As Auto Leasing Continues to Slow, Increasingly Targeted Marketing May Play Key Role in Maintaining Brand Loyalty

19 Januar 2023 - 2:00PM

The auto lease market continued to slow down for much of 2022

causing some automakers to lose traditionally loyal customers. A

new TransUnion (NYSE: TRU) study found that the auto lease market

was down almost half from 31% in January 2020 to 17% in July 2022,

more than twice the decrease in auto financing over the same

period.

The study examined the behavior of 3.8 million consumers who

terminated a lease between July 2021 and June 2022. It included

analyzing consumer segments based on subsequent auto credit

activity and a review of relevant credit metrics. Additionally, the

study examined make and brand loyalty for the next vehicle

acquisition.

Results from the study showed a decrease in the number of

consumers ending a lease who chose to lease again from July 2021 to

June 2022, with only 25% of consumers doing so. This represented a

40% decrease since January 2020. The study also found that a larger

proportion of consumers coming off of a lease were choosing to

finance their next vehicles, despite the fact that this ultimately

led to an average monthly payment increase of $217.

“Increasingly, we are seeing consumers at the end of their auto

leases choosing not to lease another vehicle, but rather, to

finance a new car purchase or buy a car with no financing at all,”

said Satyan Merchant, senior vice president and automotive business

leader at TransUnion. “While this may result in short-term gains

for dealers, it has the potential to lower dealer profitability in

the long-term due to longer consumer cycle times and can also

negatively impact future off-lease used vehicle inventory and

remarketing opportunities.”

Customer Loyalty Under Pressure

Additional study findings showed that consumers are opting to

end their leases earlier in the lease life-cycle than previously.

For those consumers who ended their leases in the year 2022, 26%

ended their leases six or more months prior to the lease’s expected

termination date, an increase of nearly 63% since 2019. The study

also showed that only 7% of lessees ended their auto leases two or

more months after the expected lease termination date, down from

15% three years prior.

Consumers Are Ending Their Auto Leases

Earlier in 2022 compared to 2019

|

|

6+ months prior |

3-5 months prior |

2 months prior |

1 month before or after |

2 months after |

3-5 months after |

6+ months after |

|

2019 |

16 |

% |

13 |

% |

9 |

% |

47 |

% |

5 |

% |

4 |

% |

6 |

% |

|

2022 |

26 |

% |

13 |

% |

8 |

% |

46 |

% |

1 |

% |

2 |

% |

4 |

% |

X axis represents the month that consumers ended their

leases relative to its expected end date; Source: TransUnion U.S.

consumer credit database

Brand loyalty among consumers decreased significantly for

consumers who chose a loan versus a lease for their next auto.

Study findings revealed that lease-to-lease loyalty increased for

both manufacturer and make since 2019, while lease-to-loan loyalty

declined over that period. This could pose a challenge to captive

lenders that rely on leasing as an effective way to keep consumers

in the brand portfolio. Indeed, only 41% of households that went

from a lease to a loan purchased a vehicle of the same make in the

first seven months of 2022.

“It’s more important than ever that manufacturers and dealers

keep existing lessees in lease products,” said Merchant. “The use

of new marketing tools such as Neustar’s ElementOne® Analytics

Platform can help dealers most effectively target and reach

customers who may be interested in leasing or have leased a vehicle

in the past, ultimately maximizing returns through smarter audience

strategies and omnichannel marketing campaigns.”

To learn more about the findings of the study, visit here. More

information on how TransUnion Marketing Solutions

helps businesses confidently engage consumers with

comprehensive identity and people-based marketing technology can be

found here.

About TransUnion (NYSE: TRU)TransUnion is a

global information and insights company that makes trust possible

in the modern economy. We do this by providing an

actionable picture of each person so they can be reliably

represented in the marketplace. As a result, businesses and

consumers can transact with confidence and achieve great things. We

call this Information for Good®.

A leading presence in more than 30 countries across five

continents, TransUnion provides solutions that help create economic

opportunity, great experiences and personal empowerment for

hundreds of millions of people.

http://www.transunion.com/business

|

Contact |

Dave

Blumberg |

| |

TransUnion |

| |

|

| E-mail |

david.blumberg@transunion.com |

| |

|

| Telephone |

312-972-6646 |

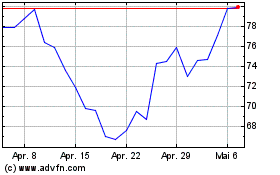

TransUnion (NYSE:TRU)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

TransUnion (NYSE:TRU)

Historical Stock Chart

Von Apr 2023 bis Apr 2024