Current Report Filing (8-k)

17 Juni 2022 - 10:20PM

Edgar (US Regulatory)

0000086312

false

0000086312

2022-06-15

2022-06-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 15, 2022

The Travelers Companies, Inc.

(Exact name of registrant as specified

in its charter)

|

Minnesota

(State or other jurisdiction of

incorporation) |

|

001-10898

(Commission File Number) |

|

41-0518860

(IRS Employer

Identification No.) |

485 Lexington Avenue

New York, New York

(Address of principal executive offices)

|

10017

(Zip Code) |

(917) 778-6000

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

¨ Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which

registered |

| Common stock, without par value |

|

TRV |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry into a Material Definitive Agreement.

On June 15, 2022, The Travelers Companies, Inc.

(the “Company”) entered into a $1.0 Billion Five-Year Revolving Credit Agreement (the “Credit Agreement”) with

a syndicate of financial institutions, including JPMorgan Chase Bank, N.A., as administrative agent; JPMorgan Chase Bank, N.A., BofA Securities, Inc.,

Citibank, N.A., U.S. Bank National Association, and Wells Fargo Securities, LLC as joint lead arrangers and joint bookrunners; and Bank

of America, N.A., Citibank, N.A., U.S. Bank National Association and Wells Fargo Bank, National Association as co-syndication agents.

The Credit Agreement replaced the Company’s previous $1.0 Billion Five-Year Revolving Credit Agreement, which was terminated on

June 15, 2022.

The Credit Agreement provides for up to $1.0 billion

of credit. The interest rates applicable to loans under the Credit Agreement are generally based on a base rate plus a specified margin

or a term rate based on SOFR (including a credit spread adjustment) plus a specified margin. In addition, the Company will pay a facility

fee on each lender’s commitment irrespective of usage. The applicable margin and the amount of the facility fee vary based upon

the Company’s long-term senior unsecured non-credit-enhanced debt ratings.

Pursuant to covenants in the Credit Agreement,

the Company must maintain an excess of consolidated net worth (as defined in the Credit Agreement) over goodwill and other intangible

assets of not less than $13,900,000,000. In addition, the Credit Agreement contains other customary restrictive covenants as well as certain

customary events of default, including with respect to a change in control. Unless terminated earlier by the Company, the Credit Agreement

is scheduled to expire on June 15, 2027, subject to extension with lender consent according to the terms of the Credit Agreement.

Borrowings under the Credit Agreement may be used for general corporate purposes of the Company and its subsidiaries.

Pursuant to the terms of the Credit Agreement,

the Company has an option to request an increase of the credit available under the facility up to a maximum facility amount of $1.5 billion,

subject to the consent of lenders and the satisfaction of certain conditions.

The foregoing description is qualified by reference

to the Credit Agreement, a copy of which is attached hereto as Exhibit 10.1 and incorporated by reference herein.

Certain of the lenders under the Credit Agreement,

or their affiliates, have provided, and may in the future from time to time provide, certain commercial and investment banking, financial

advisory and other services for the Company and its subsidiaries, for which they have in the past and may in the future receive customary

fees and commissions.

Item 2.03. Creation of a Direct Financial Obligation or an

Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth above under Item 1.01

is hereby incorporated by reference into this Item 2.03.

Item 9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, The Travelers Companies, Inc. has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: June 17, 2022 |

THE TRAVELERS COMPANIES, INC. |

| |

|

|

| |

By: |

/s/ Christine K. Kalla |

| |

|

Name: Christine K. Kalla |

| |

|

Title: Executive Vice President and General Counsel |

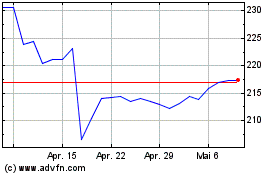

The Travelers Companies (NYSE:TRV)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

The Travelers Companies (NYSE:TRV)

Historical Stock Chart

Von Apr 2023 bis Apr 2024