TransUnion today released the findings of its Q1 2023 Credit

Industry Insights Report (CIIR), which shows that the Canadian

credit market remains resilient despite the current high cost of

living and elevated interest rates.

As part of the CIIR, TransUnion maps consumer

credit market health with its Credit Industry Indicator (CII). The

CII is a country-specific measure of consumer credit health trends,

focusing on four pillars: demand, supply, consumer behaviour and

performance. The CII for Q1 of 2023 in Canada reached 106 in March

2023, hitting close to the pre-pandemic level observed in March

2019, and slightly above the prior year level in March 2022.

Canadian Credit Industry Indicator Q1 of

2023i

| Source: TransUnion Canada consumer credit

database. |

|

(i) |

|

A lower CII

number compared to the prior period represents a decline in credit

health, while a higher number reflects an improvement. The CII

number needs to be looked at in relation to the previous period(s)

and not in isolation. In March 2023, the CII of 106 represented an

improvement in credit health compared to the same month prior year

(March 2022) and a slight increase in credit health compared to the

prior quarter (December 2022). |

The slight year-over-year (YoY) increase in the

CII was driven by a 3.1% increase in the number of consumers

carrying a balance from the previous quarter (Q4 2022), as well as

continued growth in consumer credit balances. The positive impact

from overall balance growth was slightly offset by slowing overall

demand for new credit.

Origination growth and increased credit

participation drove increased balancesAs the cost of

living rose, many Canadians turned to credit to alleviate financial

pressures. Canadians continued to build debt, as total outstanding

balances across all products increased by 5.6%, reaching a new

record of $2.32 trillion. While overall debt continued to rise in

Canada, it is important to understand the composition of the

increased balances.

Credit participation (the number of Canadians

with access to credit) grew by 2.9% YoY, as the number of Canadians

with access to credit rose to 30.6 million in Q1 2023. At the same

time, the number of consumers carrying a credit balance rose 3.1%

YoY in Q1 2023. While the number of credit-active consumers

increased across most risk tiers, the number of subprime consumers

accounted for the largest increase, growing at 8.3% YoY. While this

riskier segment had the highest rate of growth, prime and better

consumers still represent nearly three-quarters of total consumers

with a balance, indicating a relatively healthy risk distribution

of the consumer credit population.

| Consumers

with a Balance By Risk Tier, as of Q1 2023 |

|

|

|

|

|

|

Risk Tier* |

Number of Consumerswith a Balance |

YoY Growth |

Percentage of TotalCredit Population |

|

Super prime |

11.6 M |

5.00% |

41.40% |

|

Prime plus |

4.2 M |

-5.6% |

14.90% |

|

Prime |

4.4 M |

3.50% |

15.60% |

|

Near prime |

5.3 M |

3.40% |

18.80% |

|

Subprime |

2.6 M |

8.30% |

9.30% |

Another key contributor to the increase in

overall debt is the growth in origination volumes – i.e. consumers

acquiring additional credit products. Origination volumes increased

6.2% YoY, primarily driven by a surge in credit card originations

to new-to-credit consumers (a combination of Gen Z consumers

entering the credit market and new Canadians) which grew by 85% YoY

in 2022. Overall, card originations were 20% higher YoY in Q4 2022,

driven by a 24% increase in originations by prime and above

consumers, with originations to below prime consumers having

increased by 9% YoY. Prime and above consumers accounted for

two-thirds of all new card originations during 2022.

Mortgage origination, which experienced record

growth rates through 2021 and early 2022, continued to decline,

dropping 32% YoY as increasing interest rates significantly slowed

demand for new mortgages, especially in the refinance market.

As credit activity increased,

performance moved closer to pre-pandemic levelsHigher

overall credit balances as well as higher interest rates also drove

higher minimum monthly payment obligations, requiring many

consumers to direct additional disposable income to cover the

minimum required payments – particularly on mortgages and lines of

credit. Both mortgages and lines of credit are particularly

sensitive to interest rate changes, and rising rates continue to

exert pressure on these borrowers. The average line of credit

monthly payment due increased to $436 (+43% YoY) and the average

monthly mortgage payment rose to $2,032 (+16% YoY). The impact of

rate increases will continue to put pressure on mortgage borrowers

over the next year as homeowners open or renew their mortgage terms

at higher rates.

While higher balances and rising interest rates

have increased payment obligations, aggregate excess payment (the

amount consumers pay on their revolving accounts over the minimum

required) recorded 7% higher YoY levels for below prime consumers

and 11% YoY higher levels for prime and better consumers in Q1

2023. These increases indicate that consumers are continuing to pay

more than the minimum required – the average payment for credit

cards is 2.6x over the minimum required. This is a positive sign

indicating healthy consumer behaviors towards their payment

obligations.

As the Canadian market has expanded and more

consumers have entered the credit market and built balances, a

corresponding uptick in delinquency would be expected. Overall

consumer-level serious delinquency (the percentage of consumers 90

or more days past due on any account) increased by 9 bps to 1.57%;

however, it is important to note that despite this increase,

overall delinquency levels remain below pre-pandemic levels.

Bankcard serious consumer-level delinquency

rates (90+ DPD) continued to increase, up 8 bps from prior year to

0.76%. It is important to take into account the significant

origination growth seen over the past several quarters as a driving

factor of this increase.

Unsecured personal loan delinquencies also

continued to trend higher: serious consumer-level delinquency rates

(60+ DPD) have exceeded pre-pandemic levels, up 71 bps YoY to 2.09%

in Q1 2023 (consumer 60+ DPD delinquency was 1.35% in Q1 2019).

Recent origination history for this product has been heavily

weighted to below prime consumers, which is likely driving

worsening performance.

Serious account-level delinquency (60+ DPD) for

auto reached 0.78% in Q1 2023, up 10 bps YoY, which is a relatively

low rate despite the increase, and still below pre-pandemic

levels.

“Overall, the financial position of Canadian

credit consumers improved coming out of the pandemic, bolstered by

higher savings accumulated through the pandemic and supported by a

strong labour market,” said Matt Fabian, Director of financial

services research and consulting at TransUnion in Canada.

“However, the longer the current conditions of

elevated inflation and higher interest rates persist, the more

likely it is that a segment of more vulnerable consumers may

increasingly feel the pinch. Especially impacted may be

variable-rate mortgage-holders as they reach their trigger rate,

and fixed-rate mortgage-holders near the end of their terms. As

available disposable incomes become more stretched, we expect a

segment of consumers will be more likely to miss payments, and as a

result, that delinquency rates will rise,” he added. “However, we

expect any rise in delinquency rates to be moderate and in line

with increased credit activity.”

What lies ahead for Canadian consumers

in 2023 and into 2024? Given the economic uncertainty and

to provide insights into what to expect for credit market health,

TransUnion recently forecasted origination, balance and delinquency

trends for the remainder of 2023 to Q1 2024, drawing on its

extensive data and research resources.

“We anticipate the next 12 months to be

characterized by a ‘continued resiliency meets financial fragility’

mindset. Trends for 2023 are likely to be mixed, based on

consumers’ risk profiles and the uneven impact of higher inflation

and interest rates, offset by softer than anticipated activity,

recession, and slight recovery in early 2024, as well as a strong

labour market,” Fabian said.

TransUnion forecasts growth in new account

originations across all products through 2024, driven by a

combination of increased demand and a stabilizing interest rate

environment. The forecast anticipates lenders to continue to pursue

profitable growth, i.e. that there will be continued expansion in

lending with strategically managed growth and risk.

The credit card segment will remain very

competitive as issuers compete for share with new offers in the

market. TransUnion forecasts continued growth for credit cards with

strong origination volumes through to Q1 2024 for both prime and

below (up +3.5% YoY) as well as above prime segments (+11.8% YoY),

and expects to see growth in balances. The forecast shows a slight

uptick in delinquency, back to pre-pandemic levels, to 2.19% in Q1

2024 (+16 bps YoY).

Auto loan growth is expected to be skewed toward

riskier borrowers – prime and below risk tiers – with originations

in that segment growing 4.3% as vehicle inventories continue to

return to normal. This demand and the continued shift toward higher

average purchase price will drive loan sizes up by 2.8% for prime

and below in Q1 2024, while above prime balance growth is likely to

remain relatively flat YoY. Delinquency rates are expected to

improve slightly in the prime and below segment – likely down 14

bps YoY to 2.27% – as more recent acquisitions have skewed away

from below prime borrowers.

The prospect of interest rates holding steady

and potentially lowering into 2024 is expected to help revitalize

the personal loan market, as a more favourable interest rate

environment will allow lenders to expand and grow their portfolios

following their caution coming out of the pandemic. Acquisition is

forecast to grow by 16% YoY in Q1 2024, driven by a return to below

prime lending. In addition, balance growth is likely to be up 7%

for below prime consumers and up 29% for prime and better. This

increased activity is likely to drive higher delinquencies, with

serious delinquency rates forecast to rise 13 bps to 2.27%.

As the Bank of Canada pauses interest rate

hikes, a resurgence in housing demand combined with continued low

inventory will drive increased activity in Canada’s housing market,

which will in turn drive mortgage origination volume and balance

growth. TransUnion expects a 38% increase in origination volumes

from the first quarter of 2023 to the first quarter of 2024, with

the concentration of new originations skewed to prime and better

consumers. In line with home values, outstanding mortgage average

balance growth of up to 5% is also forecast in the first quarter of

2024.

For more information about the Q1 2023 Credit Industry Insights

Report, please click here.

*According to TransUnion CreditVision® risk score: Subprime =

300-639; Near prime = 640-719; Prime = 720-759; Prime plus =

760-799; Super prime = 800+

About TransUnion (NYSE: TRU)

TransUnion is a global information and insights

company that makes trust possible in the modern economy. We do this

by providing an actionable picture of each person so they can be

reliably represented in the marketplace. As a result, businesses

and consumers can transact with confidence and achieve great

things. We call this Information for Good®. TransUnion provides

solutions that help create economic opportunity, great experiences

and personal empowerment for hundreds of millions of people in more

than 30 countries. Our customers in Canada comprise some of the

nation’s largest banks and card issuers, and TransUnion is a major

credit reporting, fraud, and analytics solutions provider across

the finance, retail, telecommunications, utilities, government and

insurance sectors.

For more information or to request an interview,

contact:

Contact: Emma TiessenE-mail

Emma.Tiessen@ketchum.comTelephone 647-523-1594

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/11c651e9-32a2-4b71-8c7f-c5e868eb8c2d

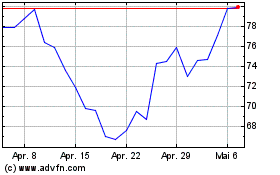

TransUnion (NYSE:TRU)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

TransUnion (NYSE:TRU)

Historical Stock Chart

Von Apr 2023 bis Apr 2024