Credit Union Loan Account Balances Rising; Fewer Members Making Payments Above Monthly Minimums

01 Juni 2023 - 2:00PM

The newly released Q2 Credit Union Market Perspectives Report from

TransUnion (NYSE: TRU) shows that stubbornly-high inflation

continues to put pressure on the monthly budgets of consumers,

credit union members among them. This has led to increasing

reliance on credit cards and personal loans as borrowers seek ways

to make ends meet.

“Credit union members are facing many of the same

inflation-driven economic challenges as the overarching market,”

said Sean Flynn, senior director of community financial

institutions at TransUnion. “As a result, credit unions are seeing

increased balances across the board when looking at credit cards,

auto loans, mortgages, HELOCs and personal loans. HELOCs and

personal loans are seeing particularly high balance growth, up more

than 39% and nearly 26% respectively year-over-year (YoY).”

Credit Unions Are Seeing Higher Total

Balances YoY

|

Product |

Total Balance Growth (% YoY) |

Origination Growth (% YoY) |

|

Bankcard |

18% |

-1% |

|

Auto Loans |

21% |

0.5% |

|

Mortgages |

12% |

-33% |

|

HELOCs |

39% |

13% |

|

Personal Loan |

26% |

12% |

While balances have increased among each of the aforementioned

product lines, it’s more of a mixed bag when it comes to

originations. Originations from Q4 2022, the most recent quarter

available for origination data, were generally flat for bankcard

and auto loans, while they were down 33% YoY for mortgages. HELOCs

and personal loans, on the other hand, saw YoY increases. The 13%

YoY growth in HELOC originations indicates that, in the face of

increasingly high interest rates, credit union members are electing

to tap into their home equity to help pay down higher interest

debt. Similarly, many credit union members likely sought personal

loans, up 12% YoY, to consolidate higher interest debt.

“Credit unions appear to be really focused on serving member

needs wherever they can,” said Flynn. “While auto loan and bankcard

originations were down for the whole industry in Q4 2022, among

credit unions they remained relatively flat. Additionally, credit

unions continue to remain a lower-rate alternative when it comes to

personal loans, growing those originations by 12% at a time when

other lenders saw significantly less growth.”

More Consumers Making Only Minimum Payments

As interest rates and prices continue to rise, fewer consumers

are making payments above and beyond their minimum monthly

payments. This bears careful attention as recent TransUnion

research has shown that excess payments above minimum balances due

have proven effective as proxy measures to consumer liquidity,

typically dropping significantly anywhere from 6 to 12 months prior

to a serious delinquency event.

Serious delinquency rates remained generally stable among credit

unions quarter-over-quarter (QoQ), with 60 DPD+ delinquency rates

coming in at 0.79% in Q1 2023, seasonally down from 0.83% in Q4

2022. 60+ DPD delinquency was up YoY from 0.50% in Q1 2022.

To learn more, visit the Q2 Credit Union Market Perspectives

Report.

About TransUnion (NYSE:TRU)

TransUnion is a global information and insights company with

over 12,000 associates operating in more than 30 countries. We make

trust possible by ensuring each person is reliably represented in

the marketplace. We do this with a Tru™ picture of each person: an

actionable view of consumers, stewarded with care. Through our

acquisitions and technology investments we have developed

innovative solutions that extend beyond our strong foundation in

core credit into areas such as marketing, fraud, risk and advanced

analytics. As a result, consumers and businesses can transact with

confidence and achieve great things. We call this Information for

Good®—and it leads to economic opportunity, great experiences and

personal empowerment for millions of people around the

world.

http://www.transunion.com/business

|

Contact |

Dave BlumbergTransUnion |

| E-mail |

dblumberg@transunion.com |

| Telephone |

312-972-6646 |

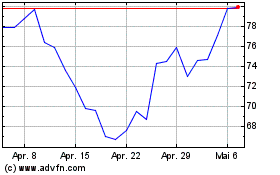

TransUnion (NYSE:TRU)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

TransUnion (NYSE:TRU)

Historical Stock Chart

Von Apr 2023 bis Apr 2024