Despite a return to something more closely resembling pre-pandemic

levels in 2022, the TransUnion (NYSE: TRU) 2023 State of

Omnichannel Fraud Report found that digital fraud continues to

rise. According to proprietary insights from TransUnion’s global

intelligence network and a specially commissioned consumer survey,

the pivot to increasingly digital transactions since the beginning

of the pandemic means the overall risk to individuals and

organizations is even greater than it was pre-pandemic.

The study showed that 4.6% of all customers’ digital

transactions globally were suspected to be fraudulent. This

percentage is in line with the rates found in 2019. However,

despite the similarities to the percentage prior to the pandemic,

because the number of transactions conducted digitally has markedly

risen in the last few years, the total volume of suspected digital

fraud attempts has increased dramatically. Globally, such attempts

have increased by 80% from 2019 to 2022, while rising 122% for

digital transactions originating in the U.S. during that time.

“The pandemic crystallized the fact bad actors focus their

efforts on organizations and institutions that have direct access

to money, products or services with easily transferable monetary

value,” said Shai Cohen, senior vice president and global head of

fraud solutions at TransUnion. “While government-funded pandemic

relief programs experienced headline-grabbing levels of fraud,

digital fraud trends pointed to industries that saw significant

growth in consumer digital engagement.”

Credit Card Fraud is Most Common, but

ACH/Debit and Synthetic Identity Fraud are Rising

|

Fraud type |

Percent of digital fraud in 2022 |

Volume change 2019–2022 |

|

Credit card |

6.5% |

76% |

|

Account takeover |

6.3% |

81% |

|

True identity theft |

6.2% |

81% |

|

ACH/Debit |

6.0% |

122% |

|

Synthetic identity |

5.3% |

132% |

Source: TransUnion TruValidate™

Top Industries Targeted by Suspected Digital Fraud

Globally Include Gaming and Retail; Travel & Leisure Fraud

Among Those on the Rise in the U.S.

Globally, the gaming and retail industries saw the highest rate

of suspected digital fraud at 7.5% and 7.2%, respectively. These

were followed by video gaming at 5.4%, financial services at 4.2%

and communities (i.e., online dating and forums) at 4.0%.

However, the highest rate of growth globally since 2019 was

observed in the travel & leisure industry. This group saw a

117% increase in suspected digital fraud globally as more and more

consumers looked to resume traveling following the pandemic period.

For transactions originating from the U.S., the travel &

leisure industry also saw a significant rise in suspected digital

fraud, where it increased by 42% since 2019. The logistics and

financial services industries also experienced significant growth

in digital fraud attempts, up 67% and 44% over the time period,

respectively.

Gaming and Retail Saw The Highest

Suspected Digital Fraud Rate between 2019 and 2022, but Industries

Such As Financial Services and Travel & Leisure are Growing

Rapidly

|

Industry |

Global suspected fraud attempt rate 2022 |

Global suspected fraud attempt rate % change

2019–2022 |

U.S. suspected fraud attempt rate % change

2019–2022 |

|

Gaming (online sports betting, poker, etc.) |

7.5% |

-21% |

-15% |

|

Retail |

7.2% |

7% |

8% |

|

Video Gaming |

5.4% |

-82% |

-72% |

|

Financial services |

4.2% |

39% |

44% |

|

Communities (online dating, forums, etc.) |

4.0% |

-8% |

-52% |

|

Travel & leisure |

2.1% |

117% |

42% |

|

Telecommunications |

2.1% |

-51% |

-39% |

|

Insurance |

1.7% |

22% |

-90% |

|

Logistics |

1.3% |

63% |

67% |

Source: TransUnion TruValidate

Consumers Regularly Face Fraud Across a Range of

Communications Platforms

The study also found that a large percentage of people are being

impacted by fraud attempts, and across a wide range of

communications vehicles. In a TransUnion-commissioned consumer

survey across 18 countries and regions globally, 52% of respondents

indicated that they were targeted by fraud via email, online, phone

call, or text messaging in the three months beginning September

2022. With U.S. respondents, 58% said they had been targeted by

fraud attempts via those communications channels over the same time

period.

“The explosion of digital transactions, the accelerated adoption

of digital technologies, and increasing appetite for faster access

to funds/credit, have led to an increase in fraud losses,

particularly in digital channels,” said Naureen Ali, vice president

of product management at TransUnion. “Consumers are expecting

organizations to protect their identities and online accounts, and

those companies that do not adequately honor those preferences may

lose business as a result.”

The study explored other types and channels of fraud. For

instance, TransUnion determined that while the vast majority (85%)

of calls received by its U.S. financial services call center

customers were from mobile phones in 2022, just 14% of all

high-risk calls were made from them last year. Conversely, for the

3% of U.S. financial services call center calls that were made from

non-fixed Voice over Internet Protocol (VoIP)—a phone number that

isn’t associated with a physical address—62% of all high-risk calls

into the call center came from them last year making it the

riskiest channel for the call center.

Data Breaches Fuel Identity Engineering, Record Balances

Attributed to Synthetic Identities

The study also examined the volume and severity of data breaches

over the course of 2022 and compared them to previous years, using

publicly available data analyzed by SontiqTM, a TransUnion

company.

Results showed that the number of data breaches in the U.S.

increased by 83% from 2020 to 2022. In addition to the overall

increase in volume, the severity of data breaches also rose,

reflected in an increase of 6% in Sontiq’s Breach Risk Score over

that time period.

These breaches have played a key role in helping to fuel an

explosion in identity engineering, with synthetic identities

becoming a record-setting problem in 2022. Outstanding balances

attributed to synthetic identities for auto, credit card, retail

credit card and personal loans in the U.S. were at their highest

point ever recorded by TransUnion—reaching $1.3 billion in Q4 2022

and $4.6 billion for all of 2022.

TransUnion came to its conclusions based on intelligence from

its identity and fraud product suite that helps secure trust across

channels and delivers efficient consumer experiences

– TransUnion TruValidate. The rate or percentage of suspected

digital fraud attempts reflect those which TransUnion customers

either denied in real time due to fraudulent indicators or

determined were fraudulent after reviewing—compared to all

transactions it assessed for fraud.

Download the TransUnion 2023 State of Omnichannel Fraud Report

to learn more. Specific country and regional data in the report

include the United States, Brazil, Canada, Chile, Colombia,

Dominican Republic, Hong Kong, India, Kenya, Mexico, Namibia,

Philippines, Puerto Rico, Rwanda, South Africa, Spain, United

Kingdom and Zambia.

For more information and insights on global fraud

trends, please download the report.

About TransUnion (NYSE:TRU)

TransUnion is a global information and insights company with

over 12,000 associates operating in more than 30 countries. We make

trust possible by ensuring each person is reliably represented in

the marketplace. We do this with a Tru™ picture of each person: an

actionable view of consumers, stewarded with care. Through our

acquisitions and technology investments we have developed

innovative solutions that extend beyond our strong foundation in

core credit into areas such as marketing, fraud, risk and advanced

analytics. As a result, consumers and businesses can transact with

confidence and achieve great things. We call this Information for

Good®—and it leads to economic opportunity, great experiences and

personal empowerment for millions of people around the

world. http://www.transunion.com/business

|

Contact |

Dave Blumberg |

|

|

TransUnion |

| |

|

| E-mail |

david.blumberg@transunion.com |

| |

|

| Telephone |

312-972-6646 |

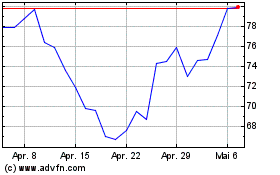

TransUnion (NYSE:TRU)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

TransUnion (NYSE:TRU)

Historical Stock Chart

Von Apr 2023 bis Apr 2024