Fourth Quarter 2022 Expected

Results

- Net loss from continuing operations of $367 million to $362

million and Adjusted EBITDA* of $4 million to $9 million

- Net loss includes a pre-tax, non-cash goodwill impairment

charge of $297 million related to the PMMA business and Aristech

Surfaces reporting units

- Cash from operations of $32 million to $37 million and capital

expenditures of approximately $54 million resulting in Free Cash

Flow* of negative $22 million to $17 million; results included a

$34 million payment for settlement of the European Commission’s

2018 investigation of the Company’s styrene purchasing practices in

Europe

Full-Year 2022 Expected

Results

- Net loss from continuing operations of $432 million to $427

million and Adjusted EBITDA* of $309 million to $314 million

- Cash from operations of $41 million to $46 million and capital

expenditures of $149 million resulting in Free Cash Flow* of

negative $108 million to $103 million

- Year-end cash of $212 million plus an additional $252 million

of available liquidity from two undrawn, committed financing

facilities

Trinseo (NYSE: TSE):

(Unaudited)

Current

Expectation Three Months Ended

Current

Expectation Year Ended

Prior

Guidance Year Ended

(In millions)

December 31, 2022

December 31,

2022

December 31,

2022

Net loss from continuing operations

$

(367) – (362)

$

(432) – (427)

$

(126) – (91)

Adjusted EBITDA*

4 – 9

309 – 314

325 - 375

Cash from operations

32 – 37

41 – 46

~150

Free Cash Flow*

(22) – (17)

(108) – (103)

~0

________________________ *For a reconciliation Adjusted EBITDA

and Free Cash Flow, both of which are non-GAAP measures, to net

loss from continuing operations and cash from operations, see Notes

1 and 2 below. For the ‘Prior Guidance’ column, refer to the

Company’s press release, furnished on its Form 8-K dated November

2, 2022, for a reconciliation of non-GAAP measures to their

corresponding GAAP measures.

Trinseo (NYSE: TSE), a specialty material solutions provider,

announced expectations for its fourth quarter 2022 financial

results. Net loss from continuing operations and Adjusted EBITDA

expectations include a pre-tax unfavorable net timing impact of $19

million from declining raw material costs as well as a $15 million

unfavorable impact from natural gas hedges that were put into place

in the second half of the year.

Commenting on the Company’s fourth quarter performance, Frank

Bozich, President and Chief Executive Officer of Trinseo, said,

“Our fourth quarter results reflect a challenging operating

environment including a continuation of customer destocking, lower

underlying demand, and volume and margin impacts from lower-cost

imports into Europe from Asia. As a result, our earnings and cash

generation were below our previous expectations. However, due to

proactive operating decisions such as idling styrene production

throughout the fourth quarter, we saw a considerable sequential

Adjusted EBITDA improvement of more than $40 million. Further

improvement in the first quarter is expected given seasonally

stronger demand, lower energy prices and the realization of our

asset restructuring initiatives.”

In connection with the Company’s annual goodwill impairment

analysis performed in the fourth quarter, the Company expects to

record a non-cash impairment charge of $297 million related to the

PMMA business and Aristech Surfaces reporting units' goodwill

balances established in 2021. The impairment charges were

attributed to a challenging macroeconomic environment, including

significantly lower demand for building & construction and

wellness applications, which led to lower operating results

including slower growth projections as well as a prolonged drop in

market capitalization. These impairment charges do not affect the

Company’s cash position, and the Company remains encouraged about

the businesses’ expected synergies and strategic value as we

continue to evolve as a specialty material and sustainable

solutions provider.

Bozich continued, “Despite the near-term challenges, we remain

very optimistic about these businesses. Sales volume has been

impacted by weak underlying demand and continued customer

destocking. In addition, both volume and margins were pressured as

elevated natural gas prices in Europe and low demand in China

created an arbitrage window for lower-cost commodity products from

Asia to be more heavily imported into Europe and North America. We

view both of these as temporary circumstances which we believe will

resolve themselves in the coming quarters.”

For a reconciliation of estimated fourth quarter and full year

2022 (unaudited) net loss from continuing operations to Adjusted

EBITDA and cash provided by operating activities to Free Cash Flow

for fourth quarter and full year 2022, see Notes 1 and 2 below,

respectively.

Trinseo will host a conference call to discuss further details

of its fourth quarter and full year 2022 financial results on

Thursday, February 9, 2023, at 10 AM Eastern Time.

Commenting on results will be Frank Bozich, President and Chief

Executive Officer, David Stasse, Executive Vice President and Chief

Financial Officer, and Andy Myers, Director of Investor Relations.

The conference call will include introductory comments followed by

a question-and-answer session.

For those interested in asking questions during the Q&A,

please register using the following link:

- Conference Call Registration

For those interested in listening only, please register for the

webcast using the following link:

After registering for the conference call, you will receive a

confirmation email with a meeting invitation and information for

entry. Registration is open through the live call, but it is

advised you register in advance to ensure you are connected for the

full call.

Trinseo will distribute its fourth quarter 2022 financial

results via press release on Business Wire and post the release and

presentation slides on the Company’s Investor Relations website on

Wednesday, February 8, 2023, after market close. The Company will

furnish copies of the financial results press release and

presentation slides to investors by means of a Form 8-K filing with

the U.S. Securities and Exchange Commission.

A replay of the conference call and transcript will be archived

on the Company’s Investor Relations website shortly following the

conference call. The replay will be available until February 9,

2024.

Unaudited financial data for the fiscal quarter and year ended

December 31, 2022, presented herein are preliminary, based upon our

good faith estimates and subject to completion of our financial

closing procedures. We have provided ranges for certain of our

expectations described herein because our fiscal quarter and

year-end closing procedures are not yet complete. While we expect

that our final financial results for the quarterly and annual

periods ended December 31, 2022, following the completion of our

financial closing procedures, will be within the ranges described

herein, our actual results may differ materially from these

estimates as a result of the completion of our financial closing

procedures as well as final adjustments and other developments that

may arise between now and the time that our financial results for

these quarterly and annual periods are finalized. All the data

presented herein has been prepared by and is the responsibility of

management. This summary is not a comprehensive statement of our

financial results for the quarterly and annual periods.

Note 1: Reconciliation of

Non-GAAP Performance Measures to Net income

We present Adjusted EBITDA as a non-GAAP financial performance

measure, which we define as income from continuing operations

before interest expense, net; income tax provision; depreciation

and amortization expense; loss on extinguishment of long-term debt;

asset impairment charges; gains or losses on the dispositions of

businesses and assets; restructuring charges; acquisition related

costs and other items. In doing so, we are providing management,

investors, and credit rating agencies with an indicator of our

ongoing performance and business trends, removing the impact of

transactions and events that we would not consider a part of our

core operations.

We also present Adjusted Net Income (Loss) as an additional

performance measure. Adjusted Net Income (Loss) is calculated as

Adjusted EBITDA (defined beginning with net income from continuing

operations, above), less interest expense, less the provision for

income taxes and depreciation and amortization, tax affected for

various discrete items, as appropriate. We believe that Adjusted

Net Income (Loss) provides transparent and useful information to

management, investors, analysts, and other stakeholders in

evaluating and assessing our operating results from

period-to-period after removing the impact of certain transactions

and activities that affect comparability and that are not

considered part of our core operations.

There are limitations to using the financial performance

measures noted above. These performance measures are not intended

to represent net income or other measures of financial performance.

As such, they should not be used as alternatives to net income as

indicators of operating performance. Other companies in our

industry may define these performance measures differently than we

do. As a result, it may be difficult to use these or similarly

named financial measures that other companies may use to compare

the performance of those companies to our performance. We

compensate for these limitations by providing reconciliations of

these performance measures to our net income, which is determined

in accordance with GAAP.

For the reasons discussed above, we are providing the following

reconciliations of expected net income from continuing operations

to Adjusted EBITDA and Adjusted Net Income (Loss) for the three

months and full year ended December 31, 2022. See “Note on

Forward-Looking Statements” below for a discussion of the

limitations of these estimates. Amounts below may not sum due to

rounding.

(Unaudited)

Three Months Ended

Year Ended

(In millions, except per share

data)

December 31, 2022

December 31,

2022

Adjusted EBITDA

$

4 – 9

$

309 – 314

Interest expense, net

(35)

(113)

Benefit from income taxes

~ 83

~ 41

Depreciation and amortization

(90)

(237)

Reconciling items to Adjusted EBITDA

(a)

(329)

(432)

Net loss from continuing

operations

(367) – (362)

(432) – (427)

Reconciling items to Adjusted Net Loss

(a)

~ 304

~ 411

Adjusted Net Loss

(63) – (58)

(21) – (16)

________________________

(a)

Reconciling items to Adjusted EBITDA and Adjusted Net Income

(Loss) for the three months and year ended December 31, 2022,

reflect the Company’s preliminary estimate of adjustments for the

periods, and primarily reflect various costs associated with

ongoing strategic initiatives of the Company, restructuring and

impairment charges. The amounts for the three months and year ended

December 31, 2022, are inclusive of the PMMA business and Aristech

Surfaces goodwill impairment and the asset restructuring plan

announced in the fourth quarter. The year ended December 31, 2022

also includes the European Commission request for information,

adjusted for foreign exchange rate impacts.

Note that the accelerated depreciation

charges incurred as part of the Company’s asset restructuring plan

are included within the “Depreciation and amortization” caption

above, and therefore are not included as a separate adjustment

within this caption.

Note 2: Reconciliation of

Non-GAAP Liquidity Measures to Cash from

Operations

The Company uses Free Cash Flow to evaluate and discuss its

liquidity position and results. Free Cash Flow is defined as cash

from operating activities, less capital expenditures. We believe

that Free Cash Flow provides an important indicator of the

Company’s ongoing ability to generate cash through core operations,

as it excludes the cash impacts of various financing transactions

as well as cash flows from business combinations that are not

considered organic in nature. We also believe that Free Cash Flow

provides management and investors with a useful analytical

indicator of our ability to service our indebtedness, pay dividends

(when declared), and meet our ongoing cash obligations.

Free Cash Flow is not intended to represent cash flows from

operations as defined by GAAP, and therefore, should not be used as

an alternative for that measure. Other companies in our industry

may define Free Cash Flow differently than we do. As a result, it

may be difficult to use this or similarly named financial measures

that other companies may use, to compare the liquidity and cash

generation of those companies to our own. The Company compensates

for these limitations by providing the following detail, which is

determined in accordance with GAAP.

For the reasons discussed above, we are providing the following

reconciliation of expected cash provided by operating activities to

Free Cash Flow for the three months ended December 31, 2022 and for

the full year ended December 31, 2022. See “Note on Forward-Looking

Statements” below for a discussion of the limitations of these

estimates. Amounts below may not sum due to rounding.

(Unaudited)

Three Months

Ended

Year Ended

(In millions)

December 31, 2022

December 31, 2022

Cash provided by operating activities

$

32 - 37

$

41 - 46

Capital expenditures

(54)

(149)

Free Cash Flow

(22) – (17)

(108) – (103)

About Trinseo

Trinseo (NYSE: TSE) a specialty material solutions provider,

partners with companies to bring ideas to life in an imaginative,

smart, and sustainability-focused manner by combining its premier

expertise, forward-looking innovations and best-in-class materials

to unlock value for companies and consumers.

From design to manufacturing, Trinseo taps into decades of

experience in diverse material solutions to address customers’

unique challenges in a wide range of industries, including consumer

goods, mobility, building and construction, and medical.

Trinseo’s approximately 3,400 employees bring endless creativity

to reimagining the possibilities with clients all over the world

from the company’s locations in North America, Europe, and Asia

Pacific. Trinseo reported net sales of approximately $4.8 billion

in 2021. Discover more by visiting www.trinseo.com and connecting

with Trinseo on LinkedIn, Twitter, Facebook and WeChat.

Use of non-GAAP measures

In addition to using standard measures of performance and

liquidity that are recognized in accordance with accounting

principles generally accepted in the United States of America

(“GAAP”), we use additional measures of income excluding certain

GAAP items (“non-GAAP measures”), such as Adjusted Net Income,

EBITDA and Adjusted EBITDA and measures of liquidity excluding

certain GAAP items, such as Free Cash Flow. We believe these

measures are useful for investors and management in evaluating

business trends and performance each period. These measures are

also used to manage our business and assess current period

profitability, as well as to provide an appropriate basis to

evaluate the effectiveness of our pricing strategies. Such measures

are not recognized in accordance with GAAP and should not be viewed

as an alternative to GAAP measures of performance or liquidity, as

applicable. The definitions of each of these measures, further

discussion of usefulness, and reconciliations of non-GAAP measures

to GAAP measures are provided herein.

Note on Forward-Looking Statements

This press release may contain forward-looking statements

including, without limitation, statements concerning plans,

objectives, goals, projections, forecasts, strategies, future

events or performance, and underlying assumptions and other

statements, which are not statements of historical facts or

guarantees or assurances of future performance. Forward-looking

statements may be identified by the use of words like "expect,"

"anticipate," “believe,” "intend," "forecast," "outlook," "will,"

"may," "might," "see," "tend," "assume," "potential," "likely,"

"target," "plan," "contemplate," "seek," "attempt," "should,"

"could," "would" or expressions of similar meaning. Forward-looking

statements reflect management’s evaluation of information currently

available and are based on our current expectations and

assumptions, our business, the economy and other future conditions.

Because forward-looking statements relate to the future, they are

subject to inherent uncertainties, risks and changes in

circumstances that are difficult to predict. Factors that might

cause future results to differ from those expressed by the

forward-looking statements include, but are not limited to, our

ability to successfully execute our business and transformation

strategy; increased costs or disruption in the supply of raw

materials; increased energy costs; our ability to successfully

generate cost savings and increase profitability through asset

restructuring initiatives; compliance with laws and regulations

impacting our business; conditions in the global economy and

capital markets; and those discussed in our Annual Report on Form

10-K, under Part I, Item 1A —"Risk Factors" and elsewhere in our

other reports, filings and furnishings made with the U.S.

Securities and Exchange Commission from time to time. As a result

of these or other factors, our actual results, performance or

achievements may differ materially from those contemplated by the

forward-looking statements. Therefore, we caution you against

relying on any of these forward-looking statements. The

forward-looking statements included in this press release are made

only as of the date hereof. We undertake no obligation to publicly

update or revise any forward-looking statement as a result of new

information, future events or otherwise, except as otherwise

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230126005978/en/

Trinseo Andy Myers Tel : +1 610-240-3221 Email:

aemyers@trinseo.com

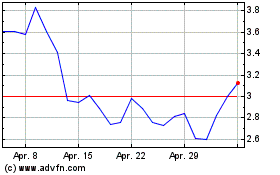

Trinseo (NYSE:TSE)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Trinseo (NYSE:TSE)

Historical Stock Chart

Von Apr 2023 bis Apr 2024