Fraud Concerns Determine who Canadians choose to do Business with, Reveals New TransUnion Survey

22 März 2023 - 11:00AM

In a recent survey, TransUnion (NYSE: TRU) explored the sentiment

and behaviours of Canadians in relation to fraud concerns when

engaging online with companies, financial service providers, and

retailers. The analysis reveals a delicate balance between

Canadians wanting to feel their personal and financial information

is protected – but without compromising their digital experience.

Nearly a third (30%) of Canadians surveyed have switched their

online transactions to another website due to fraud or security

concerns. In addition, 34%, said they are either extremely or

very likely to switch companies to get a better digital experience.

“Our research points to the challenging dynamic that Canadian

businesses, financial services providers, and retailers must

navigate,” said Patrick Boudreau, head of identity management and

fraud solutions at TransUnion Canada. “Concerns about fraud risks

are top-of-mind for consumers when engaging online – and have

significant influence on who and how they choose to transact with.

At the same time, consumers have high expectations with the digital

experience when engaging with companies and retailers online and

can be quick to abandon their shopping cart or online applications

if it feels too cumbersome. Canadian companies must walk the fine

line of having all the necessary, rigorous risk mitigating process

and tools in place to protect their customers, but without

comprising their digital experience.”

Factors that Contribute to Canadians Abandoning

Websites Canadian consumers place significant focus on

their digital experience when engaging online, with several factors

causing them to not return to a website, including:

- Fraud concerns (69%)

- Asking too much information (57%)

- Process taking too long (46%)

- Site layout being confusing (45%)

- Slow website (42%)

- Not being able to find what they were looking for (40%)

- Not receiving order confirmation post transaction (37%)

- Lack of familiarity with the company (34%)

Factors that Contribute to Canadians Abandoning their

Shopping CartWhen online shopping, fraud and/or security

concerns is one of the main reasons why Canadian consumers abandon

their carts, as well as:

- Shipping costs (69%)

- Cost of goods (43%)

- Fraud and/or security concerns (40%)

- Payment information not going through correctly (31%)

- Poor experience (24%)

- Too many security challenge steps (15%)

Expectations when Deciding who to do Business

with Among the qualities or expectations that Canadians

consider when deciding which online company to do business with,

the following rank as the number one factor:

- Security of personal data (46%)

- Quality of goods or services (22%)

- Cost savings (20%)

- Good digital experience (6%)

- Delivery times (6%)

Considerations that Impact who Canadians choose to

Transact with Online When choosing who to transact with

online, a number of features are considered important by Canadian

consumers, including:

- Confidence that personal data will not be compromised

(90%)

- Easy payment process (88%)

- Site navigation (87%)

- Ease of log-in authentication experience (86%)

- Ease of filling out forms or applications (86%)

- Ease of setting up a new account or ease of registration

(85%)

Contributing Factors for Canadians to Abandon Online

Applications Nearly half (48%) of Canadians have abandoned

an online application or form for a financial or insurance product

before completing it. This includes the following reasons:

- Too much information was required (52%)

- Process was frustrating (48%)

- Took too much time to fill out the form (42%)

- Didn’t trust that my personal data would be secure (38%)

- Site was too slow (32%)

Canadians’ Actions when Falling Victim to Fraud

Half of Canadians (50%) say they were targeted by at least one

fraud scam (via online, email, phone call or text message), but did

not become a victim. This compares to 7% who were targeted and

became a victim of fraud. The actions that Canadians took when they

discovered they were a victim of fraud include:

- Placing a freeze on their credit (55%)

- Contacting impacted companies such as credit card, retailers,

etc. (45%)

- Placing a fraud alert on their credit report (41%)

- Contacting a company that compiles and provides credit reports

(22%)

- Calling the police (17%)

- Nothing (9%)

“While there is a lot of onus and responsibility on companies to

protect their customers against fraud, Canadian consumers must also

take active steps to help protect themselves. This includes

continuing to be hyper-diligent to avoid succumbing to fraud

attempts when receiving suspicious emails, texts or phone calls. If

it feels suspicious, it likely is. Canadians must also be diligent

about regularly checking their accounts for any suspicious

activity, and through establishing and monitoring a credit report

with fraud alert capabilities. Services like TransUnion’s credit

monitoring and fraud alerts can play a significant role in helping

protect Canadians from fraud risks,” Boudreau added.

About TransUnion (NYSE: TRU)TransUnion is a

global information and insights company that makes trust possible

in the modern economy. We do this by providing an actionable

picture of each person so they can be reliably represented in the

marketplace. As a result, businesses and consumers can transact

with confidence and achieve great things. We call this Information

for Good®. TransUnion provides solutions that help create economic

opportunity, great experiences and personal empowerment for

hundreds of millions of people in more than 30 countries. Our

customers in Canada comprise some of the nation’s largest banks and

card issuers, and TransUnion is a major credit reporting, fraud,

and analytics solutions provider across the finance, retail,

telecommunications, utilities, government and insurance sectors.

Learn more at transunion.ca

|

Contact: |

Emma Tiessen |

|

Email: |

emma.tiessen@ketchum.com |

|

Phone: |

647-523-1594 |

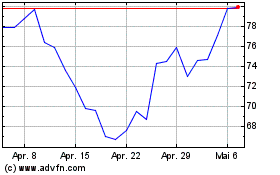

TransUnion (NYSE:TRU)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

TransUnion (NYSE:TRU)

Historical Stock Chart

Von Apr 2023 bis Apr 2024