|

|

| Neil Daniele |

|

Chief Compliance Officer |

|

2005 |

|

Chief Compliance Officer of Nomura since 2005 and Managing Director of Nomura since 2007; Chief Compliance Officer of NCRAM since 2009; Corporate Secretary of Nomura since 2013 |

The following table sets forth certain information concerning the individual who is anticipated to serve as

portfolio manager for the Fund:

|

|

|

|

|

|

|

| Name |

|

Position Held with

Proposed Adviser |

|

Since |

|

Principal Occupation or Employment |

| Sky Chen |

|

Portfolio Manager |

|

2007 |

|

Senior Portfolio Manager, NAM Taiwan |

Required Vote

The 1940 Act requires that an investment advisory contract between an investment company and an investment adviser be in writing, that such

contract specify, among other things, the compensation payable to the adviser pursuant thereto and that such contract be approved by the holders of a majority of the investment company’s outstanding shares of common stock as defined in the 1940

Act. As defined in the 1940 Act, a “majority of the outstanding shares” means the lesser of 67% of the voting securities present at the Special Meeting of Stockholders, if more than 50% of the outstanding shares are present, or more than

50% of the outstanding securities. For this purpose, both abstentions and broker non-votes will have the effect of a vote to disapprove the Proposed Agreement. If this proposal is not approved by stockholders,

the Fund will continue under the Current Agreement while the Board of Directors considers other steps.

The Proposed Agreement is attached

as Appendix A.

THE BOARD RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE PROPOSAL TO APPROVE THE PROPOSED AGREEMENT BETWEEN THE FUND AND

NOMURA

GENERAL INFORMATION

Investment Adviser

Allianz Global

Investors U.S. LLC currently (“Allianz”) acts as the Adviser to the Fund pursuant to the Current Agreement. The principal business address of the Adviser is 1633 Broadway, New York, NY 10019.

Fund Administration

State Street

Bank and Trust Company acts as Administrator to the Fund pursuant to an Administration Agreement between the Administrator and the Fund. The principal business address of the Administrator is State Street Financial Center, One Lincoln Street,

Boston, Massachusetts 02111.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

Set forth below is information with respect to persons who are registered as beneficial owners of more than 5% of the Fund’s outstanding

shares as of [ ], 2022.

|

|

|

|

|

|

|

|

|

|

|

| Title Of Class |

|

Name and Address |

|

Shares |

|

|

Percent of

Class |

|

| Common Stock |

|

CEDE & CO Bowling Green

STN P. O. Box 20 New York, NY 10274-0020 |

|

|

[ |

] |

|

|

[ |

]% |

The shares held by Cede & Co. include the accounts set forth below. This information is based on

publicly available information such as Schedule 13D and 13G disclosures filed with the SEC or other similar regulatory filings from foreign jurisdictions.

|

|

|

|

|

|

|

|

|

| Title Of Class |

|

Name and Address of

Beneficial Owner |

|

Amount and Nature of

Beneficial Ownership |

|

Percent of

Class |

|

| Common Stock |

|

City of London 77 Gracechurch Street,

London England EC3V OAS |

|

Has shared power to vote and dispose of 2,837,955 shares |

|

|

37.99 |

% |

| Common Stock |

|

Lazard Asset Management LLC 30 Rockefeller

Plaza New York, New York 10112 |

|

Has sole power to vote and dispose of 1,412,479 shares |

|

|

18.91 |

% |

| Common Stock |

|

1607 Capital Partners LLC 13 S 13th Street,

Suite 400 Richmond, Virginia 23219 |

|

Has sole power to vote and dispose of 626,357 shares |

|

|

8.38 |

% |

| Common Stock |

|

Allspring Global Investments Holdings, LLC

525 Market Street San Francisco, California 94105 |

|

Has shared power to vote and dispose of 575,114 shares |

|

|

7.70 |

% |

MISCELLANEOUS

Proxies will be solicited by mail and may be solicited in person or by telephone or facsimile or other electronic means, by officers of the

Fund or personnel of the Administrator. The Fund has retained AST Fund Solutions LLC to assist in the proxy solicitation and setting up and administering the virtual stockholder meeting for the Fund. The total cost of proxy solicitation services,

including legal and printing fees, is estimated at $8,000, plus out-of-pocket expenses. The expenses connected with the solicitation of proxies including proxies

solicited by the Fund’s officers or agents at the Meeting, by telephone or by facsimile or other electronic means will be borne by the Fund. The Fund will reimburse banks, brokers, and other persons holding the Fund’s shares registered in

their names or in the names of their nominees for their expenses incurred in sending proxy material to and obtaining proxies from the beneficial owners of such shares.

In the event that sufficient votes in favor of the Proposal set forth in the Notice of this Meeting are not received by September 6,

2022, the persons named as attorneys in the enclosed proxy may propose one or more adjournments of the Meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of the holders of a majority of the

shares present at the Meeting or by proxy at the session of the Meeting to be adjourned. The persons named as proxies in the enclosed proxy will vote in favor of such adjournment those proxies which they are entitled to vote in favor of the

Proposal. They will vote against any such adjournment those proxies required to be voted against the Proposal. The chairman of the Meeting also may adjourn the Meeting from time to time. Any adjournment may be made to a date not more than 120 days

after the original record date without notice other than announcement at the Meeting. The costs of any such additional solicitation and of any adjourned session will be borne by the Fund.

STOCKHOLDER PROPOSALS

In

order to submit a stockholder proposal to be considered for inclusion in the Fund’s proxy statement for the Fund’s 2023 Annual Meeting of Stockholders, stockholder proposals must be received by the Fund (addressed to The Taiwan

Fund, Inc., c/o Secretary of the Fund/State Street Bank and Trust Company, P.O. Box 5049, One Lincoln Street, Boston, Massachusetts 02111-5049) not later than November 9, 2022. Any stockholder who desires to bring a

proposal at the Fund’s 2023 Annual Meeting of Stockholders without including such proposal in the Fund’s proxy statement, must deliver written notice thereof to the Secretary of the Fund (addressed to The Taiwan Fund, Inc.,

c/o Secretary of the Fund/State Street Bank and Trust Company, P.O. Box 5049, One Lincoln Street, Boston, Massachusetts 02111-5049), not before January 19, 2023 and not later than February 18, 2023.

|

| By order of the Board of Directors, |

| Brian F. Link |

| Secretary |

|

| The Taiwan Fund, Inc. c/o State Street

Bank and Trust Company |

| P.O. Box 5049 |

| One Lincoln Street, |

| Boston, Massachusetts 02111 |

[ ], 2022

APPENDIX A

THE TAIWAN FUND, INC.

INVESTMENT

ADVISORY AGREEMENT

AGREEMENT, dated and effective as of 12:00 A.M. EST (New York time) September [ ], 2022 (the “Agreement”), between THE

TAIWAN FUND, INC., a Maryland corporation of One Lincoln Street, PO Box 5049 (02206-5049), Boston MA 02111 (herein referred to as the “Fund”), and Nomura Asset Management U.S.A. Inc., a company organized in New York with its principal

place of business at 309 West 49th Street, New York, New York 10019 (herein referred to as the “Adviser”).

NOW THEREFORE, in consideration of the mutual covenants hereinafter contained, it is hereby agreed by and between the parties hereto as follows:

1. The Adviser hereby undertakes and agrees, upon the terms and conditions herein set forth, (i) to make investment decisions for the Fund, to prepare

and make available to the Fund research and statistical data in connection therewith and to supervise the acquisition and disposition of securities by the Fund, including the selection of brokers or dealers to carry out the transactions, all in

accordance with the Fund’s investment objectives and policies and in accordance with guidelines and directions from the Fund’s Board of Directors; (ii) to assist the Fund as it may reasonably request in the conduct of the Fund’s

business, subject to the direction and control of the Fund’s Board of Directors; (iii) to maintain or cause to be maintained for the Fund all books, records, reports and any other information required under the Investment Company Act of

1940, as amended (the “1940 Act”) and to furnish or cause to be furnished all required reports or other information under Taiwan securities laws, to the extent that such books, records and reports and other information are not maintained

or furnished by the custodian or other agents of the Fund; (iv) to report regularly to the Fund’s Board of Directors on the investment program for the Fund and to furnish the Fund’s Board of Directors such periodic and special reports

as the Fund’s Board of Directors may reasonably request, including, but not limited to, reports concerning investment transactions and performance of the Fund; (v) to provide reasonable assistance to the Fund’s administrator as needed

in the preparation of reports and notices by the Fund to stockholders, in the preparation of filings with the Securities and Exchange Commission (the “SEC”) and other regulatory and self-regulatory organizations, including preliminary and

definitive proxy materials and post-effective amendments to the Fund’s registration statement on Form N-2 under the Securities Act of 1933, as amended, and the 1940 Act, as amended from time to

time, (vi) to pay the salaries and expenses of such of the Fund’s officers and directors as are directors, officers or employees of the Adviser (and to permit its directors, officers or employees to so serve if elected to such positions by

the Fund’s Board of Directors); provided, however, that the Fund, and not the Adviser, shall bear travel expenses (or an appropriate portion thereof) of directors and officers of the Fund who are directors, officers or employees of the Adviser

to the extent that such expenses relate to attendance at meetings of the Board of Directors of the Fund or any committees thereof or advisers thereto and provided further that such expenses are incurred in accordance with the Fund’s travel

policy in effect at the time, (vii) to assist the Fund’s Treasurer in identifying passive foreign investment companies (PFICs) in the Fund’s portfolio, (viii) to

provide sub-certifications to support certifications made by officers of the Fund in documents filed by the Fund with the SEC, (viii) to identify securities in the Fund’s portfolio that

constitute holdings of 5% or more of the voting shares of a portfolio company, (ix) to assist in identifying securities that are restricted or illiquid securities, (x) to provide the Fund with information on brokerage commissions incurred

by the Fund, (xi) to assist in the implementation of the Fund’s Discount Management Program, (xii) to provide reasonable assistance to the Fund’s Board of Directors or the Fund’s administrator to determine or confirm the

value of any portfolio security for which the Fund’s administrator seeks assistance from the Adviser or identifies for review by the Adviser, (xiii) to the extent permitted, to assist in such marketing and investor relations activities

with respect to the Fund as the Fund may reasonably request, (xiv) to host and maintain the Fund’s website, (xv) to prepare the Fund’s monthly “Insight” report to investors, (xvi) to provide certain stockholder

services, (xvii) to permit one of its or its affiliate’s directors, officers or employees to serve without compensation as an officer of the Fund if elected to such positions and to assume the obligations herein for the compensation herein

provided, and (xviii) to vote the Fund’s proxies only in accordance with the Adviser’s proxy voting policies in effect from time to time, provided that the Fund’s Board of Directors has approved the Adviser’s proxy voting

guidelines including any amendments from time to time. The Adviser shall bear all expenses arising out of its duties hereunder but shall not be responsible for any expenses of the Fund other than those specifically allocated to the Adviser in this

paragraph 1. In particular, but without limiting the generality of the foregoing, the Adviser shall not be responsible for the following expenses of the Fund: organization and certain offering expenses of the Fund (including out-of-pocket expenses, but not including overhead or

employee costs of the Adviser or of any one or more organizations acting as “participating affiliate” of the Adviser); fees payable to any consultants, including an advisory board, if

applicable; legal expenses; auditing and accounting expenses; telephone, telex, facsimile, postage and other communication expenses; taxes and governmental fees; stock exchange listing fees; fees, dues and expenses incurred by the Fund in connection

with membership in investment company trade organizations; fees and expenses of the Fund’s custodians, subcustodians, transfer agents and registrars; payment for portfolio pricing or valuation services to pricing agents, accountants, bankers

and other specialists, if any; expenses of preparing share certificates and other expenses in connection with the issuance, offering, distribution, sale or underwriting of securities issued by the Fund; expenses of registering or qualifying

securities of the Fund for sale; expenses relating to investor and public relations; freight, insurance and other charges in connection with the shipment of the Fund’s portfolio securities; brokerage commissions or other costs of acquiring or

disposing of any portfolio securities of the Fund; expenses of preparing and distributing reports, notices and dividends to stockholders; costs of stationery; costs of stockholders’ and other meetings; litigation expenses; or expenses relating

to the Fund’s dividend reinvestment and cash purchase plan (except for brokerage expenses paid by participants in such plan).

2. The Fund

acknowledges that in rendering investment advisory services to the Fund under this Agreement, the Adviser may use the resources of its affiliate, Nomura Asset Management Taiwan Ltd. (“Taiwan Affiliate”) that is not registered under the

U.S. Investment Advisers Act of 1940 (the “Advisers Act”) to provide discretionary investment advice to the Adviser and execute portfolio trades for the Fund. Taiwan Affiliate is a “participating affiliate” of the Adviser as that

term is used in relief granted by the staff of the SEC allowing U.S. registered advisers to use investment advisory and trading resources of unregistered non-U.S. advisory affiliates subject to the

regulatory supervision of the registered adviser. Taiwan Affiliate and its employees who provide services to the Fund are considered under the Participating Affiliate Agreement between the Adviser and Taiwan Affiliate to be “associated

persons” of the Adviser as that term is defined in the Advisers Act for purposes of the Adviser’s required supervision.

3. In the selection of

brokers or dealers and the placing of orders for the purchase and sale of portfolio investments for the Fund, the Adviser shall seek to obtain for the Fund the most favorable price and execution available, except to the extent it may be permitted to

pay higher brokerage commissions for brokerage and research services as described below. In using its best efforts to obtain for the Fund the most favorable price and execution available, the Adviser, bearing in mind the Fund’s best interests

at all times, shall consider all factors it deems relevant, including by way of illustration, price, the size of the transaction, the nature of the market for the security, the amount of the commission, the timing of the transaction taking into

account market prices and trends, the reputation, experience and financial stability of the broker or dealer involved and the quality of service rendered by the broker or dealer in other transactions. Subject to such policies as the Fund’s

Board of Directors may determine, the Adviser shall not be deemed to have acted unlawfully or to have breached any duty created by this Agreement or otherwise solely by reason of its having caused the Fund to pay a broker or dealer that provides

brokerage and research services to the Adviser an amount of commission for effecting a portfolio investment transaction in excess of the amount of commission another broker or dealer would have charged for effecting that transaction, if the Adviser

determines in good faith that such amount of commission was reasonable in relation to the value of the brokerage and research services provided by such broker or dealer, viewed in terms of either that particular transaction or the Adviser’s

overall responsibilities with respect to the Fund and to other clients of the Adviser as to which the Adviser exercises investment discretion. In selecting brokers or dealers to execute a particular transaction and in evaluating the best overall

terms available, the Adviser may consider the brokerage and research services (as those terms are defined in Section 28(e) of the Securities Exchange Act of 1934) provided to the Fund and/or other accounts over which the Adviser or an affiliate

exercises investment discretion. The Fund hereby agrees with the Adviser that any entity or person associated with the Adviser which is a member of a national securities exchange is authorized to effect any transaction on such exchange for the

account of the Fund which is permitted by Section 11(a) of the Securities Exchange Act of 1934 (the “1934 Act”), subject to compliance with the 1940 Act and the rules thereunder.

4. The Fund agrees to pay to the Adviser in United States dollars, as full compensation for the services to be rendered and expenses to be borne by the

Adviser hereunder, the fee based on the average net assets of the Fund set forth in Schedule A hereto, which will include a performance fee adjustment. The fee payable to the Adviser shall be computed, accrued and paid as provided in Schedule A. The

Fund shall provide the Adviser with a monthly accounting of the performance adjusted fee. The value of the net assets of the Fund shall be determined pursuant to the applicable provisions of the valuation policies of the Fund, as amended from time

to time.

5. The Adviser agrees that it will not make a short sale of any capital stock of the Fund or purchase any share

of the capital stock of the Fund otherwise than for investment. Where the Adviser provides services to the Fund in relation to derivative products, including futures contracts and options, the Adviser shall provide to the Fund, upon request, product

specifications and prospectus or offering documents (if any).

6. Nothing herein shall be construed as prohibiting the Adviser from providing investment

advisory services to, or entering into investment advisory agreements with, other clients (including other registered investment companies), including clients which may invest in securities of Taiwan issuers, except that the Adviser shall notify the

Fund where it acts as the investment adviser or investment manager to any other investment company that is listed on the New York Stock Exchange and has a policy to invest primarily in Taiwan securities. In addition, the Adviser may not utilize

information furnished to the Adviser by advisers and consultants to the Fund in providing investment management services to another New York Stock Exchange listed investment company with a policy to invest primarily in Taiwan securities.

Nothing contained herein shall be construed as constituting the Adviser as an agent of the Fund.

Whenever the Fund and one or more other accounts or

investment companies advised by the Adviser have available funds for investment, investments suitable and appropriate for each shall be allocated in accordance with procedures believed by the Adviser to be equitable to each entity, which procedures

and any amendments thereto shall be provided to the Fund’s Board for review. Similarly, opportunities to sell securities shall be allocated in a manner believed by the Adviser to be equitable. The Fund recognizes that in some cases this

procedure may adversely affect the size of the position that may be acquired or disposed of for the Fund. In addition, the Fund acknowledges that the persons employed by the Adviser to assist in the performance of the Adviser’s duties hereunder

will not devote their full time to such service and nothing contained herein shall be deemed to limit or restrict the right of the Adviser or

any

affiliate of the Adviser to engage in and devote time and attention to other businesses or to render services of whatever kind or nature.

7. (a) The

Adviser does not guarantee the future performance of the Fund or any specific level of performance, the success of any investment decision or strategy that the Adviser may use, or the success of the Adviser’s overall management of the Fund. The

Fund understands that investment decisions made for the Fund by the Adviser are subject to various market, currency, economic, political and business risks, and that those investment decisions will not always be profitable.

(b) The Adviser may rely on information reasonably believed by it to be accurate and reliable. Neither the Adviser nor its officers, directors, employees or

agents shall be subject to any liability for any act or omission, error of judgment or mistake of law, or for any loss suffered by the Fund, in the course of, connected with or arising out of any services to be rendered hereunder, except by reason

of willful misfeasance, bad faith, or gross negligence on the part of the Adviser in the performance of its duties or by reason of reckless disregard on the part of the Adviser of its obligations and duties under this Agreement. Any person, even

though also employed by the Adviser, who may be or become an employee of the Fund and paid by the Fund shall be deemed, when acting within the scope of his employment by the Fund, to be acting in such employment solely for the Fund and not as an

employee or agent of the Adviser.

(c) Neither party shall be liable to the other for any indirect, consequential, punitive or special loss or damages

under this Agreement.

8. (a) The Adviser agrees to indemnify the Fund for, and hold it harmless against, any and all losses, claims, damages,

liabilities (including amounts paid in settlement with the written consent of the Adviser) or litigation (including reasonable legal and other expenses) to which the Fund may become subject (“Losses”) as a direct result of Adviser’s

willful misfeasance, bad faith or gross negligence in the performance of its duties or from reckless disregard by it of its obligations and duties under this Agreement; provided, however, that nothing contained herein shall require that the Fund be

indemnified for Losses that resulted from the Fund’s or its agent’s willful misfeasance, bad faith or gross negligence in the performance of its duties or from reckless disregard by it of its obligations and duties under this Agreement;

further provided that the Adviser shall have been given written notice concerning any matter for which indemnification is claimed under this Section.

(b)

The Fund agrees to indemnify the Adviser for, and hold it harmless against, any and all Losses to which the Adviser may become subject as a direct result of this Agreement or the Adviser’s performance of its duties hereunder; provided, however,

that nothing contained herein shall require that the Adviser be indemnified for Losses that resulted from the Adviser’s willful misfeasance, bad faith or gross negligence in the performance of its duties or from reckless disregard by it of its

obligations and duties under this Agreement; provided that the Fund shall have been given written notice concerning any matter for which indemnification is claimed under this Section.

9. This Agreement shall be in effect for an initial term of two years from the date of this Agreement and shall

continue in effect from year to year thereafter, but only so long as such continuance is specifically approved at least annually by the affirmative vote of (i) a majority of the members of the Fund’s Board of Directors who are not parties

to this Agreement or interested persons of any party to this Agreement, or of any entity regularly furnishing investment advisory services with respect to the Fund pursuant to an agreement with any party to this Agreement, cast in person at a

meeting called for the purpose of voting on such approval, and (ii) a majority of the Fund’s Board of Directors or the holders of a majority of the outstanding voting securities of the Fund. This Agreement may nevertheless be terminated at

any time without penalty, on 60 days’ written notice, by the Fund’s Board of Directors, by vote of holders of a majority of the outstanding voting securities of the Fund, or by the Adviser.

This Agreement shall automatically be terminated in the event of its assignment. Any notice to the Fund or the Adviser shall be deemed given when received by

the addressee.

10. This Agreement may not be transferred, assigned, sold or in any manner hypothecated or pledged by either party hereto, except as

permitted under the 1940 Act or rules and regulations adopted thereunder. It may be amended by mutual agreement of the parties, but only after authorization of such amendment by the affirmative vote of (i) a majority of the members of the

Fund’s Board of Directors who are not parties to this Agreement or interested persons of any party to this Agreement, or of any entity regularly furnishing investment advisory services with respect to the Fund pursuant to an agreement with any

party to this Agreement, cast in person at a meeting called for the purpose of voting on such approval and (ii) if required by applicable SEC rules, regulations or orders, a vote of the holders of a majority of the outstanding voting securities

of the Fund.

11. The Adviser may, without cost to the Fund, employ an affiliate or a third party to perform any accounting, administrative, reporting and

ancillary services required to enable the Adviser to perform its functions under this Agreement. Notwithstanding any other provision of the Agreement, the Adviser may provide information about the Fund to any such affiliate or other third party for

the purpose of providing the services contemplated under this clause. The Adviser will act in good faith in the selection, use and monitoring of affiliates and other third parties, and any delegation or appointment hereunder shall not relieve the

Adviser of any of its obligations under this Agreement.

12. This Agreement shall be construed in accordance with the laws of the State of New York,

without giving effect to the conflicts of laws principles thereof, provided, however, that nothing herein shall be construed as being inconsistent with the 1940 Act. As used herein, the terms “interested person,” “assignment,”

and “vote of a majority of the outstanding voting securities” shall have the meanings set forth in the 1940 Act, the rules and regulations thereunder and interpretations thereof by the SEC or its staff.

13. This Agreement may be executed simultaneously in two or more counterparts, each of which shall be deemed an original, and it shall not be necessary in

making proof of this Agreement to produce or account for more than one such counterpart.

14. Each party hereto irrevocably agrees that any suit, action

or proceeding against either of the Adviser or the Fund arising out of or relating to this Agreement shall be subject to the jurisdiction of the United States District Court for the Southern District of New York or the Supreme Court of the

State of New York, New York County, and each party hereto irrevocably submits to the jurisdiction of each such court in connection with any such suit, action or proceeding. Each party hereto waives any objection to the laying of venue of any such

suit, action or proceeding in either such court, and waives any claim that such suit, action or proceeding has been brought in an inconvenient forum. Each party hereto irrevocably consents to service of process in connection with any such suit,

action or proceeding by mailing a copy thereof by registered or certified mail, postage prepaid, to its address as set forth in this Agreement.

15. The

Adviser represents and warrants that it is duly registered as an investment adviser under the U.S. Investment Advisers Act of 1940. Taiwan Affiliate has received a license from the Financial Supervisory Commission in the Republic of China to provide

services under the Participating Affiliate Agreement. The Adviser will use its reasonable efforts to, and to cause Taiwan Affiliate to, maintain in effect such registration and license during the term of this Agreement. The Participating Affiliate

Agreement complies with the laws and regulations of the United States and the Republic of China.

The Fund acknowledges that the Fund may have provided and may, from time to time, provide certain personal

information on individuals relating to the Fund and/or a third party (“Data”) to the Adviser. The Fund acknowledges that the Adviser has informed the Fund of its right to request access to and/or correction of the Data which the

Adviser may hold and that request may be made to the Compliance Officer of the Adviser at its principal place of business in the State of New York as stated at the beginning of this Agreement. The Fund further acknowledges that the Adviser has

informed the Fund and the Fund hereby consents that Data may be collected, held, processed, disclosed or used by the Adviser and transferred to any office of the Adviser, any of Adviser’s affiliates or Associates, any of the Adviser’s

agents and any other third party which provides services to the Adviser, within or outside the State of New York, for the purposes of the Adviser or any such other entity providing the services contemplated under this Agreement and to facilitate the

provision by an affiliate to the Fund of potential additional products and services. The Fund represents and warrants that appropriate consent has been obtained from the relevant individuals for such collection, storage, processing, disclosure,

usage and transfer of Data.

16. The Fund represents and warrants that it has full legal right to enter into this Agreement and to perform the obligations

hereunder and that it has obtained all necessary consents and approvals to enter into this Agreement.

17. The parties will inform each other in writing

within a reasonable time of material changes to the information provided to each other under this Agreement.

IN WITNESS WHEREOF, the parties have

executed this Agreement by their officers thereunto duly authorized as of the day and year first written above.

THE TAIWAN FUND, INC

By:

Name: William Kirby

Title: Chairman

|

|

|

| NOMURA ASSET MANAGEMENT U.S.A. INC. |

|

|

| By: |

|

|

| Name: |

| Title: |

SCHEDULE A

MANAGEMENT FEE

In consideration of the services

described in the agreement, the Fund will pay the Adviser a fee (“Management Fee”) that will be composed of a Base Fee (defined below) and a Performance Adjustment (defined below) to the Base Fee based upon the investment performance of

the Fund’s shares in relation to the investment record of a securities index determined by our Board of Directors to be appropriate (“Index”) over the same performance period.

Base Fee. The base fee is calculated and accrued daily at the annual rate of 0.60% of the Fund’s average daily net assets (“Base Fee”).

Performance Adjustment. The Adviser’s compensation is increased or decreased from the Base Fee by a performance adjustment (“Performance

Adjustment”) that depends on whether, and to what extent, the investment performance of the Fund’s shares exceeds, or is exceeded by, the performance of the TAIEX Total Return Index, expressed in US dollars (the ”Index”).

The Performance Adjustment is calculated and accrued, according to a schedule that adds or subtracts an amount at a rate of 0.0005% (0.05 basis points) of the

Fund’s average daily net assets for the current Performance Period through the prior business day for each 0.01% (1 basis point) of absolute performance by which the total return performance of the Fund’s shares exceeds or lags the

performance of the Index for the period from the beginning of the current Performance Period through the prior business day. The maximum Performance Adjustment (positive or negative) will not exceed an annualized rate

of +/-0.25% (25 basis points) of the Fund’s average daily net assets, which would occur when the performance of the Fund’s shares exceeds, or is exceeded by, the performance of the Index by

5 percentage points (500 basis points) for the Performance Period. For purposes of calculating the Performance Adjustment, the NAV of the Fund and the level of the Index will be determined as of the close of trading on the Taiwan Stock Exchange on

each business day; the exchange rate to be used for purposes of converting the TAIEX Total Return Index into the Index on each business day shall be the same exchange rate as used to determine the NAV on that business day; and “business

day” shall mean any day that on which trading occurs on the New York Stock Exchange. The Performance Adjustment will be calculated and accrued pursuant to a process agreed to by the Adviser and the Fund.

For purposes of calculating the Performance Adjustment, the total return performance of the Fund’s shares will be the sum of:

1) the change in the net asset net asset value per share (“NAV”) during the Performance Period, after deducting any accretion in the

NAV resulting from the repurchase of shares by the Fund; plus

2) the value of the cash distributions per share paid by the Fund during

the Performance Period; plus

3) the value of capital gains taxes per share paid or payable on undistributed realized long-term capital

gains accumulated during the Performance Period; expressed as a percentage of the NAV per share at the beginning of the Performance Period.

For this

purpose, the value of distributions per share of realized capital gains, of dividends per share paid from investment income and of capital gains taxes per share paid or payable on undistributed realized long-term capital gains shall be treated as

reinvested in shares of the Fund at the NAV per share in effect at the close of business on the ex-dividend date for the payment of such distributions and dividends and the date on which provision is

made for such taxes, after giving effect to such distributions, dividends and taxes.

The investment record of the Index will be the sum of:

1) the change in the level of the Index during the Performance Period, as expressed in US dollars; plus

2) if not reflected in the Index, the value, computed consistently with the Index, of cash distributions made by companies whose securities

comprise the Index during the Performance Period, expressed as a percentage of the Index level at the beginning of the Performance Period. For this purpose, cash distributions on the securities which comprise the Index shall be treated as reinvested

in the Index at least as frequently as the end of each calendar quarter following the payment of the dividend.

To the extent an event occurs that impacts the Fund’s NAV per share or the investment record of the Index

and results from circumstances out of the ordinary course of business including, but not limited to, the receipt of litigation proceeds, an NAV error correction, a change in the Index performance resulting from market news, or some other event that

is outside of the ordinary course of business, the Board of Directors will consult with Adviser to determine whether such impact should be excluded from the performance adjustment calculation.

Notwithstanding any other provision in this Schedule A, any calculations of the investment performance of the Fund’s shares and the investment

performance of the Index will be made in accordance with the Investment Advisers Act of 1940, as amended, and any applicable rules thereunder.

Performance Period. The period over which performance is measured (“Performance Period”) is initially from September [ ], 2022 to

August 31, 2023 and thereafter each 12-month period beginning on September 1 immediately following the prior Performance Period through August 31 of the following year.

Payment of Fees. The Fund will pay the Adviser, on a monthly basis, a fee at the annual rate of the Base Fee applied to the average daily net assets of the

Fund for the month. At the end of each Performance Period, the Fund will pay the Adviser, or the Adviser will pay the Fund, the positive or negative amount, as the case may be, of the Performance Adjustment for the Performance Period. From the date

on which the Adviser begins to manage the Fund to August 31, 2023, the Fund will pay the Adviser only the Base Fee, without any Performance Adjustment.

Index. The initial Index for the Performance Fee is set forth above. If the Fund’s Board of Directors determines, based on consultation with the Adviser,

that another appropriate Index should be substituted as the Index, the Board may determine to use such other appropriate Index for purposes of the Performance Adjustment (the “Replacement Index”) without stockholder approval, unless

stockholder approval of the change is otherwise required by applicable law. Any Replacement Index will be applied prospectively to determine the amount of the Performance Adjustment. The Index will continue to be used to determine the amount of the

Performance Adjustment for that part of the Performance Period prior to the effective date of the Replacement Index.

EVERY STOCKHOLDER’S VOTE IS IMPORTANT EASY VOTING OPTIONS: Please detach at perforation before mailing. THE TAIWAN FUND, INC.

SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON SEPTEMBER 6, 2022 THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS. The undersigned hereby appoints William C. Kirby and Brian F. Link, and each of them, the proxies of the undersigned,

with full power of substitution to each of them, to vote all shares of The Taiwan Fund, Inc. which the undersigned is entitled to vote at the Special Meeting of Stockholders of The Taiwan Fund, Inc. to be held virtually on September 6, 2022 at

9:00 a.m., local time, and at any adjournments thereof, (i) to approve a proposed Investment Advisory Agreement between the Fund and Nomura Asset Management U.S.A. Inc.; and (ii) in their discretion, on any other business which may

properly come before the meeting or any adjournments thereof. The undersigned hereby revokes all proxies with respect to such shares heretofore given. The undersigned acknowledges receipt of the Proxy Statement dated August [ ], 2022. This proxy,

when properly executed, will be voted in the manner directed herein and, absent direction will be voted “FOR” the Proposal. VOTE VIA THE INTERNET: www.proxy-direct.com VOTE VIA TELEPHONE: 1-800-337-3503 TWN_32649_[ ] THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED ON THE REVERSE SIDE. xxxxxxxxxxxxxx code

EVERY STOCKHOLDER’S VOTE IS IMPORTANT Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of

Stockholders to be Held on September 6, 2022. The Proxy Statement and Proxy Card for this meeting are available at: https://www.proxy-direct.com/twn-[ ] IF YOU VOTE ON THE INTERNET OR BY TELEPHONE, YOU NEED NOT RETURN THIS PROXY CARD Please

detach at perforation before mailing. TO VOTE MARK BLOCKS BELOW IN BLUE OR BLACK INK AS SHOWN IN THIS EXAMPLE: X THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE PROPOSAL: A Proposal 1. To approve a proposed Investment Advisory Agreement

between the Fund and Nomura Asset Management U.S.A. Inc. ☐ ☐ ☐ THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE PROPOSAL: B Authorized Signatures — This section must be completed for your vote to be counted. —

Sign and Date Below Note: Please sign exactly as your name(s) appear(s) on this Proxy Card, and date it. When shares are held jointly, each holder should sign. When signing as attorney, executor, administrator, trustee, guardian, officer of

corporation or other entity or in another representative capacity, please give the full title under the signature. Date (mm/dd/yyyy) — Please print date below Signature 1 — Please keep signature within the box Signature 2 — Please

keep signature within the box Scanner bar code xxxxxxxxxxxxxx TWN [ ] xxxxxxxx

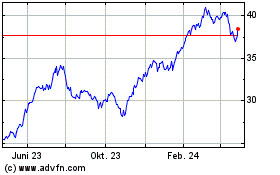

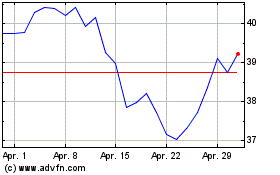

Taiwan (NYSE:TWN)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Taiwan (NYSE:TWN)

Historical Stock Chart

Von Apr 2023 bis Apr 2024