UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

___________________________________

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

| ☐ | Preliminary Proxy Statement |

| |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☐ | Definitive Proxy Statement |

| |

| ☒ | Definitive Additional Materials |

| |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

The Travelers Companies, Inc.

_________________________________________________________________________________________________

(Name of Registrant as Specified In Its Charter)

_________________________________________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | |

| ☒ | | No fee required. |

| ☐ | | Fee paid previously with preliminary materials |

| ☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

May 16, 2022

RE: The Travelers Companies, Inc. (“Travelers” or the “Company”)

2022 Annual Meeting of Shareholders – May 25, 2022

Dear Fellow Shareholders:

We are writing to ask for your support by voting in accordance with the recommendations of our Board of Directors on all of the proposals included in our Proxy Statement, which was filed on April 8, 2022 and is available at https://investor.travelers.com/home/default.aspx and on the SEC website. The Board has recommended a vote against each of the shareholder proposals. We would like to reiterate some important information about why the Board has recommended a vote “AGAINST” two of the proposals in particular:

•Item 5 – Shareholder Proposal Relating to GHG Emissions; and

•Item 7 – Shareholder Proposal Relating to a Racial Equity Audit.

We encourage you to review our Proxy Statement for a more fulsome explanation of the Board’s recommendations and supplement those disclosures below.

GHG Emissions Proposal

While Travelers is proud to advance a comprehensive climate strategy, which we discuss in further detail on our sustainability website and in our TCFD Report, the Board has recommended a vote against the shareholder proposal relating to GHG emissions for two simple reasons:

1.The Company’s Robust Climate Reporting Directly Addresses the Proposal’s Request in its Entirety.

The proponents are requesting the publication of a report “addressing if and how [the Company] intends to measure, disclose, and reduce the GHG emissions associated with its underwriting, insuring, and investment activities . . .” (emphasis added).

Among its other disclosures, the Company’s existing comprehensive report, published pursuant to the recommendations of the Task Force on Climate-related Financial Disclosures (“TCFD”), includes clear disclosure directly responsive to the proponent’s request.

With respect to the Company’s underwriting/insurance activities, the Company’s TCFD Report provides the following discussion regarding its decision not to measure, disclose, and reduce the GHG emissions associated with those activities:

“. . . GHG emissions data for the vast majority of our underwriting portfolio (e.g., personal automobile, homeowners, small and mid-sized businesses) is not readily available and, where it is available, the data quality remains uneven. Accordingly, at this time, we cannot accurately calculate the total emissions of our customers and are therefore unable to disclose the emissions, or establish any emissions reduction targets, with respect to our underwriting portfolio.” (TCFD Report p. 9; emphasis added)

Similarly, with respect to investment activities, Travelers’ TCFD Report states:

“GHG emissions data for the substantial majority of segments of our investment portfolio (e.g., municipal bonds, structured bonds, private equity funds) is not readily available and, where it is available, the data quality remains uneven. Accordingly, at this time, we cannot accurately calculate the total emissions of our investment portfolio and are therefore unable to disclose the emissions, or establish any emissions reduction targets, with respect to our portfolio.” (TCFD Report p. 13; emphasis added)

Thus, the Company has fully addressed the proposal’s request.

2.The GHG Emissions Data Associated with the Company’s Underwriting and Investment Portfolios is Largely Unavailable and, Where it is Available, the Data is Unreliable

The resolution of the proposal requests disclosure regarding “if and how” Travelers “intends to measure, disclose, and reduce the GHG emissions associated with its underwriting, insuring, and investment activities . . .” As explained above, the Company has fully implemented that request. To the extent that, despite the proposal’s plain meaning, the proposal is interpreted as requesting that Travelers affirmatively measure, disclose and reduce the GHG emissions associated with its underwriting and investment activities, the Company does not currently have the ability to do so for reasons beyond its control. As stated above and in the Company’s publicly available TCFD Report, the GHG emissions data for the vast majority of the Company’s underwriting portfolio (e.g., personal automobile, homeowners, small and mid-sized businesses) and for the substantial majority of segments of the Company’s investment portfolio (e.g., municipal bonds, structured bonds, private equity funds) is not readily available and, where it is available, the data quality remains uneven. This is not a matter of Travelers having “slightly less than perfect data,” as euphemistically suggested by the proponent, but about overwhelmingly absent and unreliable data. As explained in the Company’s TCFD Report, Travelers is, very simply, unable to accurately calculate the total emissions of either its underwriting or investment portfolio or to disclose or establish any emissions reduction targets with respect to such portfolios.

Travelers acknowledges that other property casualty insurance companies have made net zero or other environmental commitments with respect to their portfolios. We believe that such goals are aspirational in nature and are not a reflection of the current availability or reliability of GHG emissions data, nor do they imply the existence of well-established methodologies to estimate such data. Travelers believes that, in light of the realities of the current GHG emissions data landscape, it is imprudent – and not in the best interest of shareholders – for the Company to commit to measuring, disclosing or reducing the emissions associated with its underwriting and investment portfolios.

Racial Equity Audit Proposal

Travelers is a proud and longstanding supporter of racial justice, both within our company and within the communities in which we live and work. Nonetheless, as it relates to the proposal’s request, Travelers’ participation in a heavily regulated industry meaningfully constrains its behaviors in ways that do not apply to other companies that have considered similar proposals and/or that have committed to undertake racial equity audits relating to their business practices. While this proposal is well-intentioned and originates from a noble aspiration, in Travelers’ case, its implementation would cause the Company to violate state laws that preclude insurers from taking race into account in their underwriting and pricing decisions. In this vein, the Company notes the following:

•The proposal’s sweeping and general resolution requests an audit relating to the purported “racial impacts of [the Company’s] policies, practices, products, and services.” This language clearly includes the Company’s underwriting and pricing practices, and the proposal’s supporting statement further elucidates that the proposal’s focus is on the Company’s underwriting and pricing practices.

•The language of the proposal does not merely request an audit to assess, but also to produce “recommendations for improving the racial impacts of [the Company’s] policies, practices, products and services.” Likewise, the supporting statement calls for corporations such as Travelers to “recognize and remedy industry- and company-specific barriers to everyone’s full inclusion in societal and economic participation.”

•The suggestion that Travelers should take steps to alter its underwriting criteria and/or pricing to achieve different outcomes when measured on the basis of race, however, is unlawful under the insurance laws of nearly every state in which the Company operates. In one form or another, state laws prohibit insurers from distinguishing among “individuals or risks of the same class or of essentially the same hazard and expense element because of the race, color, religion, or national origin of such insurance risks or applicants” (Illinois statute quoted as but one example of such state laws). In fact, the Company does not even collect information regarding the race of its customers for use in its underwriting and/or pricing decisions.

•There is no safe harbor or other exception that would authorize an insurer to take race into account in order to achieve different outcomes on the basis of race. It is the consideration of race itself that is unlawful regardless of otherwise worthy motives.

•In this regard, any reference to racial equity audits being conducted by other financial institutions is inapposite, both in light of the unique regulatory environment in which insurers operate, discussed briefly herein and in more detail in the Company’s proxy statement, as well as the more limited scope of those audits as compared to the audit requested in the current proposal’s resolution.

We appreciate your time and consideration on these matters and ask for your support of all of the Board’s recommendations. Our Proxy Statement, this supplemental proxy material and our 2021 Annual Report are available at https://investor.travelers.com/home/default.aspx.

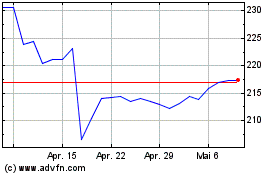

The Travelers Companies (NYSE:TRV)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

The Travelers Companies (NYSE:TRV)

Historical Stock Chart

Von Apr 2023 bis Apr 2024