Additional Proxy Soliciting Materials (definitive) (defa14a)

15 Mai 2023 - 12:58PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant

x

Filed by a Party

other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement |

| |

|

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ¨ |

Definitive Proxy Statement |

| |

|

| x |

Definitive Additional Materials |

| |

|

| ¨ |

Soliciting Material Pursuant to §240.14a-12 |

The Travelers Companies, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| x |

No fee required. |

| |

|

| ¨ |

Fee paid previously with preliminary materials |

| |

|

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Beginning on May 15,

2023, The Travelers Companies, Inc. sent the following communication to certain of its shareholders.

Dear [Name of Institutional Shareholder]:

We are writing to ask for your support by voting in accordance with

the recommendations of our Board of Directors on all of the proposals included in our 2023 Proxy Statement, which was filed on April 7,

2023, and is available at https://investor.travelers.com/home/default.aspx and on the SEC’s website.

The Board has recommended a vote AGAINST each of the shareholder proposals,

as discussed in further detail in our 2023 Proxy Statement. This supplemental filing reiterates some important information about why the

Board believes that one proposal in particular is not in the best economic interest of shareholders:

· Item 8

– Shareholder Proposal Relating to a Racial Equity Audit

In addition, this supplemental filing articulates the Board’s

approach with respect to reviewing and evaluating shareholder proposals.

We encourage you to review our 2023 Proxy Statement for a more complete

explanation of the Board’s recommendations.

Racial Equity Audit Proposal

The Board believes that the proposal’s

request, which directly implicates the Company’s insurance offerings, is not in the best interest of shareholders because it:

| · | is impossible to implement without violating the insurance laws of the vast majority of states, which are designed to protect

minorities and people of color and prohibit the consideration of race in underwriting and pricing decisions; |

| · | conflicts with the Company’s longstanding practice not to take race into account in its underwriting and pricing decisions; |

| · | conflicts with the highly regulated insurance environment in which the Company operates and would insert the Company into decisions

that are solely within the ambit of insurance regulators; and |

| · | risks prejudicing the Company in potential future litigation in which insurers are routinely involved, since it would

remove a significant defense of the Company in some of these actions – namely, that it does not possess or otherwise

utilize racial data on its insureds. |

In addition, the Board believes that the actions

requested by the proposal — which would entail a significant investment of resources and time, including by senior executives

— are inadvisable, among other reasons, in light of:

| · | the Company’s thoughtful and comprehensive underwriting and pricing policies and practices, including robust governance and

controls designed to ensure that its rating factors are actuarially sound and that its underwriting and pricing practices comply with

all applicable laws and do not consider race or other legally protected characteristics; and |

| · | the fact that the insurance industry is subject to significant oversight, review and regulation of its underwriting and pricing

practices by independent state regulatory bodies that conduct market conduct and financial exams, rendering a third-party racial

audit unnecessary. |

Based in part on the Company’s engagements with its shareholders,

the Company has published significantly enhanced disclosure with respect to the Company’s existing and robust governance, processes

and controls designed to ensure that its rating factors are actuarially sound, comply with all applicable laws and do not consider race

or other protected characteristics. For more information, we encourage you to review the Ethics & Responsible Business Practices

section of our sustainability report, available at https://sustainability.travelers.com.

Further, based on the Company’s

engagements with its shareholders, the Company believes that more than a majority of its shareholders support Travelers’ approach

of increased disclosure.

[Depending on Recipient of Letter: Finally,

we would like to note that when a substantially similar proposal appeared on the proxy ballot of your institution in [insert year], your

board of directors recommended a vote AGAINST this proposal.]

The Board’s Approach to Reviewing and Evaluating Shareholder

Proposals

In addition to the above discussion, the Company would like to take

this opportunity to address the Board’s approach to reviewing and evaluating shareholder resolutions more generally.

Increasingly, shareholder proponents are calling upon the insurance

industry to address complex societal or global challenges through insurance – often through shareholder proposals that seek to alter

insurers’ well-established approaches to underwriting, pricing and/or investing. While these proposals address important national

or global issues, and while many insurers, including Travelers, are working hard and in good faith to do their part to contribute to the

solutions, some requests – however well-intentioned and laudable – cannot be reconciled with the 50-state regulatory framework

in which property casualty insurers operate, or with the best economic interest of shareholders.

This is particularly the case with shareholder requests that implicate

the property casualty insurance industry’s foundational principles of risk-based underwriting and pricing, and/or that seek to limit

the flexibility of insurers to invest their assets for the primary purpose of enabling them to fund future claim payments.

The Company’s Board of Directors is

particularly sensitive to proposals that would require the Company to alter its risk-based approach to underwriting and pricing –

the bedrock principle of the insurance industry – by incorporating into its underwriting and/or pricing decisions factors that are

not predictive of risk and that seek to steer the insurance industry away from deploying underwriting capacity for reasons other than

underwriting risk and returns. Ultimately, the industry’s risk-based approach to underwriting and pricing benefits consumers by

increasing the availability of insurance at fair prices that appropriately reflect the related risks and ensures the financial solvency

of insurers to pay covered claims decades into the future. Likewise, this approach benefits communities by ensuring that businesses can

access traditional forms of risk transfer. The Board is similarly concerned about proposals that would restrain the Company’s ability

to invest its assets for the primary goal of ensuring its ability to pay claims as they come due.

The Board believes that an attempt to utilize

insurance as a tool to achieve public policy goals – however admirable – is likely to have long-term and unintended negative

consequences on the Company, its customers, its communities, its shareholders and the effective operation of insurance markets.

It is with these concerns in mind that the

Board reviews and evaluates shareholder proposals submitted to the Company. The Board encourages investors to review its responses to

all of the shareholder proposals included in the Company’s 2023 Proxy Statement and, in particular, its articulation of the specific

ways in which the Board believes each of the proposals jeopardizes the ability of the Company to continue to deliver long-term value to

its shareholders.

* * *

We appreciate your time and consideration

on these matters and ask for your support with respect to all of the Board’s recommendations. Our 2023 Proxy Statement, this supplemental

proxy material and our 2022 Annual Report are available at https://investor.travelers.com/home/default.aspx.

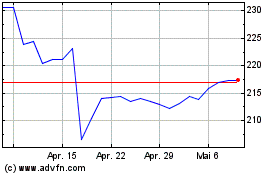

The Travelers Companies (NYSE:TRV)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

The Travelers Companies (NYSE:TRV)

Historical Stock Chart

Von Apr 2023 bis Apr 2024